Weekly S&P500 ChartStorm - 1 May 2022

The Weekly S&P500 ChartStorm is a selection of 10 charts which I hand pick from around the web and post on Twitter . The purpose of this post is to add extra color and commentary around the charts.

The charts focus on the S&P500 (US equities); and the various forces and factors that influence the outlook - with the aim of bringing insight and perspective...

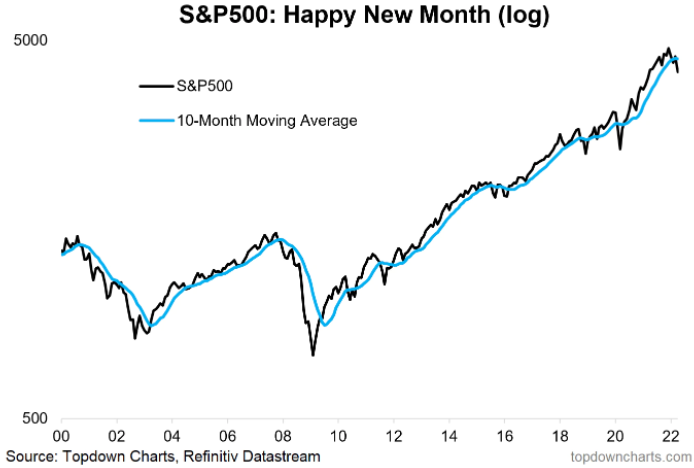

1. Happy(?) New Month! Another month, another update to the monthly chart, now tracking clean an clear below its 10-month moving average.

Source: @topdowncharts

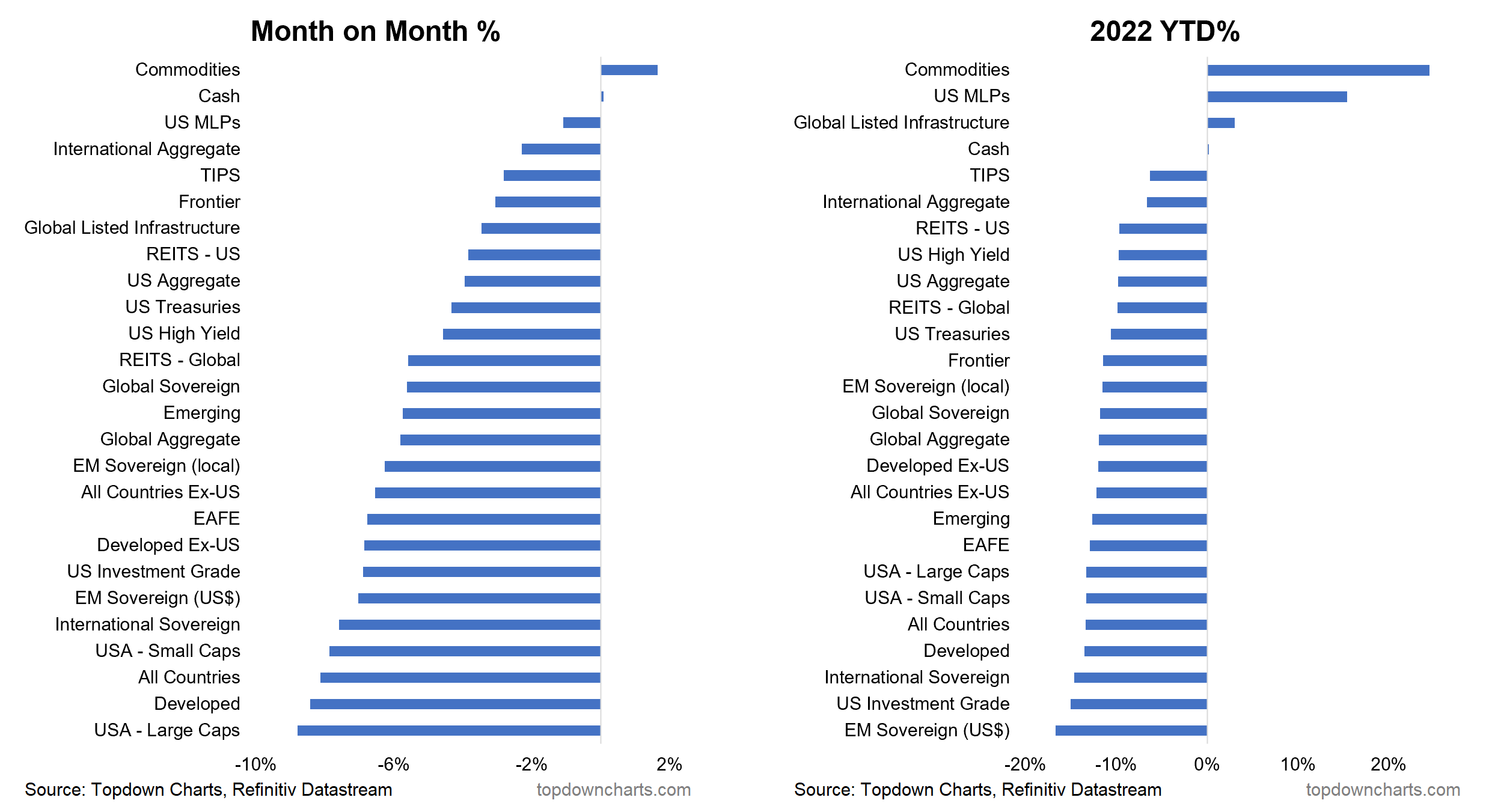

2. Monthly Asset Returns: US Large Cap equities were at the bottom of the table in April… basically everything except cash & commodities was in the crapper this month.

Source: Asset Class Returns

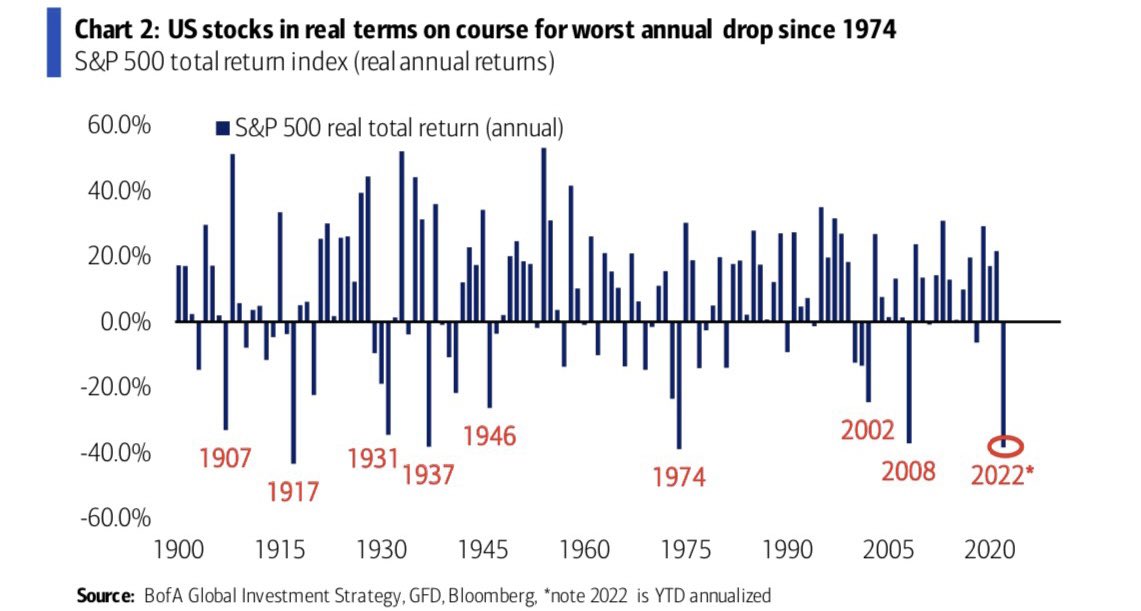

3. S&P500 Real Returns: CPI-Adjusted S&P500 on track for its worst performance since 1974 (and if you wanted a macro analog, the 70's have some similarities... e.g. surging inflation, geopolitical shocks, surging rates).

Source: @Marlin_Capital

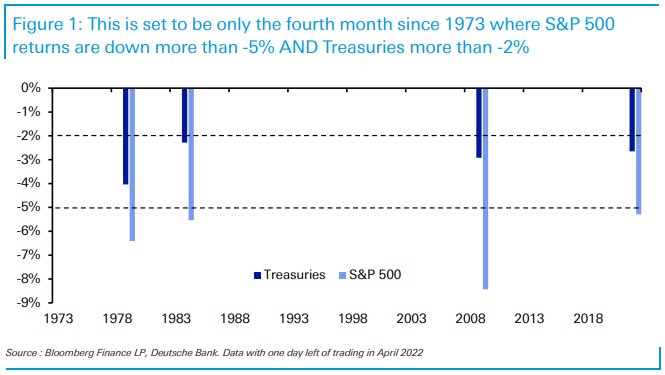

4. Rare Returns: As highlighted in chart 2, both stocks and bonds have had a rough and tough time this year. It was always going to be a hard ask for bonds to be a diversifier to stocks when both were extreme expensive -- all was needed was an inflation shock.

Source: @DiMartinoBooth

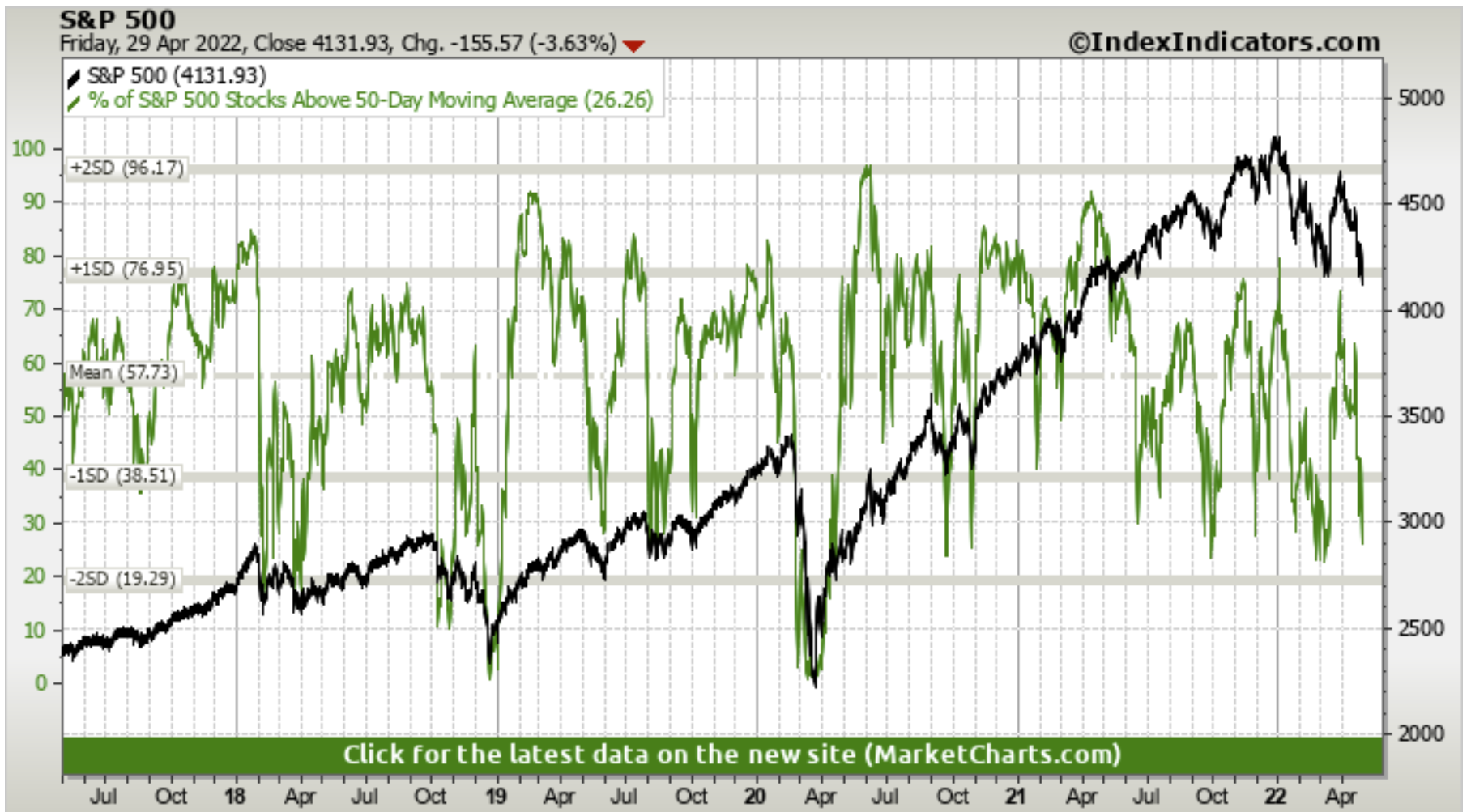

5. Bad Breadth Update: An update to that 50dma breadth chart from last week : starting to look a little more oversold this week... but I would probably still just call it strong bearish momentum as the index has also taken out a pretty key level.

Source: @MarketCharts

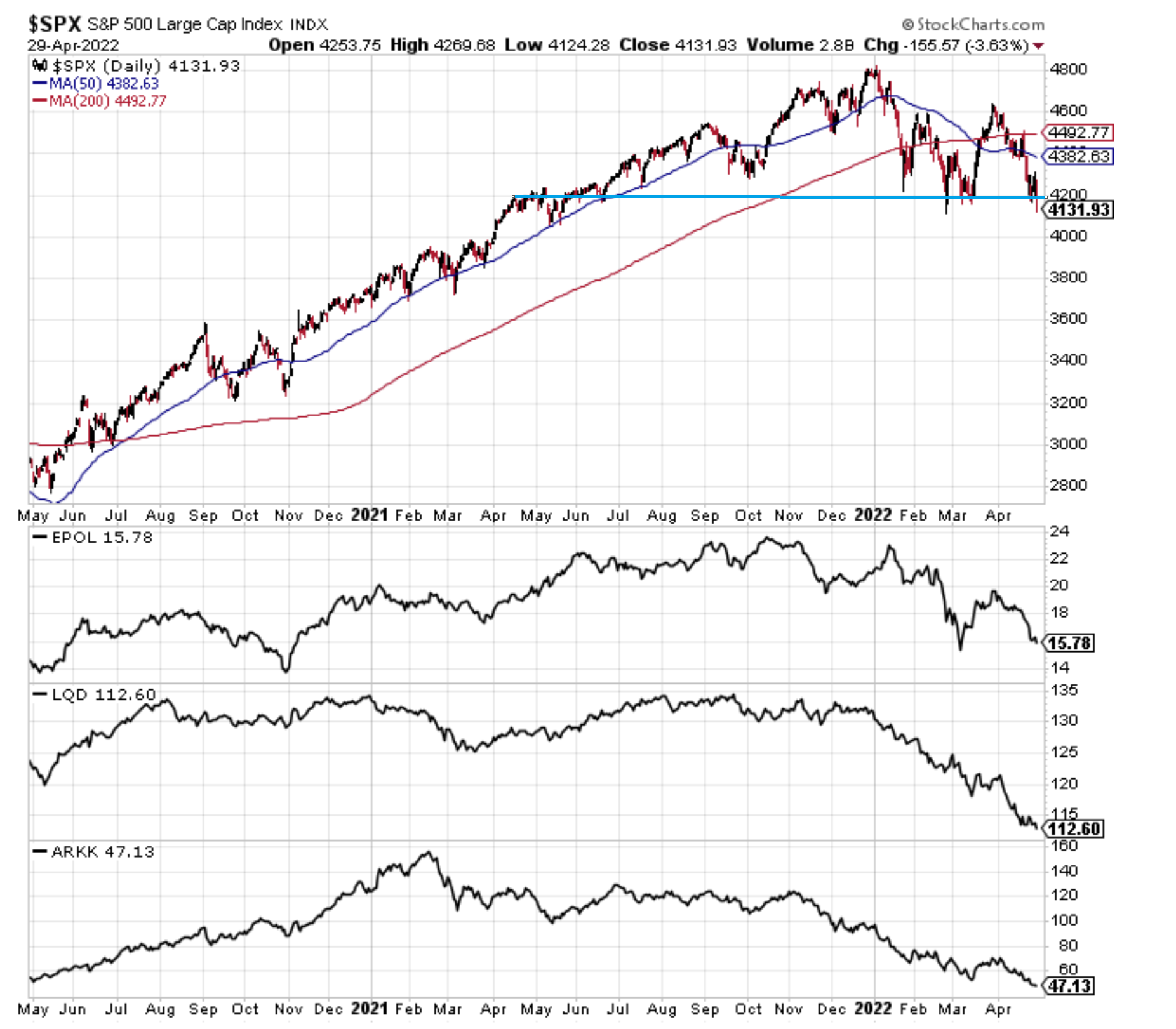

6. Correction-Drivers Update:

-EPOL (geopolitics proxy): worsening, high risk of spillovers.

-LQD (credit/rates): new lows as bond yields spike further + credit risk sentiment is starting to stumble too as the macro outlook dims.

-ARKK (tech burst): new lows as tech reset plays through.

And the index has made an initial break down. Not good.

Source: @Callum_Thomas

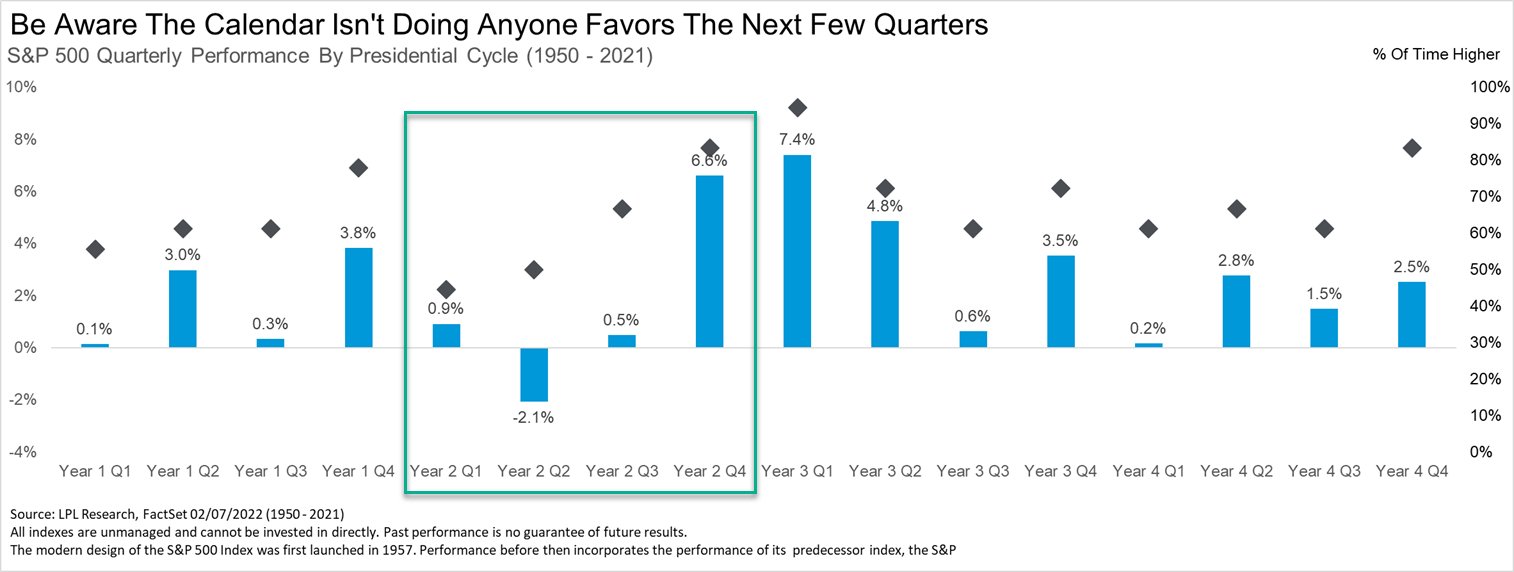

7. "SELL IN MAY"

(especially May of Mid-Term years)

(of course: past performance - while informative and interesting context - is no guarantee of future results)

Source: @RyanDetrick

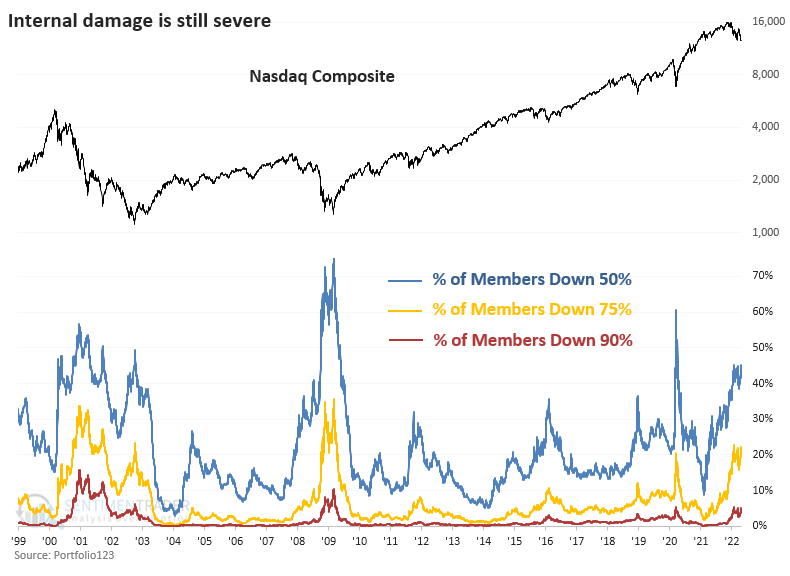

8. Let There be no Ambiguity: This is a bear market.

Under the surface the picture is clear as demonstrated in this excellent chart. We are only now starting to see the index roll over in earnest.

Source: @jasongoepfert

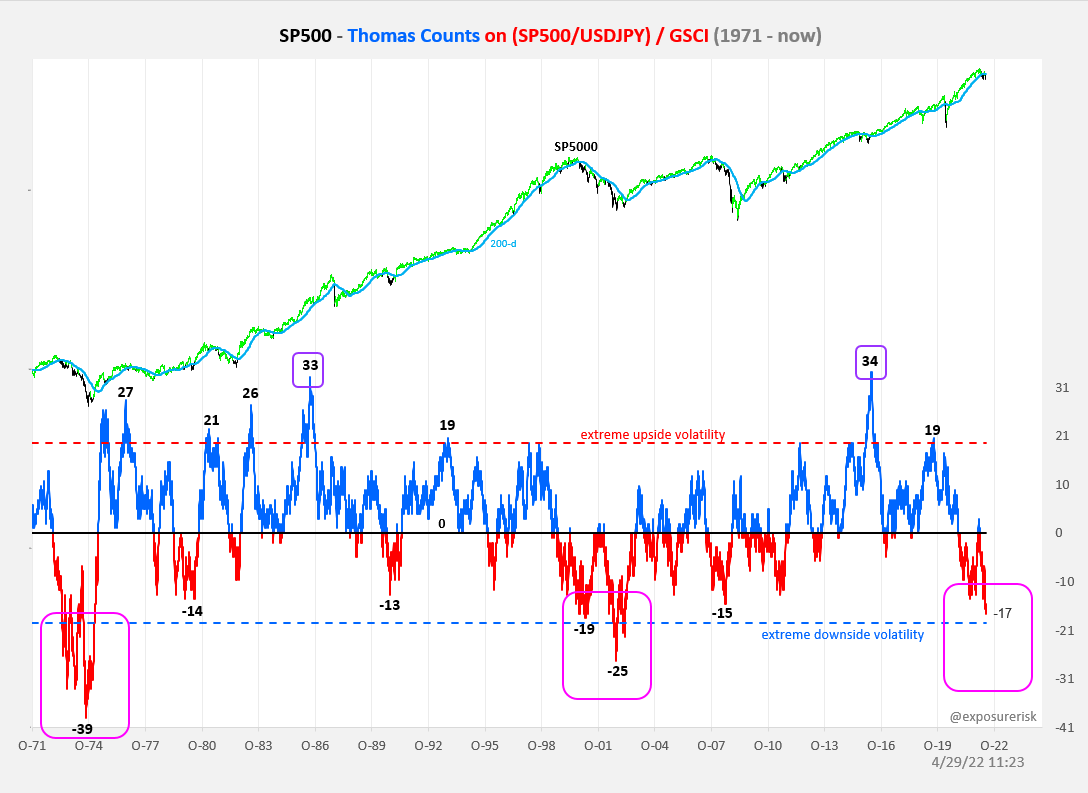

9. History Rhymes: Without even delving into the specifics of this chart the thing that is crystal clear is how many parallels there are NOW versus BOTH 2000 (tech boom/bust) AND 1970's (inflation/geopolitical shocks).

Source: @exposurerisk

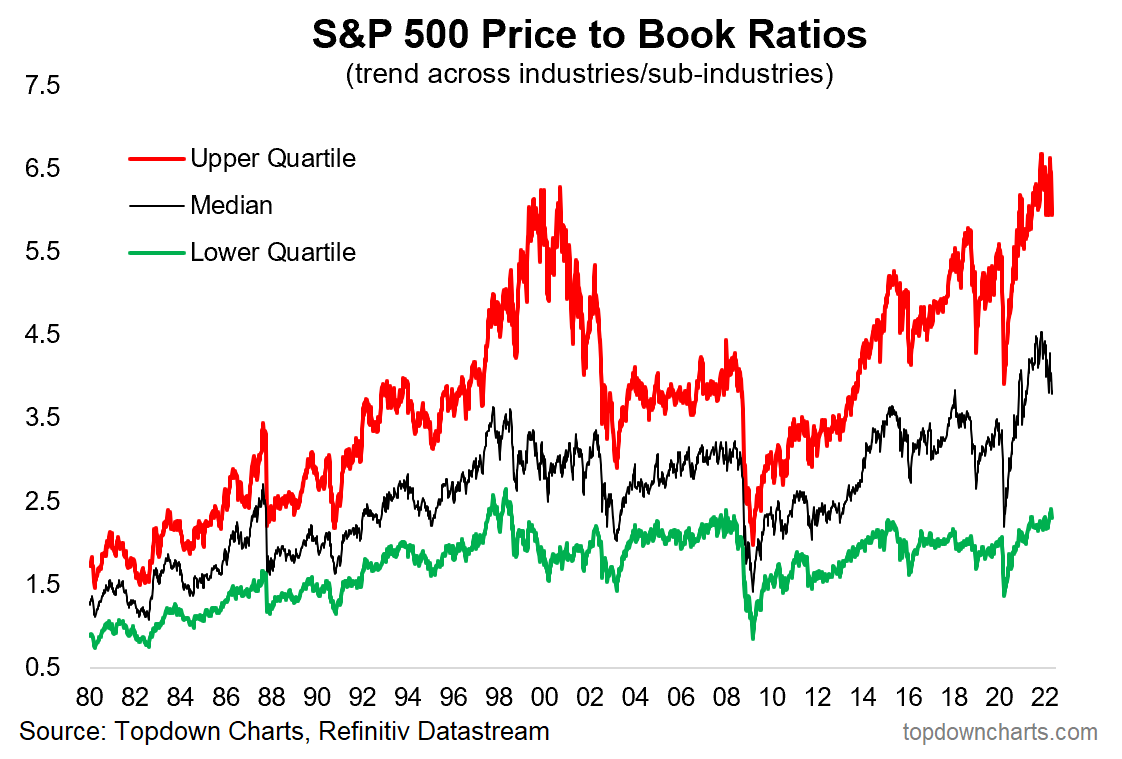

10. Valuations: I know not everyone likes the Price-to-Book ratio, and fewer still like comparing valuations across time, and people will offer plenty of explanations/reasons for why it’s so high...

But sh*t still expensive.

Source: Vertiginous Valuations

Thanks for reading!

Callum Thomas

Founder and Head of Research at Topdown Charts