Why Equal Risk Contribution Matters

SEPTEMBER 26, 2019

While equal risk contribution is just one of many options for constructing investment portfolios, it offers the opportunity to control volatility risk, and in doing so, improve risk-adjusted returns—making it a compelling option for many investors. What exactly is an equal risk contribution portfolio, how does it work, and why should investors consider this approach?

In the simplest of terms, equal risk contribution is a portfolio-construction technique that weights securities so they contribute equally to the risk of a portfolio.

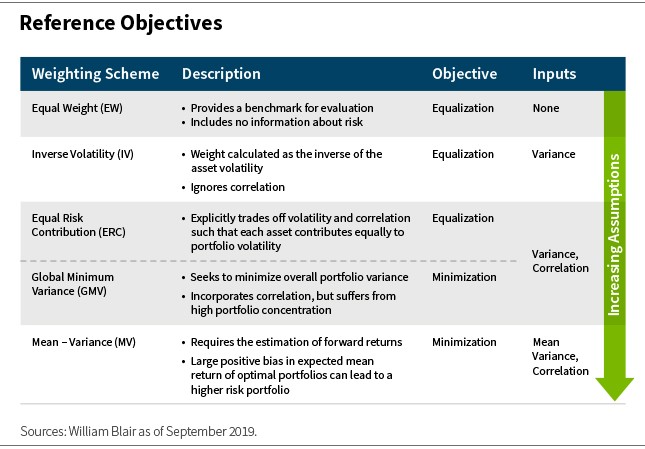

Comparing Portfolio Objectives

There are many ways to construct a portfolio. In the table below, we show several, ranked in order of the number of inputs required to calculate them.

The simplest is an equal weight portfolio, which only requires us to know how many positions are in the portfolio to assess the size of each. A capitalization-weighted portfolio is in this camp, although it has one additional piece of information required. We’ll ignore that one here, mostly to avoid adopting the design of the benchmark.

An inverse volatility portfolio is sometimes applied in managed futures products, but it’s a close cousin to the equal weight portfolio. In this case, we’re taking in one measure of risk asset volatility—to size each position as the inverse of its volatility. This measure ignores any correlation benefits we might garner, so we don’t see it used frequently in practice (at least, any more).

Next, we have two portfolios that we can construct with both volatility and correlation. A global minimum variance portfolio seeks to minimize the overall volatility of the portfolio. And equal risk contribution does something different—it seeks to equalize volatility across the constituents of the portfolio.

In the simplest terms, equal risk contribution is a portfolio-construction technique that weights securities so they contribute equally to the risk of a portfolio.

This is a key concept for thinking about how these portfolios are related. The equal weight, inverse volatility, and equal risk contribution portfolios all share e qualization objectives. The global minimum variance and mean variance portfolios both look to minimize risk.

Equal risk contribution is attractive to us because it more robustly applies measures of volatility and correlation to position sizing, and it actively seeks risk diversification of the portfolio.

Examining the Alternatives

We’ll focus on the equalization portfolios, but we’ll keep the global minimum variance portfolio as an interesting reference point along the way.

Let’s take a look at four of these objectives with our hypothetical sample portfolio to see how they differ. In this case, we’ll use a four-asset portfolio to keep things simple.

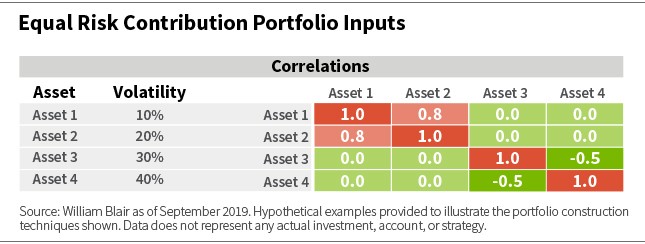

The only inputs required to calculate an equal risk contribution portfolio are the constituents’ volatilities and correlations among each other, shown in the table below.

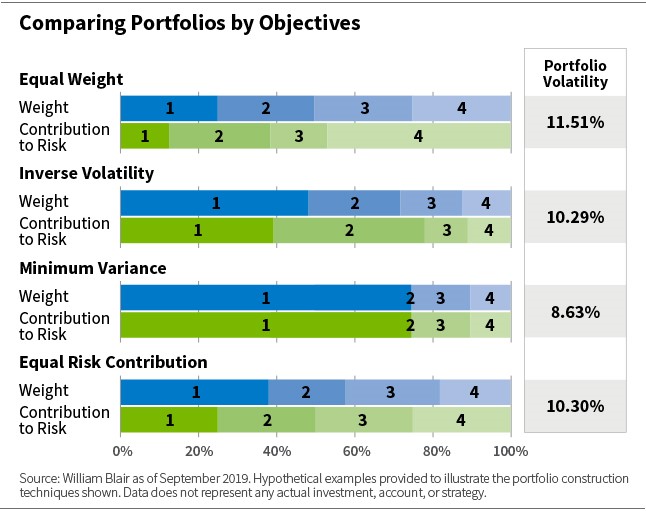

From those inputs, we can calculate the results of four portfolios: an equal weight portfolio, an inverse volatility portfolio, a minimum variance portfolio, and an equal risk contribution portfolio. The chart below shows the weight and contribution to risk of each asset for those four portfolios. Let’s compare.

In the first panel, the equal weight portfolio, the positions are all the same size (as shown in the upper bar). However, the portfolio has disproportionate risk contribution from the fourth asset, and the highest portfolio volatility (as shown in the lower bar). We might have wanted to distribute the risk by making the positions all the same, but instead we ended up with a concentrated portfolio in terms of risk contribution.

In the second panel, the inverse volatility portfolio, the first position has the highest weight but the lowest volatility. That said, the high correlation of the first two assets is not considered, so their combined risk dominates the portfolio. Portfolio volatility, however, is somewhat lower than in the equal weight portfolio.

In the third panel, the minimum variance portfolio is highly concentrated in the first asset and does not allocate to the second asset at all. The overall portfolio volatility is the lowest, but this is the most concentrated of the portfolios. Note that the weight is equal to the risk contribution—an artifact of how this portfolio is formed.

In the fourth panel, we see that the equal risk contribution portfolio results in an allocation similar to that of the equal weight portfolio, but distributes the contribution of risk for each asset equally. The overall portfolio volatility is not the lowest; in fact, it will always be closer to the portfolio volatility of the equal weight portfolio and further from the volatility of the minimum variance portfolio. But the risk contribution is distributed equally across the assets.

Conclusions

An equal risk contribution approach maximizes the diversification of risk (ex-ante) across portfolio constituents, explicitly trading off the volatility and correlation of the assets.

In other words, we construct a portfolio in which each asset contributes the same amount to the portfolio’s volatility.

This is analogous to an equal weight portfolio having equal allocation in dollar terms. An equal risk contribution portfolio has equal weight in volatility terms.

Equal risk contribution is attractive to us because it more robustly applies measures of volatility and correlation to position sizing, and it actively seeks risk diversification of the portfolio.

For clients, as noted, it offers a unique opportunity to control volatility risk, and in doing so, has the potential to improve risk-adjusted returns.

Investing involves risks, including the possible loss of principal. Equity securities may decline in value due to both real and perceived general market, economic, and industry conditions. Different investment styles may shift in and out of favor depending on market conditions. Any investment or strategy mentioned herein may not be suitable for every investor. Diversification does not ensure against loss.

Peter Carl is a portfolio manager for William Blair’s systematic strategies.