MOTR Capital Management provides actionable, unbiased and systematic research based on the most important market trends.

Crypto in a Spot to Place ‘Risk-On’ Bet

Today’s note offers insights into why we recently saw crypto as a ‘Risk On’ opportunity. While this research was first released to our paying subscribers a month ago, its findings remain highly relevant for today's market given the recent outperformance. Our subscribers acted early—and you can too. Join them to receive timely research before the crowd and position yourself for future opportunities by starting your free trial today.

With our Risk Gauge firmly in “Risk-On” across all three timeframes, we should now begin to see traditional measures of ‘risk-on’ behavior manifest. We have highlighted a few examples of where we should see such change in behavior, including Biotechs (XBI ETF), the IPO ETF, and more recently China.

There are many other relationships that have yet to inflect towards ‘risk-on’. In addition to small and micro caps (IWM/IWC), these include copper vs gold (should be trending upward), Utilites vs the S&P (should be trending lower), and Aussie/Yen (should be trending higher).

Note that in each case, we say ‘should’, which is to say they don’t have to fall in line before we follow the lead of our already bullish Risk Gauge. They simply should since they traditionally do behave as described above during bull markets. If they don’t this time, so be it. That would simply mean the market cares about something else this cycle.

Another ‘risk-on’ metric we’re watching for potential inflection is crypto. We’ve covered bitcoin in the past, so in today’s CMI, we’re taking a look at Ethereum (Figure 1). Here, we can see that price is right at major support, derived from both a major trendline support (blue line) and former congestion area (blue box).

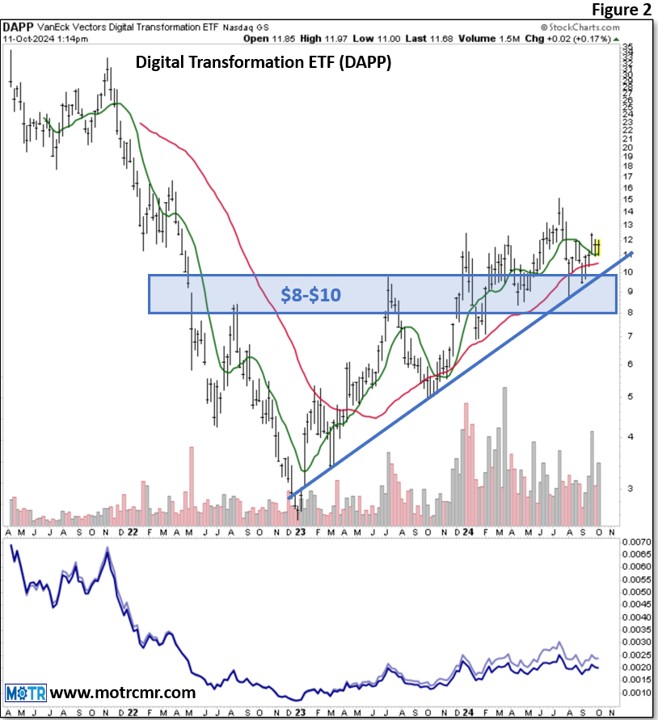

The same can be said for the Digital Transformation ETF (DAPP) (Figure 2). Since we highlighted this ETF ( here ), it has pulled back to test major supports (blue box and trendline), setting the stage for new local highs once again.

The Crypto related industry ranks at the top of the #1 ranked Financial Sector, as well. All told, be it crypto itself, or crypto related stocks, this is a good location within the current trend to get involved.