Segall Bryant & Hamill leverages its proprietary investment research, deep industry experience and long‐tenured team to provide intelligently constructed portfolio solutions.

The Importance of Downside Protection to Help Harness Long-Term Returns

Ask almost every investor and they will tell you that they are seeking strong returns and to minimize risk. When the markets go through a long advance—such as the bull market of 2009-2020—there is a natural tendency to focus more on the “strong return” part of that objective than the goal of minimizing risk. Nonetheless, downside protection strategies, or techniques used by an investment manager to prevent a decrease in the value of the investment, will reduce the frequency and magnitude of losses resulting from substantial market declines and can protect investors against significant losses. Following more than a decade of steady increases, recent events remind investors seeking strong long term risk-adjusted returns just why the risk adjusted truly matters, especially in light of the extremely turbulent market of early 2020. In fact, the ability to lessen losses during inevitable downturns may matter more long term than riding the wave of a long-term bull market’s gains.

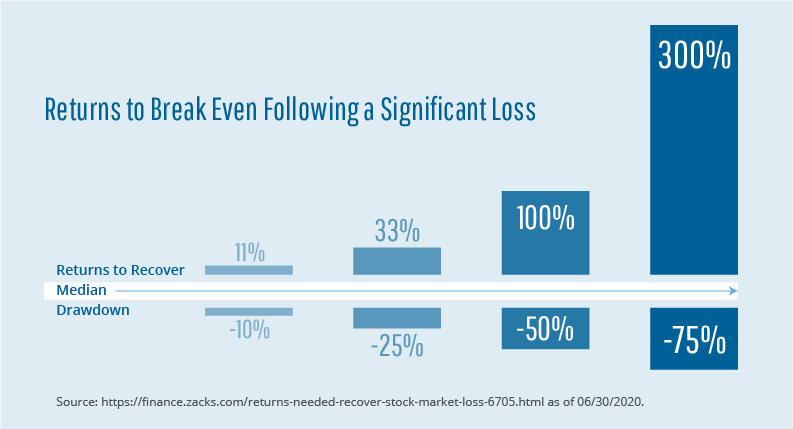

It’s important to remember that large losses require even larger gains for a portfolio to recover fully. The larger the losses, the disproportionately greater the size of the percentage gains required to make up for those losses. It’s in the math. For example, a 40% portfolio loss requires a 67% return to see a complete recovery. Lesser drawdowns may mean a faster recovery after down markets, putting clients in a potentially better position to compound returns over time. A significant loss means plenty of catching up is necessary to get back to the original starting point as principal has shrunk, particularly if an investment horizon is shorter than the time needed to recover. Much like the Greek legend of Icarus, if you fly too high without a safety net, an investor can come crashing down with no easy way back up.

Many investors are tempted to sell riskier assets after steep market declines. Portfolios that provide strong downside protection may help investors stay the course and avoid this temptation. In addition, active managers can articulate their reasons for owning each holding, which, in contrast to passive funds that hold thousands of securities, may add to an investor’s conviction during times of market stress and help them stay the course and recoup losses.

Keeping Downside Protection in View

While the unprecedented market events of 2020 clearly highlighted the importance of downside protection, they also reinforced the value of active management in volatile and down markets. Prior to the severe market pull-back in March, many investors rode the euphoria of a decade-plus equity bull run and were not focused on downside protection. Further, many of these investors opted for following markets through passive and exchange traded funds, making them vulnerable in the wake of a tail risk event.

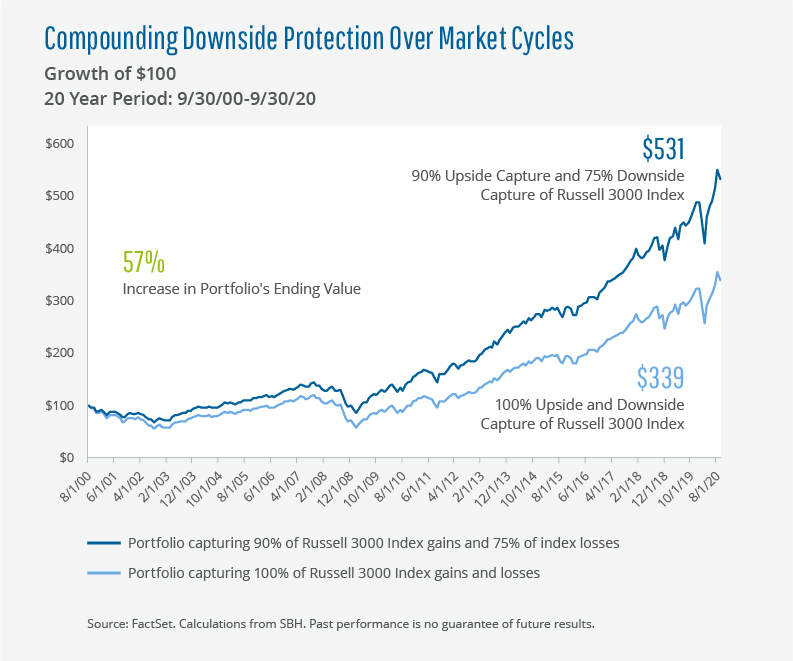

While no manager, active or passive, could have predicted a global pandemic, active managers can be prepared regardless of whatever events may transpire, versus passive strategies which are subject to the whims of the market. And while strategies directly tracking the markets are able to rise as a recovery ensues, minimizing drawdowns may have a bigger effect on long-term returns than capturing all the market’s upside. The chart below illustrates this point. The light blue line represents a portfolio that participates in 100% of the gains and losses of the Russell 3000 ® Index. The dark blue line shows a portfolio that captures 90% of the index’s gains and 75% of its losses. Over the past twenty years, investing in this portfolio would have better positioned investors to reach their long term goals.

Active managers focused on research may select what to invest in on a fundamental basis, positioning them favorably for outperformance. Uncertainty created by the global pandemic has, yet again, demonstrated that the market focuses on and values specific company attributes during times of crisis, such as less economic sensitivity, low beta, grow orientation, solid balance sheets, and high return on invested capital (ROIC).

Most importantly, an active manager who remains consistent in their strategy can repeat their approach and may avoid drawdowns over time. For example, the COVID-19 correction is the fifth major decline (greater than 25%) in the Russell 2000 ® Index since 2008. While the subsequent recovery from each crisis prior to COVID-19 has ultimately resulted in the market reaching new highs, the frequency of market contractions appears to be shortening. The ability for a manager to consistently demonstrate a repeatable process that protects capital on the downside is gaining importance as time periods between major market drawdowns are compressing, making a manager with a consistent downside strategy more valuable now than ever.

The opinions expressed are solely the opinions of Segall Bryant & Hamill. You should not treat any opinion in this material as specific inducement to make a particular investment or follow a particular strategy, but only as an expression of the manager’s opinions. The opinions expressed in this material are based upon information the manager considers reliable, but completeness or accuracy is not warranted, and it should not be relied upon as such. Market conditions are subject to change at any time, and no forecast can be guaranteed. Any and all information perceived from this material can be does not constitute financial, legal, tax, or other professional advice and is not intended as a substitute for consultation with a qualified professional. The manager’s opinions are statements are subject to change without notice and Segall Bryant & Hamill is not obligated to update or correct any information in this material. For illustrative purposes only.