New Breed of Asset Manager Steps Up to Disrupt the Data Sphere

The time-honored question of how to grow investments in a flat-yield-curve environment rears its head once again, like the upwelling of an unwelcomed red tide.

Little wonder why highly sophisticated institutional investors yearn for the oxygen of growth alternatives.

The leadership of Pagaya was driven to introduce alternative asset classes for investment with improved risk-reward ratios compared to traditional capital markets. Founded in 2015 and backed by leading fintech investors, including Oak HC/FT, Viola Ventures, and former American Express Chairman Harvey Golub, Pagaya built the first comprehensive loan-level database using a hybrid of artificial intelligence (A/I), machine learning, and human ingenuity to source alpha to its short duration, high-yield portfolio strategies.

To date, the firm has grown to $950 million in assets under management, including a $100 million debt financing deal with Citi, and the issuance of $515 million in actively managed, asset-backed securities, thus far in 2019.

We see two market realities quietly altering asset management philosophy. One shoulders the burden of the past; one embraces a limitless future: Legacy IT systems and A/I.

And the ability to pivot in this present moment of time will make or break investment outcomes.

Another Inflection Point

We’ve reached another inflection point, one that exposes the rigidity of legacy IT systems and, at the same time, points to the agility of A/I and machine learning.

Many financial institutions lumber under the weight of decades-old legacy IT systems, often siloed in different business units. The inability to break free fresh insights from existing data triggers corporate arthritis, making the business of asset management vulnerable.

Some financial institutions are also hard-pressed to cope with the constant demand to innovate, adapt, and adjust to ever-changing regulations and ever-rising expectations of the modern consumer experience.

To survive, institutional money managers must master data mining, aggregation, and integration to inform investment strategy. To thrive, however, they need to fully grasp, understand, and use the untold trillions of powerful data points buried in their creaky legacy systems.

What’s worse, failures to update and maintain legacy systems can lead to frequent and costly outages, some estimate businesses lose nearly $400,000 a year for every minute of system downtime.

Ask yourself these three tough questions:

1. Can your system support increase productivity?

2. Can you expand your data analytics commensurate with corporate expansion?

3. Can you scale and change rapidly to keep pace with the future data sphere?

Experts agree that legacy frameworks discard an enormous amount borrower data.

A tragic waste of historical insight. Until now.

Over the past three years, Pagaya created the quintessential digital bridge from hardened data to data agility. You can tap into the goldmines legacy systems represent without the need to overhaul them. Technology has also deepened our understanding of consumer behavior indicating positive implications for credit markets.

On the Pulse of A/I

Pagaya utilizes machine learning and big data analytics, framed by proprietary algorithms, that enable us to more precisely leverage and manage institutional money in the alternative credit market.

As fintech asset managers, we have the ability to penetrate and exploit valuable market data in consumer credit, mortgages, and other alternative asset classes. Ninety percent of our clients are pension funds, sovereign wealth funds, financial institutions, insurance companies and other asset managers who recognize the value of A/I-powered intelligence to uncover overlooked investment opportunities.

Why Consumer Credit?

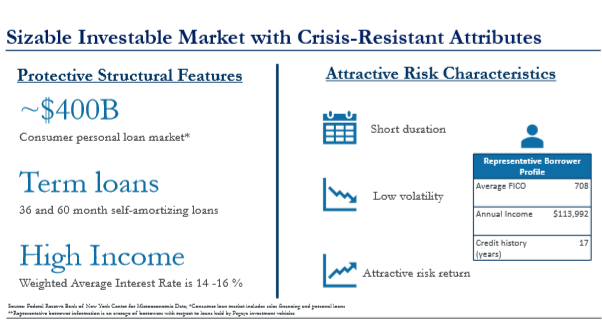

Pagaya believes that consumer credit is a good, long-term spread asset to own in a portfolio at any time. But today, it should be viewed as a defensive asset class void of the same returns compression of other asset classes.

Consumer credit exhibits the characteristics od a robust asset class—resistant to economic stress and the red tides of the market fluctuations. Over the last 20 years, and despite the 2008 financial crisis, consumer credit has produced positive returns.

With low-interest rate sensitivity and loss-adjusted yields of 7-9 percent, consumer credit provides comparable returns to high-yield instruments with less volatility, which is why it is a very attractive asset to hold in a fixed-income portfolio. Even at this point in the cycle, consumer credit loans exhibit positive risk characteristics that shorten duration, reduce volatility, and increase yield:

- *Duration: 1.5 Yrs.

- Volatility: 0.25%

- Loss-Adjusted Yield: 7-9%

*Pagaya research

Inside Consumer Credit

Representing a $4 + trillion investment opportunity, U.S. consumer credit offers compelling risk-adjusted returns with low correlation to broader markets compared to traditional fixed income. Specific to the private consumer loan market, Federal Reserve Economic Data points to the magnetism of this market:

-

Average American consumer considered financially stable

-

Household financial obligations lower than the pre-2008 recession

-

Consumer credit levels reduced by 22 percent since 2008 highs

-

Lower ratio of debt to disposable income suggests excess capacity

-

Corporate or government debt at new highs while yields compress

Against this backdrop, institutional investors need to cultivate data partners with the right approach and resources to take advantage of overlooked market opportunities.

Pagaya-Pulse—Unlocking Hidden Value

At the core of our capability resides Pagaya-Pulse, a proprietary and independent underwriting system, made robust with the application of advanced machine learning technologies.

Envision a model trained on actual performances of past loans, traditional asset management principles, and soft, logical considerations pulled from the world of natural intelligence.

Pagaya employs more than 30 elite A/I specialists and data scientists, the Delta Force of asset management, who custom-built the infrastructure to continually develop, refine, and apply comprehensive sets of analytics to dynamically underwrite, risk manage, invest, and monitor consumer credit with absolute precision. We reverse engineer the pricing of each platform and manage the portfolio risk.

While other investors recognize the consumer credit asset class as robust, they do little more than allocate to loans randomly to give the client access to the asset.

With A/I technology, instant access to current and historical data, and the logical-mathematical intelligence of human managers, we can access and analyze 1,600 parameters per individual borrower.

By comparison, traditional regression analysis attempts to infer causal relationships on as few as five underwriting inputs: FICO, debt-to-income, loan amount, coupon, and years of credit history. Instead, Pagaya meticulously underwrites and prices loans based on billions of data points.

New York, NY

Pagaya Investments US LLC │ 135 E. 57th Street │ New-York, NY 10022 │ Phone: +1 (646) 710 7714

Tel Aviv, Israel

Pagaya Technologies Ltd. │ Azrieli Sarona Building, 54th floor │ Derech Menachem Begin 121, Tel-Aviv, Israel

Phone: +972 (3) 715 0920

Nothing contained in this communication constitutes tax, legal, or investment advice. Investors must consult their tax advisor or legal counsel for advice and information concerning their particular situation. This article contains certain statements that may include “forward-looking statements.” All statements, other than statements of historical fact, included herein are “forward-looking statements.” Although Pagaya believes that the expectations reflected in these forward- looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Actual events could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors. You should not place undue reliance on these forward-looking statements. This article reflects our views and opinions as of the date herein, which are subject to change at any time based on market and other conditions. We disclaim any responsibility to update these views. These views should not be relied on as investment advice or an indication of investment intention. Discussion or analysis of any specific company-related news or investment sectors are meant primarily as a result of recent newsworthy events surrounding those companies or by way of providing updates on certain sectors of the market. Pagaya does provide investment advice to Pagaya related funds and others that are invested in consumer credit. As a result, Pagaya does stand to beneficially profit from the performance of consumer loans it owns or acquires.