A leading global investment company with specialized expertise in equities, fixed income, and alternatives.

Oil Production Cuts: Not for Shale

OIL PRODUCTION CUTS: NOT FOR SHALE

May 10, 2019

Source: Bloomberg, as of 4/30/19. Past performance is no guarantee of future results . Indexes are unmanaged, and not available for direct investment. Index returns do not include fees or sales charges. This information is provided for illustrative purposes only and does not reflect the performance of an actual investment.

THE CHART

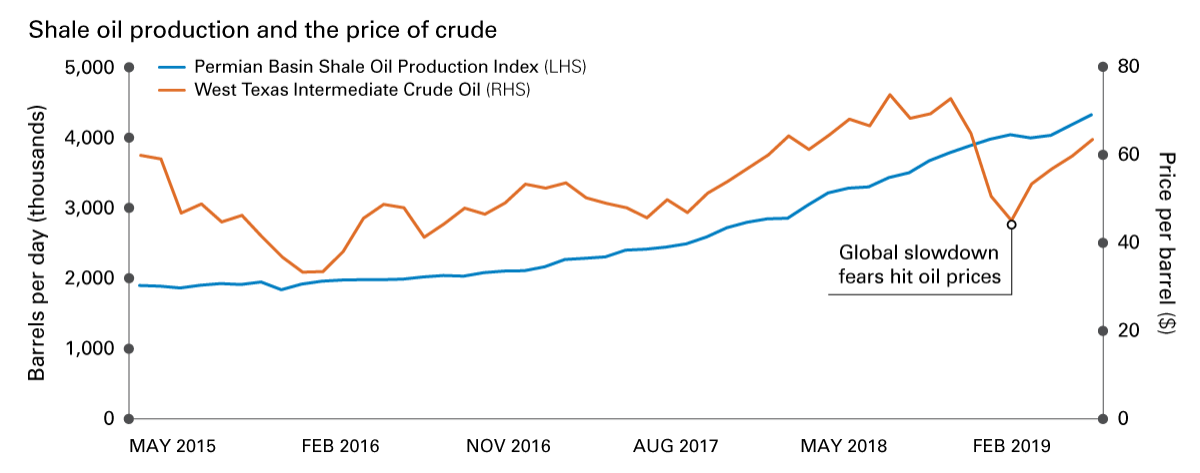

The chart shows on a monthly basis from May 2015 through April 2019, shale oil production (thousands of barrels per day) from the U.S. Permian Basin and the price per barrel of West Texas Intermediate crude oil.

THE BOTTOM LINE

- The price of crude oil fell sharply in 4Q18 over concerns about slower global growth and the prospects for a recession in the U.S.

- But oil prices have rebounded strongly this year, in part because of production cutbacks from OPEC (primarily Saudi Arabia) and Russia.

- U.S. shale oil producers, however, continued to increase output—building on a U.S. market share of global production that reached 18% in 20181.

- Shale producers have managed to reduce the average breakeven production price to around $50; five years ago, the breakeven price was closer to $70.

- With shale production profitable at a lower price, its influence on the industry continues, but in ways that may not be apparent to the average investor.

- Western Asset has indicated that the current popularity of shale may lead to tighter supply over the longer-term by causing under-investment in longer-dated supply sources .

- And, as ClearBridge energy analyst Dimitry Dayen notes, certain share prices are already reflecting how shale production is changing the way some companies manage their resources .

Footnotes:

1 Energy Information Agency.

Definitions:

The Permian Basin Shale Oil Production Index includes major U.S. shale plays: Permian Basin, Eagle Ford Shale, Marcellus Shale and Haynesville Shale.

West Texas Intermediate (WTI ), also known as Texas light sweet, is a grade of crude oil used as a benchmark in oil pricing. This grade is described as light because of its relatively low density, and sweet because of its low sulfur content. It is the underlying commodity of Chicago Mercantile Exchange's oil futures contracts.

The Organization of the Petroleum Exporting Countries (OPEC) is a permanent intergovernmental organization of 12 oil-exporting developing nations that coordinates and unifies the petroleum policies of its member countries.