Trading SOFR Options

16 Dec 2019

Following the successful launch of SOFR futures on 7 May 2018, liquidity, price discovery, volume and open interest of SOFR futures have developed such that Options on Three-Month SOFR futures are the natural next step in the development of the SOFR ecosystem. On 6 January 2020, CME will launch Options on Three-Month SOFR futures (SOFR Options).1 SOFR Options can be executed on three venues: open outcry, CME Globex, and as a block trade submitted via CME ClearPort. Each of these platforms will offer customers access to deep and diverse pools of liquidity.

In nearly all respects, the design of SOFR Options mirror Options on Three-Month Eurodollar futures (Eurodollar Options). This paper provides in-depth descriptions of SOFR Options:

- Product Suite

- Contract Specifications

- Comparing Three-Month SOFR and Eurodollar Futures Volatility

- Spreading SOFR and Eurodollar Options

Product Suite

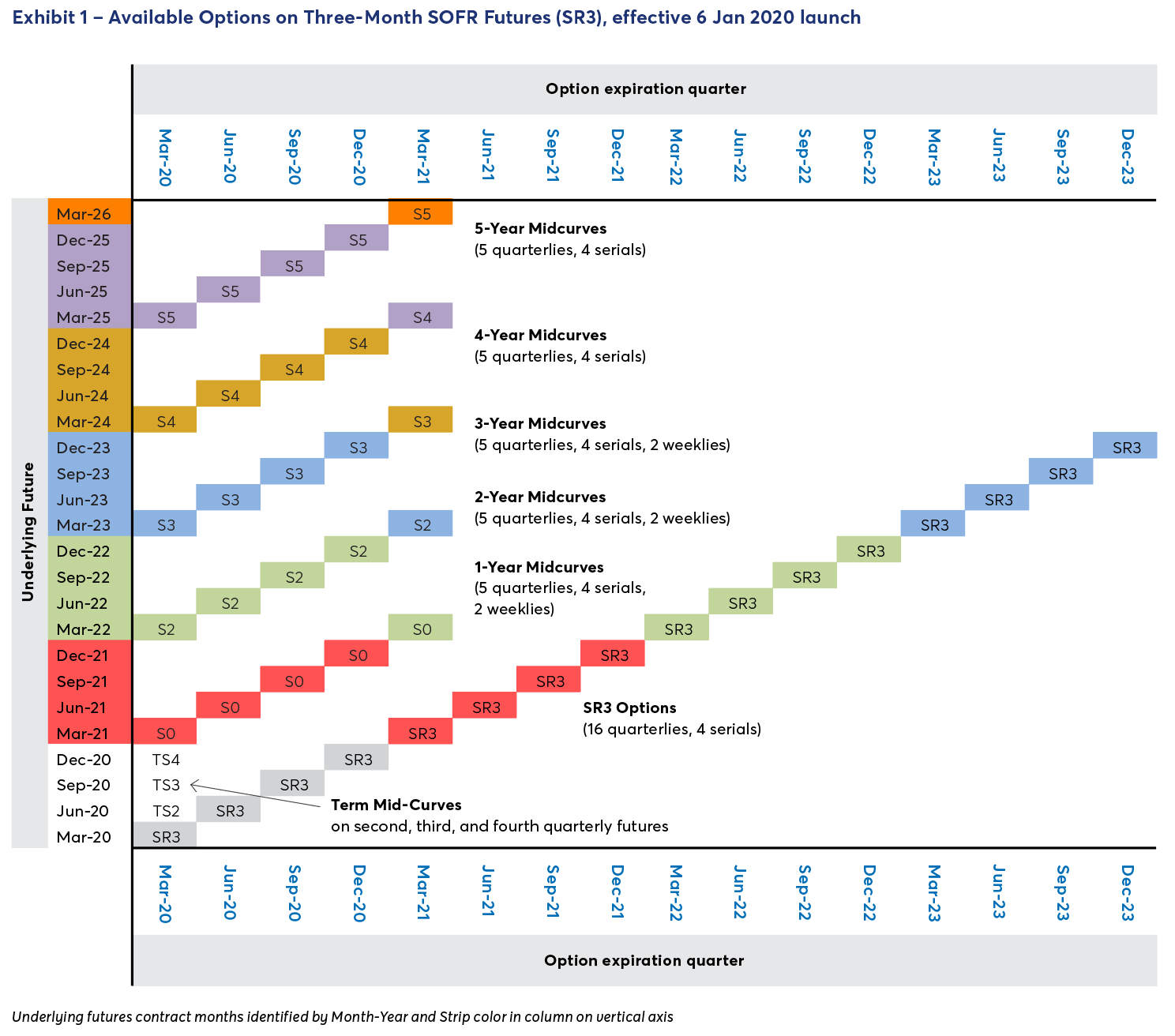

The Option contract listing calendar –generally– will be as follows:

- Quarterly Standard Options (SR3) expiring in each of the nearest 16 March Quarterly months (March, June, September, December); Serial Standard Options (SR3) expiring in each of the nearest 4 non-March Quarterly months (January, February, April, May, July, August, October, November);

- Quarterly One-Year (S0) Two-Year (S2), Three-Year (S3), Four-Year (S4), and Five-Year (S5), Mid-Curve Options expiring in each of the nearest 5 March Quarterly months; Serial One-Year, Two-Year, Three-Year, Four-Year, and Five-Year Mid-Curve Options expiring in each of the nearest 4 non-March Quarterly months; and

- Quarterly Three-Month, Six-Month, and Nine-Month Mid-Curve Options expiring in the nearest March Quarterly month. Serial Three-Month, Six-Month, and Nine-Month Mid-Curve Options expiring in each of the nearest 2 non-March Quarterly months; and

- Weekly One-Year, Two-Year, and Three-Year Mid-Curve Options expiring on each of the nearest 2 Fridays not scheduled for expiration of Quarterly or Serial Options.

Please refer to the table (Exhibit 1) below for the complete array of SOFR Options listed at launch, including commodity codes and underlying futures contract months.

Contract Specifications

Exhibit 2 summarizes contract specifications. In general, the range of products comprised within the Option product suite, the corresponding listing calendars, and the Option contract features closely mimic the CME’s extant suite of Eurodollar Options. As discussed below, noteworthy differences will be the schedule for termination of trading in expiring Options, conventions for designation of an Option’s underlying instrument.

Exhibit 2

Contract Specifications for Options on CME Three-Month SOFR Futures

(All times of day are Chicago time.)

Termination of Trading

Termination of trading in any expiring Option is scheduled to occur at close of trading on a specified Friday. For any Quarterly Standard, Serial Standard, Quarterly Mid-Curve, or Serial Mid-Curve Option, for instance, this typically will be the close of CME Globex trading on the Friday before the third Wednesday of the Option’s designated month of expiry.

In the case of Quarterly Standard Options, this contrasts to Quarterly Standard options on CME Three-Month Eurodollar futures, for which termination of trading in any option is scheduled to coincide with termination of trading in the corresponding underlying Three-Month Eurodollar futures contract (scheduled at 11am London time, generally 5am Chicago time, on the Monday before the third Wednesday of the contract month specified for both the options and the underlying futures).

Underlying Instrument

Each Option is exercisable into a specified CME Three-Month SOFR futures (“futures”) contract. The schedule of futures contract critical dates plays a pivotal role in determining which futures contract is designated to serve as the Option’s underlying instrument.

To see how, consider a hypothetical future that comes to final settlement in December. Its final settlement price is determined on the basis of the rate per annum of daily compounded SOFR interest (in accordance with CME Rule 46003.A.) during the futures contract’s Reference Quarter, the interval beginning on (and including) the third Wednesday of the previous September and ending on (and excluding) the third Wednesday of December. [1] In the nomenclature used by the Exchange to describe its Three-Month SOFR futures listings, this hypothetical futures contract would be referenced as a “September” contract (ie, in terms of the month in which its Reference Quarter begins) and not as a “December” contract.

Crucially, any Option will be associated with its underlying futures contract in terms of the month in which the futures contract Reference Quarter begins. It follows that any Option will be exercisable into a futures contract with at least three months of remaining term to final settlement beyond such Option’s expiration date:

- A Serial Standard Option (as summarized in Exhibit 2) scheduled to expire in October or November is specified to exercise into the “December” futures contract for which the Reference Quarter starts on (and includes) the third Wednesday of December and ends on (and excludes) the third Wednesday of the following March.

- A Serial Standard Option scheduled to expire in the preceding July or August is exercisable into the “September” futures contract for which the Reference Quarter starts on (and includes) the third Wednesday of September and ends on (and excludes) the third Wednesday of December.

- A Quarterly Standard Option (as summarized in Exhibit 2) scheduled to expire in September also is specified for exercise into the “September” futures contract for which the Reference Quarter spans from third Wednesday of September to third Wednesday of December.

By contrast, the adjacent Quarterly Standard option on CME Three-Month Eurodollar futures scheduled to expire in September, would be exercisable into the expiring September Three-Month Eurodollar futures contract, which comes to final settlement on the same day as the option comes to expiration, final exercise, and assignment.

Both are referenced as “September” contracts, and the interval of interest rate exposure for one is essentially the same as for the other. Crucially, the settlement date for the Three-Month Eurodollar future (ED) contract’s hypothetical three-month term bank funding rate – the third Wednesday of September 2019 – is identical to the start date of the Three-Month SOFR future (SFR) contract’s Reference Quarter, the period over which daily SOFR interest is compounded –

Exercise Price Arrays

SOFR Options futures offer exercise prices in increments of 25 basis points (0.25 IMM Index point) and 12.5 basis points (0.125 IMM Index point).

The exercise prices for the 25 basis point increments are listed daily 550 basis points (5.50 IMM Index points) above and below the nearest-to-the-money exercise price. For example, assume the prior day’s activity produced a nearest-to-the-money exercise price of 95.00. The 25 basis point increments would have produced a highest exercise price of 100.50 and the following exercise prices that are 100 basis points (1.00 IMM Index point) above the nearest-to-the-money: 95.25, 95.50, 95.75, 96.00. The 25 basis point increments would have produced a lowest exercise price of 89.50 and the following exercise prices that are 100 basis points (1.00 IMM Index point) below the nearest-to-the-money: 94.75, 94.50, 94.25, 94.00.

The exercise prices for the 12.5 basis point increments will be listed daily 150 basis points (1.50 IMM Index points) above and below the nearest-to-the-money exercise price. For example, assume the prior day’s activity produced a nearest-to-the-money exercise price of 95.00. The 12.5 basis point increments would have produced a highest exercise price of 96.50 and the following exercise prices that are 50 basis points (0.50 IMM Index point) above the nearest-to-the-money: 95.125, 95.25, 95.375, 95.50. The 12.5 basis point increments would have produced a lowest exercise price of 93.50 and the following exercise prices that are 50 basis points (0.50 IMM Index point) below the nearest-to-the-money: 94.875, 94.75, 94.625, 94.50.

Minimum Option Premium Increment

For users of Eurodollar Options, the pricing of SOFR Options will be familiar. They will be based on 100 basis points (1.00 IMM Index point) representing $2500 per contract. Equally, 0.01 IMM Index point represents $25 per contract.

Generally, with a few exceptions, the smallest price increment for SOFR Options will be a ½ basis point (0.005 IMM Index point) equal to $12.50 per contract.

Options in the nearest expiring contract month may be quoted in price increments of ¼ basis point (0.0025 IMM Index point) equal to $6.25 per contract. Additionally, some spreads may be quoted in price increments of ¼ basis point. Please refer to the Option Spreads/Combinations of the Minimum Option Premium Increment section of the Contract Specifications (Exhibit 2).

Option Exercise

SOFR Options utilize the American Style option exercise. Therefore, the option buyer has the right to exercise the option on any day they are traded.

Comparing Three-Month SOFR and Eurodollar Futures Volatility

Traders should be mindful of potential differences in SOFR and Eurodollar volatilities as they are developing option pricing models. Based upon Three-Month SOFR and Eurodollar futures price data from Jun 2018-Nov 2019, the rolling front month and fifth quarterly contract months produced the following historical volatilities (annualized) and correlation of daily price changes:

Note the historical volatilities were very similar, differing by only 2 percentage points in each case during this period of relatively high volatility. However, the difference in correlation between the first (0.900) and the fifth (0.970) quarterly futures contract months suggests as you get closer to expiration the differences in these underlying interest rates become more pronounced. SOFR and Eurodollar markets become more complementary.

Spreading SOFR and Eurodollar Options

Since the launch of SOFR futures, CME Group has experienced significant spreading of our adjacent STIR futures. Similarly, the launch of SOFR Options will create an increasing number of spreading opportunities for relative value traders. Market participants can execute spreads between SOFR and Eurodollar Options on one of three venues: in open outcry, on CME Globex, and as a block trade submitted on CME ClearPort.

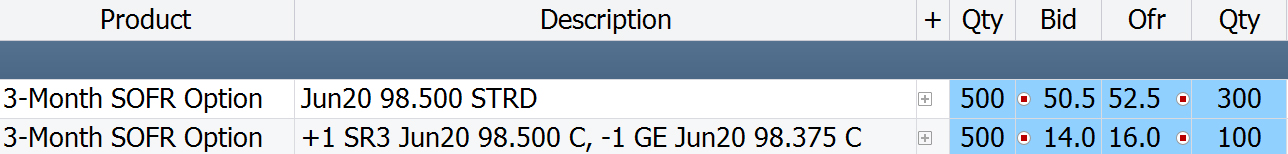

Customized spreads may be created on CME Globex using the Exchange’s User Defined Spread (UDS) functionality. The image below demonstrates two types of UDS created on CME Direct prior to launch that might be active.

Exhibit 4

SOFR Option Spreads on Globex

In the CME Group’s New Release environment on 2 Dec 2019, the following spread markets of the nearest to the money strike prices of the June 2020 contracts were observed:

- Quarterly Standard (SR3) Straddle: June 2020 98.500 Straddle (Jun20 98.500 STRD) 50.5 (basis points) bid for 500 and 300 spreads offered at 52.5 (basis points)

- Quarterly Standard SOFR (SR3)/Eurodollar (GE) Call Spread. Buying June 2020 SR3 98.500 call and selling June 2020 GE 98.375 call. Market of 14.0 (basis points) bid for 500 and 100 spreads offered at 16.0 (basis points)

Appendix

Please refer to the table below (Exhibit 5) for each of the associated product codes for SOFR Options.

Exhibit 5

Options on CME Three-Month SOFR Futures –Scope of Product Suite