MOTR Capital Management provides actionable, unbiased and systematic research based on the most important market trends.

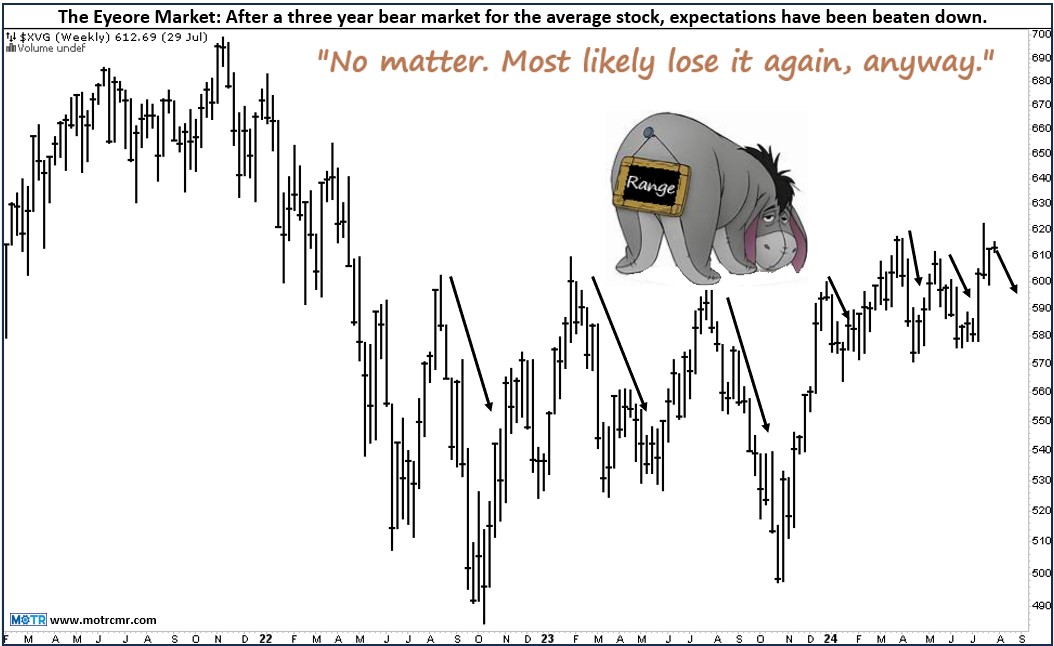

The Eyeore Market: Most Likely Lose It Again Anyway

Highlights

- The Eyeore Market is one in which investors have become so accustomed to trends failing that they automatically expect recent profits to evaporate into losses .

- This of course, has been the case for nearly three years, and recent gains appear to be fading once again.

- The good news is that in 2024, the average stock, while barely changed on the year, has actually been holding at the high end of its three-year range, allowing for slow and steady trend repair at the stock level.

- We suspect we are getting closer to the beginning of a truly robust bull market, and if so, we are going to want to quickly jettison that behavior which has recently treated us so well (sell strength) in favor of behavior best reserved for bull markets (buying breakouts).

After three years of back-and-forth bear market activity, my mind has been trained to expect failure. Whenever I have a great day or week or even month, I find myself thinking, “that was nice, but let’s not get overly excited…we’re probably going to give it all back anyway.” Recently, I had such a thought (after a great day), and then said “Geesh, I sound like Eeyore!” At which point, it dawned on me that I am probably not the only trend following momentum investor having this experience.

In that regard, I figured I would share how I am processing this experience in the event that it might help others. First, although it has been tough sledding for diversified long-term trend following, this is not my first frustrating experience. While there have been many difficult periods, the long-term value proposition of the strategy has ultimately emerged in every case…strong returns with lower-than-average drawdown risk.

Given the duration of this particular struggle, one might ask “is trend following broken?” Well, as they say, “garbage in, garbage out.” Looking at the accompanying chart, if there is no persistent trend , trend following will struggle, as it must. What would be more worrying is if trend following was struggling in the throes of a robust bull market.

Philosophically, it would be impossible for trend following to not do well in such an environment. Anecdotally, having managed through several of them, it truly is when trend following shines. We just haven’t seen a robust, durable bull market since arguably before 2018.

What if trend following actually is broken, though? What would that mean? We can answer this disturbing question by first asking what causes the market, and its constituent stocks, to trend in the first place? The answer is fundamentals, and the stronger and higher the quality of growth, the better the resulting trend. So, when we ask if trend following is broken, we are really asking “is capitalism broken?”

To paraphrase Winston Churchill, “‘Capitalism’ is the worst form of ‘economic system’, except for all those other forms that have been tried from time to time.” Therefore, if we ever do find ourselves coming to the conclusion that trend following (i.e., capitalism) is indeed broken, we will likely have far greater problems on our hands than those investment related. Such a dire scenario would imply no more durable economic growth to drive robust security price trends.

With each passing month, market conditions, as tracked by our systematic research process, continue to get better and better. Granted, they are not robust just yet, but the most recent improvement in small caps (as measured by trend, breadth, momentum, relative strength, etc.) is the best incremental change we’ve seen since the bear market started. We think this has the potential to be the beginning of a strong run for trend following and momentum.

One important lesson I have learned over the years is to be, well…careful of the lesson I’ve learned over the years! In this case, we have learned that fading market strength has been a good idea since early 2022. When we can identify the beginnings of a true bull market, we’ll want to forget that very lesson, and start buying breakouts again, the very lesson we learned in prior bull markets…ahhh, the good ol’ days.

Our Latest Thoughts:

A lot has happened since we wrote about what we called the "Eyeore Market", unfortunately in line with Eyeore's dire expectations. This includes a record spike in the S&P volatility index (VIX), reuslting in a more than 8% decline, followed by a robust, 8-day run of uninterrupted gains, leaving the average stock basically unchanged. The key obervation in the note above was the conditions were quietly getting better beneath the surface, increasing our conviction that weakness should be bought. While that conviction was put to the test, we wrote several notes to our clients to buy the early August decline.

If you'd llike to read those notes and receive a 30-day trial of our research, head on over to our website to sign up today.