April 10, 2019

A leading global investment company with specialized expertise in equities, fixed income, and alternatives.

Rates: The Homebuilder Effect

Written by: Global Thought Leadership | April 04, 2019

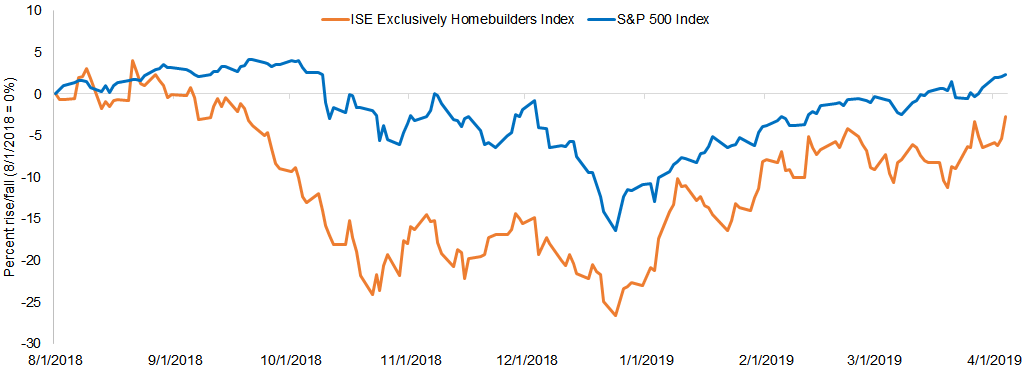

Chart courtesy of ClearBridge Investments. Source: ClearBridge, Bloomberg as of 4/4/2019. Past performance is no guarantee of future results . Indexes are unmanaged, and not available for direct investment. Index returns do not include fees or sales charges. This information is provided for illustrative purposes only and does not reflect the performance of an actual investment.

THE CHART

The chart shows, for the period August 1, 2018 to April 4, 2019, the gains/losses of the S&P 500 Index and the ISE Exclusively Homebuilder Index.

THE BOTTOM LINE

- Housing accounts for roughly 10% of the US economy, and a significant part of that is the activity of homebuilders. It’s also one of the most rate-sensitive sectors, as anyone who’s considered buying a house or apartment can attest.

- But long-term fundamentals may matter more when evaluating the prospects for homebuilding stocks going forward – which appear quite strong now, as ClearBridge Investments points out in a recent article .

- On the one hand, demand for new homes has yet to rise to its normalized level of about 1.5 million units per year.

- Supply is also a positive. Investment in the housing sector collapsed in the wake of the 2008 financial crisis – as the supply of mortgages dried up along with the unravelling of the mortgage-backed debt instruments that backed them.

- The result has been a perceived deficit of available housing – at the same time housing demand is accelerating as millennials reach their 30s and job growth continues to rise.

- These favorable fundamentals may be behind the rapid recovery of the homebuilder stocks after rising mortgage rates beginning in the second half of 2018 triggered a dramatic selloff, as well as a pause in housing starts.

- The Fed’s about-face on rate increases in early 2019 was clearly reflected in the sector’s rebound.

- Even now, with a number of homebuilder stocks trading at below book value even after the run-up so far this year, ClearBridge believes the sector could still be worthy of further examination.

Definitions:

The ISE Exclusively Homebuilders Index includes residential construction companies and prefabricated house manufacturers.

The S&P 500 Index is an unmanaged index of 500 stocks that is generally representative of the performance of larger companies in the U.S.

Originally published: RATES: THE HOMEBUILDER EFFECT

Important Information

All investments involve risk, including possible loss of principal.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Legg Mason nor any of its affiliates guarantees any rate of return or the return of capital invested.

Equity securities are subject to price fluctuation and possible loss of principal. Fixed-income securities involve interest rate, credit, inflation and reinvestment risks; and possible loss of principal. As interest rates rise, the value of fixed income securities falls.

International investments are subject to special risks including currency fluctuations, social, economic and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

Commodities and currencies contain heightened risk that include market, political, regulatory, and natural conditions and may not be suitable for all investors.

Past performance is no guarantee of future results. Please note that an investor cannot invest directly in an index . Unmanaged index returns do not reflect any fees, expenses or sales charges.

The opinions and views expressed herein are not intended to be relied upon as a prediction or forecast of actual future events or performance, guarantee of future results, recommendations or advice. Statements made in this material are not intended as buy or sell recommendations of any securities. Forward-looking statements are subject to uncertainties that could cause actual developments and results to differ materially from the expectations expressed. This information has been prepared from sources believed reliable but the accuracy and completeness of the information cannot be guaranteed. Information and opinions expressed by either Legg Mason or its affiliates are current as at the date indicated, are subject to change without notice, and do not take into account the particular investment objectives, financial situation or needs of individual investors.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Legg Mason or its affiliates or any of their officer or employee of Legg Mason accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Legg Mason. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of, and observe such restrictions (if any).

This material may have been prepared by an advisor or entity affiliated with an entity mentioned below through common control and ownership by Legg Mason, Inc. Unless otherwise noted the “$” (dollar sign) represents U.S. Dollars.

This material is only for distribution in those countries and to those recipients listed.

All investors and eligible counterparties in Europe, the UK, Switzerland:

In Europe (excluding UK & Switzerland) this financial promotion is issued by Legg Mason Investments (Ireland) Limited, registered office 6th Floor, Building Three, Number One Ballsbridge, 126 Pembroke Road, Ballsbridge, Dublin 4, D04 EP27, Ireland. Registered in Ireland, Company No. 271887. Authorised and regulated by the Central Bank of Ireland.

In the UK this financial promotion is issued by Legg Mason Investments (Europe) Limited, registered office 201 Bishopsgate, London, EC2M 3AB. Registered in England and Wales, Company No. 1732037. Authorised and regulated by the UK Financial Conduct Authority.

In Switzerland, this financial promotion is issued by Legg Mason Investments (Switzerland) GmbH, authorised by the Swiss Financial Market Supervisory Authority FINMA.

Investors in Switzerland: The representative in Switzerland is FIRST INDEPENDENT FUND SERVICES LTD., Klausstrasse 33, 8008 Zurich, Switzerland and the paying agent in Switzerland is NPB Neue Privat Bank AG, Limmatquai 1, 8024 Zurich, Switzerland. Copies of the Articles of Association, the Prospectus, the Key Investor Information Documents and the annual and semi-annual reports of the Company may be obtained free of charge from the representative in Switzerland.

All Investors in Hong Kong and Singapore:

This material is provided by Legg Mason Asset Management Hong Kong Limited in Hong Kong and Legg Mason Asset Management Singapore Pte. Limited (Registration Number (UEN): 200007942R) in Singapore.

This material has not been reviewed by any regulatory authority in Hong Kong or Singapore.

All Investors in the People’s Republic of China ("PRC"):

This material is provided by Legg Mason Asset Management Hong Kong Limited to intended recipients in the PRC. The content of this document is only for Press or the PRC investors investing in the QDII Product offered by PRC’s commercial bank in accordance with the regulation of China Banking Regulatory Commission. Investors should read the offering document prior to any subscription. Please seek advice from PRC’s commercial banks and/or other professional advisors, if necessary. Please note that Legg Mason and its affiliates are the Managers of the offshore funds invested by QDII Products only. Legg Mason and its affiliates are not authorized by any regulatory authority to conduct business or investment activities in China.

This material has not been reviewed by any regulatory authority in the PRC.

Distributors and existing investors in Korea and Distributors in Taiwan :

This material is provided by Legg Mason Asset Management Hong Kong Limited to eligible recipients in Korea and by Legg Mason Investments (Taiwan) Limited (Registration Number: (98) Jin Guan Tou Gu Xin Zi Di 001; Address: Suite E, 55F, Taipei 101 Tower, 7, Xin Yi Road, Section 5, Taipei 110, Taiwan, R.O.C.; Tel: (886) 2-8722 1666) in Taiwan. Legg Mason Investments (Taiwan) Limited operates and manages its business independently.

This material has not been reviewed by any regulatory authority in Korea or Taiwan.

All Investors in the Americas:

This material is provided by Legg Mason Investor Services LLC, a U.S. registered Broker-Dealer, which includes Legg Mason Americas International. Legg Mason Investor Services, LLC, Member FINRA/SIPC, and all entities mentioned are subsidiaries of Legg Mason, Inc.

All Investors in Australia:

This material is issued by Legg Mason Asset Management Australia Limited (ABN 76 004 835 839, AFSL 204827) (“Legg Mason”). The contents are proprietary and confidential and intended solely for the use of Legg Mason and the clients or prospective clients to whom it has been delivered. It is not to be reproduced or distributed to any other person except to the client’s professional advisers.

Forecasts are inherently limited and should not be relied upon as indicators of actual or future performance.

Asset-backed, mortgage-backed or mortgage related securities are subject to additional risks such as prepayment and extension risks.

More from Legg Mason Global Asset Management

The most important insight of the day

Get the Harvest Daily Digest newsletter.