June 04, 2019

A leading global investment company with specialized expertise in equities, fixed income, and alternatives.

Tariffs: Pushing Prices Higher?

May 31, 2019

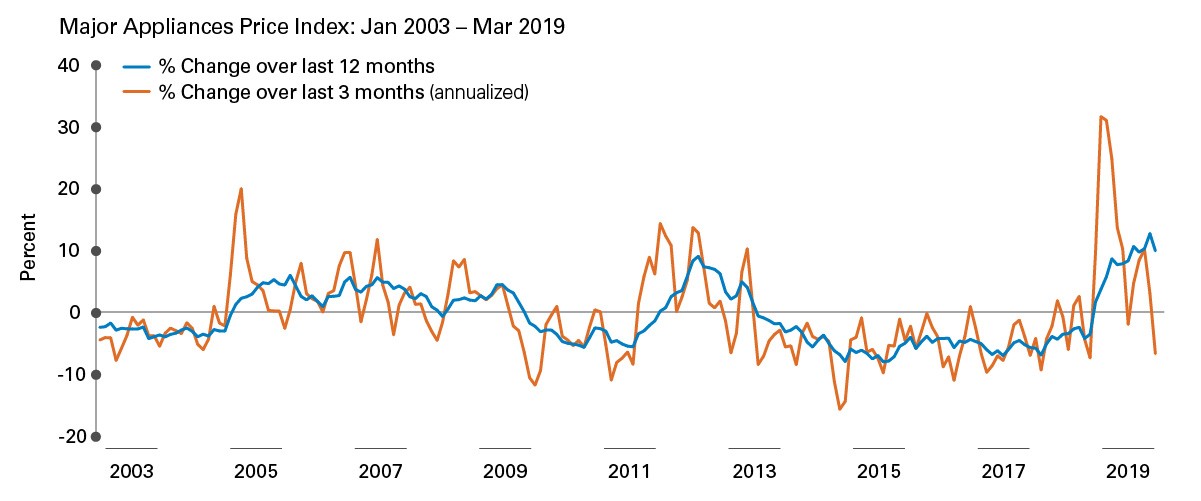

Chart courtesy of Western Asset. Source: Bureau of Economic Analysis, as of 3/31/19. Past performance is no guarantee of future results . Indexes are unmanaged, and not available for direct investment. Index returns do not include fees or sales charges. This information is provided for illustrative purposes only and does not reflect the performance of an actual investment.

THE CHART

The chart shows, on a monthly basis from January 2003 through March 2019, the 12-month percentage change and the 3-month annualized percentage change in the Personal Consumption Expenditure (PCE) Major Appliances Price Index.

THE BOTTOM LINE

- The U.S. recently imposed a third round of tariffs on Chinese goods, raising concerns about the impact on inflation and the bond market.

- Western Asset’s analysis of what happened after the first round of tariffs imposed eighteen months ago provides useful clues.

- Western examined how the 20% duty on Chinese washing machines impacted prices of major appliances. At first, prices increased rapidly and were 12% higher after twelve months.

- But the increases were short-lived—in part due to declining demand for washing machines amid higher prices.

- In fact, “real” (inflation-adjusted) consumption of major appliances actually decreased by 5% in the 12 months following the onset of the tariffs.1

- What’s more, by March 2019 the index measuring prices of major appliances had experienced an outright decline.

- While that’s just one example, it’s a great illustration of how the price impact of tariffs can be transient given other factors in the economy.

- It’s also a reason Western Asset believes the bond market will ultimately focus more on how tariffs may influence growth and financial conditions.

The Personal Consumption Expenditure (PCE) Major Appliances Price Index measures the prices of major appliances within the Personal Consumption Expenditures (PCE) Price Index. The PCE Price Index is a measure of price changes in consumer goods and services; the measure includes data pertaining to durables, non-durables and services. This index takes consumers' changing consumption due to prices into account, whereas the Consumer Price Index uses a fixed basket of goods with weightings that do not change over time.

Any information, statement or opinion set forth herein is general in nature, is not directed to or based on the financial situation or needs of any particular investor, and does not constitute, and should not be construed as, investment advice, forecast of future events, a guarantee of future results, or a recommendation with respect to any particular security or investment strategy or type of retirement account. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies should consult their financial professional.

Footnotes:

1 Source: Bureau of Economic Analysis, as of 3/31/19

More from Legg Mason Global Asset Management

The most important insight of the day

Get the Harvest Daily Digest newsletter.