Delivering compelling investment results for our clients over the long term since 1939.

Sector Spotlight: Health Care — The More Things Change...

Health care was the subject of one of 2017’s most significant legislative battles—over the “repeal and replace” of Obamacare. Although that effort ended in failure, recently enacted policy initiatives such as the passage of federal tax reform, the repeal of the individual mandate, the elimination of cost-sharing subsidies on the public exchanges and other executive orders have continued to impact health care companies in varying ways. Meanwhile, the sector has seen some major announcements on mergers and joint ventures that suggest a continued push for cost efficiency and a shift toward category-bending consumer-focused care. For insights on this key area of the market and economy, we spoke to Ari Singh, who covers health care services companies (hospitals, managed care, drug stores, pharmacy benefit managers and health care IT) for our Global Equity Research team.

Ari, how is the health care sector evolving at this stage?

The health care sector is dynamic and always undergoing change. However, the old saying of “the more things change, the more they stay the same” also applies.

What do I mean by those two conflicting statements? There is no better answer than Obamacare. Recall that the law was supposed to address multiple shortcomings of our health care system: lack of access, affordability and innovation. Costs to the overall system were expected to be addressed in subsequent legislation.

Key provisions of the law included (1) a massive restructuring of the individual marketplace, (2) the expansion of Medicaid, (3) the rollout of new, innovative payment systems and (4) higher taxes and reimbursement cuts applied to health care companies to help fund changes (1) and (2).

Despite all this, and the fact that some progress has been made, the simple reality is that access to coverage remains a problem. Furthermore, affordability really hasn’t improved, as shown by the non-stop complaining of both individuals and plan sponsors. In addition, the surprising Trump victory has essentially led to a rollback and reconsideration of many innovative programs once touted by the Obama administration.

In short, while the rules of the road were largely rewritten by Obamacare, many of the same issues that confronted the U.S. health care system back in 2008 and 2009 remain today.

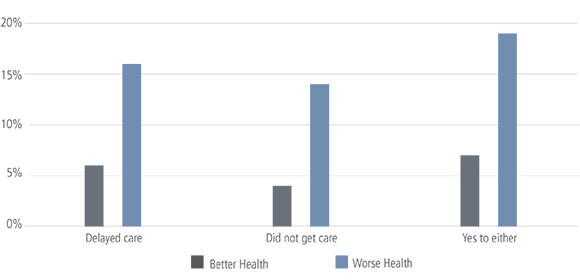

Health Care Access Remains a Key Issue

Percent of Adults Who Reported Delaying or Going Without Health Care in 2016

Source: Kaiser Family Foundation analysis of National Health Interview Survey.

How does this affect the decision-making at health care companies?

As management teams and boards think about how best to position their companies for the future, they generally come to the following conclusions: (1) Health care policy will continue to evolve but the path forward remains unclear, (2) the government’s role in health care is only going to grow larger, (3) it’s best to be a low-cost provider with superior clinical programs and (4) diversification is generally viewed as a good hedge to help manage a perpetually shifting landscape. Given the fact that most companies don’t check all of these boxes cited, M&A is likely to remain a common theme for this space.

How is technology affecting the sector?

Everybody always talks up the prospects of technology massively disrupting the health care marketplace, but it never seems to happen. Yes, there is innovation. Examples include e-prescribing, telehealth and robotic surgeries. But unlike other markets, there are significant limitations to technology’s ability to disrupt markets. Why? Inertia and regulations are two causes. The health care market is slow to change for a variety of reasons and the government generally places all kinds of regulatory burdens on companies to prevent sensitive information from leaking to the public.

There have been some key announcements over the past year, including the proposed mergers of Aetna/CVS and Express Scripts/Cigna. What are the implications of those deals?

We see the CVS/Aetna deal primarily as a diversification play, whereas Express Scripts/Cigna is about diversification and improving Cigna’s cost position in specialty drugs.

Will these deals change the health care landscape? We think the answer is yes—and by a lot. Assuming regulatory approval, three of the four largest diversified health plans will now be vertically integrated with major pharmacy benefits managers (PBMs). And the adoption of new price/care-focused clinical programs revolving around specialty drugs will only accelerate as incentives between parties are more closely aligned.

If Cigna, Aetna and UnitedHealth Group (which also owns a PBM) can prove to the market that these programs cut costs without disrupting beneficiaries, then other payer companies will likely follow their lead—which could usher in a material change in how our system manages high-cost populations. The current solution of making the sick pay for a greater amount of their health care costs is just not working, so the market needs to innovate and come up with alternative solutions.

How about the consortium formed by Amazon, Berkshire Hathaway and JP Morgan to reduce health care costs for their employees—does that have broader ramifications?

Although the announcement has received a lot of press, we have yet to see anything that would suggest that these partners are even close to solving our nation’s health care problems. In fact, they don’t even plan on announcing a CEO for the venture until late 2018, so we wouldn’t expect to hear anything definitive about their plans for at least another year.

Although there has been some speculation that they could create a managed care entity to compete with the likes of Aetna/Cigna and UnitedHealth Group, we believe they will spend most of their time and energy on crafting technology solutions that help beneficiaries make better purchase decisions. That would actually be a positive for managed care companies and we would expect them to be fast adopters of any new technology rolled out by this consortium. Time will tell if our view is accurate.

Amazon’s “footsteps” are being heard in other ways. Should anyone worry?

There is a view that Amazon will eventually disrupt the health care delivery system for both pharma and medical supplies. And that has weighed on valuations. However, we have yet to see anything differentiated from the company, so the reaction seems to be just based on Amazon’s reputation of successfully disrupting other industries—and the assumption that something similar will play out in health care.

Regardless, we don’t expect Amazon to make a serious dent in the earnings profile of most health care service companies anytime soon. Barriers to entry are quite high, and the company seems unlikely to bring anything new and innovative to this market with its current suite of assets. Still, we do see several markets where they could make inroads, such as distributing commodity-like products to physician and dental offices.

Will there be more mergers? Will health care functions continue to be combined?

Yes, in my view. Health care is dynamic so businesses are constantly looking for ways to reinvent themselves to address a continually evolving marketplace. And that means that M&A will continue to thrive. The only wild card is what type of activity will be permitted by the Department of Justice and the Federal Trade Commission. If the currently slated transactions get approved, then we will likely see more large-scale deals in 2019. If not, then we will likely see more “tuck-in” acquisitions over the next year, whether to add scale capabilities or provide diversification.

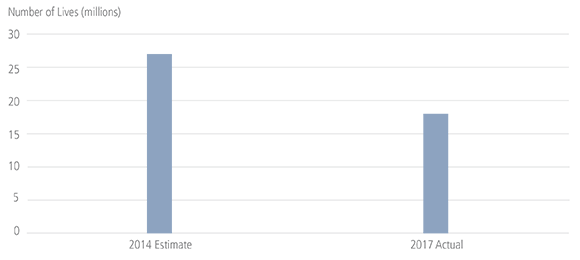

Obamacare’s Clipped Wings

Enrollment in Individual Market: Forecast vs. Actual

Source: Congressional Budget Office.

How has Donald Trump affected the sector?

Tax reform has been a big positive for the group, with many stocks seeing double-digit improvements to their earnings outlook after the passage of the law. But the administration’s failure to pass “repeal and replace” is significant. That had the potential to disrupt the sector, so as analysts we are happy that never amounted to anything serious. Although President Trump has made some administrative changes that have weakened public exchanges, that hasn’t moved the earnings needle for the publicly traded stocks. He has promised to materially lower drug prices, but again nothing game-changing has happened.

What variables could drive the performance of the sector this year?

Health care policy is always important to watch. All it takes is a major election for the macro picture to shift dramatically. Look no further than to the last three Presidential cycles: President Bush gave us the launch of Medicare Part D (drug coverage), as well as a new private offering for Medicare; Obama gave us Obamacare and Trump has spent much of his time trying to unwind that law. As a result, investors are likely to view results of the upcoming midterm elections as a harbinger of the 2020 election cycle. If the Democrats trounce the Republicans, that would likely be bad for the health care sector. If the election yields a mixed result, then that would likely be positive. We shall see how it all plays out.

Outside of the election, we believe two other important drivers this year will be (1) what Trump’s upcoming drug-pricing proposal actually looks like and (2) whether the Aetna/CVS and Express Scripts/Cigna deals receive regulatory approval.

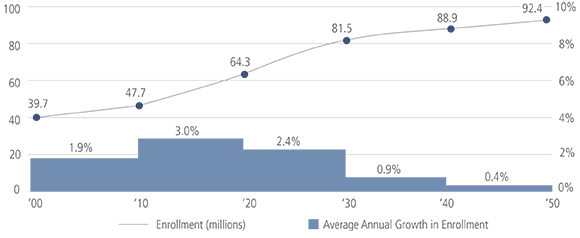

Growing Medicare Enrollment Will Pressure Budgets—and Help Drive Change

Projected Change in Medicare Enrollment, 2000–2050

Source: 2013 Annual Report of the Board of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds.

Let’s look at the long term. What do you see as the future of health care in five or 10 years?

The health care market is always evolving and the pace of the evolution is largely dictated by public policy. That shouldn’t be a big surprise given the fact that the government is the biggest payer in the system. As a result, elections matter and the people in power will ultimately shape the end markets, thereby creating risks and opportunities for companies. As it is nearly impossible to predict election outcomes and their impact on future policy, it is equally difficult to predict what the next five to 10 years will look like on a macro level.

That said, we think a few investable themes will remain: (1) Demographic trends point to an aging population, so Medicare will likely play an even bigger role in our health care system. (2) Greater Medicare enrollment will put more pressure on government budgets, and send policymakers scrambling for potential solutions. (3) Almost everybody agrees that the current Medicare fee-for-service payment system is dated and needs to evolve, so that could lead to the rise of more “pay-for-value” contracts between the various players in the supply chain. (4) The delivery system will continue to evolve, with traditional hospitals yielding less serious medical cases to other, more cost-effective sites. (5) Drug costs could continue to balloon with the launch of new treatments, so payers will need to find a balance between allowing access and managing costs. (6) Last, we would expect connectivity within the health care system to continue to increase, albeit slowly.

Despite all the moving parts, we believe companies with low-cost positions that are able to offer their clients clinical solutions that “bend the cost curve” will ultimately thrive regardless of the policy backdrop.

Thanks very much for your insights.

My pleasure.

This material is provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice. This material is general in nature and is not directed to any category of investors and should not be regarded as individualized, a recommendation, investment advice or a suggestion to engage in or refrain from any investment-related course of action. Investment decisions and the appropriateness of this material should be made based on an investor's individual objectives and circumstances and in consultation with his or her advisors. This material is not intended as a formal research report and should not be relied upon as a basis for making an investment decision. The firm, its employees and advisory clients may hold positions within sectors discussed, including any companies specifically identified. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. Information is obtained from sources deemed reliable, but there is no representation or warranty as to its accuracy, completeness or reliability. All information is current as of the date of this material and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole. Neuberger Berman products and services may not be available in all jurisdictions or to all client types.

This material may include estimates, outlooks, projections and other “forward-looking statements.” Due to a variety of factors, actual events or market behavior may differ significantly from any views expressed. Investing entails risks, including possible loss of principal. Investments in hedge funds and private equity are speculative and involve a higher degree of risk than more traditional investments. Investments in hedge funds and private equity are intended for sophisticated investors only. Indexes are unmanaged and are not available for direct investment. Past performance is no guarantee of future results.

This material is being issued on a limited basis through various global subsidiaries and affiliates of Neuberger Berman Group LLC. Please visit www.nb.com/disclosure-global-communications for the specific entities and jurisdictional limitations and restrictions.

The “Neuberger Berman” name and logo are registered service marks of Neuberger Berman Group LLC.

© 2009-2018 Neuberger Berman Group LLC. | All rights reserved

RSS Import: Original Source