ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 50 instruments including FX majors, Gold, Silver, Copper, Oil, Natural Gas, Soybeans, Sugar ,Corn TNX and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup videos, Educational Resources, and 24 Hour chat room where they are provided live updates and given answers to their questions. The guidance of ElliottWave-Forecast gives subscribers the wherewithal to position themselves for proper entry and exit in the Forex marketplace. We believe our disciplined methodology is pivotal for long-term success in trading.

Market Volatility Leads to Palantir (PLTR), Bullish Sentiment Continues

Palantir Technologies (PLTR), Inc. is a holding company, which engages in the development of data integration and software solutions. It operates through the Commercial and Government segments. The firm offers automotive, financial compliance, legal intelligence, mergers and acquisitions solutions.

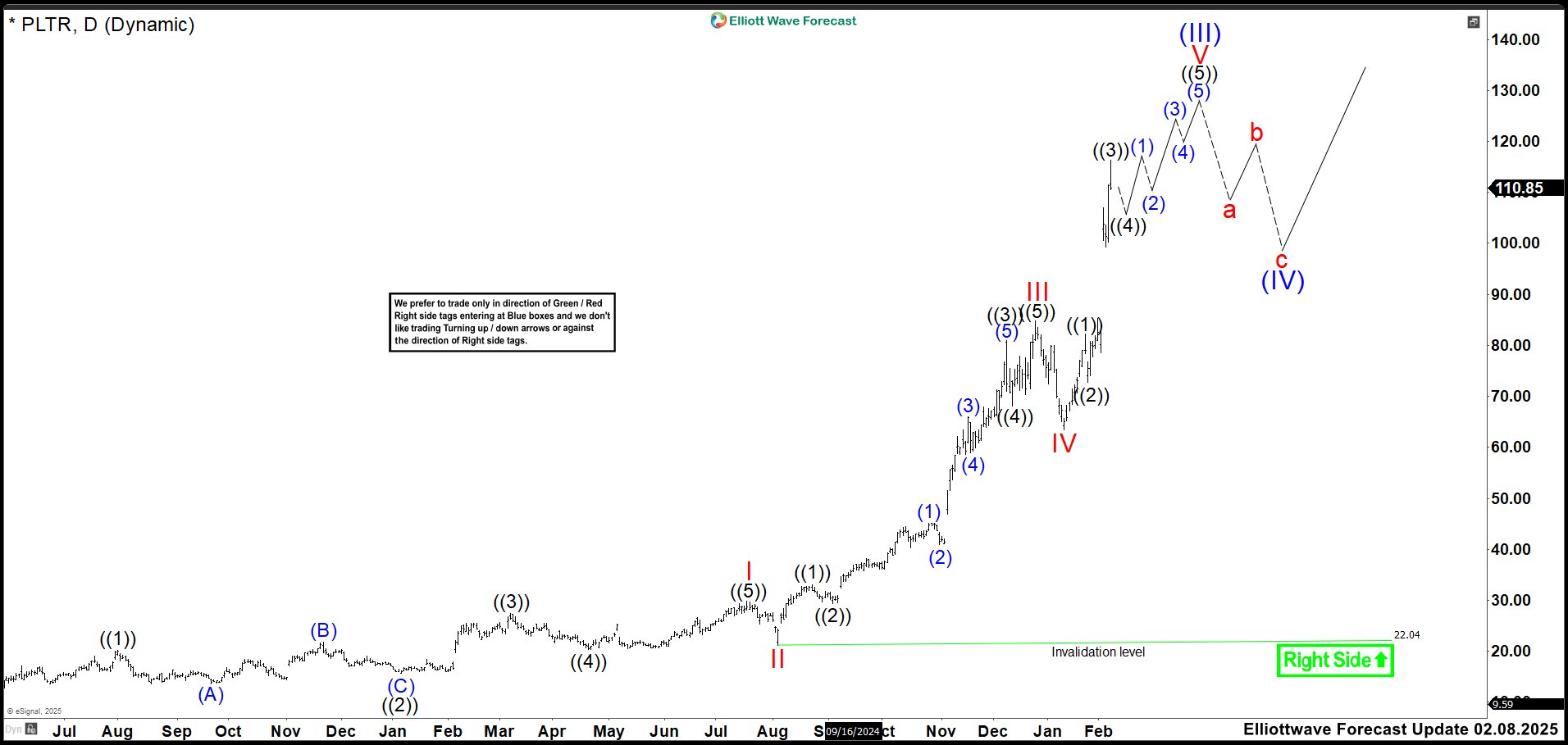

PALANTIR (PLTR) Daily Chart February 8th 2025

This is the last chart updated a couple days ago. The rally continued as we expected and the market resumed the bullish trend to build wave V with the last earnings announcement. The movement was showing 3 waves up and we were waiting for wave ((4)) of V before it continues higher. Also we suggested that, as long as we don’t see that wave ((4)), the price could continue to rise without any problem, but if you see the correction it is an opportunity to buy to continue the trend in wave ((5)) of V and wave (III). We were managing a target price of $127 to end the cycle.

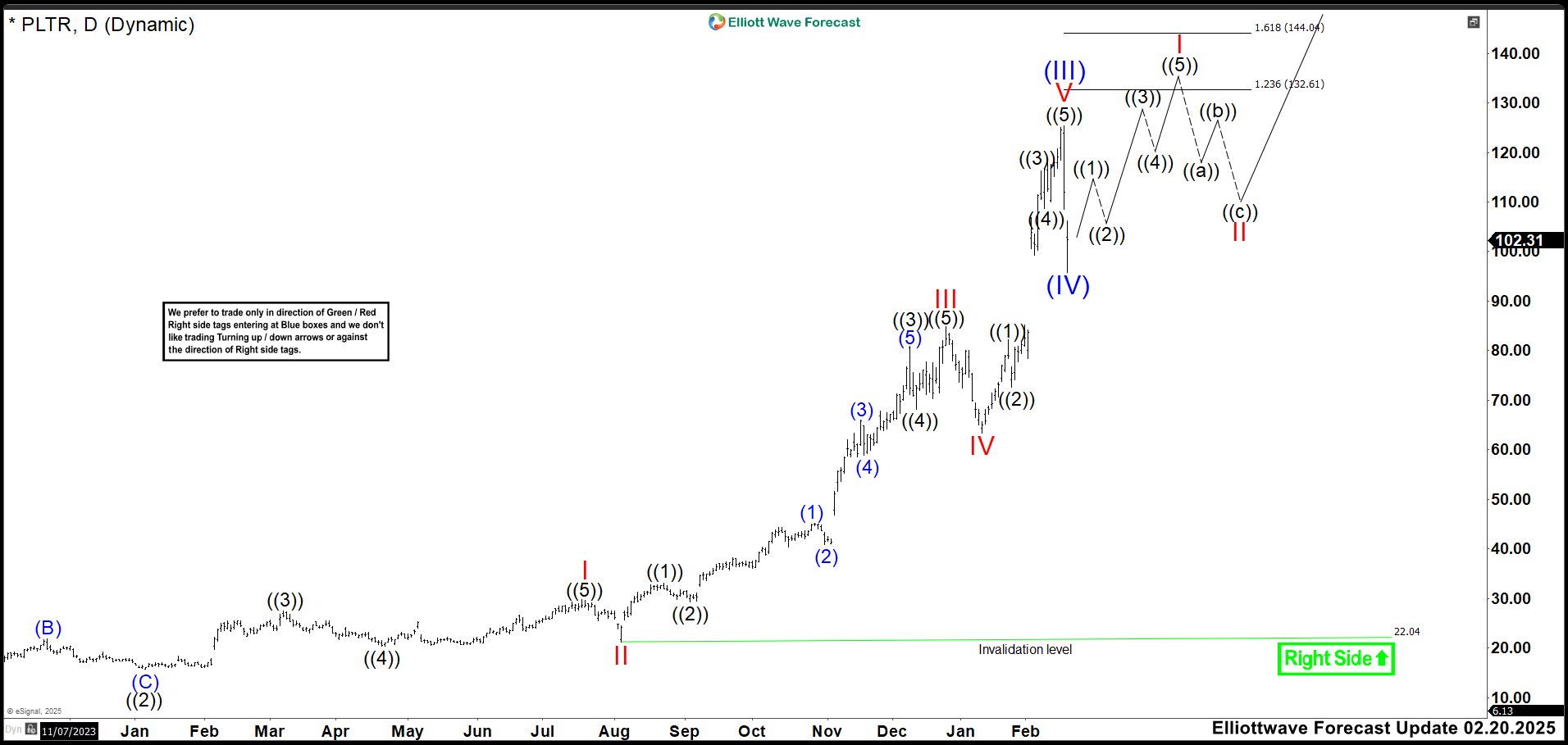

PALANTIR (PLTR) Daily Chart February 20th 2025

Palantir (PLTR) has suffered a sharp drop in its share price recently, losing more than 20% in two days. The Defense Budget proposal and other factors suggest that the company is going to sell 10 million shares until September. The only clear point is that we finished wave (III) at 125.41, it could not reach 127. The correction stopped at the 23.6% retracement of wave (III), which means that wave (IV) might have already finished. If that is the case, then the price action should continue bullish towards 132.61 - 144.04 area to complete wave I of (V). If wave (IV) has not finished yet, then it may drop to around 80 before continuing higher. For now, we will expect to resume with the up trend of the market. Trade Smart!

Source: https://elliottwave-forecast.com/stock-market/palantir-pltr-strong-pullback-bull-yet/