September 28, 2018

A leading global investment company with specialized expertise in equities, fixed income, and alternatives.

YIELD: LOOK TO EUROPEAN STOCKS

Written by: Global Thought Leadership | August 17, 2018

Source: Bloomberg, August 16, 2018. Past performance is no guarantee of future results. Indexes are unmanaged, and not available for direct investment. Index returns do not include fees or sales charges. This information is provided for illustrative purposes only and does not reflect the performance of an actual investment.

THE CHART

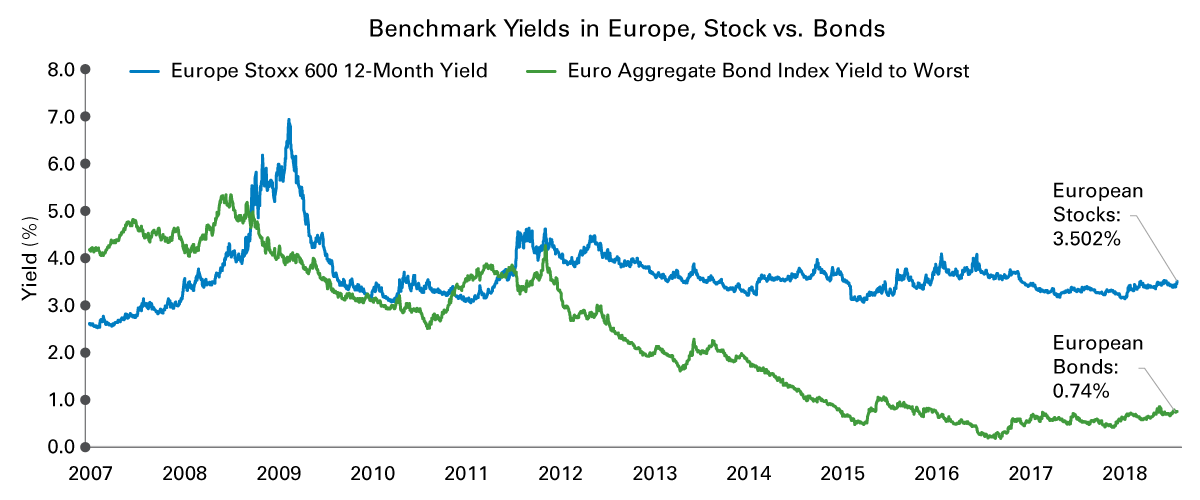

The chart shows, for Jan 2, 2007 to August 16, 2018, the 12-month indicated dividend yield of the STOXX Europe 600 Index and the yield of the Bloomberg Barclays Euro Agg Bond Index

THE BOTTOM LINE

- Where might income be found at potentially advantageous prices? Some astute investors have turned to European markets, where stocks, as a whole, offer potentially attractive yields.

- As of August 16, 2018, the Euro Stoxx 600 Index has a 12-month dividend yield of about 3.5%, compared to the roughly 1.8% yield of the S&P 500 Index.

- That’s especially noteworthy in an environment where European Central Bank (ECB) has been aggressively accommodative over the past 5 years, holding its benchmark rate at 0.0%, and driving some benchmark government bonds into negative yields.

- With the ECB clearly stating that it plans to keep rates at or near 0% for at least another year, the interest rate environment underpinning stocks appears to be solid in the near term.

- Compare that to the U.S., where the economy is moving from strength to strength, allowing the Fed to raise interest rates, to the point that shorter-term rates have eclipsed stocks in terms of yield; the 2.86% yield on U.S. 10-year Treasuries now exceeds the dividend yield of the S&P 500 by over 100 basis points.

- But yield is only one factor among many affecting the relative attractiveness of European stocks. European growth is still fragile and fragmented, the banking sector is still not on a solid footing, and events like Turkey’s currency and political problems can still rattle parts of the stock and bond markets.

- Nonetheless, Europe’s stock market has some attractive attributes for active investors willing to expand their horizons.

Originally published: YIELD: LOOK TO EUROPEAN STOCKS

All data Source: Bloomberg, August 16, 2018, unless otherwise specified.

Definitions:

The STOXX Europe 600 Index represents large, mid and small capitalization companies across 17 countries of the European region.

The Bloomberg Barclays Euro Agg Index represents overall investment-grade and sovereign bond in the euro area.

More from Legg Mason Global Asset Management

The most important insight of the day

Get the Harvest Daily Digest newsletter.