We help investors, asset managers, and brokers succeed in the alternative investment space.

VIX: Not All 1,000 pt drops are the same

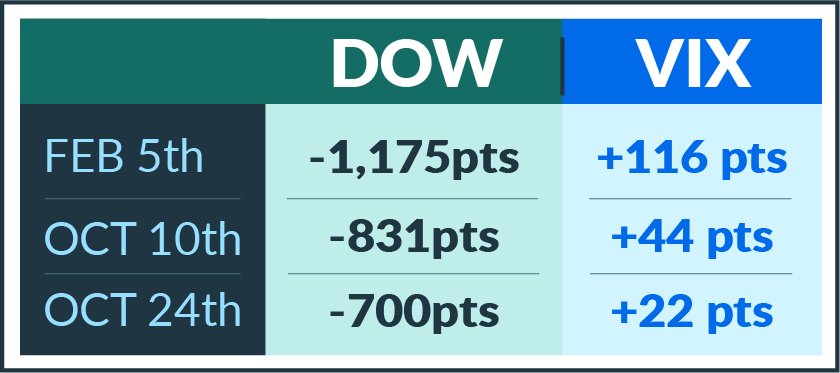

We jokingly tweeted out yesterday how the VIX’s three different reactions to seemingly similar market sell offs this year has reminded us of the many faces of Jim Carrey. Here’s the imagery to go along with that concept:

But all jokes aside, it’s worth noting the movement of the VIX during these somewhat big sell offs declines in a non-linear fashion in relation to the decline in the point drop. We’ve covered time and again how we live in extremistan, to borrow a phrase from Nassim Taleb, where Jeff Bezos wealth is 100s of standard deviations above the mean , but that’s typically in relation to the point drop itself, not the quad-rivative that is the VIX (a derivative of an index of a derivative of an index). Now we see it in the VIX, where the first such move is shocking, the next one upsetting, and the third one little more than an eyebrow raise.

We were reminded of a comment from Pearl (who recently completed their 3 rd full year of trading ) Capital Management’s Tim Jacobson at a former panel discussion on VIX trading, where he said:

….to think of the VIX as a radar screen – where all of the known information the market is reflected on the screen in various blips and dots. The sum of all that information comes out to be the current VIX level. Continuing, he stated that unless one of those known blips becomes larger, or a new unforeseen blip hits the screen, the VIX won’t move. The larger the blip and more unexpected its arrival on your screen (and closeness to your ship) the larger the movement in the VIX will be.

While most of us think of the VIX going up when the stock market goes down, that isn’t technically what it’s doing. It’s measuring the increase/decrease in premiums on a basket of options on the stock market, so reacting to not just the movement, but also the violence of that movement, and the unexpectedness of it. Yesterday’s sell off, on the heels of an already weak market, we decidedly not unexpected, thus the muted reaction from the VIX. Indeed, it’s possible for the VIX to actually fall while the stock market is falling – if the drop is less than what was expected. Imagine a scenario where the market falls -300 points a day for a few days. The first day is going to be that big new blip on the radar screen, shooting the VIX higher and putting everyone on high alert. But the following beeps on the radar screen will be in the same spot at the same distance, telling investors to remain concerned, but concerned in a known unknown sort of way. The spikes and outliers come from the unknown unknowns.

RSS Import: Original Source