ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 50 instruments including FX majors, Gold, Silver, Copper, Oil, Natural Gas, Soybeans, Sugar ,Corn TNX and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup videos, Educational Resources, and 24 Hour chat room where they are provided live updates and given answers to their questions. The guidance of ElliottWave-Forecast gives subscribers the wherewithal to position themselves for proper entry and exit in the Forex marketplace. We believe our disciplined methodology is pivotal for long-term success in trading.

Sugar: Double Zigzag Elliott Wave Structure

Many Elliott wave practitioners call every WXY structure a double zigzag structure when in reality, every WXY structure is not a double zigzag structure. In this blog, we explain the difference between a double zigzag Elliott wave structure and a double three Elliott wave structure and take a look at a double zigzag structure which is unfolding in the market right now.

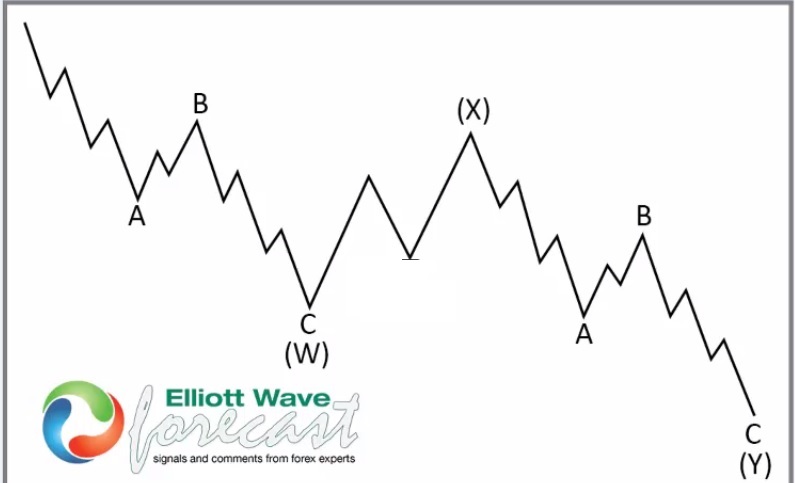

Double Zigzag Elliott Wave Structure

Image below is that of a double Zigzag Elliott Wave Structure. Wave (W) is a zigzag in which both A and C are in 5 waves. Same is the case with wave (Y) and again both A and C are in 5 waves and that's why it qualifies as a double zigzag Elliott wave structure. Now, wave (W) can consist of any corrective structure, it could consist of a lesser degree W-X-Y and same with wave Y and if that's the case, then it would be called a double three Elliott Wave structure. Thus, to conclude we could say that every double zigzag structure is a double three structure but every double three structure is not a double zigzag.

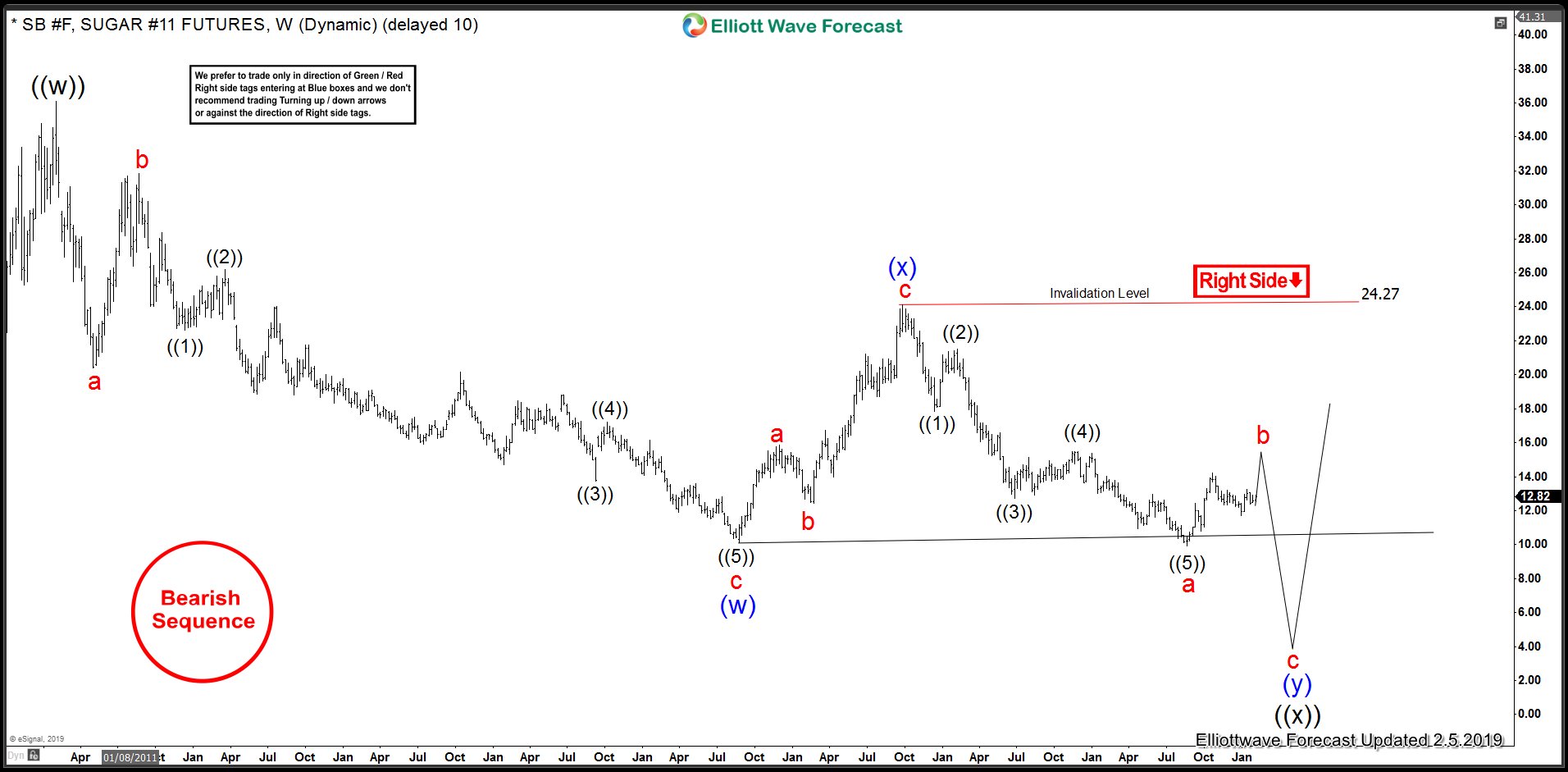

SB_F Sugar Elliott Wave Analysis: Weekly Chart

Below is the weekly chart of Sugar Futures which shows 5 swings a zigzag drop from $36.08 down to $10.13 followed by a 3 waves bounce to $24.27. After this, Sugar futures dropped below $10.13 in 5 waves and started bouncing. Cycle from $24.27 low ended at $9.91 and Sugar is now in a bounce to correct the decline from $24.27 peak. As bounces fail below $24.27 high, Elliott wave sequence calls for Sugar futures to make another swing lower below $9.91 to complete 7 swings or a double zigzag structure lower from $36.08 peak.