"Hedge fund manager specializing in forensic financial research"

Why Echo Global Logistics's Fundamental and Accounting Issues, High Leverage, and Covenant Breach Result in 50%-60% ...

Report Entitled "Logistical Nightmare

"

Spruce Point Capital Management is pleased to announce it has released the contents of a unique short idea involving Echo Global Logistics, Inc. (Nasdaq:

ECHO

), a billion-dollar company in the transportation logistics sector where we see $11.00-13.00 per share, or approximately 50-60% downside. We have a "" opinion detailed extensively in our presentation, which is accessible on our

website

. We also encourage all of our readers to follow us on Twitter

@Sprucepointcap

for exclusive research updates. Please review our Disclaimer at the bottom of this email.

Quick Highlights

- Echo's founders should be heavily scrutinized and have a pattern of cashing out early and disappointing investors by promoting "disruptive" technologies.

- The company's transportation logistics roll-up story has not demonstrated any operating leverage. Its recent deal to buy Command Transport added substantial leverage and business risk to investors.

- Stripping out the contribution from recent acquisitions illustrates that Echo's organic revenue growth has been declining for multiple quarters and is now negative.

- Echo appears to have breached a covenant of its ABL; the company is becoming more dependent on short-term financing, which could jeopardize its ability to implement its growth strategy.

- Normalizing Echo's financials for accounting distortions and placing an 8-9x multiple on 2017 EBITDA gets us to 50-60% downside. Upside of 11% to analysts' average target a terrible risk/reward.

Update on Recent Spruce Point Campaigns

We are pleased to update our readers on the tangible outcomes resulting from our recent campaigns. In April, we initiated Sabre Corp. (NASDAQ: SABR ) with a "Strong Sell" and argued that aggressive accounting was masking fundamental pressures and cash flow overstatement. On August 2nd, Sabre issued its Q2'16 earnings and revised its cash flow guidance downward. The company also made the bizarre statement that it could not provide forward guidance on a GAAP basis without unreasonable effort! Last month, we warned our readers about AECOM (NYSE: ACM ) and detailed our concerns about its earnings quality and cash flow. We also argued that the company's AECOM Capital sales should not be considered as "core" earnings. Just this week, AECOM revised its earnings guidance lower and said annual earnings would come at the low end of its $3.00-3.40 range due to the company's inability to monetize its capital stake. The mere fact that the majority of AECOM's annual earnings was predicated on liquidating an equity capital position should be concerning to its investors.

Echo Checks All of Our Boxes For the Perfect Short

Insiders with a history of value destruction, limited alignment with shareholders, a commoditized business with decaying fundamentals and diminishing transparency, inflated Non-GAAP results, problematic accounting, overvaluation, and a consensus "buy" on Wall Street... Echo has everything we like as the perfect short! It was IPO'ed in 2009 and promoted as a company with a "proprietary" technology capable of disrupting the transportation logistics market. Echo's founders, the same people behind Groupon (NASDAQ: GRPN ), have used an identical playbook to promote Echo. The founders have a repeated history of value destruction and a knack for cashing out early before losses mount. Echo is nothing more than a transportation broker matching demand with supply and taking a small cut of the deal. The company is a subscale player and has not demonstrated any operating leverage from its roll-up strategy. Free cash flow after acquisitions (including numerous contingent payments) is negative since its IPO.

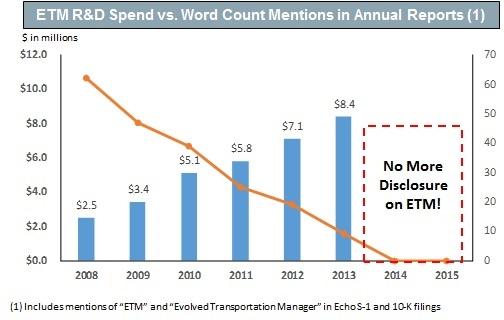

Echo has churned through five chief technology officers and has quietly suspended all discussion of its Enhanced Transportation Management, "ETM," platform, which was once the cornerstone of its IPO pitch and plastered all over its IPO prospectus .

Now called "Optimizer," the company's website portal is sadly not even optimized for the world's top browser, Chrome! Echo is further challenged by dozens of young start-ups backed by the founders of Amazon, eBay, and others, and all set to disrupt fringe players like Echo with Uber-like real-time, location-based technologies.

According to a Frost & Sullivan Study ( Uber for Trucks: Executive Analysis, May 2016 )

- It believes that the Uber model for trucking is poised to revolutionize freight mobility.

- Mobile-based freight brokerage generates ~$100 million in revenues. By 2025, the mobile freight market is expected to grow at a compound annual growth rate of 74.65% and generate $26.4 billion in revenue for the entire market. It is estimated that by 2025, 16% of 3PL will be enabled through mobile platforms.

- "Mobile-based freight brokers are strategizing to grow their network by offering as much value as possible for free to customers on their apps. In addition to strengthening their freight brokering capabilities, mobile-based freight brokers are bundling transportation management solutions together to attract customers."

According to an Oliver Wyman recent study: ( Uber Trucking is on its Way, 2016 )

"."

As a slap in the face to Echo, New Enterprise Associates, the company's first venture backer , is now backing Transfix , a new "disruptive" online marketplace for truckload capacity offering free apps to customers. Echo's only attempt at a mobile app in 2011 appears to have failed and is no longer available on the Apple store or Google Play .

(Source: Google Trends )

Background on Echo's Founders

Echo was co-founded by Eric Lefkofsky and partner Brad Keywell. Their track record should be carefully vetted by investors:

- The duo bought children's apparel company Brandon Apparel Group. It later faltered, Lefkofsky explained in his blog entitled "When You Don't Know What to Say" ( September 2012 ): "" (Note: Echo recently took on $230 million of debt, and we believe its industry is changing.)

- The pair later founded Starbelly.com, an online promotional merchandise seller in 1999. In early 2000, Starbelly sold itself to publicly traded Ha-Lo Industries for $240 million, much of which went Lefkofsky. Commenting on the deal, Keywell said, "This move positions us just where we want to be long term, which is to dominate this entire industry."

- Shortly thereafter, Ha-Lo declared bankruptcy . Shareholders and others blamed the Starbelly deal, and a series of lawsuits ensued. According to legal filings, Lefkofsky made the following statement to Ha-Lo colleagues even as the business was deteriorating: "."

Lefkosky and Keywell later emerged as founders of three new "technology" companies, the most notable and promoted among which was Groupon. Groupon's struggles have been well publicized; its stock is down 80% since IPO'ing at $20/share in 2011

According to Lefkofsky , "." Need we say any more? To his credit, Lefkofsky has held most of his equity in the company (along with Keywell), and even assumed an interim role as CEO , before being replaced.

Lefkofsky and Keywell founded Echo in 2005 with the strategy of using "proprietary" technology to gain share in the large and fragmented transportation logistics industry, with $1.3 trillion of annual spend according to data cited in its prospectus

- According to the S-1 , Lefkofsky and Keywell owned 18.9% and 12.4%, of Echo respectively. As of the company's last proxy statement and SC 13G/A , Lefkfofsky owns just 3.3%, while Keywell owns a token 2%.

- Lefkofsky quietly resigned from the Board in December 12, as stated in an 8-K filing. Shortly thereafter, Echo noted a material weakness .

Another insight into Lefkosfky can be seen on his blog, "The Valley or the Peak" ( August 2012 ):

"."

Echo vs. Groupon: Same People, Same Playbook, Same End Result...?

Masking Organic Growth Deterioration With The Acquisition of Command Transportation

Under pressure to grow revenues to $3 billion by 2018, and facing fundamental pressures in its industry such as excess transportation capacity and declining rates, Echo announced its largest deal to acquire Command Transportation, founded by Paul Loeb in June 2015. The company paid a rich 11.2x EV/EBITDA to acquire a truckload brokerage business (a lower-margin, "spot"-oriented business adding a higher risk profile to shareholders).

The company leveraged itself over 3x Net Debt/EBITDA and diluted shareholders to complete the deal.

Echo is an "asset-light" business, which means increased leverage on its business can be destructive for shareholders when things go bad. It has promoted Command's technology platform as "industry-leading," but in reality we don't believe it's anything unique. To illustrate, Loeb founded American Backhaulers , which was sold to industry behemoth C.H. Robinson (NASDAQ: CHRW ) in 1999. Loeb's partner, Jeff Silver, went to study supply chain logistics at MIT, found a competitor - Coyote Logistics - and just sold it to UPS , while CHRW sued Loeb claiming he misappropriated the technology . In all likelihood, CHRW and UPS both have some form of Command and Echo's secret technology sauce. But don't take our word for it, insiders tend to know best.

" Completely Outdated Technology Platform Found Matching Outdated New CIO "

(Source: Glassdoor : July 19, 2015)

" Avoid at All Costs "

"."

(Source: Glassdoor : April 19, 2015)

" IT Department Downhill Spiral "

"."

(Source: Glassdoor : July 14, 2015)

Based on our research, Command Transportation has had meaningful employee departures since the deal closed, and Command's founder recently returned $750,000 in cash to Echo, citing "employee retention criteria" without further specifics in the recent 10-Q .

Reading between the lines, we interpret this as a decidedly negative. After adjusting Echo's recent reported sales figures for recent M&A deals, we find its organic revenue growth has been declining for each of the past few quarters, and is now negative.

Our results are corroborated by declining Google search interest.

(Source: Google Trends )

Outrageous Synergy Assumptions and Diverging GAAP/Non-GAAP Performance Suggest Echo Will Dramatically Miss Growth Expectations

Echo guided the market to expect $200-300 million of revenue synergies by 2017 from adding Command and cross selling services. The revenue synergy targets are 50-70% of the $407 million enterprise value paid for Command! Moreover, we analyzed all of the recent headlines making M&A deals in the sector and cannot find any transaction even close to promising this level of synergy.

To make matters even more questionable, in Q2'15 (one year after closing the deal) Echo added $3 million of mysterious cost savings synergies, but offered no specifics on the conference call . The company's Non-GAAP financial performance is diverging at an alarming rate from its GAAP financials, suggesting financial strain and future problems.

Echo's results continue to generally disappoint. In Q2'16, it reported quarterly Non-GAAP EPS of $0.27 and missed expectations of $0.32, coming in -16% below expectations (1). Echo called out $3.1 million of Command integration costs, or $0.06 cents per share, to conveniently "beat" expectations by $0.01 (2). At times, Echo's Command integration costs don't appear to have not even reconciled among public statements (3).

We believe investors should be highly cautioned about the company's earnings quality given escalating integration costs, and now mysterious and unexplained cost synergies announced in Q2'16.

(1) Sources: Echo Press Release and Echo Misses 2Q Profit Forecasts .

(2) CFO Sauers, Q2'16 Conference Call .

(3) Echo says total costs in 2015 were $2.3 million, but adding Q2 cost of $0.2 million ( on the conference call ), $1.5 million in Q3 ( press release ), and $0.8 million in Q4 ( press release ), we get $2.5 million.

(4) Midpoint of guidance range.

Not surprisingly, the company is out touting it is already on the hunt for more acquisitions without even making due on its Command promises, but to us this just appears to be a Hail Mary that it can paper over its problems with more deals. To underscore our point, we observe that Echo's audit fees have risen >40% p.a. in the past three years, and are materially higher on a revenue and per employee basis than that of any of its industry peers.

Echo has acknowledged material weaknesses in its financial controls in the past. In 2012, the company admitted it had been defrauded in its acquisition of Shipper Direct, resulting in the quiet resignation of founder Lefkofksy in December 2012. A coincidence or not: Echo had received money back from Shipper's founders, just as it recently received money back from Command.

Echo Appears to Be Out of Compliance With Its Credit Agreement

As part of its Command deal, the company entered into a $200 million asset-based lending (ABL) agreement to provide itself working capital. In recent years, Echo has become much more dependent on short-term financing, a worrisome sign given its poor cash management policies. For example, we observe that Echo earns no interest income on its cash balances!

In our opinion, Echo is not currently in compliance with its ABL covenants . In March 2016, the company announced an agreement to expand its headquarter lease to 225k sq. ft. By our analysis, this makes little economic, as each of its 1,300 employees will have 170 sq. ft. (almost an entire office per person). The terms of Echo's ABL agreement limit additional indebtedness to $12.5 million, but by reviewing the footnotes of the company's operating leases, it is clear it has assumed ~$42 million of leases.

(Source: 10-K and Q1'16 10-Q )

Not surprisingly, Echo dropped the language in its recent 10-Q that appeared in previous financial filings stating that it was in compliance with ABL agreement. A covenant breach would limit the company's ability to implement its acquisition growth strategy.

Broken Alignment Among Insiders and Current Shareholders

Management keeps gearing more of its pay toward cash, not stock.

How can management be incentivized and new technology talent attracted when no stock options are granted?

Various Accounting and Financial Presentation Distortions

In our opinion, Echo's financial statements cannot be taken at face value, due to a plethora of questionable accounting assumptions and changes of financial presentation and disclosure that distort the true condition of its business.

For example, we observe that the company stopped disclosing enterprise customers , which was a critical selling point of its IPO to demonstrate revenue and cash flow stability.

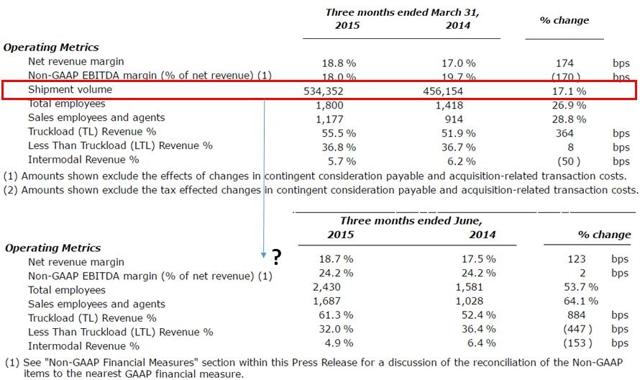

Echo even stopped disclosing shipping volumes , a critical metric to evaluate its business.

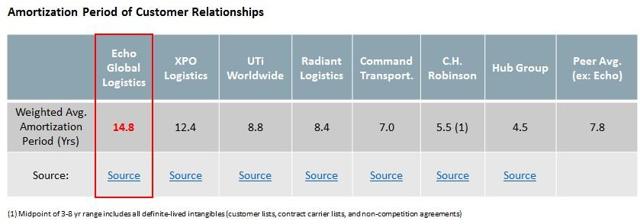

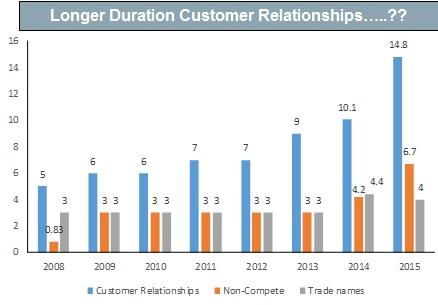

From an accounting perspective, investors should recall that Groupon was forced to restate its revenues from gross to net revenues pre-IPO after questioning by the SEC. Around this time, Echo quietly changed its presentation of "gross profit" to "net revenue." Upon reviewing Echo's Terms of Service and recent accounting guidance , it also appears that the company's gross revenue accounting is problematic given it appears to act as an agent (broker) and shifts financial responsibilities to carriers to perform the client service. Another clear area of concern is Echo's intangible amortization policies. We observe that the company has stretched its assumption for amortizing customer relationships every single year, and now has the most aggressive assumption in the industry!

Echo Trades At an Unjustified Premium; Normalizing Results Gets Us 50-60% Downside:

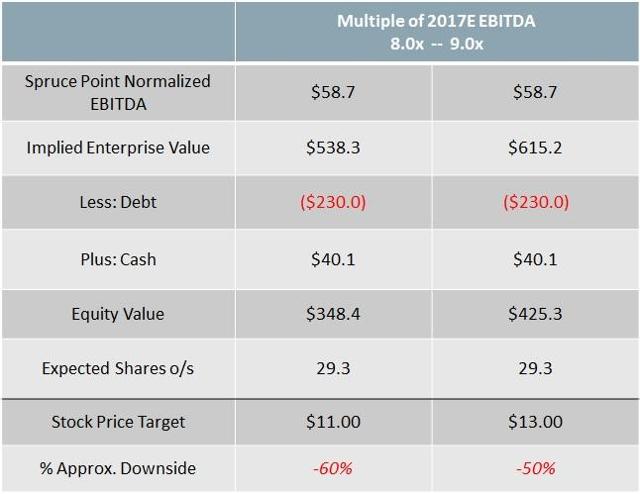

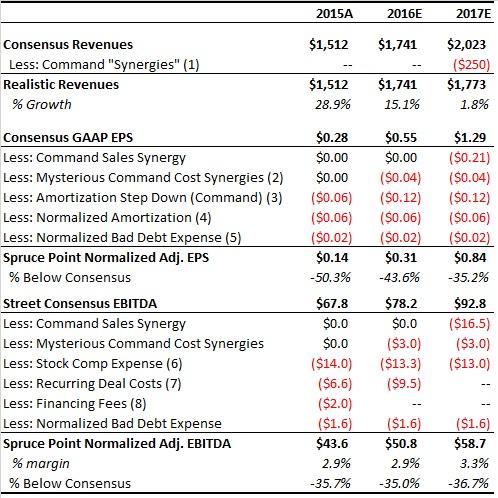

Wall Street sell-side analysts have a nearly unanimous "Buy" recommendation on Echo and see an average upside to $29.65 (11%+). In our view, this is a terrible risk/reward proposition for owning the company's shares. By normalizing Echo's accounting methods, and giving the company no credit for its preposterous synergies, we believe its true EPS and EBITDA are approx. 35% lower than 2017 Street estimates.

(1) Most analysts just take management's word that $250 million of revenue synergies can be achieved. We give Echo zero credit, given a year has passed with nothing to show.

(2) In Q2'16, management came up with unspecified $3 million of cost synergies; we give them zero credit for this.

(3) Adjusted to reverse the Q3'15 reallocation of intangibles to goodwill.

(4) Normalizes amortization to 8 years in line with industry peers versus Echo's 14.8 years.

(5) Normalizes bad debt expense closer to industry average of 1.6% of receivables.

(6)-(8) Multiple non-standard add-backs relative to peers that we don't give credit for. We also don't believe eliminating recurring M&A costs for a roll-up strategy is justified.

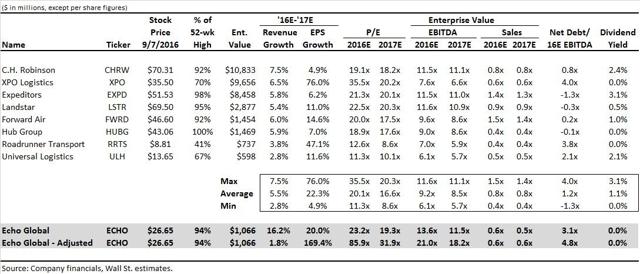

Echo trades at a rich 11.5x inflated 2017E EBITDA multiple. It competes against well-established, larger players that are more deserving of a premium multiple, in our view. In the table below, we list the valuations for C.H. Robinson, XPO Logistics (NYSEMKT: XPO ), Expeditors International (NASDAQ: EXPD ), Landstar (NASDAQ: LSTR ), Forward Air (NASDAQ: FWRD ), Hub Group (NASDAQ: HUBG ), Roadrunner Transportation (NYSE: RRTS ) and Universal Logistics (NASDAQ: ULH ). The company's most relevant peers are asset-light operators CHRW, HUBG and EXPD.

Echo's rich multiple appears predicated on its above-average revenue growth. To hit this enormous target, it will have to extract full synergies from its Command acquisition and acquire further companies. We are skeptical Echo can hit the Command revenue synergy goals (to date we don't believe they've demonstrated any synergies). Furthermore, given that we believe Echo has breached a covenant of its ABL, we hold Echo may have trouble accessing its liquidity for further deals.

By applying a discounted industry multiple of 8x-9x to our normalized EBITDA, we derive a price target of $11.00-13.00 per share (approx. 50-60% downside).

Disclaimer

This research expresses our investment opinions, which we have based upon interpretation of certain facts and observations, all of which are based upon publicly available information, and all of which are set out in our complete research presentation report on our website. Any investment involves substantial risks, including complete loss of capital. Any forecasts or estimates are for illustrative purpose only and should not be taken as limitations of the maximum possible loss or gain. Any information contained herein may include forward looking statements, expectations, pro forma analyses, estimates, and projections. You should assume these types of statements, expectations, pro forma analyses, estimates, and projections may turn out to be incorrect for reasons beyond Spruce Point Capital Management LLC's control. This is not investment or accounting advice nor should it be construed as such. Use of Spruce Point Capital Management LLC's research is at your own risk. Any historical performance achieved from any idea or opinion from Spruce Point Capital Management should not be considered an indicator of future performance. Please visit Sumzero.com for full details of their investment opinion ranking methodology. You should do your own research and due diligence before making any investment decision with respect to any of the securities covered herein.

You should assume that as of the publication date of any presentation, report or letter, Spruce Point Capital Management LLC (possibly along with or through our members, partners, affiliates, employees, and/or consultants) along with our subscribers and clients has a short position in all stocks (and/or are long puts/short call options of the stock) covered herein, including without limitation Echo Global Logistics, Inc. ("Echo"), and therefore stand to realize significant gains in the event that the price of its stock declines. Following publication of any presentation, report or letter, we intend to continue transacting in the securities covered therein, and we may be long, short, or neutral at any time hereafter regardless of our initial recommendation.

This is not an offer to sell or a solicitation of an offer to buy any security, nor shall any security be offered or sold to any person, in any jurisdiction in which such offer would be unlawful under the securities laws of such jurisdiction. Spruce Point Capital Management LLC is not registered as an investment advisor, broker/dealer, or accounting firm.

To the best of our ability and belief, as of the date hereof, all information contained herein is accurate and reliable and does not omit to state material facts necessary to make the statements herein not misleading, and all information has been obtained from public sources we believe to be accurate and reliable, and who are not insiders or connected persons of the stock covered herein or who may otherwise owe any fiduciary duty or duty of confidentiality to the issuer, or to any other person or entity that was breached by the transmission of information to Spruce Point Capital Management LLC. However, Spruce Point Capital Management LLC recognizes that there may be non-public information in the possession of Echo Global Logistics, Inc. or other insiders of Echo Global Logistics, Inc. that has not been publicly disclosed by Echo Global Logistics. Therefore, such information contained herein is presented "as is," without warranty of any kind - whether express or implied. Spruce Point Capital Management LLC makes no other representations, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results to be obtained from its use. All rights reserved. This document may not be reproduced or disseminated in whole or in part without the prior written consent of Spruce Point Capital Management LLC.