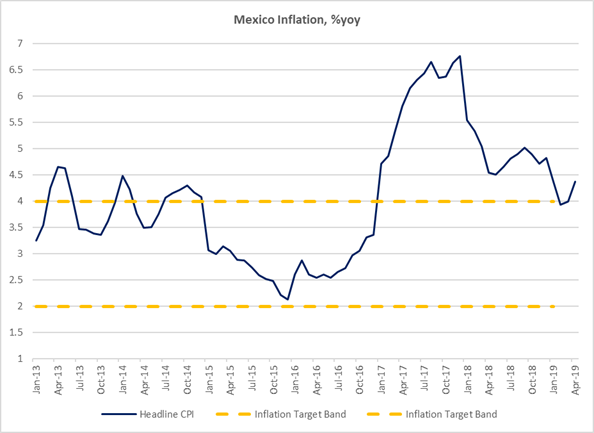

Mexico Inflation Refuses to Subside>

Mexico’s upside inflation surprises justify a cautious monetary policy stance. Brazil’s pension reform bill clears the first hurdle in the lower house.

Sizeable upside surprises in Mexico’s core and headline bi-weekly inflation strongly suggest that policy rate cuts are not coming any time soon

. Headline inflation accelerated to 4.38% year-on-year, moving away from the central bank’s target range (see chart below) and giving credence to board members’ hawkish stance (Mexico’s real policy rate is about 3.7%). The market continues to price in 39bps of easing in the next 12 months, hoping that the soft growth outlook and decent fiscal performance can soften the policy bias.

There was a sense of relief among Brazil-watchers yesterday as the crucial pension reform bill cleared its first hurdle in the lower house committee

. So, the bill is still on the right track, and the debate now moves to a special committee, where it will reside for several tumultuous months. The key question/concern right now is the extent of potential dilutions and their impact on the expected fiscal savings.

China’s decision to inject additional liquidity

via 1-year medium-term lending facility

(in addition to the RMB200B provided on April 17) provided more color on the central bank’s policy intentions, following upside activity surprises. The recent communications from the central bank (PBoC) and the Communist Party’s Politburo raised the possibility of a more measured approach on the monetary front, especially as regards further cuts in bank reserve requirements. However, today’s developments show that authorities are not shying away from other policy instruments, especially those that target structural deficiencies (such as small companies’ access to credit).

RSS Import: Original Source