The Rising Appeal of Alternative Credit:

How to Avoid Common Investment Strategies in Uncommon Markets

If you’re a non-traditional investor—or want to be—you can act right now to preserve capital, earn an attractive return, manage risk, and position yourself and your firm to take advantage of higher risk premiums. Too good to be true?

In this post, we lay the groundwork for investing in alternative credit markets.

As we know, alternative investments typically include venture capital, private equity, hedge funds, real estate investment trusts, commodities or precious metals, rare coins, wine, and art, assets which usually perform with low correlation to stocks and bonds.

Of course, analysts find these alternatives difficult to value, in part, because they’re more illiquid than traditional investments. But some experts, like us, believe they could give you the investing edge you need in this low-yield market.

Alternative asset classes continue to grow in popularity, spurred on by institutional investors allocating more money to alternative investments on the realization of long-term benefits.

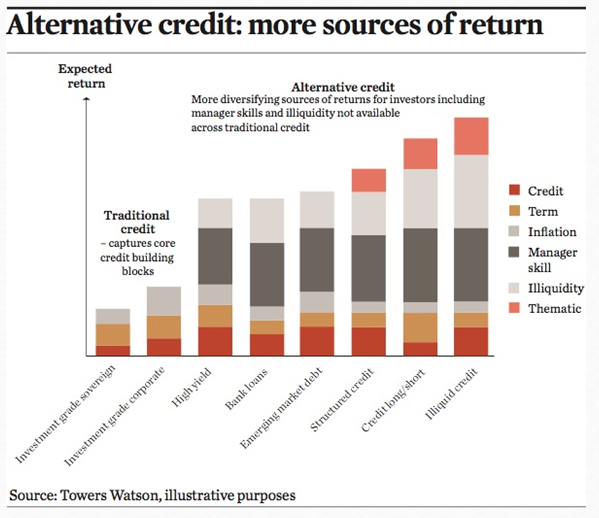

A sub-class alternative asset, alternative credit, encompasses all credit not traditional investment grade, sovereign or corporate debt. From liquid strategies like high-yield bonds, bank loans, and structured credit to less liquid strategies like direct lending and specialty finance, alternative credit today is booming.

Growing Sub-Asset Class

Pre-2008, a well-established non-bank lending market existed in the U.S., with North America providing the bulk of financing for alternative lenders. In fact, roughly 85 percent of all finance comes from sources other than banks in the US

1

.

Post-2008, the cost of capital for loans compelled many banks to shrink balance sheets. What’s more, new regulations like Basel III led to further deleveraging. Today, banks are not only less inclined to hold loans, but they’re selling off whole portfolios.

1 Financing the Economy 2016: The role of alternative asset managers in the non-bank lending environment, published by Deloitte, the Alternative Credit Council and the Alternative Investment Management Association

Into this chasm stepped non-bank financial institutions to offer alternative sources of funding. As the long recovery unfolded, demand for credit grew, too, leading to the rise in alternative credit strategies.

Chasing Yield

The no-to-low yield environment frustrates the most creative investors among us. But don’t stumble over low-interest rates and volatility in the quest for yield. To recoup losses, investors show a willingness to take on more illiquidity and risk in their credit portfolios.

According to the 2017 edition of Willis Towers Watson’s Global Alternative Survey, as reported by HSBC, “illiquid credit saw the largest percentage increase over the previous 12-month period.” Assets under management rose from USD178 billion to USD360 billion.

Investors also seek diversification in the name of more income. Based on Prequin data, performance across the alternative credit sector shows strong yield compared to other sectors. Specifically, direct lending funds are producing potential IRR returns of between 10 to 15 percent.

Alternative Credit Performance

In our experience, investment in alternative credit exhibits these behaviors:

-

Low correlation to the broader market

-

Low volatility return profile (3-year plus track record to support)

-

Repeatability using a differentiated fintech skillset

-

Lower duration

-

Higher-yield alternatives to traditional fixed income

Access to the alternative credit asset class opens through a gateway to A/I, advanced machine learning technologies (computer-simulated human intelligence processes), and big data analytics. For us, it is invigorating to find hidden caches of promising data pointing to robust opportunities for attractive investment outcomes.

Of course, A/I and machine learning is becoming ubiquitous and soon will not qualify as an early differentiator. However, Pagaya occupies a highly specialized niche at the apex of man and machine.

As an A/I-powered asset manager, our future-forward approach to alternative, data-driven investment management well-serves the sophisticated needs of institutional and high-net-worth investor markets which we define as institutional banks, pensions plans, foundations, private wealth, and sovereign wealth funds, which represents 90 percent of Pagaya investors.

Man & Machine

Using the brainpower and risk management experience of over 40 technology specialists, in combination with A/I and machine learning, Pagaya developed Pulse, a proprietary, independent underwriting system to analyze new asset classes at a depth seldom, if ever, reached by typical asset managers.

Machine learning provides us with greater accuracy in pricing and evaluation of risk, which gives us the capability to conduct intricate underwriting of each loan, then automatically acquire and settle loans, as well as monitor risk.

Guided by our Pulse technology framework, Pagaya constructs bespoke investment portfolios aimed at achieving short-duration, high-yield return profiles with low correlation to the broader market and insulated with crisis-resistant features.

Pagaya creates investment funds from alternative credit opportunities that improve risk/reward ratios, as compared to traditional capital markets. We act decisively by taking less credit risk and, importantly, reducing exposure to QT, changes in the credit cycle, and widening risk premiums as prices decrease.

Optimize the Risk/Reward Equation

Pagaya continually questions, innovates, engineers and re-engineers of state-of-the-art technologies. By applying A/I and machine learning strategies to human-centered intelligence, both fluid and logical, our next-generation prediction models fully optimize the risk/reward equation.

Capitalizing on alternative credit requires speed and precision in decision making far beyond any traditional tools or strategies. Then, you must deploy a real-time program of continuous process improvement in system building and technical platforms to understand, hypothesize, test and apply nascent learnings.

Our analytical teams perform rigorous study of data to emerge with deep market insight and creative ideas. We closely collaborate with internal and external stakeholders by sharing our findings so they can take advantage of ever-moving markets.

While our initial focus zeros in on the sub-class of alternative credit, we’re rapidly moving into unsecured consumer credit with the goal to expand soon into auto loans, mortgages, and other burgeoning markets.

Many institutions are adding alternative credit as a solution to anemic returns in the form of direct lending. Not content to use traditional quantitative and qualitative tools, Pagaya pushes past conventional thinking on informed risk management and investment decision making.

Assuming you possess the fine-tuned sensibilities of most investors, you’re determined to withstand this late-cycle environment and gain the strength and vitality necessary to stay ahead of the next market shift.

***

Consider the intrinsic value of alternative credit investment in your portfolio.

And give us a call for a brief discussion to galvanize your determination.

New York, NY

Pagaya Investments US LLC │ 135 E. 57th Street │ New-York, NY 10022 │ Phone: +1 (646) 710 7714

Tel Aviv, Israel

Pagaya Technologies Ltd. │ Azrieli Sarona Building, 54th floor │ Derech Menachem Begin 121, Tel-Aviv, Israel

Phone: +972 (3) 715 0920

Nothing contained in this communication constitutes tax, legal, or investment advice. Investors must consult their tax advisor or legal counsel for advice and information concerning their particular situation. This article contains certain statements that may include “forward-looking statements.” All statements, other than statements of historical fact, included herein are “forward-looking statements.” Although Pagaya believes that the expectations reflected in these forward- looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Actual events could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors. You should not place undue reliance on these forward-looking statements. This article reflects our views and opinions as of the date herein, which are subject to change at any time based on market and other conditions. We disclaim any responsibility to update these views. These views should not be relied on as investment advice or an indication of investment intention. Discussion or analysis of any specific company-related news or investment sectors are meant primarily as a result of recent newsworthy events surrounding those companies or by way of providing updates on certain sectors of the market. Pagaya does provide investment advice to Pagaya related funds and others that are invested in consumer credit. As a result, Pagaya does stand to beneficially profit from the performance of consumer loans it owns or acquires.