The leading independent provider of IPO company analysis, research and commentary.

Super Elastic Bubble Plastic

The Elastic IPO (NYSE: ESTC) will price tonight. The price was bumped up to $33-35 but given the company position in software infrastructure the shares should still perform well from that level.

We have our summary comments below but investors in this one will want to review the ESTC prospectus and read our transcript of the ESTC IPO roadshow .

Technology

The name of the company is a little misleading. It's true that the core product "Elasticsearch" provides a search and analytics engine. But it does this as a data store. That means for *some* applications it can obviate the need for a separate database to be the system of record. For example many applications that might require MongoDB ($MDB) could use Elastic instead. (Read more in the competition section below for what me mean about overlap between databases and Elastic.)

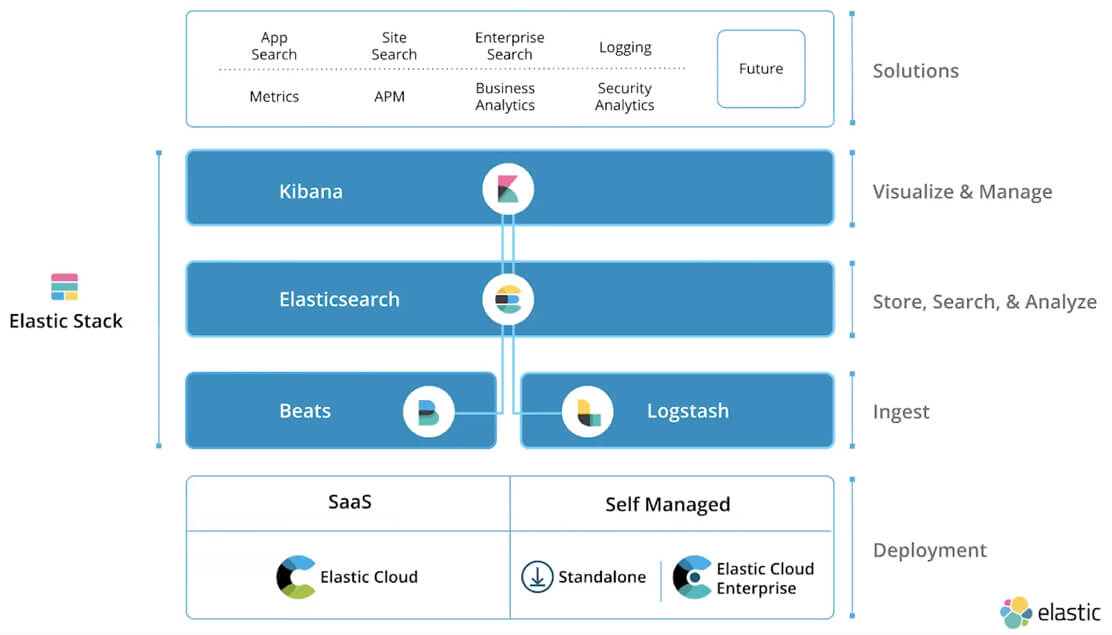

Elastic is really a data management company that puts search functionality at the core of their design vision. The "Elastic Stack" includes a development console (Kibana) and tools for ingesting and enriching data which are the domain of "extract, transform and load" ETL tools from companies like Talend ($TLND) .

Elastic is also built to be embedded in other applications. The company cites companies like Uber, Instacart and Tinder where Elastic is the "engine inside" their applications. Elastic can also run completely inside a customer data center or in the cloud hosted on AWS, Google Cloud, or Azure. This removes a key obstacle for some enterprise customers who either can't or won't run everything in the cloud.

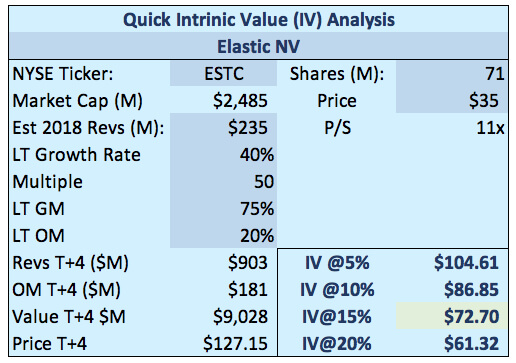

Elastic has a subscription-based, open-source rooted business model which is what customers and investors like best. The majority of the subscription revenue is for on-premise deployments but the cloud portion is growing even more rapidly then the overall business. Revenues for the fiscal year ended April 2018 were up 81% to $160M. The company still has negative operating margins but their business model and 70%+ gross margins should translate into 20%+ operating margins when the company is more mature.

Investors in other enterprise software stocks will want to keep a close eye on Elastic. Their "solutions" space is where they target adjacent areas like logging and operations management, application performance management, and business analytics. Companies like Splunk $SPLK , New Relic $NEWR , and even Tableau $DATA may see more of Elastic in their worlds - not as a direct competitor perhaps but with features that address some of their more basic use cases.

Competition

Elastic has plenty of competition. For example much of what they do is offered directly by Amazon across their AWS platform. But why then would customers chose Elastic which runs on top of AWS as an option? One reason is functionality and ease-of-use. It's possible to use AWS to do the same thing but it would be far more difficult to build and use. The same is true of Google .

Microsoft is more of a direct competitor as a provider development and deployment platforms that run both in the cloud (Azure) and on-premise. Neither AWS or Google Cloud offers customers an on-premise option.

The "big three" cloud players also focus on providing solutions for their own proprietary cloud which "locks in" customers to some degree. Most large enterprises use all three cloud vendors but don't want to base their core application infrastructure on any one of the three. Elastic offers a service that can be deployed on-premise or on any cloud - private or public.

There are other software providers that offer search-oriented solutions. Some are even also open source. The Apache project has technology that can be used to do some of the same things Elastic provides. There are also service providers like Sematext which on one hand act as a system integrator for Elastic but they also use and recommend a variety of sometimes competitive technologies.

Database systems like PostgreSQL and MongoDB offer search functions too. They are not as sophisticated as what Elastic search provides but these databases support more application functions like transactions. As a general rule if data is "read many, write few" then Elastic will be a good choice. When data is "read few, write many" then Elastic is probably not going to be a good main data store. Applications needing both will benefit from using both.

Stock Conclusion and Valuation

Investors have been bidding up the prices of enterprise SaaS players to dizzy levels. Elastic is best-of-breed in multiple categories which argues for a premium valuation. With that in mind we constructed our IV reflecting a 50 multiple of future operating earnings. It's a big number but it's reflective of current market conditions.

We liken $ESTC to $TWLO which only experienced some weakness when one of their main customers, Uber, decided to bring in a second source. Could the same thing happen to Elastic? In some ways we'd love to see it because we'd get a good entry point on the stock like we did with Twilio.

So it's not going to be cheap to get into Elastic on the IPO or during initial trading. We plan on buying some and then watching it carefully, looking for an opportunity to add over time. We decided to short $MDB against our anticipated position in $ESTC to remove some of the market and sector risk in our portfolio. (Remember we don't make investment recommendations, please consult your registered financial advisor before making any investments of your own.)

The post Super Elastic Bubble Plastic appeared first on IPO Candy .

RSS Import: Original Source