Seeking resilience

Financial markets are sending conflicting messages. Record highs for U.S. equities and muted volatility are at odds with typical risk-off signals such as tumbling EM currencies, weakness in industrial commodity prices and strength in defensive stocks. Why? We see a dissonance, with rising macro uncertainty and gradually tightening financial conditions set alongside still strong economic and earnings growth.

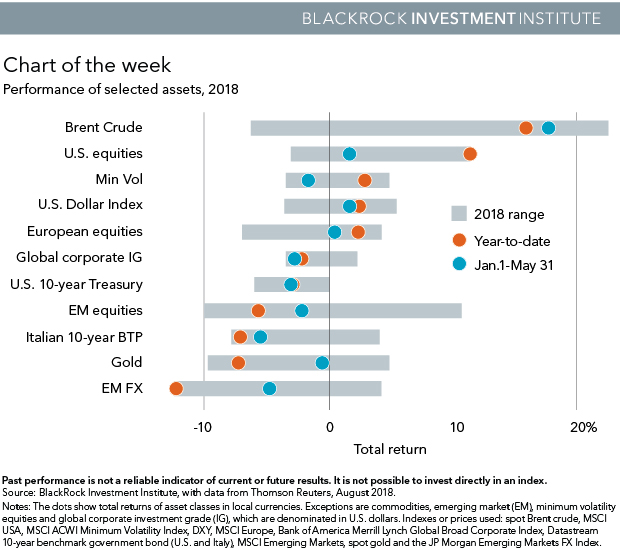

Investors returning from summer breaks face mixed messages from markets. The chart above shows 2018 performance for selected asset classes year-to-date (orange dot) and as of May 31 (blue dot), before the latest EM swoon. U.S. equities have marched higher since summer’s start, propelled by another quarter of solid sales and profit growth. 83% of U.S. firms beat second-quarter earnings estimates. Broad-based, robust sales growth shows the profit boost came from solid demand and not just tax cuts. Yet global minimum volatility equities have rebounded, typically a sign that investors are looking for safety. We believe investors are seeking resilience as they adjust to heightened economic uncertainty and moderately tighter financial conditions, partly reflecting rising trade tensions and a firmer U.S. dollar.

Summer swings

We see two dynamics driving markets today. First, U.S. fiscal stimulus and trade tensions have stoked higher macro uncertainty on the upside and downside. Second, a rise in U.S. short-term interest rates has gradually tightened financial conditions. Competition for capital from cash-like assets has pushed up the compensation investors demand for risk. This has hit areas with weak fundamentals or political uncertainties and beyond: Global equity valuations have fallen to 14.8 times forward earnings, below their long-term average.

Our BlackRock GPS points to sustained above-trend global growth. We see increasing scope for upside surprises in the U.S. as consensus expectations for growth have taken a hit amid rising trade tensions. A third of the industry-wide inflows into U.S.-listed fixed income exchange-traded products (ETPs) over the past three months has gone into ETPs holding short-term debt, according to Markit. Markets with stronger fundamentals, such as U.S. equities, have also benefited: U.S. equity funds have pulled in $10.4 billion since May even as global equity funds as a whole bled money, EPFR data shows.

A string of rolling market shocks this year did not snowball into something more systemic. We believe this was due to ongoing support from strong economic growth. Yet an uneasy equilibrium prevails. The longer macro uncertainty persists, the greater the risk of waning business confidence undermining investment spending. Risk assets are already pricing in significant downside, in our view. Any signs of declining uncertainty could spur a swift rally in risk assets such as EM equities, as prices catch up with strong earnings growth.

We expect the outlook to remain murky in the short-term. There are few indications that the U.S. and China are close to a reconciliation on trade disputes. We do not see either side willing to compromise. This warrants a focus on portfolio resilience. Bottom line: Strong earnings growth, particularly in the U.S., underpins our preference for equities over debt. We still like the momentum factor, along with a tilt toward quality for resilience. We believe fixed income investors should focus on shorter duration and higher-quality credit. See our global investment outlook , and read more market insights in our Weekly commentary .

Richard Turnill is BlackRock’s global chief investment strategist. He is a regular contributor to The Blog .

Investing involves risks, including possible loss of principal. International investing involves special risks including, but not limited to currency fluctuations, illiquidity and volatility. These risks may be heightened for investments in emerging markets. This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of September 2018 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. ©2018 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners. USR0918U-594397-1858297RSS Import: Original Source