Multi-Asset Outlook March 2024: Europe: beautiful stagnation, challenging recovery?

Peter van der Welle - Strategist Sustainable Multi Asset Solutions

European stocks will struggle to outperform in the near term, though they remain cheap compared to other markets, says strategist Peter van der Welle.

Summary

- Eurozone equities defy gravity in era of ’stagnation at full employment

- Three reasons to stay cautious on European stocks vs Japan and the US

- German example shows importance of strategic industrial policy

Equities within the Eurozone have been defying gravity by rising 11.6% in the past three months in the face of a clear economic slowdown, partly due to resilient labor markets. Its unemployment rate is still at an all-time low of 6.4%, displaying what European Central Bank (ECB) council member Klaas Knot called ‘’stagnation at full employment”.

However, a near-term recovery looks challenging, and investors can currently get better returns in Japan and the US, where the outlook is more favorable for stocks, says Van der Welle, strategist with Robeco Sustainable Multi-Asset Solutions.

“Clearly, Eurozone stock markets have been appreciating this ‘beautiful stagnation’, yet Europe has still been underperforming the US and Japan over the last three months,” he says.

“However, a few bright spots have recently emerged that could favor Europe again; from the valuation angle, historical discounts versus the global benchmarks have appeared. From a business cycle perspective, a nascent recovery in the global manufacturing cycle could particularly benefit Europe and unlock value.”

Value versus momentum

Part of the reason for this underperformance and the discounts with the US has been the nature of European markets, which tend to be dominated by more industrially based value stocks. Much of the wider stock market rally has been generated by technology-focused growth stocks. Van der Welle says there are subsequently three reasons to stay cautious on European equities.

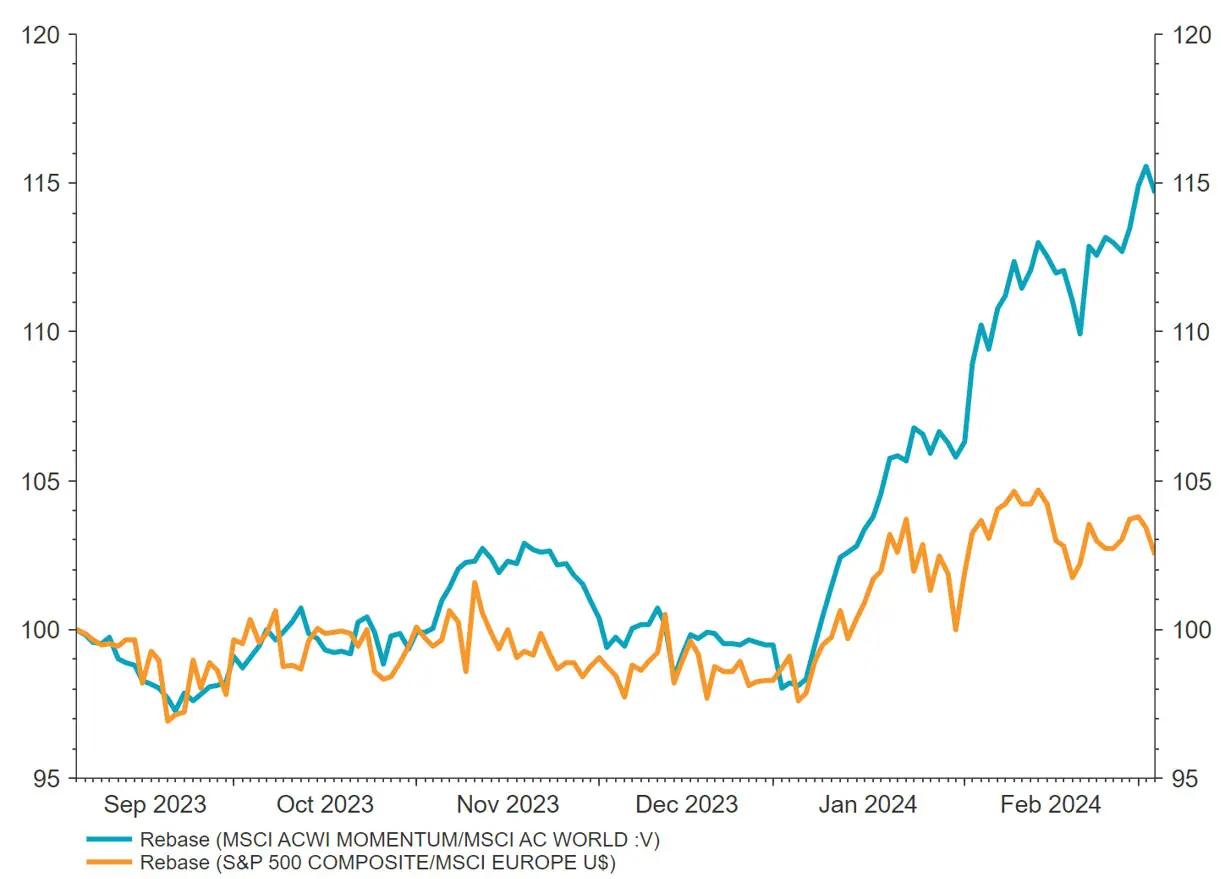

“While there are signs that the current equity market is broadening as macroeconomic data keeps surprising to the upside, the value-tilted segments of the equity market are still underperforming, and the latest bull run in equities is predominantly momentum-driven,” he says.

“The nature of this equity market rally is therefore not conducive to seeing structural outperformance of Europe versus the rest of world, or specifically in the US, as European companies are more value-tilted, whereas US stocks have a higher correlation with the momentum factor.”

“With economic growth outside the US still relatively scarce, US growth-orientated companies that deliver superior cashflow generation command a higher premium in the global stock market, and enjoy stronger momentum.”

This is a momentum-driven global equity rally.

Source

: LSEG Datastream, Robeco

A recovery already priced in

The second reason is that European equity markets have already priced in a full-blown recovery in manufacturing that has not yet arrived, and may not do so. “The global manufacturing cycle has been in recession since September 2022, but there are now nascent signs of an upswing,” Van der Welle says.

“Inventory-to-sales ratios in the US have normalized, and the export growth of pro-cyclical exporters like Taiwan and South Korea have accelerated recently. Producer confidence numbers in the manufacturing sector have surprised to the upside lately.”

“Yet, while these developments are promising for a continent with a strong manufacturing base like Europe, markets have already taken a leap of faith. For instance, the MSCI Europe is currently trading at levels more consistent with the IFO expectations confidence indicator of around 100, a value typically observed around business cycle peaks. The reading at the end of February was 81.6.”

Germany losing on penalties

Finally there are lingering downside risks with regard to profitability. For this, we can zero in on Europe’s largest economy and former industrial powerhouse – Germany. Chancellor Olaf Scholz was so confident that its former industrial glory can be restored that he predicted a Zeitenwende (historic turning point) just after taking office in a speech two years ago. The reality has proved to be another well-known German word, Schadenfreude (gloating at misfortune), for its rivals.

“There are several structural reasons for Germany’s lagging performance versus the US; the first has to do with industrial policy,”” says Van der Welle. “The recent decade has brought about a ‘winner takes all’ global economy, where increased monopoly power has tended to coincide with enhanced productivity and profitability.”

“While US companies have increased their clout, Germany’s monopoly power has dwindled on the back of a strict EU merger policy. The blockage of the Siemens-Alstom merger by the European Commission in 2019 illustrated the tension between a national industrial policy that tries to promote the creation of national champions with an EU Commission trying to uphold strict competition rules.”

“In contrast, the US has increasingly proactively shielded its (tech) hegemons, for instance by sanctioning Chinese tech giant Huawei in 2019, and providing corporate subsidies and tax incentives under the Inflation Reduction Act (IRA) for green investments.”

Miscalculation on energy

Then there are the repercussions of Russia’s war with Ukraine which have economically disadvantaged Germany in particular. Even pre-Covid, US industrial energy prices were already 30% lower compared to Europe, a differential that widened since the invasion in February 2022.

“Germany proved to have made a strategic miscalculation with its reliance on Russian energy,”” Van der Welle says. “The burden of this competitive disadvantage disproportionally fell onto Germany, as the industrial heartland of Europe, with energy-intensive manufacturing around 20% of its added value compared to 15% of the Eurozone.”

Europe will struggle to outperform

In all, global investors should not take European outperformance in a broadening equity rally for granted, as Japan and the US might still have more fuel left in their tanks, Van der Welle says.

“Given the strong momentum-led rally, exuberant expectations about a manufacturing upswing and headwinds for European near-term profitability, including a higher wage bill against lackluster productivity among other things, we think Europe will struggle to outperform in the first half of 2024.”

“We expect Japan to lead the recovery as it has the most favorable bottom-up story, with a renewed focus on shareholder value creation. That being said, if the Zeitenwende is for real, there is real value to be unlocked in German equities in the medium to longer term, as the current discount on a price/earnings basis at 50% is close to an all-time high versus their US counterparts.”

Read the full monthly outlook