"Hedge fund manager specializing in forensic financial research"

Why SharkNinja/Ecovacs Entering Vacuum Robotics Would Pose 20%-50% Downside Risk To IRobot

Executive Summary

- With iRobot’s share price now +300% since 2016, investors are cheering the re-acceleration of sales and earnings growth following years of disappointment, and ascribing a peak valuation to plateauing EPS.

- We expect SharkNinja to launch a competing product at lower price points. SharkNinja outsold Dyson to claim market share in traditional vacuums and will partner with China robotics leader Ecovacs.

- iRobot's recent patent defense strategy and acquisition of its Japanese distributor are defensive moves. Irreconcilable financial control issues are again surfacing at iRobot; investors should tread carefully.

- Robot is trading at a peak valuation and 30% above its average analyst price target of $77. Many of its long-term fundamental investors have been selling. Insiders also have been heavy sellers before its recent share price increase. Its valuation dwarfs best of breed technology consumer companies such as Apple. If iRobot were to trade closer to peers and its long-term valuation at 3x - 4x book value and 1.5x – 2.5x sales, we could see 20% – 50% downside risk.

- Spruce Point Capital Management is pleased to issue a critical update report and alert our readers it has re-established a short position in iRobot (Nasdaq: ) as a result of our industry research that suggests and , two widely successful companies in vacuums and robotics may enter the market as earlier as Q4. In addition, we have new evidence to suggest financial irregularities tied to iRobot's acquisition of its related-party distributor. We believe there is 20% - 50% downside risk potential. Please review our disclaimer at the bottom of this email. We also encourage all of our readers to follow us on Twitter for regular updates.

I. Executive Summary

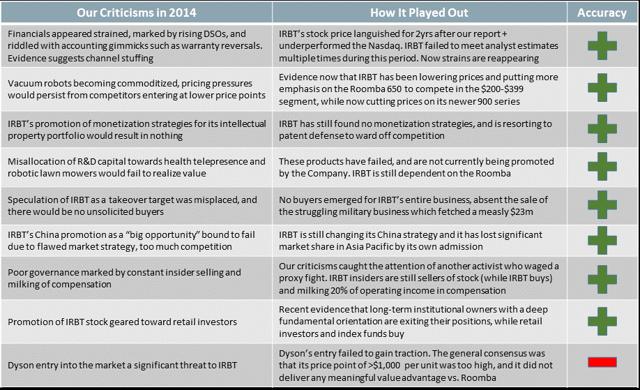

- In , Spruce Point made its first short recommendation on iRobot, noting fundamental struggles, signs of channel stuffing, and bad governance practices. We later pointed to struggles to penetrate the Chinese market in . For the following 2 years, iRobot’s share price languished and significantly underperformed the Nasdaq technology index . A majority of our criticisms and forecasts proved accurate.

- With iRobot’s share price now up 300% since 2016, investors are cheering the re-acceleration of sales and earnings growth following years of disappointment, and ascribing a peak valuation to plateauing earnings. Spruce Point believes the financial improvement reflects temporary factors and may not be sustainable. We expect new competition to storm the market, and challenge iRobot’s US market share dominance.

- iRobot’s recent financial performance reflects restocking of its supply chain after years of false starts, the removal of the struggling military business, and the acquisition boost from its Japanese distributor. We believe these factors will create very difficult comparisons for iRobot to lap in the future, and create headwinds for future share price appreciation. Furthermore, we believe recent gains are a result of lowering the price of its Roomba to move down market, which we believe is a long-term negative on margins for a technology hardware company with a narrow product focus

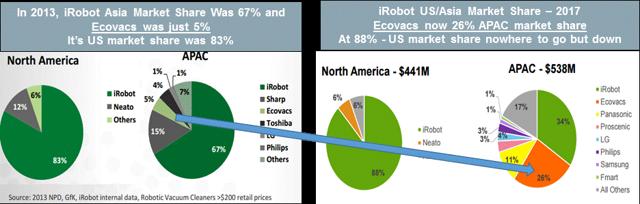

- Investors are overlooking disruptive competition likely to enter iRobot’s US market. Based on Spruce Point field research, we expect SharkNinja to launch a competing product at lower price points. SharkNinja outsold Dyson to claim market share in traditional vacuums. We believe they will partner with Ecovacs, the leader in the Chinese/Asia market which stole significant market share from iRobot. SharkNinja has a proven track record of disrupting numerous home appliance markets with dynamic market strategies, and superior products. With 88% US market share, iRobot’s share can only go down from here

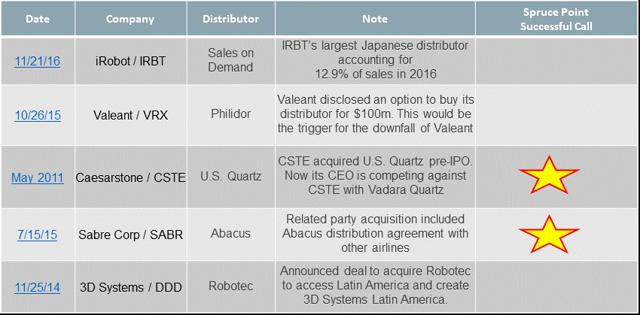

- Investors are overlooking financial control issues tied to iRobot’s recent acquisition of its Japanese distributor. The Company suspiciously retracted certain statements made about Japanese sales growth (reversing big gains to declines), and made revenue and earnings revisions which don’t add up. Spruce Point has previously pointed out early warning signs at (acquired its Asia distribution partner ) and (acquired its ), ahead of financial problems surfacing. Market observers will also note that opened Pandora’s Box and was the canary in the coal mine

- iRobot is trading at a peak valuation and 30% above its average analyst price target of $77. Many of its long-term fundamental investors have been selling, while retail and index funds buy. Insiders also have been heavy sellers before its recent share price increase. Its valuation dwarfs best of breed technology consumer companies such as Apple. If iRobot were to trade closer to peers and its long-term valuation at 3x - 4x book value and 1.5x – 2.5x sales, we could see 20% – 50% downside risk

Timeline of Recent Events Affecting iRobot Since Our Reports in 2014:

2014-2015: iRobot misses revenue and earnings expectations multiple times after our report’s warning

: iRobot attracts the attention of another activist investment firm who wagers a proxy fight, criticizing the Company’s poor capital allocation and governance

: Under pressure, iRobot sells its struggling defense and security business and has received just $23m in cash; the Company expands its share repurchase program by $100m

: Repurchases $85m of its $100m through an accelerated share repurchase : Raises guidance for second time, backs view of 15% consumer revenue growth

: Pursues inorganic growth by acquiring its Japanese distributor Sales on Demand Corp for ~$18m

: Offers 2017 guidance of 17-19% revenue growth, but EPS to a wide range of -9% to +11%; restates earnings transcript to correct gross mischaracterization of Japanese performance +20% to -17%

: Raises top end of 2017 revenue and EPS range by just $5m and 0.05c, respectively. Revises Japanese distributor contribution. After years of promoting the value of its intellectual property, iRobot finally against robotic vacuum cleaner products sold by Bissell, Hoover and Black and Decker covering 6 patents

A Majority of Spruce Point’s iRobot Concerns Have Proven Accurate

II. SharkNinja and Ecovacs: Roomba’s New Competitive Threat

SharkNinja, headquarted in Newton MA fifteen miles from iRobot, is an innovative consumer home appliance company that has disrupted markets it enters with high performance products, at affordable price points. Shark Ninja is a leader in vacuums and blenders, and targets consumers through infomercials. Based on our research, we believe they will enter the robotic vacuum market and challenge iRobot

From an article by Forbes entitled “ How Shark Ate Dyson’s Lunch In America ” –

- Formerly known as Euro-Pro, a 100-year old company that had a mere 1% of vacuum cleaner sales in 2008, SharkNinja now controls more than 20% of the US market

- Over the past seven years, its Shark vacuum cleaners and Ninja blenders and food processors, all manufactured in China, have increased sales at a compound annual growth rate of 25%, enabling the firm to triple its workforce from 250 to 800 employees

- This growth has been aided by an aggressive push on television shopping channels, with $130m spent on TV advertising last year (examples: , , )

- The Company has doubled revenues from $800 million to more than $1.6 billion and usurped Dyson as leader of the US vacuum cleaner market since bringing in consultants Gap International two years ago

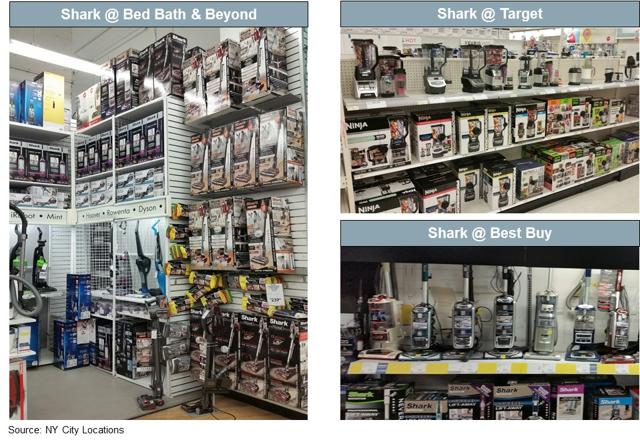

Channel checks show SharkNinja already has key distribution partners: Home Depot ( ), Bed Bath and Beyond ( ), Target ( ), Wal-Mart ( ), Costco ( ), Best Buy ( ) and Many More

- These key distribution outlets overlap with many of iRobot’s existing distribution partners

- In addition, SharkNinja is known for its extensive infomercials and television advertising. The Forbes article says it spent $130m on TV advertising, whereas iRobot spent just $64.4m on advertising in 2016 (not all TV)

Shark Ninja Recently Hired Goldman Sachs To Evaluate A Sale According To Reuters (April 2017)

- suggest that private equity firms have expressed the most interest in SharkNinja

- Given that PE firms are financially motivated to grow their investments to achieve 15%+ p.a. returns, a financial buyer would be incentivized to grow SharkNinja through product and market expansion

Our Field Research on SharkNinja’s Robotic Vacuum Ambitions

- We believe SharkNinja strives to be the #1 or #2 leader in markets it enters. Based on its track record in traditional vacuums and blenders, we believe SharkNinja is a credible threat to iRobot

- SharkNinja’s displacement of Dyson in vacuums was a result of a laser-like focus on the consumer, and its ability to engineer a superior product at a value price point. As an organization, Linkedin data shows that SharkNinja employs more engineers than sales or marketing people

- We believe Dyson failed to gain traction with its robotic vacuum because its price point of >$1,000 was simply too high, and it did not deliver meaningful performance advantage to the customer. Simply stated, Dyson could not offer a compelling value proposition

- We believe SharkNinja will use a similar strategy it used to displace Dyson with its go to market with iRobot – deliver a high performing product at a lower price point, in this case in the $299 - $399 price range

- Given SharkNinja’s marketing prowess stated to be $130m annually (2014 figures), we wouldn’t be surprised to see it spend at least 10% or more to broaden product awareness

- SharkNinja has many existing relationships with retailers such as Target ( ), Walmart ( ), Bed Bath & Beyond ( ), Best Buy ( ) and Costco ( ). We would not be surprised if they leverage these relations to distribute their robotic vacuum in addition to infomercial marketing

- Our research suggests that SharkNinja will partner with Ecovacs, the leading Chinese robotics maker and company that has gained significant share against iRobot in China

SharkNinja Commands Significant Shelf Space At Leading Retailers

- It’s easy to see why retailers would want SharkNinja to enter the vacuum robotics market. Its current vacuums and blenders command significant shelf space and are very popular with customers.

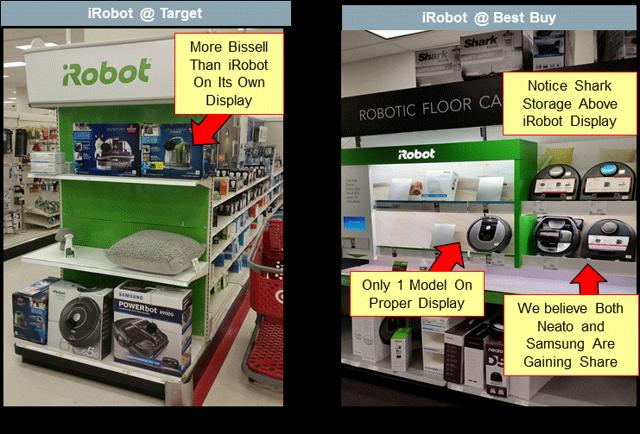

Retailers Preparing To Shrink iRobot Shelf Space

- Two of our recent site visits demonstrated a disregard for iRobot’s shelf space and proper product display. Is this indicative of retailers preparing to reduce its shelf space?

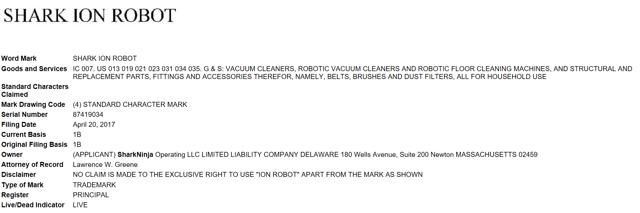

SharkNinja Just Filed a Robotic Vacuum Patent, Before iRobot’s Patent Defense Campaign

- SharkNinja’s filing of a robotic vacuum patent in April 2017 has gone unnoticed by sell-side analysts and investors, but Spruce Point believes it is a significant indicator of SharkNinja’s ambition to leverage its success in traditional vacuums to compete in home vacuum robotics.

- Coincidentally iRobot announced its patent complaints two days earlier on April 18, 2017 against Bissell, Hoover, b0bsweep, iLife, Black& Decker and three Asian companies. In our opinion, we believe IRBT’s recent patent claims are defensive, and it is clearly worried about its competitive position

Source: US Patent and Trademark Office ( ): Basic Word Mark Search > “Shark Ion Robot”

SharkNinja Employees Recruited From iRobot

- Shark Ninja has recruited various former iRobot employees, giving it institutional knowledge about the robotic vacuum market .

- This supports our belief that it has ambitions to enter iRobot’s robotic vacuum market

Source: Linkedin

Source: Linkedin

Ecovacs Has Grown Market Share Against IRBT in Asia, Now Expanding Into the US

- Ecovacs is an Asian market leader in home robotics, that has taken significant share from iRobot, and is taking clear steps to invade iRobot’s US market share. An IPO will raise capital and give it a public currency to continue its market share gains. We believe SharkNinja will partner with Ecovacs

- : ECOVACS plans to introduce seven new home cleaning robots in the US in 2016: five clean bare-floors and carpets, and two wipe glass doors and clean windows

- : Ecovacs Expands U.S. Footprint, Smart Home Technology; as part of its continuing global expansion plan, Ecovacs Robotics will move into its new 3,000-square-foot North American headquarters in San Francisco. The location of the new headquarters itself was chosen with the company’s expansion plans in mind and in large part due to its growing focus on smart home technology development.

- : Chinese robot vacuum maker ECOVACS to IPO on Shanghai Stock Exchange

SharkNinja + Ecovacs = Trouble For iRobot

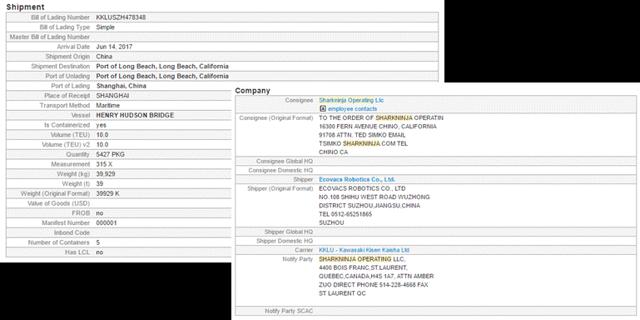

- Spruce Point believes that SharkNinja and Ecovacs are likely to partner together to enter the robotic vacuum market

- Below we have sourced a recent bill of lading shipping record from June 2017 showing a relationship exists between the two firms

- It makes sense to us that SharkNinja’s market and distribution expertise in the US would be matched with the manufacturing and technology capabilities of Ecovacs

Source: www.panjiva.com

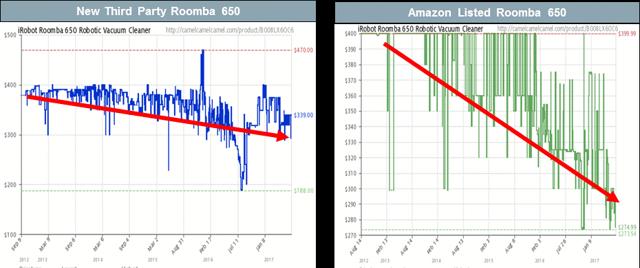

Recent iRobot Performance A Result of Going Down Market, Deflating Prices

- Based on our field research, we believe that iRobot has experienced the greatest growth by moving down market and selling into the $200 - $299 and $300 - $399 price segments. We believe it has used the IRBT 650 series to be aggressive on price, and get market share gains

- The pricing data below confirms our field research that. In the long run, we view this as a negative that iRobot, retailer of a hardware consumer product, has to erode its brand value by lower prices

- We expect margin pressure to result in the coming quarters, especially because iRobot has no more meaningful product introductions planned for next year

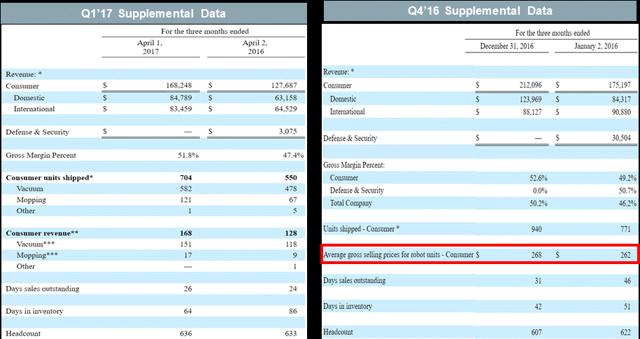

iRobot Appears To Be Obfuscating Its Price Deflation

- Look carefully at iRobot’s “Supplemental Information” at the bottom of its recent press releases and you will notice they stopped providing “ average gross selling prices for consumer robots ” – Is iRobot trying to obfuscate its price deflation?

iRobot Is Now Cutting Prices of Its High End New Roomba Product

- The Company often promotes its latest iteration of essentially the same Roomba product every year. In , the 960 series was introduced for $699 and in the 980 starting at $899

- iRobot said in Q1 that“ The $40.6 million increase in revenue from our consumer business for the three months ended April 1, 2017 was driven by a 28.0% increase in total units shipped and increased sales of our higher-priced Roomba 900 series robots as compared to the three months ended April 2, 2016 ”

- Why all the sudden demand for products that have been on the market since 2015/16? If demand is as robust as IRBT claims, why did it just cut prices by $100 on each product

III. Warning Signs From Recent Japanese Distributor Acquisition

- Investors would be well cautioned to closely evaluate iRobot’s acquisition of Sales on Demand Corp, its related-party Japanese distributor

- There are numerous examples of early warning signs when companies acquire their distribution partners or related-party entities.

New Signs Suggesting IRBT Is Gaming The Financials From Its Distributor Acquisition

Notice That IRBT’s CFO Issues Corrective Statements About Japan’s Performance in Q4’16:

Original CFO Comment on Japan( ): “Austin just to circle back on your initial question on Japan and China in the fourth quarter, so without getting too specific, Japan was up probably about 20% in the fourth quarter year-on-year and China’s a fairly difficult comp just based on the timing both last year and this year. So don’t read too much in to this, but it was over 200% growth in the fourth quarter on China. But again we encourage everybody to really focus on the full year growth rates for all of those regions versus Q4 specifically.”

Revised CFO Comment on Japan ( : “ Austin just to circle back on your initial question on Japan and China in the fourth quarter, so without getting t oo specific, Japan was [down 17%] (corrected by company after the call) in the fourth quarter year-on-year [because we wanted to make sure the channels were clear ahead of our acquisition and China was down 50% from Q4 last year as expected. As you may recall we received an $11M order in Q3 2016 from China that we were expecting in Q4 so China was up 140% in Q3 and then down year-over-year in Q4] (corrected by company after the call). But again we encourage everybody to really focus on the full year growth rates for all of those regions versus Q4 specifically.”

Then Following Quarter (Q1’17) : “We have reduced our Japan expectations versus those provided in February due to our analysis of inventory at retailers in Japan at the end of Q1, which was higher than we would typically like to see. We have lowered the level of incremental revenue post acquisition as we work through this channel inventory .

Revision of Deal Terms and Financials Suggest More Inventory Acquired: The purchase price of the acquisition increased from earlier estimates. The purchase price is mostly inventory. The higher the purchase price, the more inventory acquired.

11/21/16 ( ): iRobot will acquire the business for a cash amount equal to the book value of the acquired assets at close, primarily inventory, estimated to be between $14m-$16m, subject to exchange rates in effect on the date of acquisition.

5/5/17 ( ): On April 3, 2017, the Company closed its previously-announced acquisition of the iRobot-related distribution business of Sales On Demand Corporation for approximately $18 million in cash, equal to the book value of the acquired assets. The acquisition price is subject to adjustments and will be finalized no later than May 18, 2017.

Why does IRBT need 6 months to accurately account for and value inventory it acquired from its distributor? How hard is it to count the number of unsold Roombas sitting in a warehouse and at retailers?

Financial Impact Revision From Distributor Acquisition Very Questionable

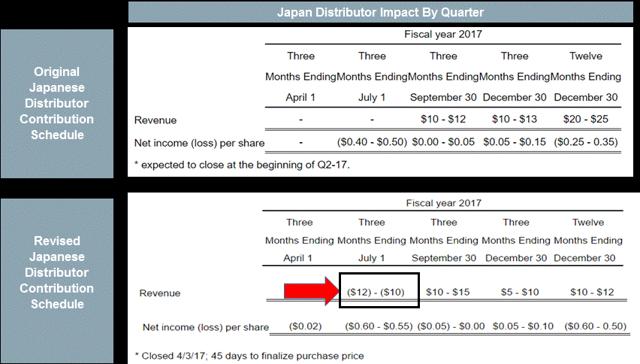

- Original sales increase from Japanese acquisition of $20-$25m and ($0.25) to ($0.35) EPS dilution (Q4’16 )

- Later sales cut in half to $10-$12m and loses double ($0.50) to ($0.60) (Q1’17 )

- The distributor acquisition closed on schedule, yet is now expected to have a negative contribution to Q2? IRBT says it has to sell through acquired inventory.

iRobot’s Japanese forecasts simply aren’t adding up.

- Recall that it revised its sales contribution from $20 - $25m to $10 - $12m between Q4’16 and Q1’17.

- This revision amounts to between $10 - $13m lower sales

- However, based on previous statements noted below made directly from management the expected revision should have been just $4.7m - $7.0m

- Therefore, we believe this is irrefutable evidence of financial control issues

(1) : As our largest international market, Japan is estimated to comprise roughly 15% of this year’s total revenue.

(2) : For the full year, we expect revenue in the U.S. to grow from 18% to 20%, China and Japan to grow approximately 30% each, and EMEA to grow mid-teens over 2016.

IV. iRobot’s Significant Overvalution and 20% - 50% Downside Risk Potential

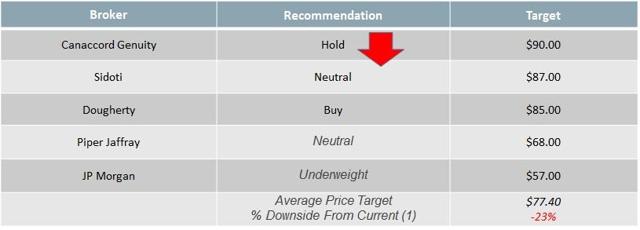

IRBT At Irrational Premium To Price Targets, Recent Brokers Are Negative

- iRobot is trading at 23% above the average analyst price target; what do current investors know that its seasoned analysts don’t? We caution that Canaccord downgraded IRBT recently from Buy to Hold

5/30/17 : We are downgrading IRBT to HOLD from Buy following nearly a 70% appreciation for the stock YTD, and 50% PE expansion on consensus NTM earnings. While we remain positive on growth prospects for the company (healthy momentum in the U.S. as connectivity is driven deeper into the Roomba portfolio and accelerating international growth), we expect only modest upside to our estimates for the balance of the year and see little additional room for valuation expansion from present all-time highs. Further, the lack of a new flagship product in 2017 could heighten uncertainty ahead of the holiday season and drive multiple compression. Our price target remains $90 and our estimates are unchanged.

( Based on $101/share price

( Based on $101/share price

Retail and Index Funds Driving Share Price, While Long-Term Fundamental Owners Sell

Source: Fund Holding Information

iRobot Insiders Always Sell

Our previous reports noted that insider ownership has declined materially over the years, and that trend continues. Insiders were heavy sellers even before the recent share price increase, which should be considered a red flag. We expected continued insider sales while the share price remains elevated

Source: Bloomberg

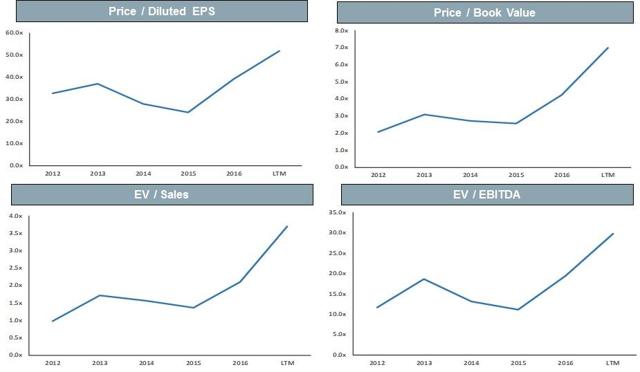

Peak Valuation For Fundamentally The Same Vacuum Company

Investors are ascribing a peak valuation to iRobot based on its recent renewed growth. However, we believe there one-time factors aiding recent growth such as inventory restocking, removal of the losing defense business from the financials, and the inclusion of the Japanese distributor. Absent any new product drivers, iRobot will face significant year-over-year comparison which will most certainly be difficult to achieve.

iRobot At An Irrational Premium To Peers

- iRobot is best viewed as stagnant technology hardware company with limited growth or innovation opportunities

- As we’ve illustrated before, many of its previous product introductions such as health telepresence or lawn robots have failed to gain traction.

- For comparison, iRobot’s current valuation exceeds Apple ( ), which many would argue is the primer consumer technology company

- For investors that want exposure to home appliances and consumer products, we believe Newell Brands ( ), Whirlpool ( ) and Spectrum Brands ( ) are safer bets

- Our long-run base case view is that iRobot will be revalued in line with broken/faddish technology companies such as GoPro ( ) and FitBit ( )

Spruce Point Estimates 20% - 50% Downside Risk Potential

Disclaimer

This research expresses our investment opinions, which we have based upon interpretation of certain facts and observations, all of which are based upon publicly available information, and all of which are set out in our complete research presentation report on our website. Any investment involves substantial risks, including complete loss of capital. Any forecasts or estimates are for illustrative purpose only and should not be taken as limitations of the maximum possible loss or gain. Any information contained herein may include forward looking statements, expectations, pro forma analyses, estimates, and projections. You should assume these types of statements, expectations, pro forma analyses, estimates, and projections may turn out to be incorrect for reasons beyond Spruce Point Capital Management LLC’s control. This is not investment or accounting advice nor should it be construed as such. Use of Spruce Point Capital Management LLC’s research is at your own risk. Any historical performance achieved from any idea or opinion from Spruce Point Capital Management should not be considered an indicator of future performance. You should do your own research and due diligence before making any investment decision with respect to any of the securities covered herein. Spruce Point Capital Management, subscribers and/or consultants shall have no obligation to inform any investor or viewer of this report about their historical, current, and future trading activities

You should assume that as of the publication date of any presentation, report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our subscribers and clients has a short position in all stocks (and are long/short combinations of puts and call options of the stock) covered herein, including without limitation iRobot Corporation ("IRBT" or "the Company"), and therefore stand to realize significant gains in the event that the price of its stock declines. Following publication of any presentation, report or letter, we intend to continue transacting in the securities covered therein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation.

This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Spruce Point Capital Management LLC is not registered as an investment advisor, broker/dealer, or accounting firm.

To the best of our ability and belief, as of the date hereof, all information contained herein is accurate and reliable and does not omit to state material facts necessary to make the statements herein not misleading, and all information has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer, or to any other person or entity that was breached by the transmission of information to Spruce Point Capital Management LLC. However, Spruce Point Capital Management LLC recognizes that there may be non-public information in the possession of iRobot or other insiders of iRobot that has not been publicly disclosed by iRobot. Therefore, such information contained herein is presented “as is,” without warranty of any kind – whether express or implied. Spruce Point Capital Management LLC makes no other representations, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All rights reserved. This document may not be reproduced or disseminated in whole or in part without the prior written consent of Spruce Point Capital Management LLC.

Disclosure: I am/we are short IRBT, CSTE.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.