May 11, 2017

ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 50 instruments including FX majors, Gold, Silver, Copper, Oil, Natural Gas, Soybeans, Sugar ,Corn TNX and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup videos, Educational Resources, and 24 Hour chat room where they are provided live updates and given answers to their questions. The guidance of ElliottWave-Forecast gives subscribers the wherewithal to position themselves for proper entry and exit in the Forex marketplace. We believe our disciplined methodology is pivotal for long-term success in trading.

Learning Flat Elliott Wave Structure

There are three different types of Flat Elliott Wave Structure:

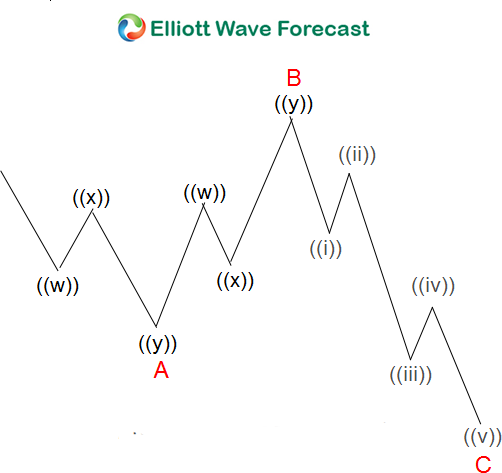

A. Regular Flat Elliott Wave Structure

Rules:

- Corrective 3 waves labelled as ABC

- Subdivision of wave A and B is in 3 waves

- Subdivision of wave C is in 5 waves

- Wave B terminates near the start of wave A

- Wave C generally terminates slightly beyond the end of wave A

- Wave C must have momentum divergence

Fibonacci Relationship:

- Wave B = 50%, 61.8%, 76.4%, or 85.4% of wave A

- Wave C = 61.8% – 123.6% of wave AB

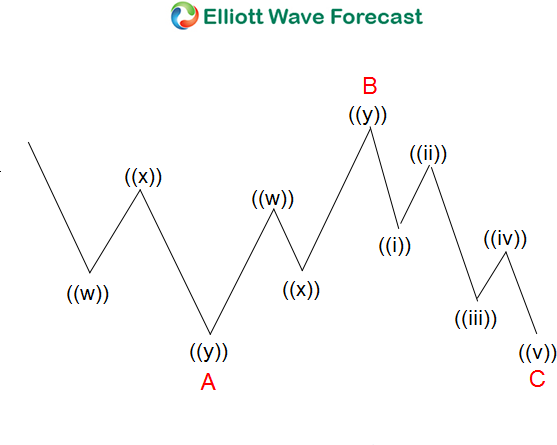

B. Expanded Flat Elliott Wave Structure

Rules:

- Corrective 3 waves labelled as ABC

- Subdivision of wave A and B is in 3 waves

- Subdivision of wave C is in 5 waves

- Wave B terminates beyond the starting level of wave A

- Wave C ends substantially beyond the ending level of wave A

- Wave C must have momentum divergence

Fibonacci Relationship:

- Wave B = 123.6% of wave A

- Wave C = 123.6% – 161.8% of wave AB

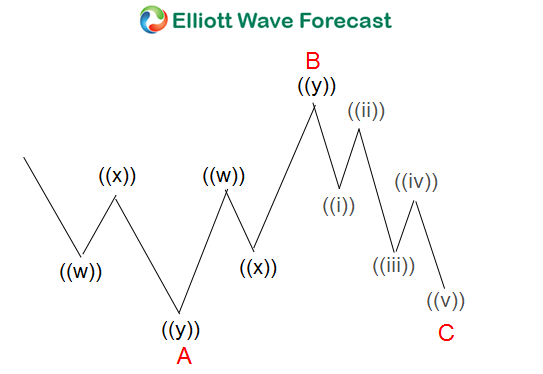

C. Running Flat Elliott Wave Structure

Rules:

- Corrective 3 waves labelled as ABC

- Subdivision of wave A and B is in 3 waves

- Subdivision of wave C is in 5 waves

- Wave B terminates substantially beyond the starting level of wave A

- Wave C travels full distance, falling short of the level where wave A ended

- Wave C must have momentum divergence

Fibonacci Relationship:

- Wave B = 123.6% of wave A

- Wave C = 61.8% – 100% of wave AB

To learn more about Elliott Wave and our trading technique of 3, 7 or 11 swings, check out our Educational classes and sign up for a Free 14 day Trial . At EWF, we cover 52 instrument in different asset classes from forex, commodities, and indices. We provide Elliottwave forecast in 4 different time frames, Live Trading Room , 24 hour chat room, live sessions, and much more.

More from ElliottWave Forecast

The most important insight of the day

Get the Harvest Daily Digest newsletter.