Options AI - The freedom to choose between stock, options and spreads, all from one chart. Set an informed price target and instantly find the trade that’s right for you.

Portfolio protection for a busy month. Credit vs Debit Spreads with VIX near 30.

As mentioned in prior posts , implied volatility in options remains elevated and is not reacting to day to day moves in the broader market. The spot VIX is stubbornly holding near 30, even on up days, and the futures curve is upward sloping into the election, with November futures close to 32. With so much on the plate, the election, stimulus negotiations, earnings season, and more, this makes sense.

For those looking for portfolio hedges or outright directional positioning, it's a slightly more complicated options environment than what is typical. It's more similar to a single stock name with an important event on the horizon.

One way to convert current levels of implied volatility into actionable decision making is by looking at what options are pricing and using that for strike selection.

We'll look at the SPY and compare both credit and debit spreads for those looking for protection.

SPY Expected Move

First, a check on the expected move in SPY, via Options AI . The one month view now captures the election. In fact, you can see the expected move widen for that week (to the right of the chart):

What's interesting is what the bullish consensus corresponds to the historical chart, nearly matching the early September highs (~357). The bearish consensus nearly matches recent lows from late September (~322).

So options traders are looking at the same recent levels everyone else is, whether they know it or not. And implied volatility is almost perfectly reflecting that. That means that a breakout to new highs, or a breakdown below recent lows would mean volatility is currently underpriced, even with the VIX 29. Conversely, if the market stays within those bands, it was overpriced.

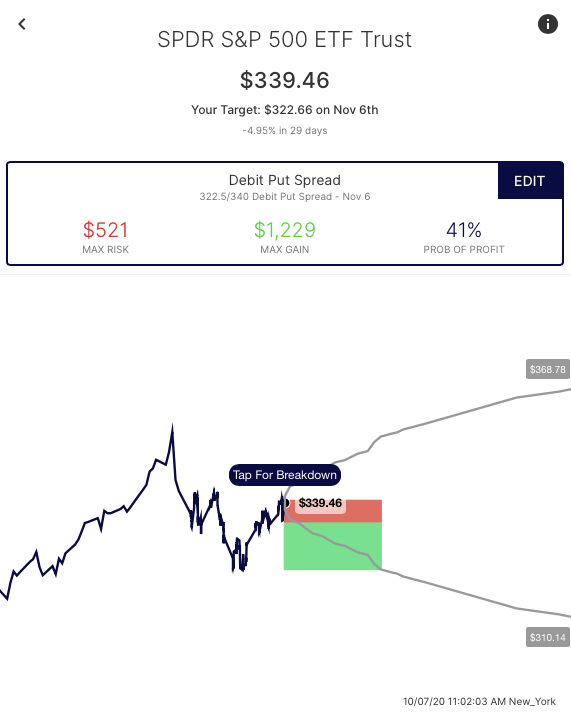

From a trading perspective, let's look at some options spreads that account for those expected move levels. Here's a bearish price target, in line with the expected move, via Options AI :

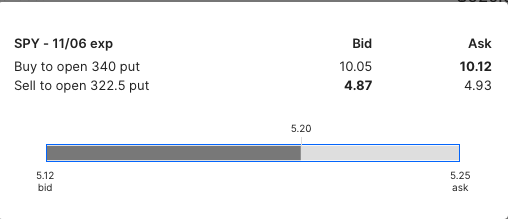

Debit put spread - The +340/-322.50 debit put spread buys an at the money put and sells a put at the lower expected move. Its risk/reward is about 5 to 12 with a 41% probability of profit, based on its breakeven just below $335 in SPY:

It offers no protection below the recent lows but it finances any move to those recent lows by selling the 322.50 put at nearly $5, cutting the total cost in half from an outright at the money put.

If protection is needed below that level that short put strike can simply be adjusted lower, making the overall trade more costly but allowing for more room below. For instance, here's how the cost, risk/reward and probability change when the lower strike is 310:

The 310 put is about $3, making the risk/reward roughly 7 to 20.

Credit call spread - The other method, especially when concerned about high implied volatility is to look to "sell to the bulls" via a credit call spread. Here we see the -340/+356 credit call spread. Selling an at the money call and defining risk by buying an upside call at the bullish expected move. Its risk/reward is about 9 to 7 with a 62% probability of profit, based on its breakeven around $347 in SPY:

This only provides $7 in "protection" and therefore is more appropriate for those that aren't looking to protect against disaster as much as simply not expecting new highs anytime soon.

Summary

Bringing this full circle, because implied volatility is likely to stay elevated until the election these are less about the level of vol as they are about where that volatility translates into expected moves. Of course, when used as a hedge, how they affect underlying profit and losses is the key, while comparing the breakevens and where max loss and max gain (and therefore max protection) occur.