MBA, Financial Analysis, Top 15 rated: New York University (NYU) Stern School of Business

Tower One Wireless Secures Blockbuster Deal to Build 150 Towers

** Figures in C$ unless otherwise noted, tower valuations & financial metrics are estimates only **

In a past life, I was a corporate bond analyst. The Big 3 wireless tower leasing companies, American Tower [NYSE: AMT ], Crown Castle [NYSE: CCI ] & SBA Communications [NASDAQ: SBAC ] were low-rated entities, even by junk bond standards.

Here’s a quote from Moody’s initial bond rating of Crown Castle in 1997 ,

“ Moody’s has assigned a B3 rating (low end of junk credit) to Crown Castle’s US$100M notes due 2007. The ratings reflect the high level of debt relative to near-term cash flow; revenue concentration with 2 customers; and the expectation of future acquisitions, which will likely maintain high debt leverage… “

Tower One Wireless , [CSE: TO ] / [OTCQB: TOWTF ] is a telecom infrastructure company with a market cap of $7.5M ( as of April 8th, 93.4M shares outstanding, < 96M shares fully-diluted ). This Company reminds me of Crown Castle 22 years ago. As of the end of March, Tower One had a total of 82 towers in Argentina, Colombia & Mexico . 18 had 2 tenants on them. So, there are 100 paying tenants. On average, each tower has 1.22 tenants. Therefore, the “ co-location ” rate is 22% or 1.22x. Another 31 towers are under construction.

Tower One Signs Blockbuster Development Deal for 150 New Towers

Management recently generated $3.4M in non equity-dilutive working capital by selling 23 towers in Colombia for 15 times Tower Cash Flow (“ TCF “). Tower One built them for US$900K , and sold them for US$2.6M . The Company just signed a development deal with a Third Party for the construction 150 towers in Colombia & Mexico. This is perhaps the biggest event in the Company’s history . US$1.8M has already been advanced. Funds drawn down have a 0% (zero) interest rate and there are no debt covenants. Instead, milestones dictate the release of funds. There’s no cap on how much the Third Party will advance.

The Third Party will purchase towers from Tower One at 1 5x TCF in the first year. Then, for a period of 2 years, the Third Party will pay 10x TCF for every additional tenant that lease the towers. TCF is 80%-85% of gross tower rent. It costs Tower One $85K to build a tower. It can sell it to the Third Party for $148.5K ($1,000 rent x 12 months) times a 82.5% TCF margin = $9,900 in annual TCF. $9,900 times a 15x multiple = $148.5K/tower. Plus residuals, or earn-outs of 10x TCF for additional tenants. If on average the sold towers were to have 1.2 tenants after 24 months, that would be an incremental $19,800/tower , for a total of $168,300 . At 1.3 tenants/tower, it would mean an extra $29,700/tower .

This is an attractive deal for both parties, the Third Party gets cash-flowing towers where the heavy lifting has already been done and at an attractive price. Tower One benefits as it could end the period ( after selling 150 towers ) with several million in cash & minimal debt. Management will then be in a position to obtain longer-term, lower-cost funding from a wider range of entities. Tower One will keep the towers it builds using its longer-term funding, allowing those assets to grow more valuable. { see What Might a Tower be Worth? section below}

Despite my enthusiasm, it’s far from certain that this Company will thrive. Management needs to execute, which has been a big problem because Tower One has been underfunded & understaffed. If management can arrange steady, multiple-year funding from this Third Party and other sources, they will be able to focus on what they do best… building & leasing towers!

Co-location Offers Huge Incremental Margi n s

Co-location is the secret sauce of the tower leasing model. 90%+ of the total cost for 2 or 3 co-located tenants, is incurred at the time the tower is built. The incremental margins are huge. Unused space available to host a 2nd or 3rd tenant is a valuable intangible asset. Tower One’s structures cost $80,000-$90,000 and can accommodate up to 3 tenants. Each tower is, “ built to suit ,” meaning that an anchor tenant is in place when the structure is completed. Contracts are long-term; 5-10 years, plus multiple 5-yr. options. Contracts are typically, “take-or-pay.”

Argentina, One of the Best Markets in the World

Argentina has a lot of tower infrastructure catching up to do. The economy languished under the previous government that was unfriendly to foreign enterprises (including wireless carriers, like Claro – Mexico and Telefonica – Spain) . As a result, Argentina is one of the best markets in the world to be a builder of telecom infrastructure. Consider this commentary from last year….

Quote, Olivier Puech, CEO – LatAm, American Tower :

“Two critical factors pushed American Tower to enter Argentina. We are talking about a country which is lagging behind in the deployment of 4G, the densification of infrastructure & fibre connectivity. With about 15,000 existing sites, we estimate that at least 10,000 more are needed in the next few years to bring the level of coverage & capacity up to regional standards.”

10,000 new towers, split among 8 builders, over 3 years… that’s 417 towers per year, per builder . If Tower One could build 10/month in Argentina, (120/yr.) that would be a tremendous accomplishment, potentially setting the stage for a higher valuation. Mexico is also a strong telecom market, consider what a senior executive from American Tower said at a UBS event on 12/4/18 ,

“ I think Mexico has probably been our best international market over the last couple years from a growth rate perspective, driven by the deployment of 4G… So we think there’s a solid trajectory there, where you’re going to be able to sustain mid-teens organic growth…”

And, from American Tower’s February earnings call,

“ …In Latin America demand remains strong with carriers focusing on improving & extending 4G networks…. we expect new business additions to increase by ~ 10% year-over-year. Given the acceleration of network densification needs for 4G, we’re excited about our build-to-suit program. Our outlook implies new builds in LATAM will increase by > 50% versus last year. International growth was supported by significant network spending by tenants across our footprint, especially in key markets like Mexico… Our teams down in LATAM are really excited about the levels of investments that are being made all over the region… “

What Might a Tower be Worth?

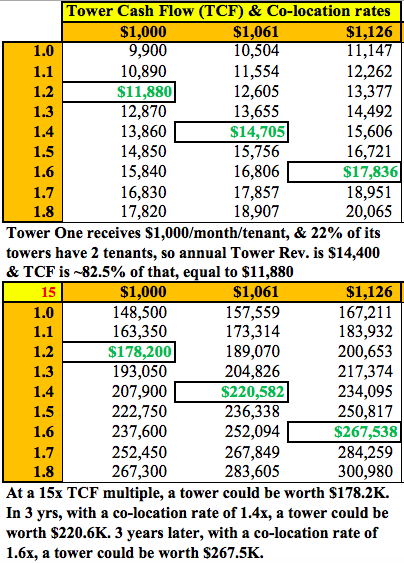

How much might a tower with a lifespan of 20+ years be worth? It’s reasonable to assume that the co-location rate will increase over time, but by how much and how quickly? In the chart below, I show that at $1,000 rent per tenant, per month, annual revenue is $12,000. For ( an average of 1.1 tenants / tower, a co-location rate of 10% ) annual revenue would be $13,200/yr ., and it would be $14,400/yr ., for ( 1.2 tenants / tower, a co-location rate of 20% ), etc….

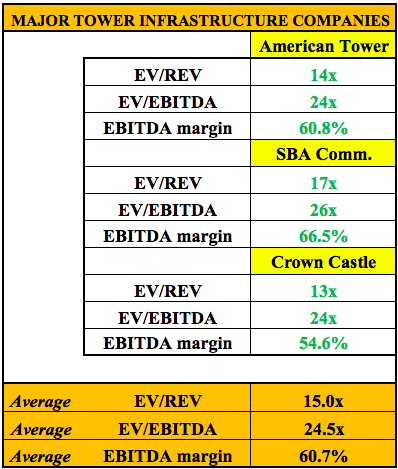

With annual revenue per tower currently $14,400 , we can estimate the value of the Company’s towers. $14,400 x a 82.5% TCF margin x a 15x TCF multiple = $178.2K . The Company has 82 towers x $178.2K = $14.6M , just shy of twice the current market cap. { See chart below ). Look at the valuation metrics for AMT, CCI & SBAC. The average multiple of ( trailing 12-month ) EBITDA, a proxy for cash flow, is 24.5x .

I assume an annual 2% rent escalator increases rent to $1,061 / month / tenant in 3 years, and the towers have an average co-location rate of 1.4x (40%) at that time. In 3 years, a tower at a 15x TCF multiple might be worth $220.6K { see chart above } . Three more years of +2% increases and the rent might be $1,126 / month , and the co-location rate 1.6x (60%). In that scenario, a tower could be worth $267.5K . The point of this exercise is not to precisely say what a tower will be worth, but to show that increasing rents & co-location rates have a multiplier impact on tower valuations over time .

Despite the compelling math of potential tower valuation, timing is a big risk factor. If management were to take down a lot of debt, but then was delayed in their tower buildout, that would be a BIG concern. There have already been delays over the past 18 months. Some towers that were in backlog fell out of backlog. Luckily, the Company has a modest debt balance.

Tower One’s Mgmt. Team & Select Board Members

Alejandro (Alex) Ochoa, President, CEO & Director

Mr. Ochoa is co-Founder of Tower One Wireless. He has > 18 years’ experience in financial services, working at Morgan Stanley Dean Witter, Prudential Securities & Raymond James. Most recently he served as consultant to Mackie Research Capital Canada’s Investment Banking Practice with a LATAM focus . Over the past 6 years, he helped start 2 other Tower companies. Dedicated to LATAM, his areas of expertise include mining / energy transactions in advisory, capital raises & strategic asset sale roles with transactions in Colombia, Mexica & Peru. He has covered Telecom Infrastructure Companies from the U.S., Argentina & Colombia . Mr. Ochoa is fluent in Spanish and understands South American Capital Markets.

Luis Parra, COO

Mr. Parra was a Co-Founder of Ingeant SA . He currently co-manages the operation of Ingeant SA iColombia and advises companies on the development of infrastructure projects. Parra worked at Ecopetrol with responsibility for the Barrancabermeja refinery and managed the operation of QMC-TELECOM in Colombia. Luis has worked throughout South America, managing various operations in the Dominican Republic, Peru, Costa Rica, Panama & Colombia. He has a civil engineering degree and a degree in Finance & Project Evaluation.

Santiago F. Rossi CFO

Mr. Rossi is a senior financial & business development executive with a history of success in challenging global business environments. He has > 20 years’ experience in demanding positions with international telecom, tech and oil & gas corporations. He’s recognized for his sound decision-making ability and a proactive approach. Mr. Rossi has a solid record of success in M&A, including leading negotiations & managing people, processes & systems integration . He has managed equity financings & exit transactions with PE firms & international financial firms. He has been a key contributor to the buildout of the world’s leading provider of global satellite-based connectivity & media services for mobility markets on land, sea & air, serving > 400 corporate clients in > 120 countries.

Rolland Bopp , Advisor

Mr. Bopp has an extensive background at senior levels in telecom, including as Chairman, President & CEO of Deutsche Telecom Inc. New York , and Executive VP, and member of the operating board of Mannesmann Corp . in New York, NY and Düsseldorf, Germany, a US$ 20 billion global engineering & telecom service company.

Octavio De LaSprilla , Country Manager (Colombia)

Octavio De LaSprilla was formally COO of Continental Towers . He helped expand the portfolio to over 200 towers in a 2-yr period. His role today is the interface of Tower One with the 4 principal wireless telecom operators of Colombia.

Carlos Reyes Regional Director – Latin America

Mr. Reyes has extensive telecom-related operational experience including building BTS towers throughout Colombia. A former C-Level executive at LatAm based wireless & satellite communications companies. Mr. Reyes’s previous work experience includes managing Torres Unidas infraestructura Colombia – a subsidiary of Torres Unidas Group.

Robert “Nick” Horsley , Director

Mr. Nick Horsley has > 13 years’ capital markets experience in finance, investor relations, marketing management, merchant banking and M&A. Mr. Horsley has served as a Director and a consultant to several public & private companies and has worked in a variety of industries including: consumer goods, energy, nutraceuticals, pharmaceuticals & technology.

Fabio Alexander , Director

Mr. Alexander is Founder & CEO of Executive Investment Partners LLC ; a diversified investment company based in Miami, Florida with holdings in various industries including Aviation, Mortgage Banking, Technology, Insurance, Real Estate & Retail Services.

Conclusion

Data usage is soaring the world over, analysts forecast it doubling or tripling in 5 years. The wireless business is booming. But, there can’t be a boom without substantial growth in underlying telecom infrastructure. The upcoming switch to 5G might be a few years off in Tower One’s markets, 4G upgrades are in full swing. Argentina is in great need of new towers. Tower One Wireless [CSE: TO] / [OTCQB: TOWTF] is an up-and-coming leader in Argentina.

The Company signed a very important development deal with a Third Party to build and sell 150 towers, an attractive deal for both parties. Will 2019 be the breakout year for Tower One ? Will there be months where 20 or 30 towers get built? If so, a market cap of $7.5M is far from aggressive. A company that could get taken out in 2020 or 2021 by a growing list of potential suitors. Top on the list could be the Third Party who has done their homework and has committed a considerable amount of time & capital to Tower One .

Disclosures : The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER] , ( together, [ER]) about Tower One Wireless, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Tower One Wireless are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned no shares in Tower One Wireless and the Company was an advertiser on [ER] . Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.