A leading global investment company with specialized expertise in equities, fixed income, and alternatives.

TAKE A BREAK, MR. POWELL

DEC 20, 2018

We believe the Fed should pause and acknowledge that what it's done so far is affecting the economy – perhaps more than stated so far.

All eyes were on the Federal Reserve (Fed) this past week—not so much on what it did, but on what Chairman Powell suggested may guide its actions in the future.

After the December rate hike, we believe the Fed should pause and acknowledge that what it has done so far is having an effect on the economy – and may be more potent than it has acknowledged so far.

Chairman Powell and Vice Chair Clarida have recently hinted that the fed funds rate may be reaching the neutral zone, which is somehow embedded in their R* concept. Raising the fed funds rate far enough so it can be lowered in the next downturn seems like a perfect attitude to create the next downturn.

Francis Scotland has written cogently on the risks never defined by the Fed in the quantitative tightening (QT) program which is draining liquidity from the system late in the cycle. This piece presents an idea that may give the Fed an “Aha” moment that it has reached neutral or beyond.

In plain sight

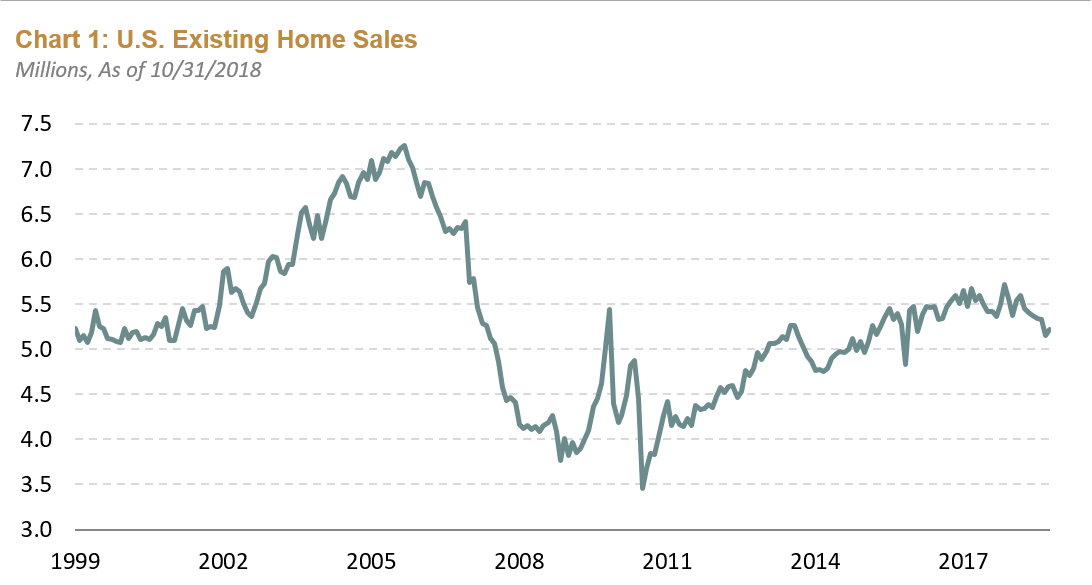

Conducting economic analysis by simply looking around can tell us some important things. Housing has begun to roll over, and is commonly thought of as the most interest-rate sensitive part of the economy. While rates are still low in a Post-War construct, they have moved up considerably, raising the cost of purchase and lowering prices. Consider this the “canary in the coal mine.”

Chart Courtesy of Brandywine Global Investment Management. Source: Macrobond, as of 10/31/2018. Past performance is no guarantee of future results. This information is provided for illustrative purposes only and does not reflect the performance of an actual investment.

The Fed’s dual mandate targets inflation and full employment. While my blog addresses the fed funds rate through the lens of inflation, unemployment at 3.7% seems to be a real concern. This comes after the average worker has experienced a decline in real income for 20 years! The Phillips curve seems to have lost its relevance, not only in the U.S., but around the developed world. Productivity is finally rising. Why is it the Fed’s job to keep wages down for the average worker?

The inflation equation

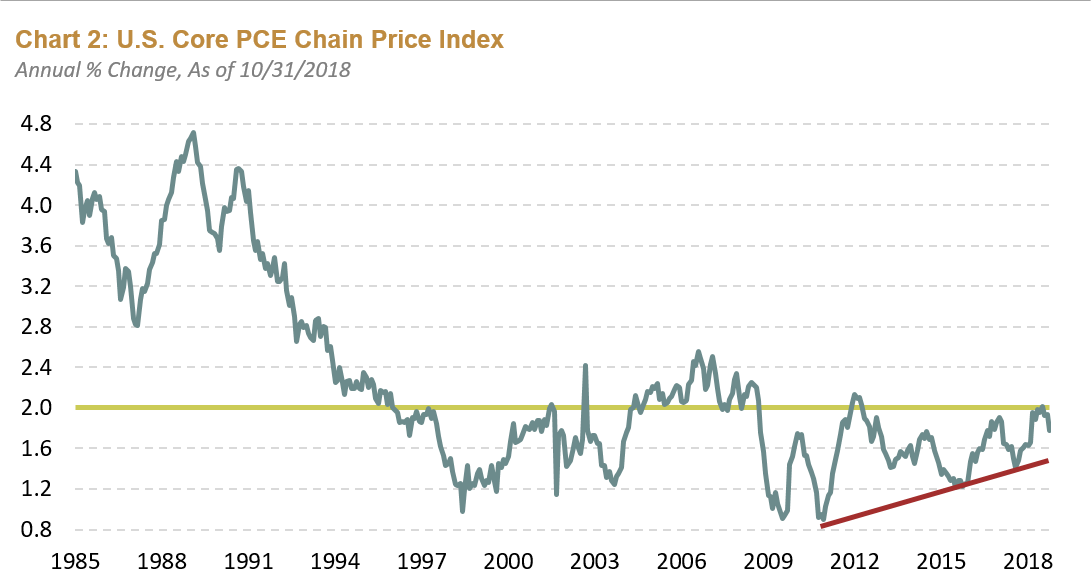

The core personal consumption expenditures (PCE) deflator is the Fed’s stated favorite inflation target. Chart 2 below shows that the Fed has reached its target, and now the PCE deflator seems to be heading down.

Chart Courtesy of Brandywine Global Investment Management. Source: Haver Analytics, as of 10/31/2018. Past performance is no guarantee of future results. This information is provided for illustrative purposes only and does not reflect the performance of an actual investment.

The numbers falling off from last year show that 1.5% is a real possibility. Why is the Fed ignoring this? Vice Chair Clarida stated that the Fed might be comfortable with inflation above its target for a period of time, even as it falls, while market-based indicators like the 5-year breakeven inflation rate derived from the Treasury market has collapsed from 2.1% to 1.6% since Chairman Powell’s speech on October 2, when he stated the neutral rate was far away. He did not state whether far away meant time or level, but the markets have been concerned since. The PCE deflator has spent most of the time below 2% since 1995. Why is the Fed ignoring the fact that the PCE deflator only touched 2% and has moved into reverse?

Maybe the secret to understanding the Fed is that it seems to be grounded in absolute levels, while the market—and I believe the world—is more affected by relative price changes. Also, demographics, debt levels, and technology all have an impact on inflation, and all exert some degree of downward pressure.

The real deal

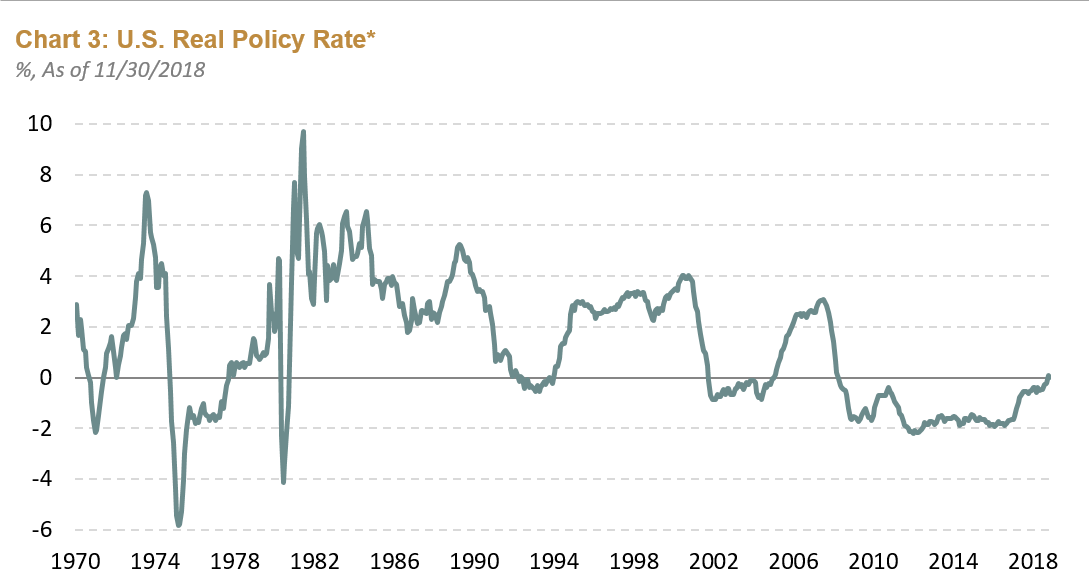

The next two charts show two ways at looking at the changes in the real fed funds rate over time. The first (Chart 3) is simply the real rate that has been in a downtrend since Paul Volcker broke the back of inflation as Fed Chairman in the early 80s.

Chart Courtesy of Brandywine Global Investment Management. Source: Haver Analytics, as of 10/31/2018. * The policy interest rate refers to the Fed's target rate, and is adjusted for inflation using the U.S. Core PCE Price Index. Past performance is no guarantee of future results. This information is provided for illustrative purposes only and does not reflect the performance of an actual investment.

The real rate has reached zero, much higher than recent history, but perceptibly low by many Federal Open Market Committee (FOMC) members, who see a dot plot moving higher into more historically normal levels. I believe, as do the markets, that this is a risky strategy, which could lead the Fed to over-tighten again after creating the risks in the first place.

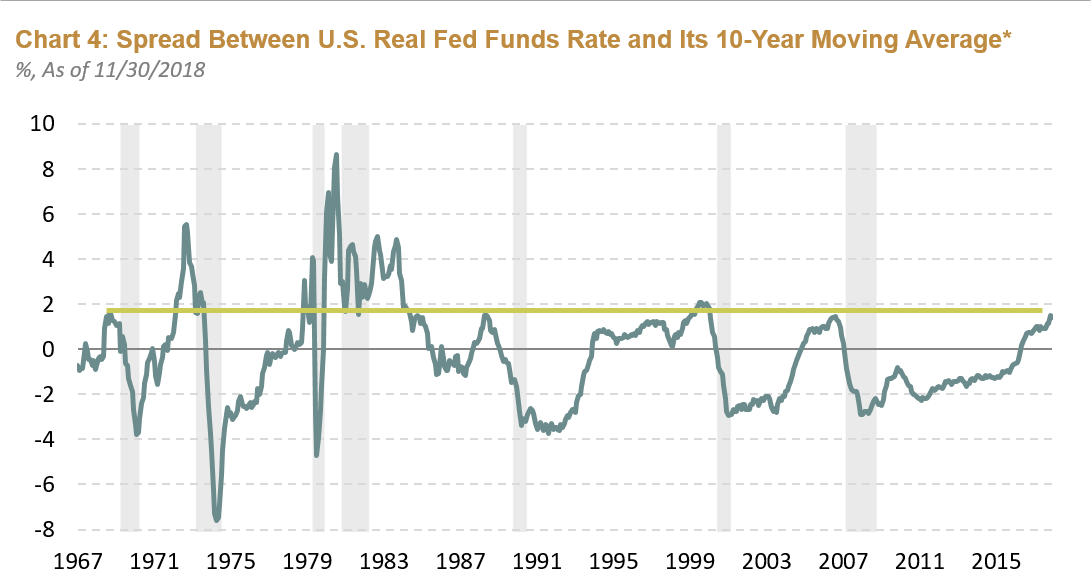

By any sensible thinking, Chart 3 shows the real funds rate is very low. However Chart 4 gives a completely different interpretation, and gives an invitation to the Fed to pause after the inevitable hike on December 19. The Fed should take the pause that refreshes, and wait patiently and observe.

Chart Courtesy of Brandywine Global Investment Management. Source: Haver Analytics, as of 10/31/2018. * The policy interest rate refers to the Fed's target rate, and is adjusted for inflation using the U.S. Core PCE Price Index. Past performance is no guarantee of future results. This information is provided for illustrative purposes only and does not reflect the performance of an actual investment.

Be careful what you fear

If we think about history, we see that the real funds rate is up meaningfully relative to its 10-year average. So what? You can observe that with the exception of two occasions—both periods of embedded inflation expectations and an oil crisis to boot—a recession followed in the not-too-distant future after reaching this current spread. It is because this spread translates into economic change through higher rates hitting housing, putting downward pressure on price-to-earnings for the stock market, increasing real corporate borrowing costs, and putting upward pressure on the U.S. dollar. The interest rate side of the Fed’s mandate is saying loudly to take a break. The Fed can always tighten again if needed. Why create what you most fear?

Author:

David F. Hoffman, CFA

Managing Director, Portfolio Manager