What is an intuitive way to understand the key idea behind the Black-Litterman Portfolio Optimization?

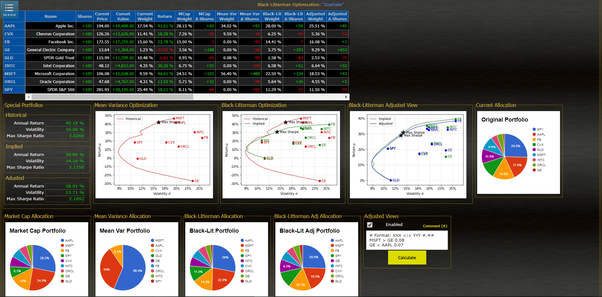

I think the easiest way to understand it is to see Portfolio Optimization using the Black Litterman model. Here is an example of the calculation from ZooNova.com

Explanation.

In the traditional Markowitz Mean-Variance approach, the portfolio is optimized by maximizing expected returns while minimizing variance-covariance (i.e. "risk"). Since returns are difficult to estimate, and must be calculated for each asset, the optimized portfolio is sensitive to small changes.

Using Black-Litterman Reverse Optimization, expected returns are not estimated. Instead, it presumes that the entire market is optimally allocated by way of market cap weights. Accordingly, "implied" returns are derived from these weights and the estimated risk.

A Bayesian inference is also provided to integrate the user's view market view into the estimated equilibrium returns. This take the form of:SYM <|> SYM #.###For example, "MSFT > AAPL 0.02" indicates that MSFT will outperform AAPL by 2%. Based on adjusted expected returns and a calculated confidence factor (ω = τ · P · C · P−1 where τ = 0.025), a new optimal ("adjusted") portfolio is computed.

Cheers.