Turkey's tumult puts a spotlight on country ETFs

- Country ETFs are essential tools for managing risk in times of stress

- What happens when market chaos erupts eight time zones east of Wall Street?

- Investors turn to country exchange traded funds .

With Turkey in freefall, the iShares MSCI Turkey ETF (TUR) became an important tool for accessing a crippled market.

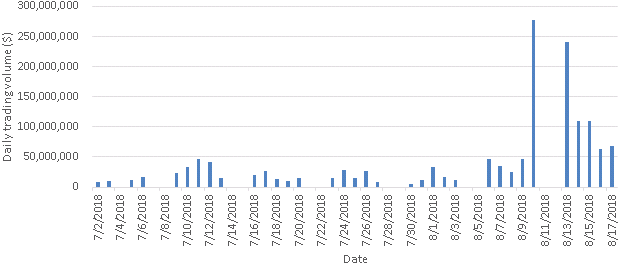

The U.S.-listed ETF experienced record trading volume in recent days as investors used the fund to express views on Istanbul-listed stocks and the Turkish lira.

The iShares MSCI Turkey ETF experienced a record $277 million in trading volume on Aug. 10, as the lira plumbed an all-time low versus the U.S. dollar.1 On the following session, Aug. 13, the ETF traded $241 million, the second-biggest tally ever.2

Trading the iShares MSCI Turkey ETF (TUR)

Source: Bloomberg

ETFs provide access to overseas markets and can help facilitate price discovery — the market-clearing price based on supply and demand — when foreign markets are closed. Since closing bell for Istanbul’s main stock exchange is 11:00 a.m. Eastern Time, the iShares MSCI Turkey ETF was the only U.S.-listed ETF that provided pure access to Turkish assets for much of the U.S. trading session.

Trading in the iShares MSCI Turkey ETF was most intense in critical moments before and soon after U.S. trading opened on Aug. 10, a reflection of demand from investors even at a time when individual Turkish stocks were available. That morning, some $30 million in ETF shares changed hands before markets opened in the U.S.; another $78 million in the session’s first 30 minutes. Together, this period accounted for more than one-third of the day’s record volume.3

A sharp drop in the lira was brought on by a confluence of concerns about debt loads of Turkish corporations, runaway inflation, and a tit-for-tat trade row with the U.S. Global markets have remained volatile as worries spread that a prolonged lira slump could pressure creditor banks to Turkish companies and that broad risk aversion may trigger selling of emerging-market assets.

Even so, trading has been efficient and orderly in the iShares MSCI Turkey ETF despite wild price swings and heavy volumes. The bid-ask spread, or the difference between the highest price prospective buyers will pay for the ETF and the lower price for a prospective seller, remained in line with historic averages.4

Recent trading in the iShares MSCI Turkey ETF is the latest example of a U.S.-listed country ETF becoming a hub for trading activity tied to overseas markets.

- In May 2018, the iShares MSCI Malaysia ETF (EWM), a U.S.-listed ETF that seeks to track an index of Malaysian stocks, traded more than four times its average volume on a single session.5 This flurry of activity occurred on a day when the local market was closed following a historic election.

- In May 2017, the iShares MSCI Brazil ETF, a U.S.-listed ETF that seeks to track an index of Brazilian stocks, traded the most in its history (and efficiently) following allegations of high-level government corruption.6

The outlook for Turkey remains uncertain but one fact is clear: iShares country ETFs can help unlock investment opportunities in the heat of crisis.

Article was originally on iShares.com

© 2018 BlackRock, Inc. All rights reserved.

1 BlackRock; Bloomberg

2 BlackRock; Bloomberg

3 BlackRock; Bloomberg

4 BlackRock; Bloomberg

5 BlackRock (May 9, 2018).

6 BlackRock (May 18, 2017); Barron’s, “EWZ Got Walloped, but it Also Kinda Saved the Day,” May 18, 2017.

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries.

There can be no assurance that an active trading market for shares of an ETF will develop or be maintained.

Shares of iShares ETFs may be bought and sold throughout the day on the exchange through any brokerage account. Shares are not individually redeemable from the ETF, however, shares may be redeemed directly from an ETF by Authorized Participants, in very large creation/redemption units.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

This document contains general information only and does not take into account an individual's financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, "BlackRock").

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Barclays, Bloomberg Finance L.P., BlackRock Index Services, LLC, Cohen & Steers Capital Management, Inc., European Public Real Estate Association (“EPRA® ”), FTSE International Limited (“FTSE”), ICE Data Services, LLC, India Index Services & Products Limited, JPMorgan Chase & Co., Japan Exchange Group, MSCI Inc., Markit Indices Limited, Morningstar, Inc., The NASDAQ OMX Group, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), New York Stock Exchange, Inc., Russell or S&P Dow Jones Indices LLC. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, who is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Neither FTSE nor NAREIT makes any warranty regarding the FTSE NAREIT Equity REITS Index, FTSE NAREIT All Residential Capped Index or FTSE NAREIT All Mortgage Capped Index; all rights vest in NAREIT. Neither FTSE nor NAREIT makes any warranty regarding the FTSE EPRA/NAREIT Developed Real Estate ex-U.S. Index, FTSE EPRA/NAREIT Developed Europe Index or FTSE EPRA/NAREIT Global REIT Index; all rights vest in FTSE, NAREIT and EPRA.“FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license.

©2018 BlackRock, Inc. All rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, the iShares Core Graphic, CoRI and the CoRI logo are registered and unregistered trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

585181