ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 50 instruments including FX majors, Gold, Silver, Copper, Oil, Natural Gas, Soybeans, Sugar ,Corn TNX and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup videos, Educational Resources, and 24 Hour chat room where they are provided live updates and given answers to their questions. The guidance of ElliottWave-Forecast gives subscribers the wherewithal to position themselves for proper entry and exit in the Forex marketplace. We believe our disciplined methodology is pivotal for long-term success in trading.

Union Pacific Railroad (NYSE:UNP) - Bullish Sequence Calling Higher

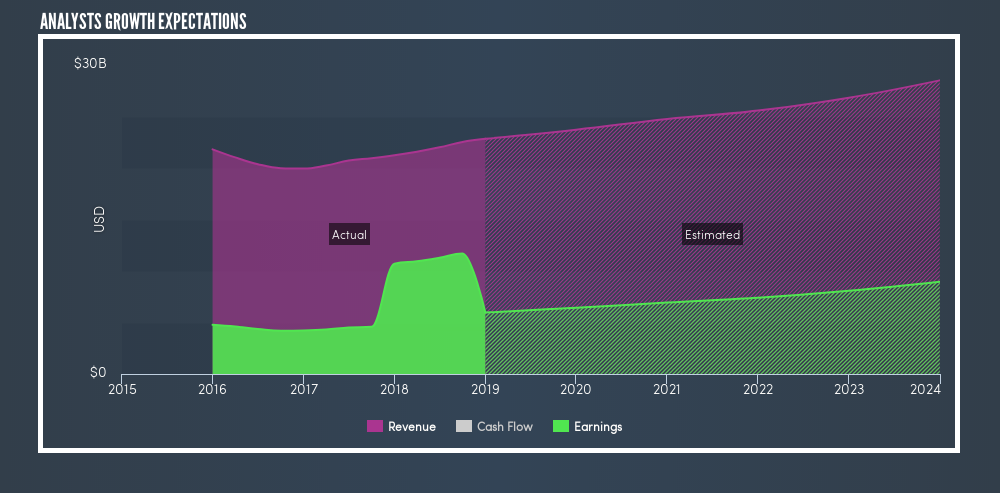

Union Pacific Railroad (NYSE:UNP) is a publicly-traded railroad holding company that was established in 1969. Last year, revenues grew to $22.8 billion, while earnings was up in mid-single-digits to $10.8 billion. Revenue growth was led by strong gains in Intermodal, amid capacity constraints in the trucking industry and a higher industrial production for commodities shipments.

Union Pacific's year on year earnings growth rate has been positive over the past 5 years and it outperformed the Transportation industry. Its earnings are expected to grow by 7.1% yearly and revenue is expected to grow by 4% yearly.

UNP Future Revenue and Net Income Expectation

Moving on to the technical picture of the stock using weekly and daily Elliott wave chart :

From January 2016 low, UNP rallied higher in an impulsive 5 waves advance breaking 2015 peak which opened a new bigger cycle to the upside. The 5 waves rally ended as a wave I in September 2018 then did a 3 waves pullback Zigzag Structure in wave II which reacted higher from the blue box area $129 - $122.

Up from there, the stock resumed the rally breaking to new all time highs and opening a new bullish sequence to the upside calling for a move toward target area $226 - $287. Therefore, UNP pullbacks are expected to remain supported above December 2018 low $127 and find buyers in 3 , 7 or 11 swings.

UNP Elliott Wave Daily Chart

UNP Elliott Wave Weekly Chart

Conclusion

UNP bulls are looking to stay in charge as the stock has a bullish sequence from 2016 and 2018 lows so Investors may be looking ahead to the next couple of weeks for buying opportunities during the coming pullbacks