We help investors, asset managers, and brokers succeed in the alternative investment space.

Quant Funds share of the Hedge Fund Industry

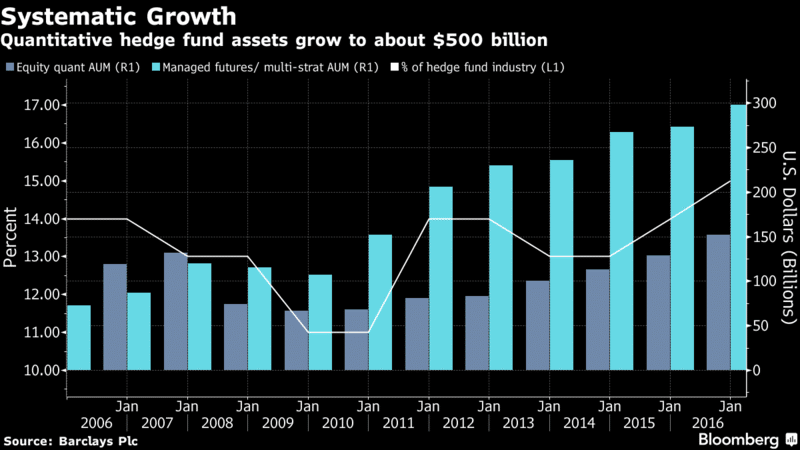

There are many ways to define what constitutes a quantitative hedge fund, but we’re quite certain we know one type quite well – systematic multi-market managed futures funds which have been using computer algorithms to track markets and trigger trade signals for decades. We do our best to keep track of the real size of the managed futures industry , but rarely do we talk about quant-heavy Managed Futures’ size compared to the rest of the hedge fund industry. But the recent surge in “ quants running Wall St” type press has been providing some good insight into just that.

There’s no surprise here, but Quantitative hedge funds like Managed Futures, Systematic Macro, and Multi-Strat quants seem to not only be growing, but they’re becoming a larger and larger part of the hedge fund industry , via Bloomberg and Barclay’s PLC.

One thing can be said for sure: funds using automated investing processes are the fastest growing segment of the hedge fund universe.

“Fundamentally driven managers have historically captured the focus, the flows and the glory,” wrote the Barclays team led by Louis Molinari, global head of capital solutions, in a note to investors Friday. “But in the last few years, a resurgence of interest in the space has developed from both managers and investors.”

Here’s a look at how the quant industry has grown over the past few years.

These quants now represent 17% of the total hedge fund industry…. Good for about $300 Billion. As Mark Cuban was quoted as saying once, algorithms are dominating the market…. It’s truly a ‘Terminator’ market. We’re all for the cyborgs churning out returns, let’s just hope they don’t go Skynet or Matrix and turn the tables on us.

RSS Import: Original Source