Northern Trust Asset Management is a global investment manager that helps investors navigate changing market environments in efforts to realize their long-term objectives.

U.S. Election 2024: An Analysis of the Tax Scenarios for Investors

Key Points

What this is

We explore the scenarios for tax policies, and how they could impact investors, depending on the outcome of the November elections.

Why it matters

With the 2017 Tax Cuts and Jobs Act due to expire at the end of 2025, the election could impact significantly future tax policy.

Where it's going

With uncertainty surrounding tax policy, we think investors should be aware of and prepare for potential tax code changes.

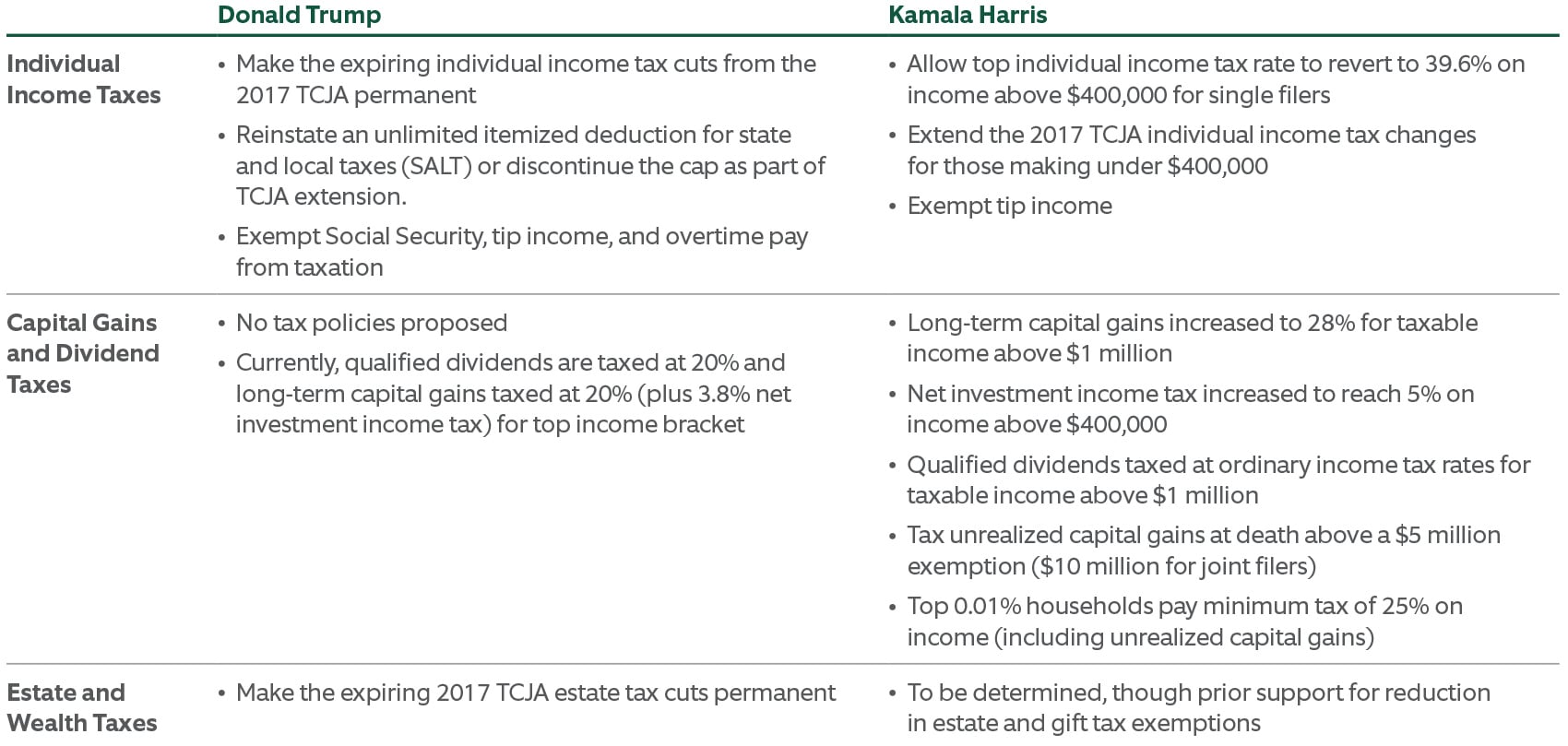

As the election nears, we think investors should start considering tax policy scenarios based on the election outcome, especially because the 2017 Tax Cuts and Jobs Act (TCJA) is scheduled to expire at the end of 2025. The makeup of the White House and Congress likely will determine how tax and other policy areas are resolved. Both candidates have indicated their positions on tax policy, meaning that investors can evaluate the impact on those areas relevant to their circumstances. Exhibit 1 highlights where the candidates stand on key issues related to individuals and their investments.

While investors await the election outcome in November, and we expect they’ll wait much longer for a revised tax code, we think now is a good time to prepare for potential outcomes. As discussed in our recent paper U.S. Election 2024: What Can Investors Expect with So Much at Stake? , we believe in preparation over prediction. Regardless of the election outcome, partnering with an experienced investment manager can help investors navigate uncertainty and achieve their goals.

Tax Cuts and Jobs Act

The Tax Cuts and Jobs Act, passed in 2017, reduced corporate taxes, increased individual deductions, and capped the state and local state deduction. Many of the individual tax cuts are set to expire in 2025, which could lead to future tax changes.

EXHIBIT 1: Where do candidates stand on policy relevant to individuals?

Both candidates have indicated their position on tax policy, meaning that investors can evaluate the impact on those areas relevant to their circumstances.

Sources: Northern Trust, Tax Foundation. Stances derived from multiple third party sources including statements made by the candidates or their staff, or articles from sources citing those statements.

Equity Impact

Higher tax rates mean lower after-tax returns for taxable investors, all else equal. For example, if we assume an investor receives a dividend yield of 1.5%, then the change in tax policy highlighted in Exhibit 1 would decrease the after-tax return by 0.31% per year for the top tax bracket. There would also be an impact from an increase in capital gains taxes, although the degree of the impact depends on a number of variables including the existing unrealized gains and losses in the portfolio, portfolio turnover and market returns.

Of course, taxes are only one part of the equation as investors also balance risk and total return. While not trading avoids realizing any gains, it can also create significant risks to a portfolio such as tracking error to a capitalization-weighted benchmark or over-concentration. If the capital gains tax rate is higher, then realizing gains becomes more expensive and realizing losses becomes more beneficial. Investors can run a variety of scenarios through their portfolios to incorporate these dynamics to better understand the trade-offs and determine the optimal strategy.

Considerations for Realizing Long-Term Capital Gains

While portfolio action before clarity on tax policy would be premature, investors may ask based on the election results whether to realize long-term gains prior to a potential increase in the capital gains tax. In other words, they could realize capital gains during the lower-rate environment and increase their cost basis by reinvesting the proceeds, potentially lowering future capital gains if the tax rate rises.

The answer depends on several variables and investor-specific details. These include estimated market returns, details about the unrealized gains and losses, loss carry forwards time horizon, intentions for transferring assets, cash needs and diversification needs. When we have analyzed this question in the past, we found that the results are highly dependent on inputs such as market rates of return and future cash flow needs, which are both very difficult to predict. Therefore, a careful analysis of individual circumstances is required to determine the optimal approach.

What About Municipal Bonds?

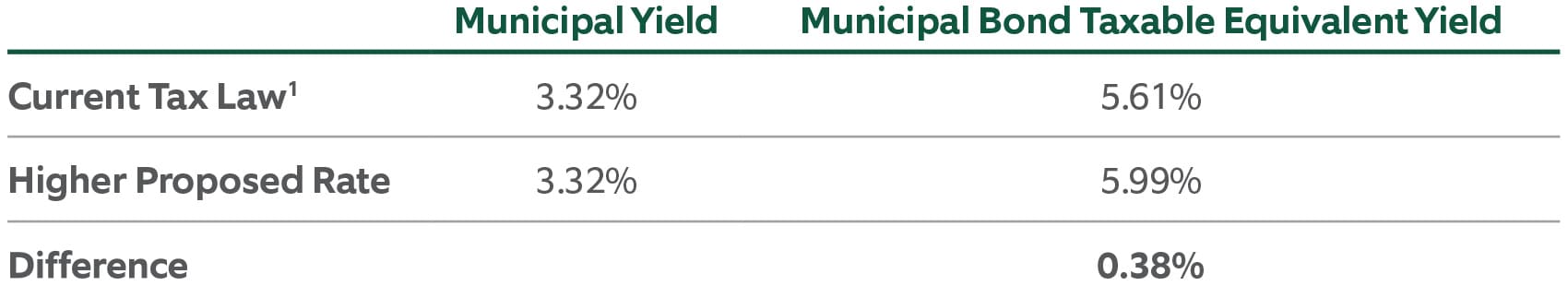

Because municipal bonds are exempt from federal taxes, the marginal tax rate plays an important role for investors. This rate directly determines an important metric when evaluating comparable taxable bonds — the taxable equivalent yield. The taxable equivalent yield for a municipal bond is the pretax yield to investors if the municipal bond were taxable, making its yield comparable to taxable bonds. So tax-equivalent yields for municipal bonds are higher than their actual yields.

As shown in Exhibit 2 , this tax-exempt benefit means that, all else being equal, a higher income tax rate increases the benefit of municipal bonds relative to taxable equivalents. For example, under the current tax rates, municipal bonds provide a taxable equivalent yield of 5.61%. If the TCJA expires, the top marginal rate reverts to 39.6%. Also, the net investment income tax could increase to 5% from 3.8%. In this scenario, the municipal bond taxable equivalent yield would increase to 5.99%, a 0.38% pickup.

EXHIBIT 2: Potential Impact to municipal bond yields

All else being equal, a higher income tax rate increases the benefit of municipal bonds relative to taxable equivalents.

Source: Northern Trust Asset Management, Bloomberg Municipal Bond Index. Notes: Yields represent broad index yields as of 9/30/2024 market close. After-tax equivalent yield reflects the pre-TCJA top federal personal income tax rate of 39.6% along with an increase of net investment income tax from 3.8% to 5%.

Preparation for Tax Policy Uncertainty

With uncertainty surrounding the tax landscape, we think investors should be aware of and prepare for potential tax policy changes. Financial professionals, such as tax advisors and investment consultants, can help navigate through the various tax and investment issues. In addition, partnering with an experienced investment manager across asset classes can provide a tailored approach to meet client-specific objectives.