December 01, 2016

Aswath Damodaran @ Stern School of Business at New York University

Professor of Finance at the Stern School of Business at NYU

Myth 5.4: Negative Growth Rates forever? Impossible!

As you peruse discounted cash flow valuations, it is striking how infrequently you see projections of negative growth into the future, even for companies where the trend lines in revenues and earnings have been anything but positive. Furthermore, you almost never see a terminal value calculation, where the analyst assumes a negative growth rate in perpetuity. In fact, when you bring up the possibility, the first reaction that you get is that it is impossible to estimate terminal value with a negative growth rate. In this post, I will present evidence that negative growth is neither uncommon nor unnatural and that the best course, from a value perspective, for some firms is to shrink rather than grow.

Negative Growth Rates: More common than you think!

The belief that most firms have positive growth over time is perhaps nurtured by the belief that it is unnatural for firms to have negative growth and that while companies may have a year or two of negative growth, they bounce back to positive growth sooner rather than later. To evaluate whether this belief has a basis in fact, I looked at compounded annual growth rate (CAGR) in revenues in the most recent calendar year (2015), the last five calendar years (2011-2015)and the last ten calendar years (2006-2015) for both US and global companies and computed the percent of all companies (my sample size is 46,814 companies) that have had negative growth over each of those time periods:

Australia, NZ and Canada

|

5014

|

41.44%

|

36.73%

|

28.20%

|

Developed Europe

|

7082

|

33.42%

|

30.03%

|

24.25%

|

Emerging Markets

|

21196

|

43.06%

|

29.35%

|

21.50%

|

Japan

|

3698

|

33.41%

|

20.76%

|

31.80%

|

United States

|

9823

|

39.69%

|

26.76%

|

28.10%

|

Grand Total

|

46814

|

39.86%

|

28.64%

|

24.69%

|

Publshing & Newspapers

|

346

|

53.77%

|

48.44%

|

45.69%

|

Computers/Peripherals

|

327

|

43.30%

|

42.12%

|

45.65%

|

Electronics (Consumer & Office)

|

152

|

43.70%

|

47.11%

|

44.44%

|

Homebuilding

|

164

|

31.51%

|

22.69%

|

35.87%

|

Oil/Gas (Production and Exploration)

|

959

|

79.22%

|

43.75%

|

35.40%

|

Food Wholesalers

|

126

|

37.00%

|

30.59%

|

33.33%

|

Office Equipment & Services

|

160

|

40.58%

|

32.54%

|

33.33%

|

Real Estate (General/Diversified)

|

418

|

41.33%

|

32.72%

|

32.52%

|

Telecom. Equipment

|

473

|

43.00%

|

37.36%

|

32.43%

|

Steel

|

757

|

73.23%

|

50.65%

|

32.08%

|

Negative Growth Rates: A Corporate Life Cycle Perspective

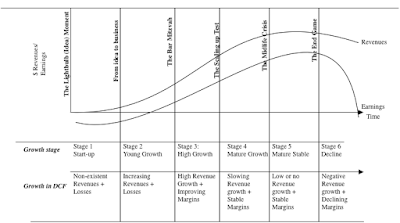

One framework that I find useful for understanding both corporate finance and valuation issues is the corporate life cycle, where I trace a company’s life from birth (as a start-up) to decline and connect it to expectations about revenue growth and profit margins:

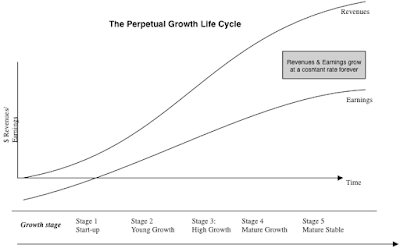

If you buy into this notion of a life cycle, you can already see that valuation, at least as taught in classes/books and practiced, is not in keeping with the concept. After all, if you apply a positive growth rate in perpetuity to every firm that you value, the life cycle that is more in keeping with this view of the world is the following:

If you buy into this notion of a life cycle, you can already see that valuation, at least as taught in classes/books and practiced, is not in keeping with the concept. After all, if you apply a positive growth rate in perpetuity to every firm that you value, the life cycle that is more in keeping with this view of the world is the following:

The problem with this life cycle perspective is that the global market place is not big enough to accommodate these ever-expanding behemoths. It follows, therefore, that there have to be companies (and a significant number at that) where the future holds shrinkage rather than growth. Fitting this perspective back into the corporate life cycle, you should be using a negative growth rate in revenues and perhaps declining margins to go with those shrinking revenues in your valuation, if your company is already in decline. If you are valuing a company that is mature right now (with positive but very low growth) but the overall market is stagnant or starting to decline, you should be open to the possibility that growth could become negative at the end of your forecast horizon.

There is an extension of the corporate life cycle that may also have implications for valuation. In an earlier post, I noted that tech companies age in dog years and often have compressed life cycles, growing faster, reaping benefits for shorter time periods and declining more precipitously than non-tech companies. When valuing tech companies, it may behoove us to reflect these characteristics in shorter (and more exuberant) growth periods, fewer years of stable growth and terminal growth periods with negative growth rates.

There is an extension of the corporate life cycle that may also have implications for valuation. In an earlier post, I noted that tech companies age in dog years and often have compressed life cycles, growing faster, reaping benefits for shorter time periods and declining more precipitously than non-tech companies. When valuing tech companies, it may behoove us to reflect these characteristics in shorter (and more exuberant) growth periods, fewer years of stable growth and terminal growth periods with negative growth rates.

Negative Growth Rates: The Mechanics

As I noted in my last post, the growth rate in perpetuity cannot exceed the growth rate of the economy but it can be lower and that lower number can be negative. It is entirely possible that once you get to your terminal year, that your cash flows have peaked and will drop 2% a year in perpetuity thereafter. Mathematically, the perpetual growth model still holds:

If you do assume negative growth, though, you have to examine whether as the firm shrinks, it will be able to divest assets and collect cash. If the answer is no, the effect of negative growth is unambiguously negative and the terminal value will decline as growth gets more negative. If the answer is yes, the effect of negative growth in value will depend upon how much you will get from divesting assets.

To illustrate, consider the example of the firm with $100 million in expected after-tax operating income next year, that is in perpetual growth and let’s assume a perpetual growth rate of -5% a year forever. If you assume that as the firm shrinks, there will be no cash flows from selling or liquidating assets, the terminal value with a 10% cost of capital is:

To illustrate, consider the example of the firm with $100 million in expected after-tax operating income next year, that is in perpetual growth and let’s assume a perpetual growth rate of -5% a year forever. If you assume that as the firm shrinks, there will be no cash flows from selling or liquidating assets, the terminal value with a 10% cost of capital is:

Terminal value = $100/ (.10-(-.05)) = $666.67

If you assume that there are assets that are being liquidated as the firm shrinks, you have to estimate the return on capital on these assets and compute a reinvestment rate. If the assets that you are liquidating, for instance, have a 7.5% return on invested capital, the reinvestment rate will be -66.67%.

Reinvestment rate = -5%/7.5% = 66.67%

If you are puzzled by a negative reinvestment rate, it as the cash inflow that you are generating from asset sales, and your terminal value will then be:

Terminal value = $100 (1-(-0.6667))/ (.10 – (-.05)) = $1,111.33

Put simply, the same rule that governs whether the terminal value will increase if you increase the growth rate, i.e., whether the return on capital is greater than the cost of capital, works in reverse when you have negative growth. As long as you can get more for divesting assets than as continuing investments (present value of cash flows), liquidating them will increase your terminal value.

Our unwillingness to consider using negative growth in valuation has turned the game over to growth advocates. Not surprisingly, there are many in academia and practice who argue that the essence of good management is to grow businesses and that the end game for companies is corporate sustainability. That's nonsense! If you are a firm in a declining business where new investments consistently generate less than the cost of capital, your attempts to sustain and grow yourself can only destroy value rather than increase it. It is with this, in mind, that I argued in an earlier post that the qualities that we look for in a CEO or top manager will be different for companies at different stages of the life cycle:

A visionary at the helm is a huge plus early in corporate life, but it is skill as a business builder that allows young companies to scale up and become successful growth companies. As growth companies get larger, the skill set shifts again towards opportunism, the capacity to find growth in new places, and then again at mature companies, where it management’s ability to defend moats and competitive advantages that allow companies to harvest cash flows for longer periods. In decline, it is not vision that you value but pragmatism and mercantilism, one reason that I chose

Larry the Liquidator

as the role model. It is worth noting, though, that the way we honor and reward managers follows the growth advocate rule book, with those CEOs who grow their companies being put on a much higher pedestal (with books written by and about them and movies on their lives) than those less ambitious souls who presided over the gradual liquidation of the companies under their command.

Conclusion

I believe that the primary reason that we continue to stay with positive growth rates in valuation is behavioral. It seems unnatural and even unfair to assume that the firm that you are valuing will see shrinking revenues and declining margins, even if that is the truth. There are two things worth remembering here. The first is that your valuation should be your attempt to try to reflect reality and refusing to deal with that reality (if it is pessimistic) will bias your valuation. The second is that assuming a company will shrink may be good for that company's value, if the business it is in has deteriorated. I must confess that I don't use negative growth rates often enough in my own valuations and I should draw on them more often not only when I value companies like brick and mortar retail companies, facing daunting competition, but also when I value technology companies like GoPro, where the product life cycle is short and it is difficult to keep revitalizing your business model.

YouTube Video

Attachments

I believe that the primary reason that we continue to stay with positive growth rates in valuation is behavioral. It seems unnatural and even unfair to assume that the firm that you are valuing will see shrinking revenues and declining margins, even if that is the truth. There are two things worth remembering here. The first is that your valuation should be your attempt to try to reflect reality and refusing to deal with that reality (if it is pessimistic) will bias your valuation. The second is that assuming a company will shrink may be good for that company's value, if the business it is in has deteriorated. I must confess that I don't use negative growth rates often enough in my own valuations and I should draw on them more often not only when I value companies like brick and mortar retail companies, facing daunting competition, but also when I value technology companies like GoPro, where the product life cycle is short and it is difficult to keep revitalizing your business model.

YouTube Video

Attachments

- Percent of negative revenue growth companies, by sector

- Percent of negative revenue growth companies, by country and region

DCF Myth Posts

Introductory Post:

DCF Valuations: Academic Exercise, Sales Pitch or Investor Tool

- If you have a D(discount rate) and a CF (cash flow), you have a DCF.

- A DCF is an exercise in modeling & number crunching.

- You cannot do a DCF when there is too much uncertainty.

- It's all about D in the DCF (Myths 4.1 , 4.2 , 4.3 , 4.4 & 4.5 )

- The Terminal Value: Elephant in the Room! (Myths 5.1, 5.2, 5.3, 5.4 & 5.5)

- A DCF requires too many assumptions and can be manipulated to yield any value you want.

- A DCF cannot value brand name or other intangibles.

- A DCF yields a conservative estimate of value.

- If your DCF value changes significantly over time, there is something wrong with your valuation.

- A DCF is an academic exercise.

More from Aswath Damodaran

Aswath Damodaran, Stern School of Business at New York University

A few weeks ago, I started receiving a stream of message about an Instagram post that I was allegedly starring in, where after offering my views on Palantir's valuation, I was soliciting investors to invest with me (or with an investment entity that ...

Aug 05, 2025

Aswath Damodaran, Stern School of Business at New York University

At the start of July, I updated my estimates of equity risk premiums for countries, in an semiannual ritual that goes back almost three decades. As with some of my other data updates, I have mixed feelings about publishing these numbers. On the one ...

Jul 31, 2025

Aswath Damodaran, Stern School of Business at New York University

In this post, I will bring together two disparate and very different topics that I have written about in the past. The first is the role that cash holdings play in a business , an extension of the dividend policy question, with an examination of why ...

Jul 18, 2025

Aswath Damodaran, Stern School of Business at New York University

It is true that most investing lessons are directed at those who invest only in stocks and bonds, and mostly with long-only strategies. It is also true that in the process, we are ignoring vast swaths of the investment universe, from other asset ...

Jun 17, 2025

Aswath Damodaran, Stern School of Business at New York University

I was on a family vacation in August 2011 when I received an email from a journalist asking me what I thought about the S&P ratings downgrade for the US. Since I stay blissfully unaware of most news stories and things related to markets when I am on ...

Jun 02, 2025

Aswath Damodaran, Stern School of Business at New York University

I started the month on a trip to Latin America, just as the tariff story hit my newsfeed and the market reacted with a sell off that knocked more than $9 trillion in market cap for global equities in the next two days. The month was off to a bad ...

May 03, 2025

Aswath Damodaran, Stern School of Business at New York University

When markets are in free fall, there is a great deal of advice that is meted out to investors, and one is to just buy the dip , i.e., buy beaten down stocks, in the hope that they will recover, or the entire market, if it is down. "Buying the dip" ...

Apr 21, 2025

Aswath Damodaran, Stern School of Business at New York University

I was boarding a plane for a trip to Latin America late in the evening last Wednesday (April 2), and as is my practice, I was checking the score on the Yankee game, when I read the tariff news announcement. Coming after a few days where the market ...

Apr 07, 2025

Aswath Damodaran, Stern School of Business at New York University

I will start with a couple of confessions. The first is that I see the world in shades of gray, and in a world where more and more people see only black and white, that makes me an outlier. Thus, if you are reading this post expecting me to post a ...

Mar 15, 2025

Aswath Damodaran, Stern School of Business at New York University

In my ninth (and last) data post for 2025, I look at cash returned by businesses across the world, looking at both the magnitude and the form of that return. I start with a framework for thinking about how much cash a business can return to its ...

Mar 05, 2025

Aswath Damodaran, Stern School of Business at New York University

There is a reason that every religion inveighs against borrowing money, driven by a history of people and businesses, borrowing too much and then paying the price, but a special vitriol is reserved for the lenders, not the borrowers, for encouraging ...

Feb 24, 2025

Aswath Damodaran, Stern School of Business at New York University

While I was working on my last two data updates for 2025, I got sidetracked, as I am wont to do, by two events. The first was the response that I received to my last data update , where I looked at the profitability of businesses, and specifically at ...

Feb 18, 2025

Aswath Damodaran, Stern School of Business at New York University

I am in the third week of the corporate finance class that I teach at NYU Stern, and my students have been lulled into a false sense of complacency about what's coming, since I have not used a single metric or number in my class yet. In fact, we have ...

Feb 12, 2025

Aswath Damodaran, Stern School of Business at New York University

In the first five posts, I have looked at the macro numbers that drive global markets, from interest rates to risk premiums, but it is not my preferred habitat. I spend most of my time in the far less rarefied air of corporate finance and valuation, ...

Feb 08, 2025

Aswath Damodaran, Stern School of Business at New York University

If the title of this post sounds familiar, it is because is one of Disney’s most iconic rides, one that I have taken hundreds of times, first with my own children and more recently, with my grandchildren. It is a mainstay of every Disney theme park, ...

Feb 06, 2025

Aswath Damodaran, Stern School of Business at New York University

I am going to start this post with a confession that my knowledge of the architecture and mechanics of AI are pedestrian and that there will be things that I don't get right in this post. That said, DeepSeek's abrupt entry into the AI conversation ...

Jan 31, 2025

Aswath Damodaran, Stern School of Business at New York University

It was an interesting year for interest rates in the United States, one in which we got more evidence on the limited power that central banks have to alter the trajectory of market interest rates. We started 2024 with the consensus wisdom that rates ...

Jan 28, 2025

Aswath Damodaran, Stern School of Business at New York University

In my first two data posts for 2025, I looked at the strong year that US equities had in 2024, but a very good year for the overall market does not always translate into equivalent returns across segments of the market. In this post, I will remain ...

Jan 26, 2025

Aswath Damodaran, Stern School of Business at New York University

In my last post , I noted that the US has extended its dominance of global equities in recent years, increasing its share of market capitalization from 42% in at the start of 2023 to 44% at the start of 2024 to 49% at the start of 2025. That rise was ...

Jan 17, 2025

Aswath Damodaran, Stern School of Business at New York University

For the last four decades, I have spent the first week of each year collecting and analyzing data on publicly traded companies and sharing what I find with anyone who is interested. It is the end of the first full week in 2025, and my data update for ...

Jan 10, 2025

Aswath Damodaran, Stern School of Business at New York University

I am a teacher at heart, and every year, for more than two decades, I have invited people to join me in the classes that I teach at the Stern School of Business at New York University. Since I teach these classes only in the spring, and the first ...

Dec 11, 2024

Aswath Damodaran, Stern School of Business at New York University

You might know, by now, of my views on ESG, which I have described as an empty acronym, born in sanctimony, nurtured in hypocrisy and sold with sophistry. My voyage with ESG began with curiosity in my 2019 exploration of what it purported to measure, ...

Nov 14, 2024

Aswath Damodaran, Stern School of Business at New York University

In this, the first full week in November 2024, the big news stories of this week are political, as the US presidential election reached its climactic moment on Tuesday, but I don't write about politics, not because I do not have political views, but ...

Nov 07, 2024

Aswath Damodaran, Stern School of Business at New York University

It is a sign of the times that I spent some time thinking about whether the title of my post would offend some people, as sexist or worse. I briefly considering expanding the title to "Sugar Daddies and Molasses Mommies", but that just sounds ...

Oct 28, 2024

Aswath Damodaran, Stern School of Business at New York University

In a court filing on October 9, 2024, the US Department of Justice (DOJ) let it be known that it was considering a break-up of Alphabet, with the addendum that it would also be pushing for the company to share the data it collects across its multiple ...

Oct 18, 2024

The most important insight of the day

Get the Harvest Daily Digest newsletter.