The leading independent provider of IPO company analysis, research and commentary.

Your Father’s Enterprise SaaS Company

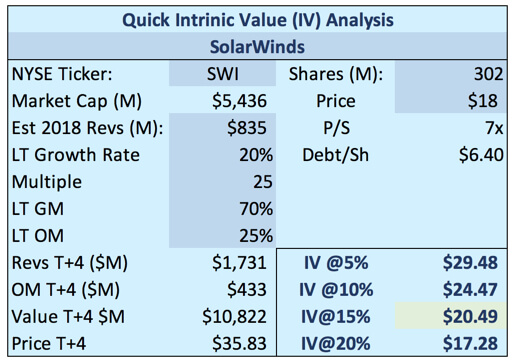

SolarWinds (NYSE: SWI $17-19) will be returning to the public markets this week after being taken private by private equity firms Silver Lake and Thoma Bravo in February of 2016 in a $4.5B deal. In the middle of the range, the company would have a market capitalization of $5.4B. Post-IPO these PE companies will still own about 83% of the company - making it a "controlled business." As expected from a PE-controlled business, SWI will carry $2B on the balance sheet post-IPO.

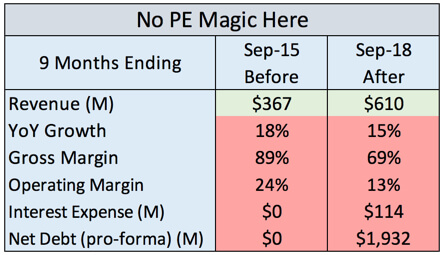

Consider this: For the nine months ended September 2015 equity investors enjoyed operating income of $88M. For the same period in 2018 investors got $79M in operating income but with $114M in interest expenses!

As we highlight below the market is a little more open then it was and SWI will be generating substantial cash flow which can be used to pay down debt and or repurchase shares.

SWI makes network and systems management tools. They first came public in 2009 and gained an investment following thanks to their diverse product set, good growth, and very high-profit margins. Unlike the large network management software providers like Computer Associates ($CA), SolarWinds sells lots of "point products" that are designed to solve a problem quickly and directly. Instead of selling large "enterprise deals" the company targets individual engineers and department managers who have the need and budget to buy individual tools. Today the company sells over 50 different products.

A key and differentiated part of the story is that a large component of company revenues are from maintenance contracts. For example for the September quarter maintenance revenues were just over $101M out of the $212M total. These revenues are basically recurring and by selling a large number of smaller products the SolarWinds revenue production is fairly predictable - not the typical large deal-driven business. The business remains profitable with operating margins at 11%.

The Pre-PE Buyout SolarWinds

SolarWinds did well as a public company from 2009 until when they were bought. In fact, their business was more attractive then it is now. For example, their 2Q 2015 report delivered revenue growth of 17% to $119M with a stunning operating profit margin of 43%. Operating cash flow was even higher at $55M that quarter. Guidance for the full year was $500-512M with operating profit margins of 42%. And this was a quarter viewed as "disappointing" to Wall Street. The core issue for SWI was that their overall "conversion rate" from various online sources didn't come in as high as they expected.

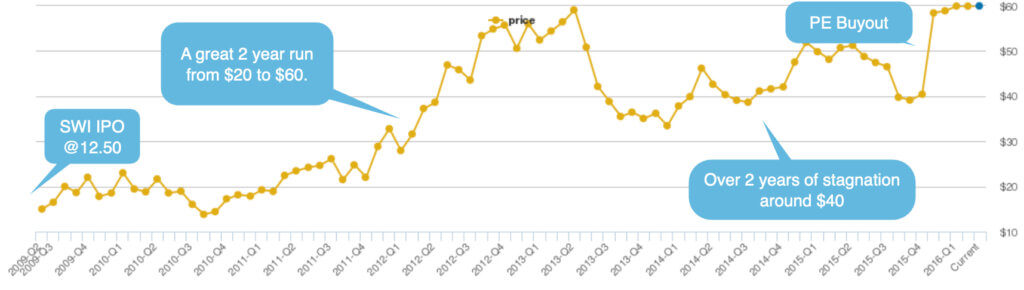

Although the shares performed well for a while they stagnated during their last few years as a public company - opening the door for the PE firms to step in and buy a very profitable company that could support high levels of debt and continue to grow.

Stock Conclusion and Valuation

It's a little hard to love SolarWinds given their growth rate, debt, and valuation. There are some things to like. The first one is that the entire market feels more open then it has in some time. In a baffling move, Computer Associates ($CA) is being acquired by chip maker Broadcom ($AVGO). BMC has been owned by PE firms for years and was recently sold by Gain and Golden Gate to KKR for $8.5B. Bain and Golden Gate had acquired BMC in 2013 for $6.9B. We're sure that a bevy of PE-friendly transactions and fees boosted returns during this period since a 23% gain over 5 years is low.

We've decided to look at SWI as a growth investor rather than a more cash-flow-focused value type. We had to push our assumptions to get to a positive IV for the SWI IPO.

For example, we are building in some improvement in YoY growth rates and operating margins. We note the debt will be $6.40/share post-IPO which we are not deducting from the IV at 15%.

Bulls on SWI will suggest this is just the wrong way to look at a company that is really a servant of private equity at this point - it's all about EBITDA and cash flow which can be used to retire debt and/or buy back shares. Our experience with companies of this type is 1) they tend to get lower valuations than growth-focused peers and 2) their approach to the business often results in a deterioration of their competitive position.

Luckily for SWI their competition may be less-than-focused given current ownership and pending acquisitions. There are only a few pure-play companies like New Relic really executing well in the market.

We also acknowledge that a flotilla of highly-motivated investment banks will be selling this deal hard and eager for a share of follow on fees and opportunities with these PE firms. Buyer beware.

These guys look more like partners of the PE firms than SolarWinds investors.

The post Your Father’s Enterprise SaaS Company appeared first on IPO Candy .

RSS Import: Original Source