ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 50 instruments including FX majors, Gold, Silver, Copper, Oil, Natural Gas, Soybeans, Sugar ,Corn TNX and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup videos, Educational Resources, and 24 Hour chat room where they are provided live updates and given answers to their questions. The guidance of ElliottWave-Forecast gives subscribers the wherewithal to position themselves for proper entry and exit in the Forex marketplace. We believe our disciplined methodology is pivotal for long-term success in trading.

NVIDIA Corp. $NVDA Extreme Areas Offering Buying Opportunities

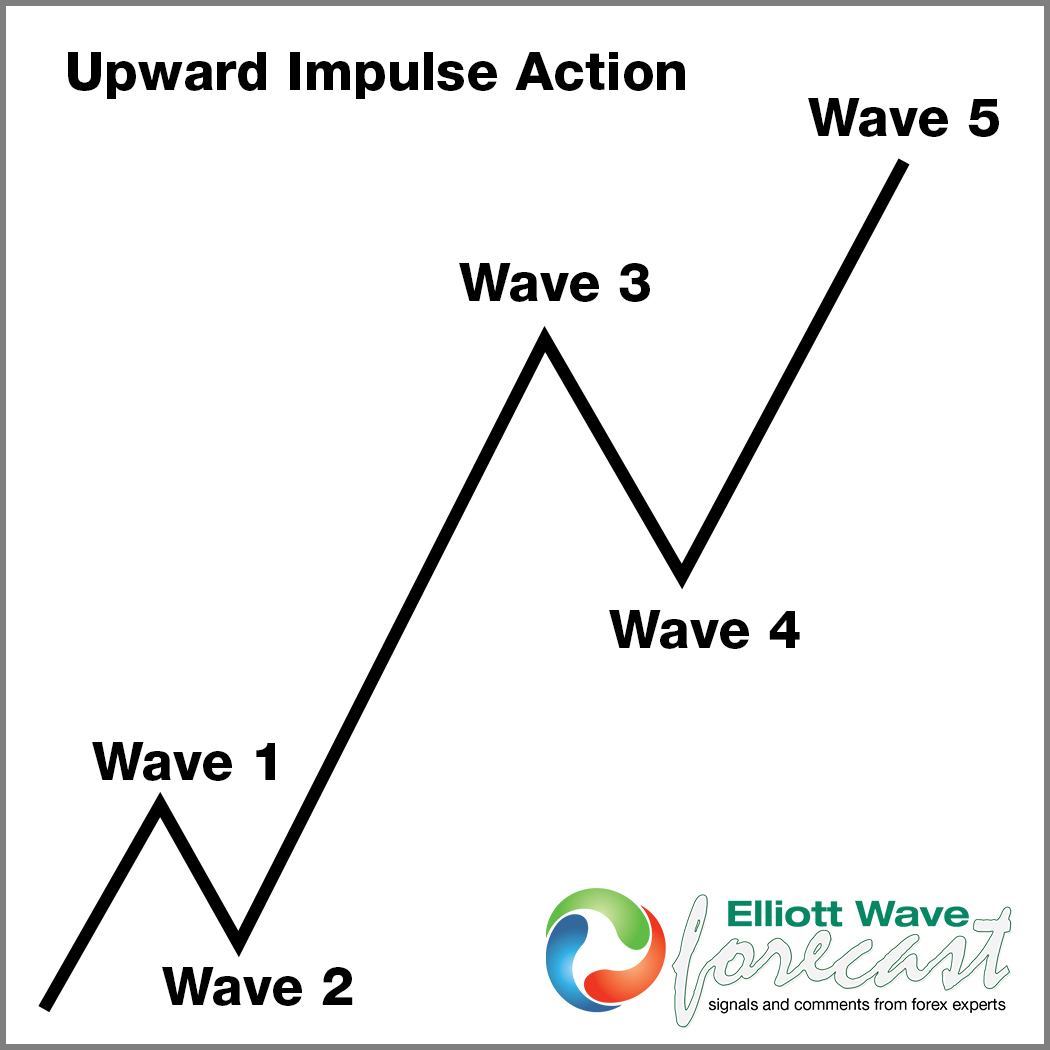

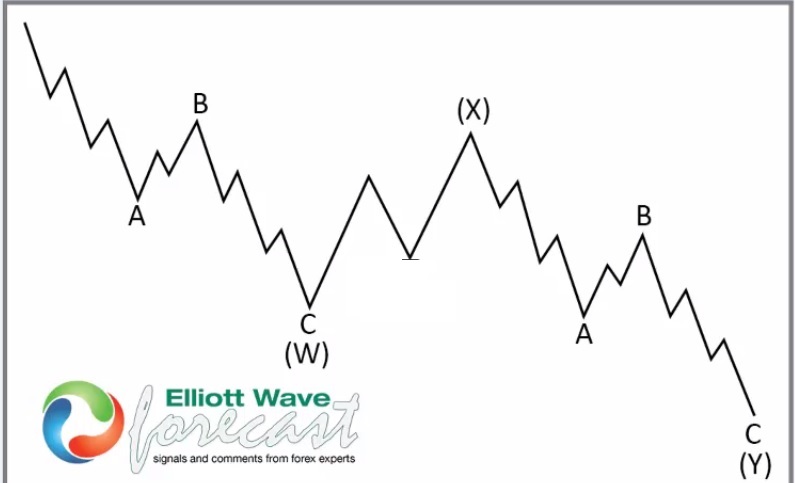

Hello everyone! In today’s article, we’ll examine the recent performance of NVIDIA Corp. ($NVDA) through the lens of Elliott Wave Theory . We’ll review how the rally from the April 21, 2025 low unfolded as a 5-wave impulse followed by a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock.

5 Wave Impulse + 7 Swing WXY correction

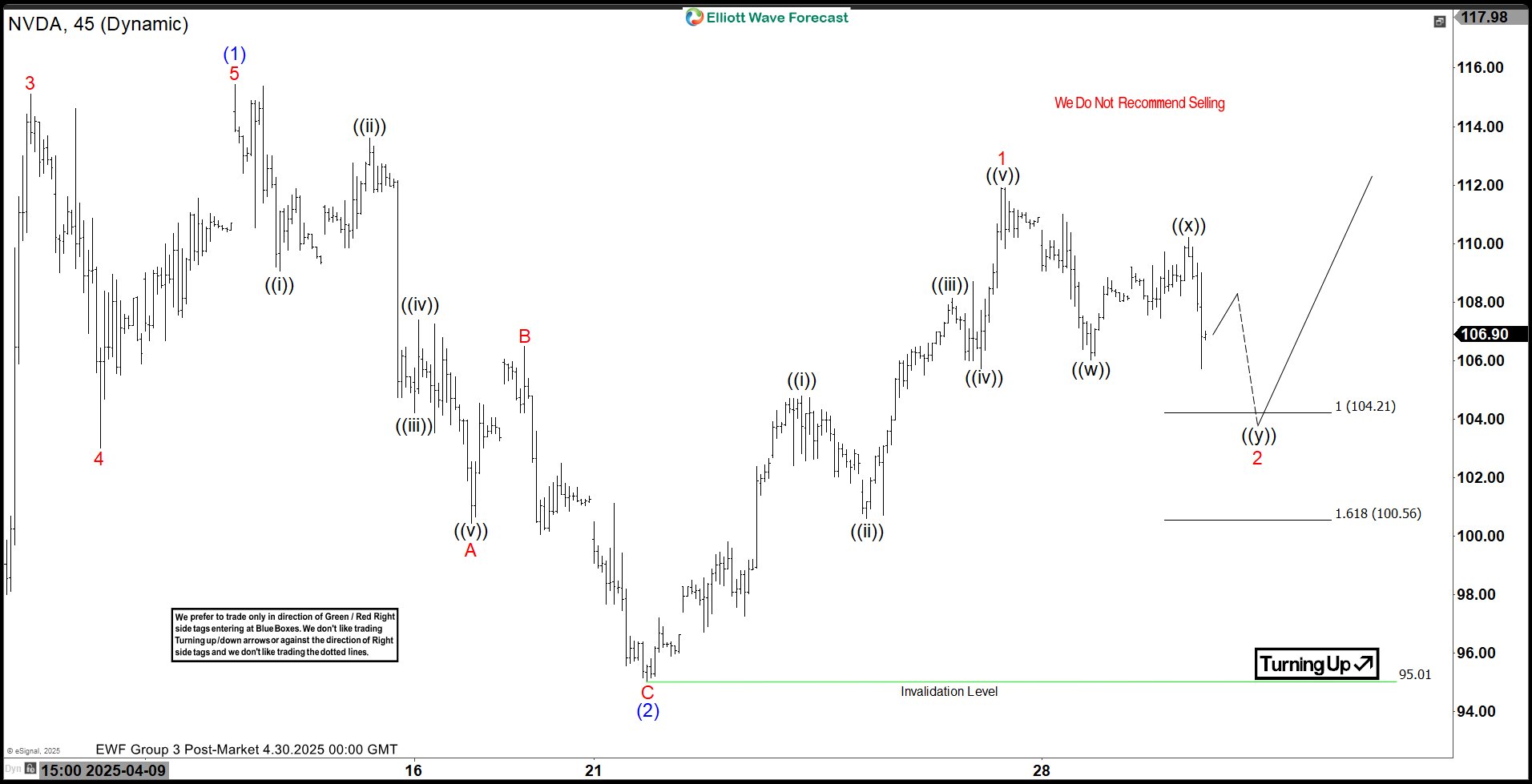

$NVDA 1H Elliott Wave Chart 4.30.2025:

This setup aligns with a typical Elliott Wave correction pattern (WXY), in which the market pauses briefly before resuming its primary trend.

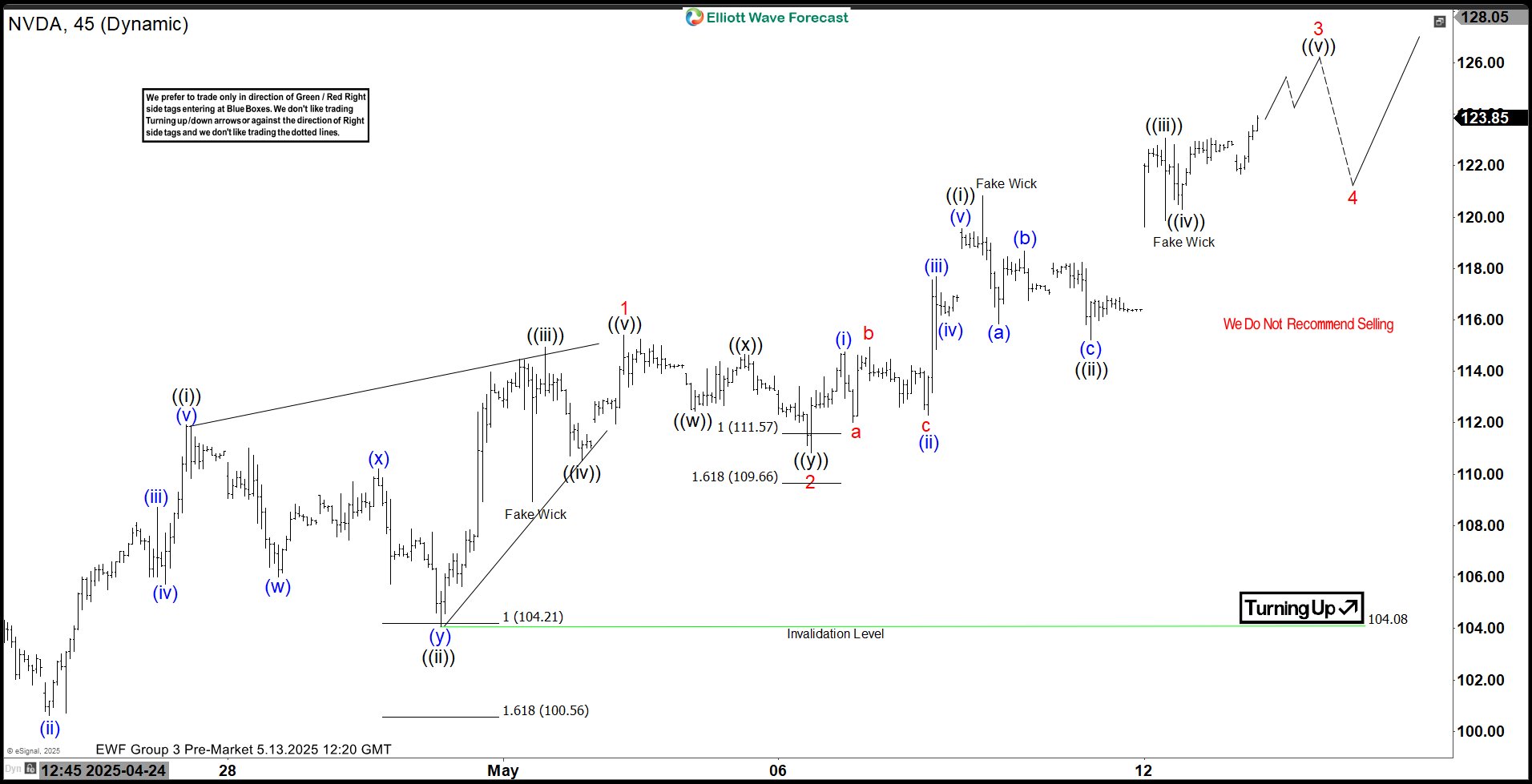

$NVDA 1H Elliott Wave Chart 5.13.2025:

The most recent update, from May 13, 2025, shows that the stock bounced as predicted. Currently, it is trading higher in wave 3 looking for continuation higher towards 124 - 142 area before another pullback can happen.

Conclusion

In conclusion, our Elliott Wave analysis of NVIDIA Corp. ($NVDA) suggests that it remains supported against April 2025 lows. As a result, traders should buy the dips and monitor the $124 –$142 zone as the next potential target. In the meantime, keep an eye out for any corrective pullbacks that may offer entry opportunities. By applying Elliott Wave Theory, traders can better anticipate the structure of upcoming moves and enhance risk management in volatile markets.

Source: https://elliottwave-forecast.com/stock-market/nvidia-corp-nvda-extreme-areas-offering-buying-opportunities/