A leading global investment company with specialized expertise in equities, fixed income, and alternatives.

Why Listed Infrastructure?

Sep 19 2018

Airports, electrical plants, gas pipelines, rail and roads provide essential services. The relatively predictable nature of the demand for such assets means the market price of the companies that manage them can act differently to other equities.

Low volatility

The essential nature of infrastructure assets to society makes demand for their services relatively easy to predict. Even at times of economic weakness, consumers continue to use water, electricity and gas. Also, an increase in population or gross domestic product will lead to higher revenue for user pay assets such as toll roads.

The companies that own these assets often have a monopoly on the services they provide and so enjoy relatively stable fundamental valuations. This can lead towards lower volatility in the market price for the companies that own such assets during the peaks and troughs of business cycles.

Sustainable yields

Infrastructure companies tend to provide predictable income distributions to investors. This is due to the relatively stable earnings derived from their underlying assets. Furthermore, predictable income distributions can also be the result of regulation and/or long-term contracts which enforce viable and stable cash flows. This can provide clear visibility for revenues and dividends.

The impact of rising yields on listed infrastructure

Sharp rises in bond yields can lead to a short-term sell off in utility stocks. This is because the market generally prices utility companies based on their dividend yields, which for yield-driven investors appear relatively less attractive as bond yields rise. However, for long-term, active investors this short-term mispricing may present a good buying opportunity as the fundamental valuations underpinning these securities remain unchanged. This is because when bond yields rise utility companies can go back to their regulator and seek an increase to their ‘allowed returns’. Generally, such allowed returns are calculated utilising the Capital Asset Pricing Model (CAPM). A key input into CAPM is the risk-free rate¹, for which many regulators use the ten-year government bond yield as a proxy. Therefore, as the ten-year bond yield increases, the risk-free rate also increases along with the utility company’s ‘allowed returns’. So, for utilities, the exposure to interest rates is generally limited to the length of time between the reset periods. The timing of these regulatory resets varies across jurisdictions.

An expanding asset class

As the global population increases and living standards rise, there is rising demand for improved infrastructure. Governments increasingly turn to the private sector to build or manage the necessary projects and, as a result, the investment opportunities grow. Analysis undertaken between RARE Infrastructure and Chicago-based David Hale Global Economics, predicted the value of infrastructure assets would increase from $49 trillion to $110 trillion between 2014–2030, a 124% rise. More recent reports confirmed this approximate increase. In 2016, Citibank estimated that $58.6 trillion would be built over the next 15 years² and a McKinsey and Company report³, also from 2016, put the figure at $57 trillion.

One of the biggest spends is coming from China’s One Belt, One Road project which aims to speed the transportation of goods between China, Asia and Europe. While in the US, the government has approved a $200 billion federally funded investment to leverage at least $1.5 trillion in infrastructure investment. In addition, it is seeking changes to legislation to remove barriers to private investment in infrastructure assets.

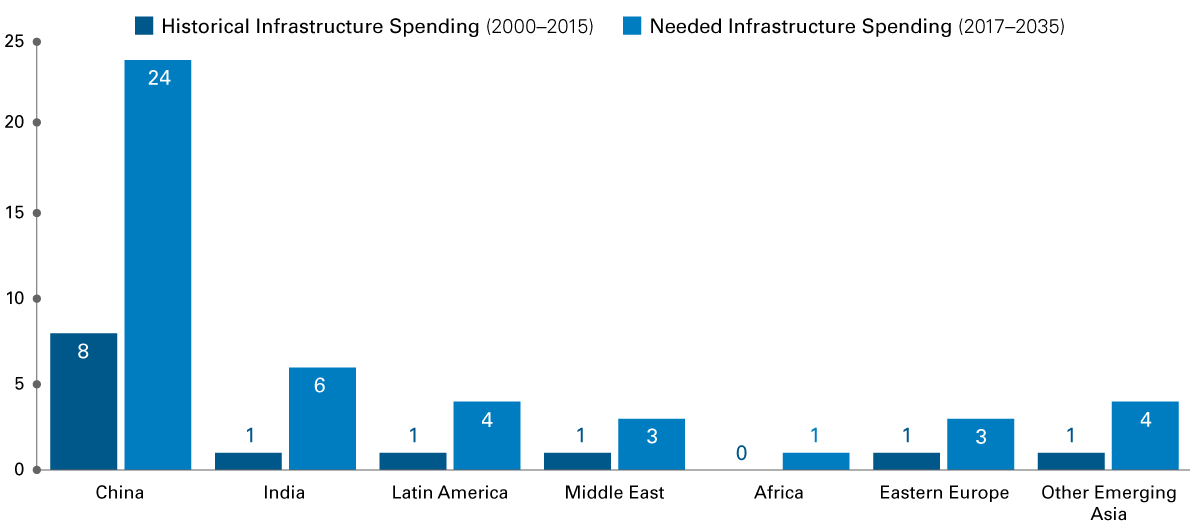

Emerging Markets Infrastructure Spending Needs : Historical Infrastructure Spending (2000-2015) vs Needed Infrastructure Spending (2017-2035)

USD trillion (at constant 2017 prices)

Source: Analysis taken from report by Citi - Infrastructure For Growth, the Dawn of a New Multi-Trillion Dollar Asset Class, October 2016.

Inflation management

Either through regulation, concession agreements or contracts, the revenue that most infrastructure assets receive has an explicit link to inflation.

For regulated assets, the regulator determines the revenues that a company should earn on their assets and in doing so they typically take into account inflation. This provides a level of protection when buying a global portfolio of stocks, where individual stocks may come from countries with higher inflation than that of the domestic investor.

For user pay assets where there is a long-term rise in inflation that is accompanied by a similar rise in bond yields, the inflationary rise in cash flows should offset the rise in discount rates. As such, inflation-driven bond yields should not have a material impact on the fundamental valuation of user-pays infrastructure.

Originally published: WHY LISTED INFRASTRUCTURE?