ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 50 instruments including FX majors, Gold, Silver, Copper, Oil, Natural Gas, Soybeans, Sugar ,Corn TNX and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup videos, Educational Resources, and 24 Hour chat room where they are provided live updates and given answers to their questions. The guidance of ElliottWave-Forecast gives subscribers the wherewithal to position themselves for proper entry and exit in the Forex marketplace. We believe our disciplined methodology is pivotal for long-term success in trading.

S&P 500 ETF (SPY) Elliott Wave: Forecasting the Future Path

Hello fellow traders !

In this technical article, we’re going to take a quick look at the Elliott Wave charts of the SPY ETF , published in the members area of the website. As our members know, SPY remains overall bullish. However, currently it's correcting the cycle from the August 504.84 low. In this article, we will explain the forecast and the best way to trade SPY.

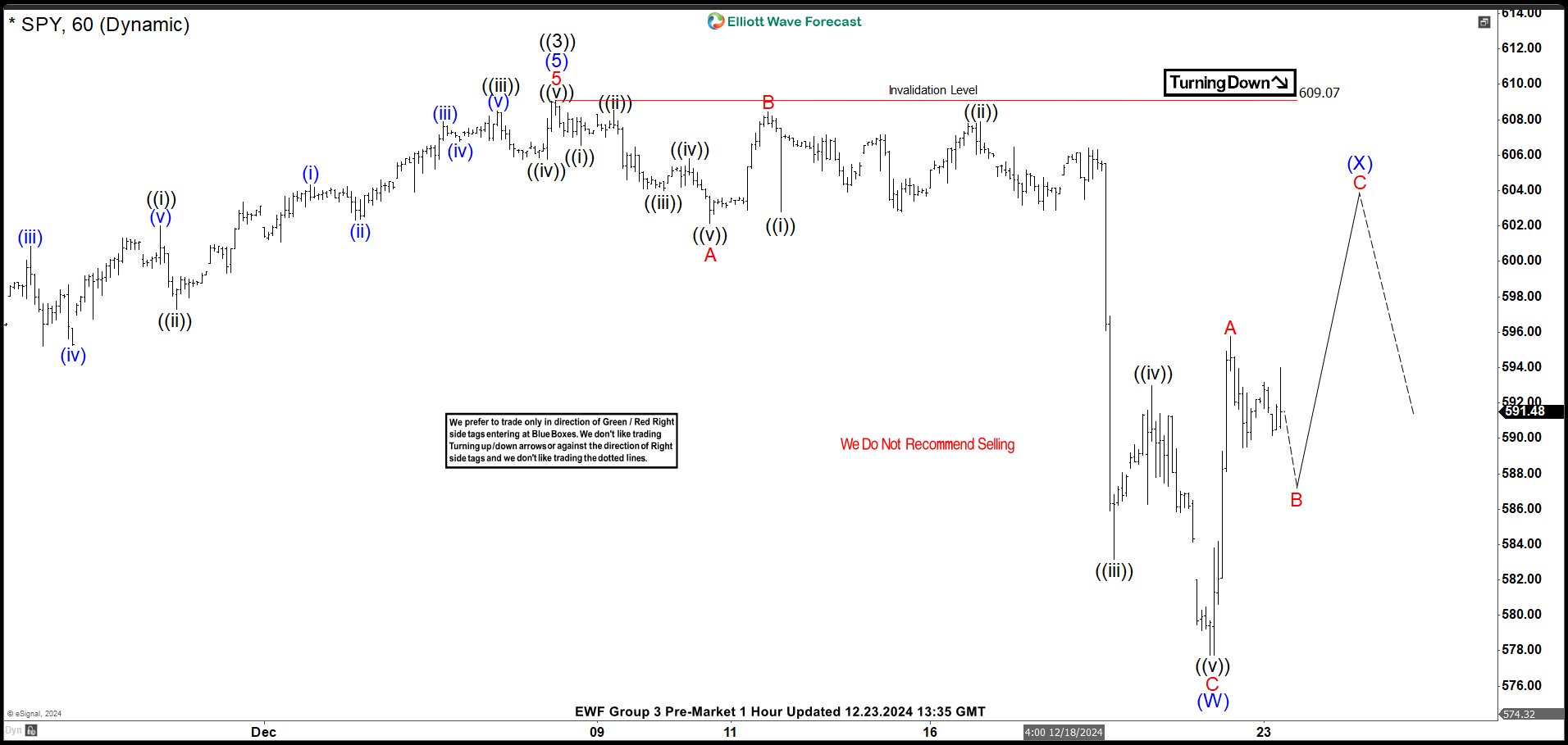

SPY H1 Update 12.23.2024

The ETF is bouncing against the 609.07 high, and currently, the recovery appears incomplete. We’ve seen a sharp rally from the lows, which looks impulsive. The current view suggests the correction can be unfolding as an Elliott Wave Zig Zag pattern while we are still in wave B.

The short-term view suggests we could see another leg down in red wave B before red wave C takes place higher. Anyway, due to the 5 waves from the low, we believe another leg up in red wave C should be seen to complete the blue wave (X) correction against the 609.07 high.

As our members know, we favor the long side in indices and ETFs and do not recommend selling SPY during any proposed pullbacks. If we see the proposed leg down, we will use it as a new buying opportunity.

Reminder : You can learn more about Elliott Wave Patterns at our Free Elliott Wave Educational Web Page .

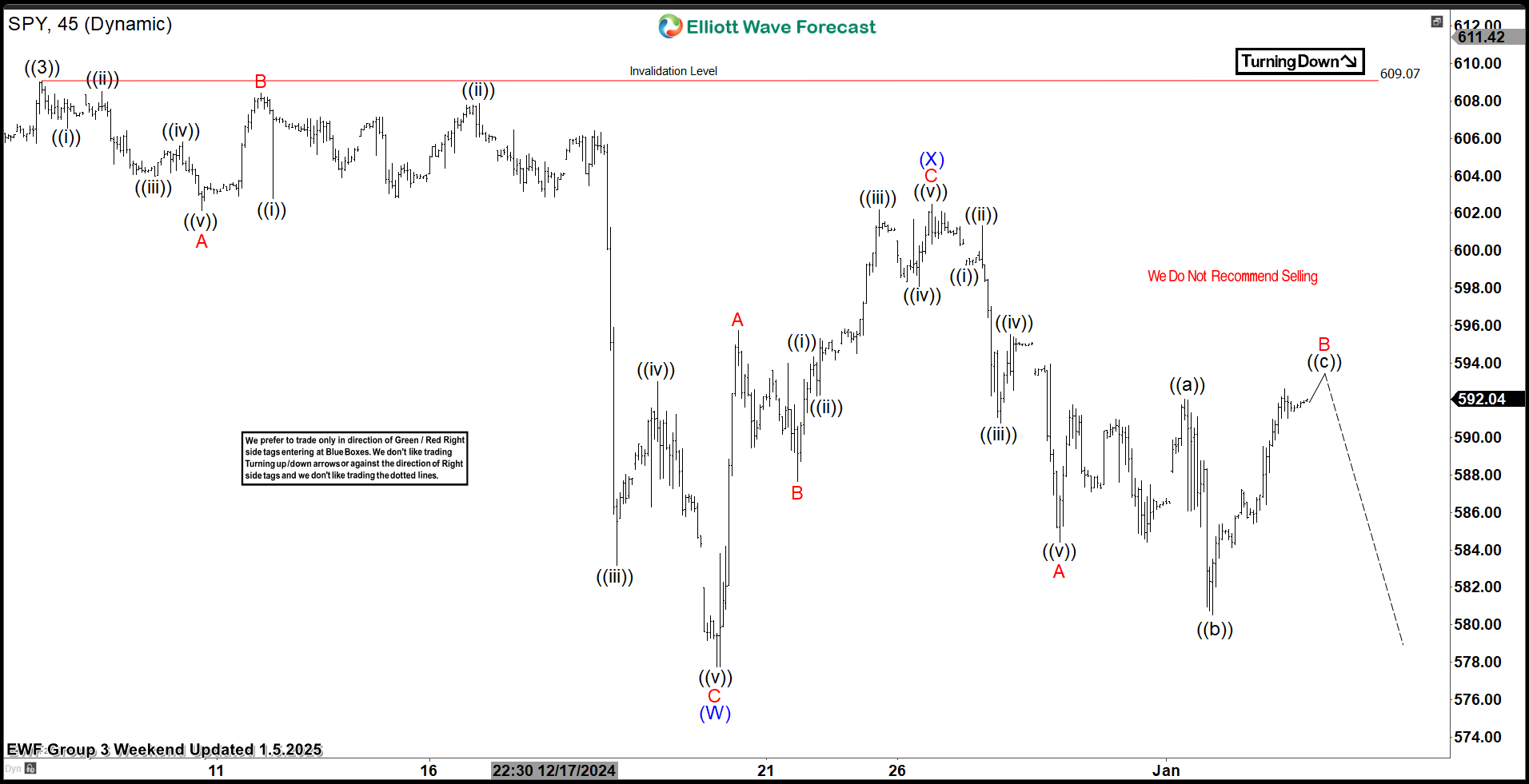

SPY H1 Update 01.05.2024

SPY has traded according to our forecast. We got 3 waves pull back in B red, and then another leg up C red. ETF completed the proposed leg up, forming a Zig Zag pattern against the 609.07 high. We consider the (X) recovery complete at 602.55 level. As long as the price remains below this high, we expect further weakness in the (Y) leg. A break of the (W) blue low is needed to confirm the proposed scenario. We do not recommend selling against the main bullish trend and will view the (Y) leg as a new buying opportunity if the next extreme zone is reached.

You can find detailed information on this trading setup in the membership area and in the Live Trading Room

90% of traders fail because they don’t understand market patterns. Are you in the top 10%? Test yourself with this advanced Elliott Wave Test

Source: https://elliottwave-forecast.com/stock-market/sp-500-etf-spy-elliott-wave/