Portfolio Risk/Return using Conditional and Modified Sharpe Ratios.

If you use the Conditional Sharpe and Modified Sharpe ratios then it gives you a better idea about portfolio risk. Here is a screenshot and information from Zoonova.com.

C-VaR

Conditional Value at Risk (CVaR) is also known as mean excess loss, mean shortfall, tail Var, average value at risk or expected shortfall. CVaR was created to serve as an extension of value at risk (VaR). The VaR model allows managers to limit the likelihood of incurring losses caused by certain types of risk, but not all risks. The problem with relying solely on the VaR model is that the scope of risk assessed is limited, since the tail end of the distribution of loss is not typically assessed. Therefore, if losses are incurred, the amount of the losses will be substantial in value. Zoonova calculates CVAR for both 95% and 99% confidence levels.

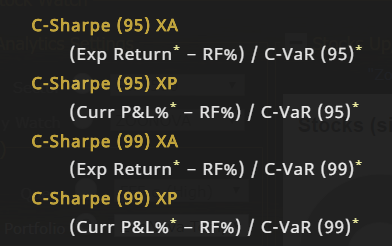

C-Sharpe

The Conditional Sharpe Ratio is defined as the ratio of expected excess return to the expected shortfall. CVaR is used as the denominator in the C-Sharpe calculation whereas the standard Sharpe ratio uses Standard Deviation as the denominator.

Modified VaR. M-VaR (96), M-VaR (99) Modified VaR uses skewness and kurtosis in the calculation. It does not assume normal distribution.

Modified Sharpe Ratio is the same formula as the C-Sharpe but uses M-VaR as the denominator.

In the first screenshot which shows Portfolio outputs you will see all these calculations. It is up to the user to then determine if the risk impact on the portfolio, Conditional VaR and Modified Var, are to high against the Sharpe ratio and excess return.

Cheers.

*Zoonova now uses Python as a programming language in their Zoonova platform.