The One Time You’ll Look Forward to Higher Fees

A Guide to Fulcrum Fees

What Is a Fulcrum Fee?

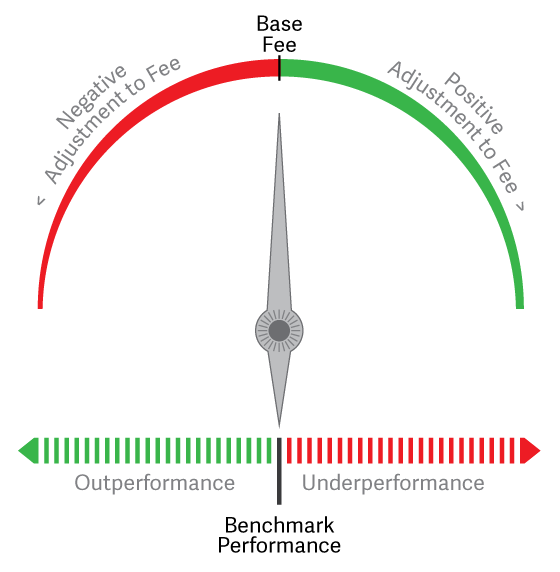

A fulcrum fee is a type of management fee that can go up or down based on the performance of the ETF as compared to a similar benchmark index.

- The benchmark index is required to be similar to the investment strategy, for example, if the ETF has a U.S. Large Cap investment strategy, a good benchmark might be the S&P 500 Index.

- The management fee will adjust up if the ETF outperforms the index and will adjust down if it underperforms the index.

| ETF Performance | 10% | 8% | 12% |

| Benchmark Index Performance | 10% | 10% | 10% |

| Fulcrum Adjustment | No Adjustment

|

Lower Management Fee 🠗 | Higher Management Fee 🠕 |

Benefits of a Fulcrum Fee

It is quite simply a way to align the portfolio manager’s interests with those of the shareholder’s.

If the portfolio manager underperforms their index benchmark, the investors pay a lower overall management fee. If the portfolio manager outperforms the index, then the portfolio manager is compensated for that performance and can earn additional fees.

Fulcrum Fee Features

The fulcrum fee has two components: the base fee and the performance adjustment .

- The base fee represents the management fee without a fulcrum adjustment. This is the management fee for the first year of the ETF.

- The performance adjustment will either increase or decrease, based on the portfolio manager’s performance.

The base fee, plus or minus the performance adjustment will represent your total fulcrum fee.

The Fulcrum Fee Schedule

Most fulcrum fees are designed to adjust incrementally, so a small amount of outperformance, might be a small increase, a small amount of underperformance would be a small decrease. If the ETF utilizes a fulcrum fee, the amounts and the schedule will be listed in the management fee section of the ETF’s prospectus.

How a Fulcrum Fee is Implemented

The performance adjustment of the fulcrum fee does not begin to affect the ETF’s management fee until the ETF has been trading for a one year period, after which the adjustments begin.

After the first year, the first fulcrum adjustment will be made by looking back over the past year. The ETF will then make adjustments. The time frame for the adjustment will vary by ETF, but typically it will be readjusted, monthly, quarterly or annually.

At the next adjustment period, the performance comparison will be based on the prior 12 months and the adjustment will be the new management fee until the next measurement period. It is important to note that each time the ETF reaches the end of its measurement time frame, it is adjusted from the original base fee and not from the most recent fee.

| Base Fee = 0.75% | |

| ETF Performance to Index | Management Fee |

| 2.00% | 0.85% |

| 1.50% | 0.83% |

| 1.25% | 0.81% |

| 1.00% | 0.79% |

| 0.50% | 0.77% |

| 0.00% | 0.75% |

| -0.50% | 0.73% |

| -1.25% | 0.71% |

| -1.00% | 0.69% |

| -1.50% | 0.67% |

| -2.00% | 0.65% |

Note: the amounts of the increase or decrease, and the performance differences to make adjustment can vary by ETF. Typically, the only requirement is that the amount and changes are the same for an increase or a decrease in the fulcrum fee adjustment. The schedule can always be found in the ETFs prospectus.

The information, statements, views and opinions included in this publication are based on sources (both internal and external sources) considered to be reliable, but not representation or warranty, express or implied, is made as to their accuracy, completeness or correctness. Such information, statements, views and opinions are expressed as of the date of publication, are subject to change without further notice and do not constitute a solicitation for the purchase or sale of any investment referenced in the publication.

RSS Import: Original Source