Northern Trust Asset Management is a global investment manager that helps investors navigate changing market environments in efforts to realize their long-term objectives.

Treasurers: Why Embracing the Latest Technology is No Longer Optional

Modernizing treasury operations may seem overwhelming, but adding automated and integrated solutions with a structured approach can deliver quick wins, helping to ease the daily pressures of time-strapped treasurers.

Modernizing treasury operations may seem overwhelming, but a structured approach can deliver quick wins and build momentum.

Corporate treasurers play a vital role in a company’s success. They manage cash flow, mitigate risk, and help drive long-term value — all while often facing an increasingly uncertain environment, tight deadlines, and growing pressure to do more with less. Effective time management is crucial. Yet, despite the availability of integrated, time-saving technologies, many corporate treasurers still rely on manual processes and outdated tools like spreadsheets and basic portals. Why, in a time of automated and integrated technology are many treasurers hesitant to make the shift to the latest technology?

A 2024 survey of treasurers, conducted in partnership with Treasury Management International [1] , revealed key obstacles to technology adoption:

- Cost:

21% of treasurers cite budget constraints.

However, industry trends show that automation offers long-term savings that justify upfront costs.

- Limited resources:

11% mention limited staff or time constraints.

Ironically, the very tools they hesitate to adopt are designed to alleviate these constraints.

- Integration challenges: 35% are already juggling multiple disconnected systems, making the idea of introducing new tools feel like an added burden. Yet, modern treasury platforms are built for seamless integration, reducing complexity instead of adding to it.

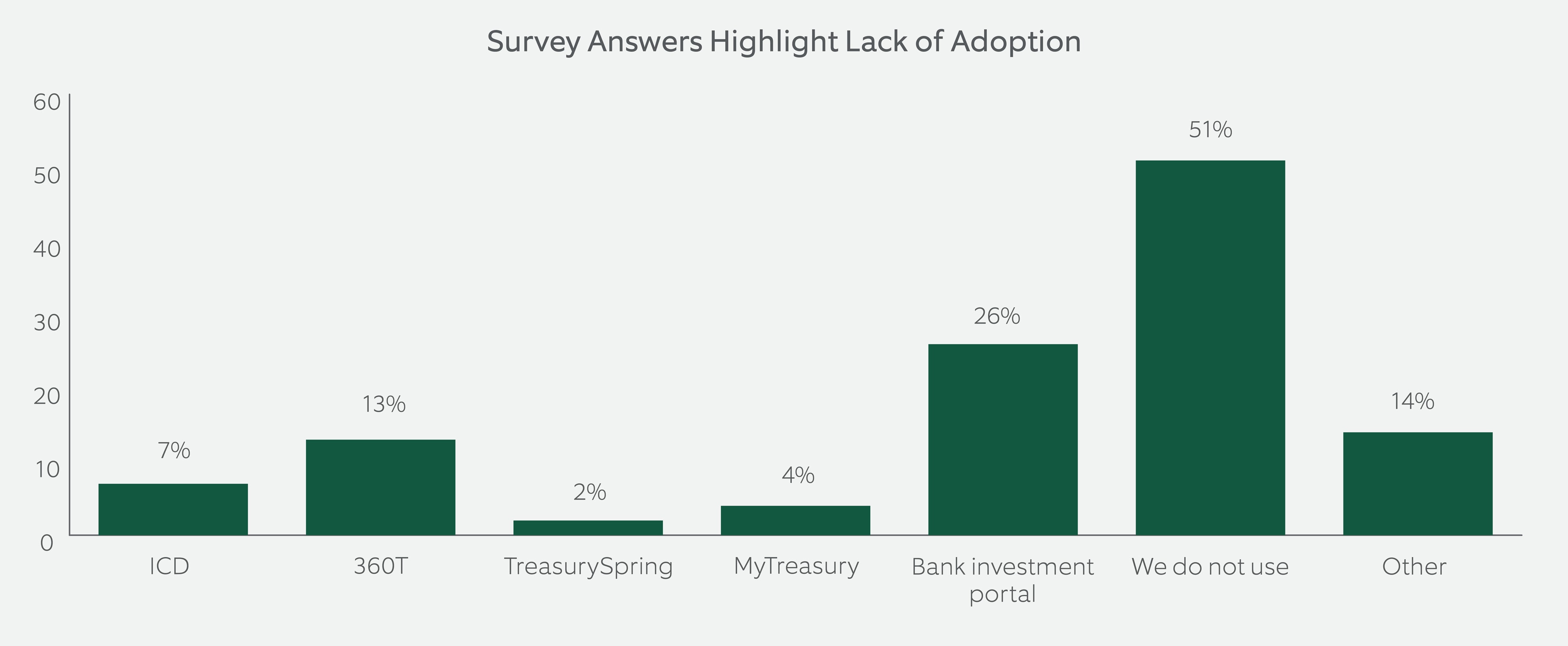

- Reluctance to change: Surprisingly, 50% of respondents still avoid investment portals, preferring traditional and more manual methods (see Exhibit 1 ). This resistance to change leaves potential gains on the table and keeps treasury functions stuck in the past, possibly putting them years behind competitors

These findings highlight a growing disconnect. The time to modernize is now.

[1] Treasury Management International (TMI) and Northern Trust Asset Management (NTAM) Global Liquidity Survey 2024

EXHIBIT 1: ABOUT 50% OF TREASURERS SURVEYED DON’T USE INVESTMENT PORTALS

Survey respondents were asked: “What investment portals does your company currently use?"

Source: Treasury Management International (TMI) and Northern Trust Asset Management (NTAM) Global Liquidity Survey 2024.

Making Technology Work for Treasury Teams

Modernizing treasury operations may seem overwhelming, but a structured approach delivers quick wins and builds momentum. By prioritizing the most pressing challenges first, treasurers and cash managers can demonstrate the immediate value of technology and gain buy-in. The right technology, including application programming interfaces (APIs) and artificial intelligence (AI), along with AI subsets like machine learning and natural language processing (NLP), can support this first step by automating processes, improving accuracy, and enhancing risk management.

APIs: The Connectivity Powerhouse

Manual processes, siloed systems, and a lack of real-time visibility into liquidity creates unnecessary hurdles. APIs break down these barriers by automating data flows and delivering up-to-date financial insights. Many treasury management systems (TMS) and enterprise resource planning (ERP) platforms already offer API capabilities, making integration easier with minimal disruption. Liquidity professionals can work with existing vendors or IT teams to make sure they’re getting the most out of their current technology and explore new solutions.

How APIs can modernize treasury

Reduces costs and improves efficiency

APIs automate data transfers from banks directly into TMS, eliminating manual reconciliations and spreadsheet updates. This automation reduces tedious tasks and unintended errors, lowers labor costs (including potential overtime), and frees up staff time for strategic activities.

Optimizes workflows and risk management

APIs integrate management tools and enable real-time cash flow forecasting, allowing proactive risk identification. They also connect previously siloed systems to create a unified financial view, which streamlines operations and reduces IT costs.

Strengthens treasury infrastructure

Treasurers can choose from a variety of API-enabled solutions, from fully integrated TMS and ERP platforms to specialized API management tools. Collaborating with experts to explore options can help them build a scalable, cost-effective treasury infrastructure.

While APIs have improved treasury operations, technology is advancing further. Intelligent automation, including AI, machine learning, and NLP, moves treasury functions beyond reactive reporting toward predictive insights.

Intelligent Automation: AI, Machine Learning, and NLP

APIs deliver the data, but AI, machine learning, and NLP turn the data into actionable insights. Many modern treasury systems now embed these technologies, allowing liquidity managers to anticipate risks and refine forecasts without overhauling their entire infrastructure.

AI: Faster decision-making

AI analyzes large data sets to detect patterns, flag inconsistencies, and assess potential risks in real time, which allows for faster responses to unexpected market shifts and more informed decision-making.

Machine learning: Sharper, more adaptive forecasts

Machine learning strengthens AI by improving its predictions over time. It analyzes historical and real-time financial patterns to refine cash flow forecasts, detect liquidity risks earlier, and adapt treasury strategies as market conditions evolve.

NLP: Automated document processing

While AI and machine learning focus on numbers and trends, NLP accelerates document processing. It scans contracts, regulatory filings, emails, and market commentary in minutes instead of hours, pinpointing anomalies and critical details faster, which reduces manual errors and simplifies compliance.

A Practical Guide to Treasury Technology Adoption

Treasury modernization requires investment, and while upgrading has a price tag, a greater cost is likely incurred by delaying necessary improvements. Every delay means lost opportunities to automate, enhance forecasting, and improve risk management. While change can feel disruptive, modernization doesn’t have to be overwhelming. Liquidity teams can leverage existing TMS or ERP vendors, industry associations, or internal IT departments to get started. These partnerships can help managers navigate the process, avoid costly missteps, and confidently implement the best solutions.

A phased approach allows treasury departments to integrate new technology at a manageable pace, ensuring efficient use of resources while minimizing disruption and maximizing benefits. The following framework outlines key steps for a smooth transition.

Four Phases of Treasury Modernization

Phase 1: Strategic assessment

Evaluate current operations, identifying inefficiencies, pain points, and areas for improvement. Gather input from consultants, technology partners, and internal stakeholders.

Key questions include:

- Which tasks are the most time-consuming or error-prone?

- What are the biggest risks or vulnerabilities?

- What obstacles hinder strategic objectives?

- Which data or insights are missing?

Phase 2: Explore solutions

Research your options and ask consultants and partners for recommendations, making sure solutions align with immediate needs and long-term goals.

Key considerations include:

- Functionality : Does the solution offer the features we need?

- Integration : Will it connect seamlessly with our existing systems (TMS, ERP, banking platforms)?

- Scalability : Can the solution grow with our future needs?

- Vendor support : Does the vendor provide comprehensive training, support, and ongoing maintenance?

Phase 3: Empower the team

Technology is only as effective as the people using it. Successful adoption requires leadership buy-in, hands-on training, and a clear understanding of how technology improves workflows. A strong change management plan will help teams embrace the transition. Managers should emphasize the benefits of the new technology and reassure the team they will have the support they need.

A successful change management strategy includes:

- Hands-on training programs to build confidence.

- Regular feedback sessions to address concerns early.

- Clear communication on how new technology improves workflows.

- Ongoing support mechanisms to improve long-term success.

Phase 4: Evaluate and optimize

Technology integration is an ongoing journey of continuous improvement. Regular evaluations and system optimizations keeps the system aligned with company goals and objectives.

How Modern Treasury Systems Can Help Strengthen Security and Compliance

Modern treasury systems are built with security and compliance in mind, offering advanced protections to safeguard financial data and integrate regulatory compliance.

Critical security features include:

- Multi-factor authorization (MFA): Adds an extra layer of protection by requiring multiple forms of verification to access a system.

- Advanced encryption protocols : Converts data into a secure format to protect it from unauthorized access.

- Real-time threat detection : Identifies and mitigates security risks before they become breaches.

- Role-based access controls : Restricts system access based on user roles and permissions.

- Firewall s: Blocks malicious activity and unwanted intrusions

Beyond security, modern treasury systems simplify regulatory compliance with:

- Automated reporting

- Built-in rule engines

- Comprehensive audit trails

Conclusion: The Future of Treasury is Now

The message is clear: modern treasury technology is no longer a luxury, but a necessity. By embracing a strategic, phased approach to modernization, treasurers and other liquidity professionals can be empowered to do what they do best: mitigate against risks, manage day-to-day business obligations, and develop long-term financial strategies. And in today’s dynamic market, these capabilities are more critical than ever before.