The Energy Transition: Fueling Tomorrow’s Economy

As growth investors, we’re inherently interested in global mega trends. One such mega trend is the energy transition—a long-tailed phenomenon benefiting from many catalysts. Below, I discuss where we are in the energy transition; why national security, big data, and other drivers have emerged as new catalysts for the transition; and the implications for investors.

The Global Energy Transition Has Evolved

Over time, the forces behind the energy transition have become deeper and the motivations more diverse.

A longstanding catalyst of the energy transition has been the adverse impact of burning fossil fuels on the climate. Globally, there has been a consensus that the world needed to shift away from a scarce, expensive, inefficient, and volatile commodity-based fossil fuel system to a cheaper, cleaner, and leaner technology that is readily available and exposed to falling costs.

The shift from hydrocarbons to electrons has resulted in greater electrification and digitalization within the power space. The commercialization of electric vehicle (EV) technology is directly linked to these initiatives as transportation is a huge contributor to emissions. Electrifying transport is, and will continue to be, beneficial from an emissions reduction perspective.

But recently, new energy transition catalysts have emerged, such as national security (particularly as importing fuel through pipelines that could potentially be compromised has emerged as a threat) and the deglobalization of supply chains. As reshoring and nearshoring accelerate, there is a need for countries in both emerging and developed markets to dramatically increase investment in their capacity to generate, transmit, and distribute power, which is also providing momentum to the energy transition.

In addition, the emergence of digitalization, big data, and artificial intelligence (AI) have resulted in a rethink on global power demand, and how cheaper, lighter, more abundant energy sources can help fuel innovation.

Cost Curves Drive Adoption

We believe the next phase of the energy transition will be driven by continued cost declines in renewable energy sources, continuing the long arc of global energy history.

Propelling this new phase is increasing efficiency across technology, commodities, and the economy. For instance, wind and solar power have become cheaper, which has helped drive down the overall cost of electricity and support an increased uptake of renewables.

But even with these new drivers, the path of the energy transition likely won’t be totally linear. In 2023, many investors lost confidence in the renewables revolution and began to challenge the notion of persistently declining costs. That year also saw higher costs and higher cost of capital for renewable developers because of higher global interest rates, which impacted the momentum of renewables installation.

However, policies that included better inflation protection were eventually put in place to help prevent future disruptions.

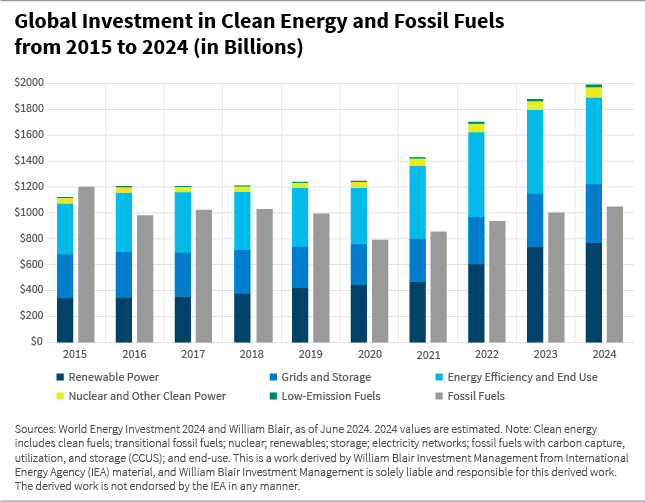

Today, inflation is declining across regions, and consensus forecasts are for interest rates to fall, which should provide support for growth in investment in renewables. In 2024, global energy investment is expected to exceed $3 trillion for the first time, with $2 trillion allocated to clean energy technology infrastructure.

Furthermore, investment in clean energy has been accelerating since 2020, and spending on renewable power, grids, and storage is now higher than total spending on oil, gas, and coal, as shown in the chart below.

The Rise of EV Adoption

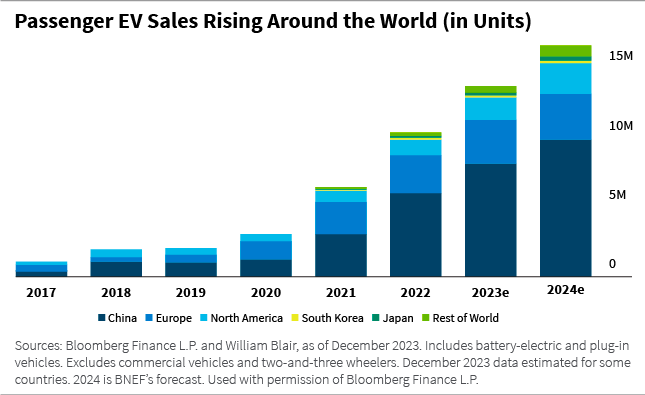

EV penetration is another notable catalyst of the energy transition. EVs are rapidly taking share from internal combustion engines, and in 2023, EVs accounted for 18% of all cars sold globally, which is 14 million cars worldwide, as shown in the chart below. Penetration is highest in China, where 60% of new car sales are electric.

Global EV penetration is projected to surpass 40% by the end of this decade. But the rapid adoption of EVs is just the beginning, as it will likely drive the need for substantial investments in infrastructure, particularly in the form of EV charging stations that will gradually replace traditional gas stations.

National Security Implications

An emerging catalyst of the energy transition is national security. The reliance on imported fuel—particularly through vulnerable pipelines—has exposed nations to significant national security risks. The potential for disruptions, whether from geopolitical tensions or sabotage, has long concerned countries dependent on external energy sources.

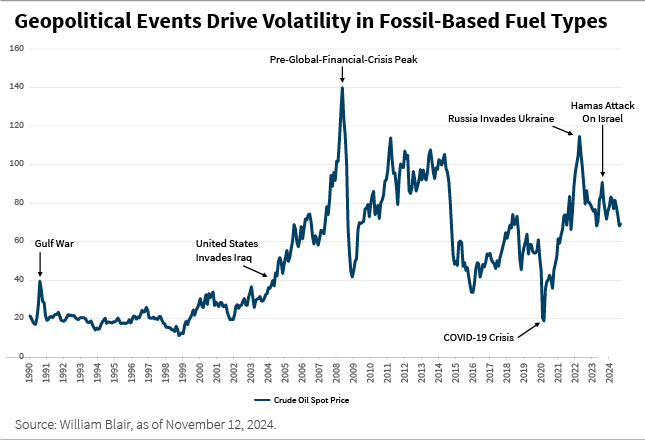

In contrast, renewable energy offers the advantage of harnessing resources generated domestically, reducing reliance on oil and natural gas imports, which have historically shown extreme price volatility driven by geopolitical events.

Since the early 1990s, oil has faced sharp price fluctuations, many of which were tied to global conflicts or macroeconomic disruptions. The natural gas market also experienced major shocks in early 2022, triggered by Russia’s invasion of Ukraine. These events underscore the vulnerabilities faced by countries reliant on fossil fuel imports.

But recent trends in renewable energy adoption have significantly improved energy independence. Advanced technologies such as smart grids and energy storage solutions are increasingly playing a role in enhancing national security by helping to ensure a reliable and resilient energy infrastructure.

As energy policy becomes increasingly intertwined with national security concerns, this linkage is helping to accelerate the broader energy transition.

Shifting Supply Chains

As supply chains undergo deglobalization and countries look to reshore and nearshore their production capabilities, there is an urgent need for both emerging and developed markets to ramp up their capacity to generate, transmit, and distribute power.

This shift is not only reshaping industries but also accelerating the energy transition in unexpected ways.

In emerging markets, there is evidence of increasing investment in clean energy, with gains primarily in renewable power, which now represents half of all power sector investments in these economies.

In addition, progress in India, Brazil, Africa, and parts of Southeast Asia reflect new policy initiatives, well-managed tenders, and improved grid infrastructure. In 2024, Africa’s clean energy investments are expected to surpass over $40 billion, nearly double what we saw in 2020.

Yet, despite this momentum, clean energy investments in emerging markets—especially outside China—remain insufficient. The World Energy Investment Report has consistently highlighted the shortfall in energy investment across these economies.

And in 2024, the share of global clean energy investment in emerging markets outside China is expected to remain around 15%—a figure far below what’s needed to sustainably meet rising energy demands.

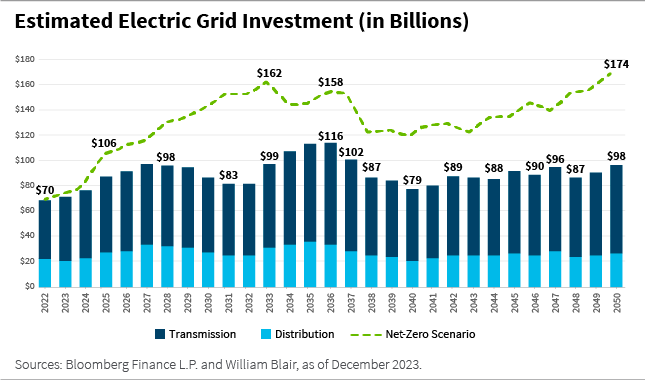

Meanwhile, in developed markets, power grids have become a bottleneck for the energy transition due to years of chronic underinvestment. But after stagnating around $300 billion per year since 2015, spending is expected to reach $400 billion in 2024, driven by new energy polices across Europe, China, the United States, and parts of Latin America.

Today, advanced economies and China account for 80% of global grid spending, but there is a significant global project pipeline in acknowledgement of the need to update to update aging grids to accommodate decentralized power generation and digital enablement.

While emerging and developed markets are leaning in and increasing investment, we believe there is room for growth. More support and investment will be required to ensure full access to modern energy and to meet the growing energy demand in a sustainable way.

Digitalization of Power Sources

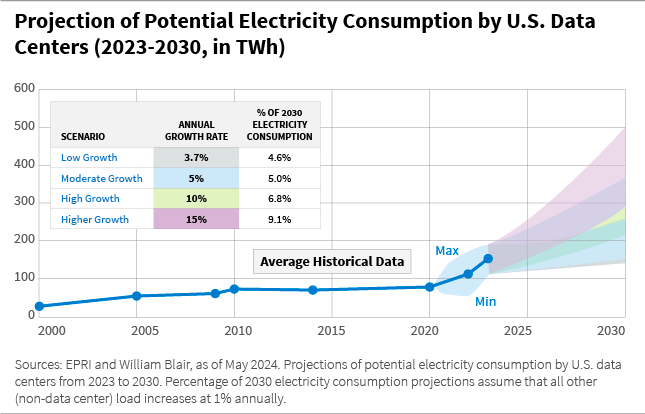

The rise of AI and hyper-scale data centers is an additional demand driver for electricity. A typical data center rack uses 12 kilowatt hours (kWh), while denser hyper-scale data centers are expected to demand near 50 kWh using the same rack base in the next three years.

The net result is that typical data centers are forecast to use nearly 7% of total U.S. power by 2030 (under a high-growth scenario), up from 4% today. AI data center energy is also expected to more than double the energy demanded by data centers and will increase their electricity demand 5% to 15% per annum.

These new demand drivers are being met with an acceleration of renewable energy in microgrids and macrogrids. Major cloud service providers such as Amazon, Microsoft, and Alphabet’s Google have announced goals to run their data centers entirely on green energy. Amazon plans to achieve this by next year, while Google and Microsoft are aiming for 2030.

We believe the global battle for AI supremacy may depend on which countries have enough data centers and power supply to support this technology. Countries with sufficient data centers and a robust, renewable power infrastructure will likely have a competitive edge in this evolving landscape.

Thus, the most critical investments in the near term will likely continue to be made in power grid infrastructure. Driving these investments are overall digitalization, the shift from hydrocarbons to electrons, and developed markets needing to upgrade their power systems to help facilitate the move from centralized to decentralized power generation.

A View of the Opportunities

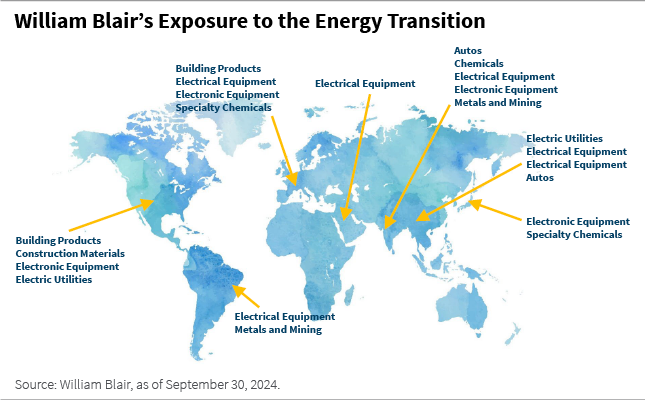

We believe the global energy transition is one of the defining growth mega trends of our time, and our portfolios aim to reflect this conviction, with exposure to key areas that are driving, and potentially benefiting from, this mega trend.

We have identified enablers of the energy transition across a wide range of sectors—from consumer goods and industrials to information technology (IT), materials, and beyond.

In the United States, we’re interested in companies that produce sustainable building products, construction materials, and electric utilities, which are pivotal in increasing the share of renewables in the national energy mix. One of the largest publicly traded renewable developers in the world is also U.S.-listed, showing the leadership role these companies play.

Despite market concerns that the newly elected Republican administration will abandon the clean energy policies of the Biden administration, resulting in a decline in renewables and grid investment, we are encouraged that fundamental market forces will prevail given the greater efficiency and cost advantages of committing to green technologies and electrification.

Across Europe, we view companies that specialize in project management, electrification, and automation solutions as compelling opportunities as well. These businesses supply essential electrical components for a variety of industries, from residential and commercial buildings to data centers and power grids. They also provide comprehensive solutions for infrastructure projects of all sizes, further advancing electrification and digitalization.

And in Asia, we’ve identified companies that supply key components to support energy infrastructure projects. As emerging markets play an increasing role in the energy transition, many of these Asian companies are vital to the success of renewable energy and electrification efforts in developing regions.

Our exposure to the energy transition spans the globe and extends across multiple sectors, reflecting the diverse and interconnected nature of this trend. By investing in companies at the forefront of these developments, we aim to position our portfolios to potentially benefit from this long-term mega trend.

In Conclusion

As the energy transition accelerates and continues to unfold, the demand for renewable energy will undoubtedly continue to grow, driven by the need for reliable, cost-effective, and sustainable power solutions.

While significant progress in improving energy infrastructure and investing in clean energy has been made in both developed and emerging markets, there is still much to be done.

We believe the transition to a cleaner energy future presents both challenges and opportunities for governments, businesses, and investors alike. As the world rethinks its approach to power generation and consumption, those who adapt to the changing energy landscape could be well positioned to succeed in this new era.

Alaina Anderson, CFA, partner, is a portfolio manager on William Blair’s global equity team.

Want more insights on the economy and investment landscape? Subscribe to our blog .

The post The Energy Transition: Fueling Tomorrow’s Economy appeared first on William Blair .