A leading global investment company with specialized expertise in equities, fixed income, and alternatives.

MIDTERM ELECTIONS: DIVIDED CONGRESS SIGNALS GRIDLOCK

NOV 07 2018

With control of the Senate and House now divided, and the prospects for a recession still muted, the S&P 500 should continue to march higher in 2019 -- with areas of potential opportunity for active managers in specific sectors.

ClearBridge Investment Strategist Jeff Schulze examines what the election results may mean for the U.S. equity market in the months ahead.

No matter what your political affiliation, it’s important to keep an unbiased lens on market expectations. Historically, regardless of election outcomes, there has been a very strong relationship between market price action and midterm elections. It’s important to note that we’ve experienced every possible congressional combination of Democratic and Republican majority during these periods.

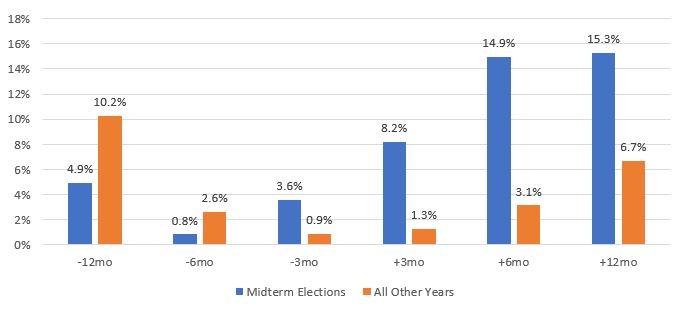

While each period may have experienced different fears, flash points and backdrops, stocks were up in the 12 months following each of the last 17 midterm elections going back to 1950. Stocks have historically performed much better than average in the three-, six- and 12-month periods following midterms, as shown below.

While it may feel like this time is different, history would suggest it rarely is. In fact, the only instance where the S&P 500 Index came close to experiencing a decline was after the 1986 election. This was a direct consequence of Black Monday, the largest single-day loss in stock market history.

Source: FactSet. Past performance is no guarantee of future results. An investor cannot invest directly in an index. Unmanaged index returns do not reflect any fees, expenses or sales charges. For illustrative purposes only and does not represent the performance of any specific investment product.

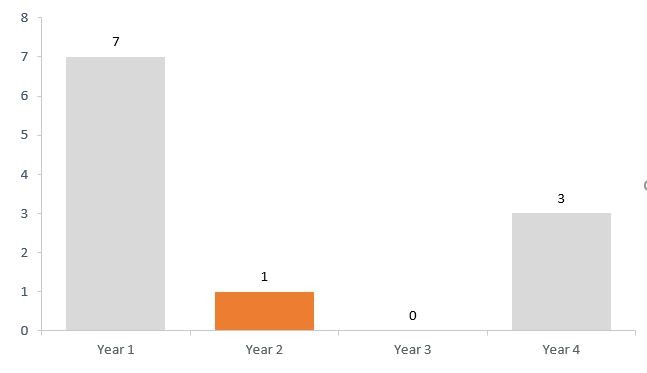

Taking a step back, we believe post-midterm election environments are positively skewed due to the presidential cycle. This phenomenon, which closely mirrors the economic cycle, shows that the economy has not seen the start of a recession during the third year of a presidential term in the modern era due to the nature of fiscal stimulus. Specifically, fiscal spending tends to be strongest during the middle of a presidential cycle, typically eroding as a new president enters or a two-term president exits the oval office. As such, recessions have historically clustered at the beginning or end of the presidential cycle:

Number of Recessions Starting Per Year of the Presidential Cycle, 1948 – 2016

Source: Strategas Research Partners. For purposes of this analysis, recession is defined as two consecutive quarters of economic contraction.

In something of a contrast to 2016, the midterm elections largely followed the script with a split in direction of the two chambers of Congress. This scenario has been the consensus narrative for several months now, and investors have had a chance to digest the potential implications. As a result, we believe the market reaction will be more muted than had one party emerged from election night with control of both the House and Senate.

The health care sector has arguably the most to gain or lose based on these elections. A congressional split takes major changes to the Affordable Care Act (ACA) and drug price controls largely out of the near-term discussion. This should be viewed by participants as positive for biopharmaceutical stocks, resulting in a potential rerating higher. Additionally, this could be the catalyst for more merger and acquisition activity within biotechnology as many larger pharmaceutical companies are flush with repatriated overseas cash.

The administration’s deregulatory efforts will likely slow but not stall, given the specter of investigations into the executive branch and government agencies by various house committees. However, the GOP-led Senate will still be in position to confirm cabinet appointees. This should help keep business confidence high, as company managements will have more certainty of a continued deregulatory operating environment. In turn, this should help to sustain the pickup in capital spending. While the benefits are broad-based, we believe continued deregulation should benefit financials and energy names the most. Additionally, portions of the new communication services sector have the potential to rerate higher as the threat from a net neutrality reversal is diminished.

The change in congressional leadership could lead to increased volatility for the market broadly, particularly as it relates to government shutdowns and debt ceiling raises. Political grandstanding as we approach 2020 will likely become more common and could lead to volatility spikes. While Democratic leaders may be willing to cut a deal that sees higher domestic spending as well as defense spending in the short term, there is a risk of defense names coming under pressure depending on the outcome of the 2020 election.

Author:

Jeff Schulze, CFA

Investment Strategist