Arca blends the best aspects of traditional finance and blockchain technology to create institutional-grade, regulated digital financial products for safe and secure exposure to digital assets.

“That’s our Two Satoshis” - Crypto Market Recap August 6, 2018

What happened this week in the Crypto markets?

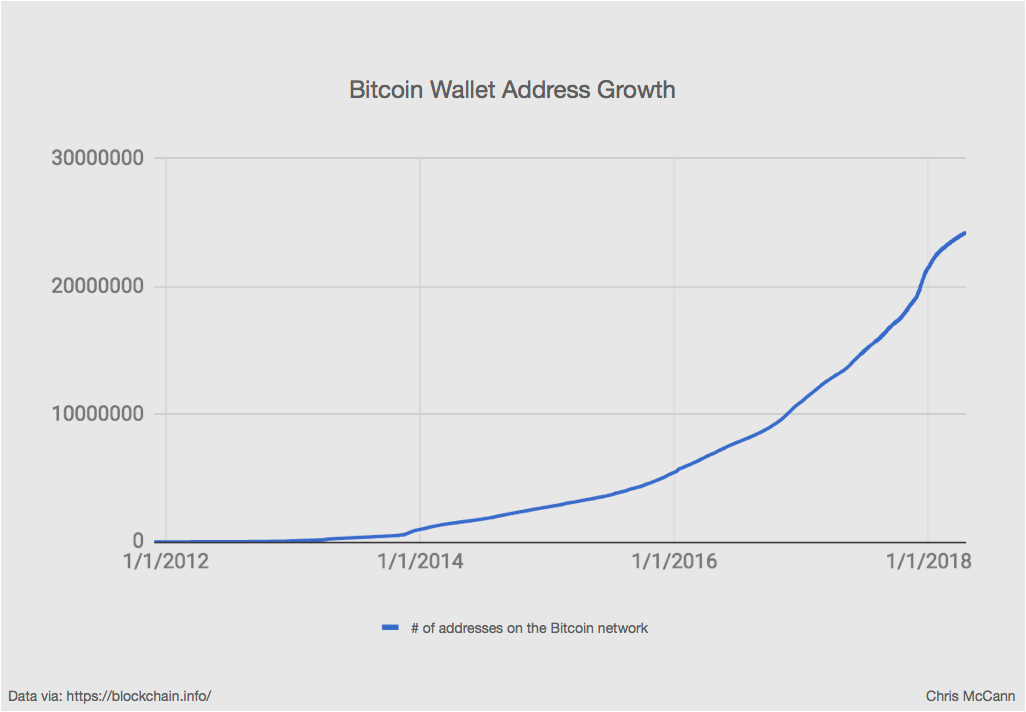

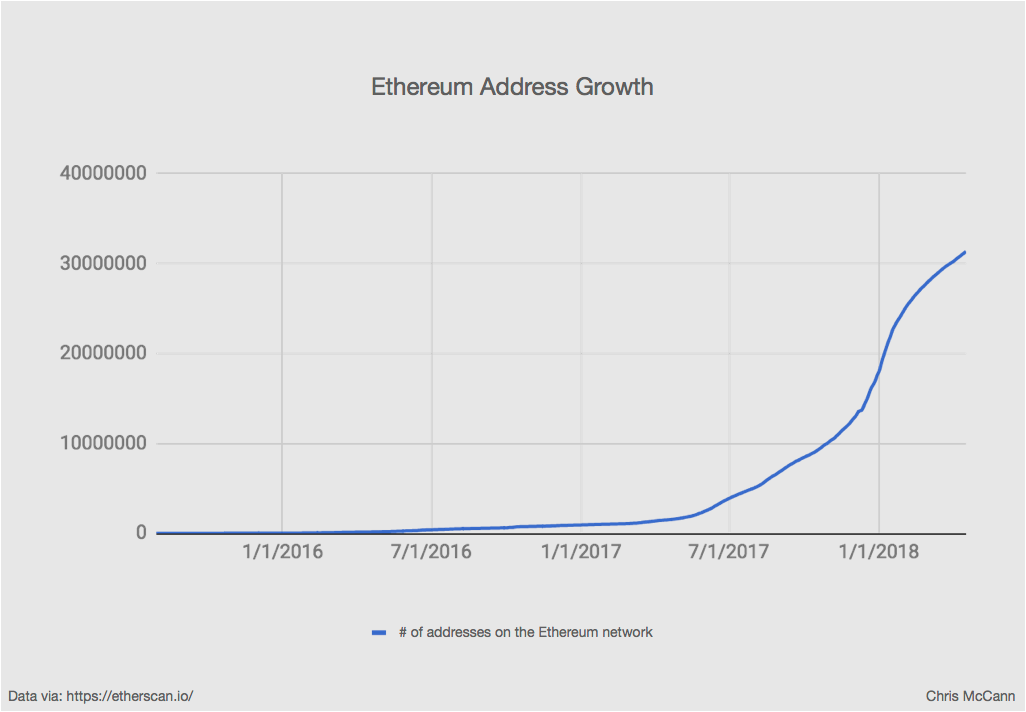

In a highly volatile nascent market, there tends to be a common acceptance (and enjoyment) of the violent positive swings. However, the nature of this market is similar to that of a pendulum. As we swing in the negative direction, many people are left to wonder “what went wrong?”. Since most people entered the market in 2017, as seen in the charts below, many have not experienced a significant Bitcoin (and cryptocurrency as a whole) bear market until now, and are disillusioned by the swift negative price action that we have seen year-to-date. For those of us who have been involved in the cryptocurrency market for longer than a year, note that volatility has been a core characteristic of Bitcoin since inception in 2009.

Growth of BTC & ETH as seen by number of wallets created to own/store

Dog Days of Bitcoin?

So with that backdrop, the question remains: what happened this week? Bitcoin lost 13.5% of its market value, falling to $7050 while the overall crypto market cap lost $38B in seven days. It may simply be inherent volatility, spurred by either real news or other factors. While it is important to try to analyze why markets move in short timeframes, it is more important to view the market from a macro perspective and understand the longer term opportunities: this has happened before, and will likely happen again. With that being said, let's take a look at what we believe to be the news that caused this week’s sell-off.

The Dangers of Margin

OkEx, a digital asset exchange that allows for Futures and Margin trading but is NOT currently available to US traders, had a forced long liquidation on July 31st of $460M USD, a liquidation so large that the counterparty short positions were unable to match. In layman’s terms, one side did not have enough losses to offset the other side’s gains, meaning traders who took a profitable short position were unable to realize their full profit. This is classified as a social loss, which can happen in any Futures trading and is not specific to crypto. Normally, a contingency plan is put in place by the exchange, with a reserve of the asset in the event they have to inject capital into the system to avoid such social loss. However, OkEx only had 10 BTC in their insurance fund, not nearly enough to cover the shortfall of around 950 BTC. This was a severe miscalculation on their part, and it would be fair to assume the market reacted as such. Since then, OkEx has stated that they are injecting an additional 2500 BTC into their insurance fund, as well as initiating a ‘clawback’ feature to cover the shortfall (at the expense of the profitable short positions).

When looking at Bitcoin, the negative price action began on July 31st, several hours before the contract was liquidated. Correlation and causation are admittedly two different things, but it is worth noting the timing here nonetheless.

Bakkt Launch Positive for Bitcoin

On a more positive front, InterContinental Exchange (ICE), the parent company of the NYSE, has teamed up with Starbucks and Microsoft (among others) to launch Bakkt, a company aiming to allow consumers to exchange Bitcoin, and eventually other cryptocurrencies, for USD, which will then be used for purchases in their retail locations. However, the scope of this announcement goes farther than that: Bakkt will leverage Microsoft Cloud to create an open and regulated global ecosystem for digital assets. This will cause a ripple effect as many institutional investors look for ways to integrate BTC into their 401(k) (for more on this news, see the “What we’re reading this week” section).

Arca in the News and on the Streets

-

Arca Funds’ PM, Jeff Dorman, recently spoke at the Crypto Funding Summit in New York, discussing the different types of Crypto Exchanges, the advantages of OTC trading, and why most investors, traders and asset managers really don’t care if exchanges are decentralized.

-

While in New York, we met with dozens of firms, both new and old, dedicated to addressing the holes in the institutional crypto investor market. We met with traditional Cap Intro and Prime Services, custody and fund administrators, crypto Exchanges and OTC dealers, and independent research and risk analysis providers.

We’re forming partnerships every day to help grow this industry, and to ultimately help our investors. Drop us a line to discuss some of the more interesting meetings and discussions we’ve had, and to hear our view on where the infrastructure is headed.

For specific information about investing in the 3 private Arca Funds, click

here

.

Notable movers and shakers

Most assets fell in unison last week, with red numbers seemingly everywhere. However, there were two tokens that stood out:

-

Ethereum Classic ( ETC ) was up 5.5% last week, and +18% versus BTC. The only news that we can pin to this price action is that Coinbase announced they are in the final testing stages for ETC and look to begin allowing deposits by Tuesday August 7th, opening trading 24-48 hours thereafter. This price action looks to be purely reactionary towards such news, as market psychology dictates (rightfully so) that increased liquidity will boost short term price action.

-

Binance Coin ( BNB ) ended the week neutral in USD, but up 12% versus BTC. BNB is a unique utility token which is price dependent on the exchange’s (Binance) profit earnings, as well as usage on the exchange itself. Binance Coin offers traders a discounted rate on transaction fees, and quarterly token burns are done to give the token value.

What we’re reading this week

A collection of news items that we feel are relevant, and helped shape our views this week:

-

Intercontinental Exchange discusses how Bakkt came to be, and how it aims to help with the adoption of Cryptocurrency in our everyday lives.

-

The impending trade war between the US and China will help establish Bitcoin as the best store of value; an asset as insurance against disaster. Gold filled this need for years, but was never right for the job. Bitcoin fits this role more accurately, and will be propelled by what looks to be a period of economic instability.

Whales Eat OTC, Retail goes to Exchanges

-

Most cryptocurrency trading is done off-exchange at OTC desks due to liquidity issues on exchanges. Most liquidity on OTC desks come from miners and other major holders of crypto. This leads to market mystery, as most volume is handled behind the scenes, and price action can be determined from these hidden transactions. As mentioned above, Arca Funds’ PM Jeff Dorman recently spoke on a panel at the Crypto Funding Summit speaking about this very topic, and drawing on his two decades of experience trading other OTC products (High Yield & Distressed corporate bonds, bank loans and reorg equities).

Northern Trust Offers Crypto Services to Hedge Funds

-

The Chicago based firm has begun to open its services up to cryptocurrency hedge funds. Northern Trust caters to institutional investors and corporations. As more and more financial giants warm to the idea of cryptocurrency as an asset class, expect a slow flow of institutional money.

Korean Exchange UpBit Audit Completed

-

UpBit comes out clean after being raided by local authorities in May on suspicions of balance sheet manipulations and inflated volumes. With Bithumb’s problems, UpBit has become the number one exchange in South Korea. This news is more a confirmation on status quo as opposed to a discovery of malicious actions. Nonetheless, anything that is not a loss can be seen as a win.

And that’s Our Two Satoshis!

Thanks for reading everyone! Questions or comments, just let us know.

- The Arca Portfolio Management Team