Options AI - The freedom to choose between stock, options and spreads, all from one chart. Set an informed price target and instantly find the trade that’s right for you.

This Week in the Options Market and a Peek Ahead

Stocks are higher again today following a bounce on Friday. With that comes a slight contraction of expected moves from last week. Focus the past few weeks has been on the major indices. Earnings come back into focus starting next week and of course the election looms. For now, options volatility seems fairly stubborn, stuck in the high 20's in the VIX and not really collapsing with the market bounce.

Expected moves via Options AI:

- VIX is ~26.50.

- Last week's expected move in SPY: 2.5%

- Last week’s actual move SPY: 0.9%

- This week's expected move in SPY: 2.2%:

- Last week's expected move in QQQ: 3.2%

- Last week's actual move in QQQ: 3.2%

- This week's expected move in QQQ: 2.9%

A look at some of the weekly expected moves for some stocks in the news today, SNAP, SPOT, CZR, CVX, UPS:

Earnings Calendar

Earnings announcements are light in the lull between quarters. This week's earnings of note, expected move and its actual move last earnings.

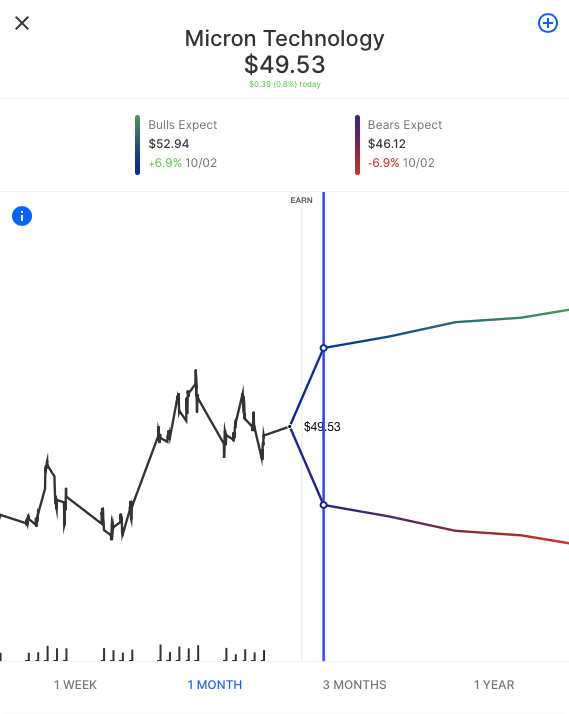

Tuesday 4:00pm - MU | expected move: 6.9% (last earnings: +4.8%)

Thursday 6:00am - PEP | expected move: 2.6% (last earnings: +0.3%)

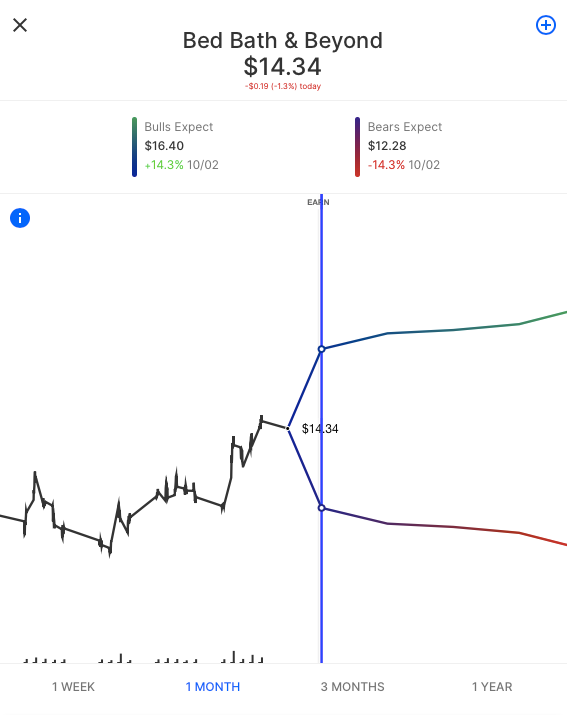

Thursday 7:00am - BBBY | expected move: 14.3% (last earnings: -24.5%)

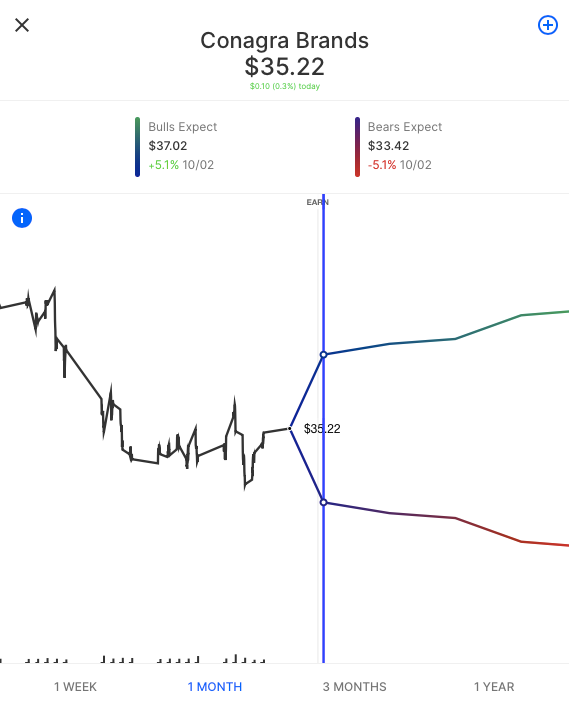

Thursday 7:30am - CAG | expected move: 5.1% (last earnings: +4.4%)