Official Franklin Templeton Investments account. For US investors only.

Keeping One’s Options Open: The Case for Convertible Securities

Bond-Equity Hybrids Let Investors Keep Their Options Open

Convertible securities are a unique asset class in the investment world, offering investors both the growth potential of common stocks and the income offered by bonds. Issued by companies looking to raise capital, these hybrid investments are generally structured as some form of debt (bonds, debentures) or preferred shares with an embedded option that allows conversion into common shares under predetermined conditions.

The debt features of convertibles stem from the interest payments and claim to principal. In this respect, convertibles are similar to bonds, with characteristics that can potentially offer less value erosion in declining markets than the underlying common stock. But they are also similar to stocks because their embedded conversion component allows investors to participate in the stock’s price appreciation potential.

If a company’s common stock rises, the convertible security should increase in value because of the conversion option. If the common stock does not perform well, the fixed income component may help provide a buffer against greater losses than the common stock alone might experience. Because of these unique characteristics, convertibles may be classified as fixed income securities, equity securities or as a separate asset class.

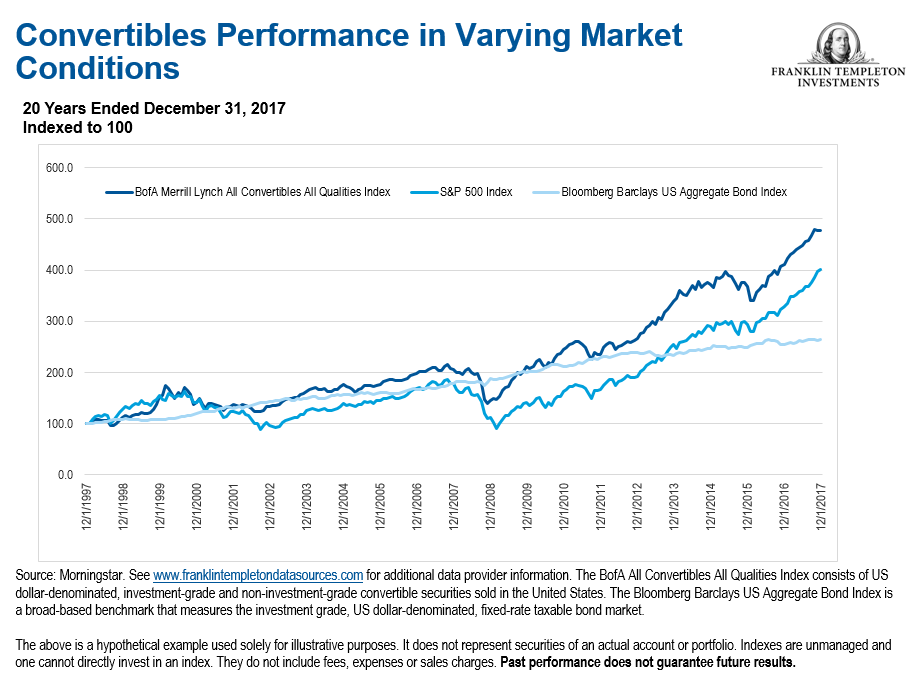

As securities that generate income, convertibles are attractive in low interest-rate environments when sources of income may be scarce. Historically, they have tended to perform well during periods of above-average market volatility, when cautious investors with a generally positive view of the equity markets seek risk-controlled equity exposure to reduce potential downside risk. (See chart below.)

Rising stock markets also tend to favor convertibles due to the price relationship with the underlying common stock. We believe this ability to adapt to myriad market conditions makes convertibles an attractive vehicle for increasing a portfolio’s diversification.

Why Companies Issue Convertibles

Convertibles allow companies to finance activities through a lower-cost form of debt that offers less potential dilution to the common shares than selling common stock. While convertibles can come with elevated risks, there are some potential advantages.

Potential advantages to the issuer include:

- Lower interest payments relative to straight debt.

- Less potential share dilution compared to equity issuance.

- Equity issued at a premium to the current stock price.

- Ability to reach a broader range of investors.

Within a company’s capital structure, convertibles can be ranked at various levels of seniority ranging from the most junior preferred stock to senior secured debt. Most convertibles are issued as senior unsecured debt, which ranks higher than stocks with respect to income distribution or liquidation.

Anatomy of a Convertible

Convertibles possess a distinct structure that includes characteristics that may be unfamiliar to some investors such as the conversion ratio, parity, conversion premium and delta.

Conversion ratio sets out the number of common shares due upon conversion to the underlying stock. The conversion price, which is calculated by dividing the price of the convertible at issue by the conversion ratio, determines the price of the underlying common stock that is required for conversion. Generally, the conversion price is set upon issuance at a premium of anywhere from 15% to 50% relative to the price of the underlying common stock, with 20% to 30% being the most typical range.

Parity refers to the value of the convertible upon conversion. It is calculated by multiplying the conversion ratio by the current stock price.

Conversion premium is the value by which the price of the convertible exceeds its parity and is calculated as a percentage of parity.

Delta measures the sensitivity of the convertible price to changes in the price of the underlying common stock.

Four Good Reasons to Consider Investing in Convertibles

1. Current Income. Investors seeking yield from equity securities may find convertibles an appealing option, as they generally provide a more attractive income component than stocks alone (although generally lower than traditional bonds), while still allowing participation in the stock’s price movement.

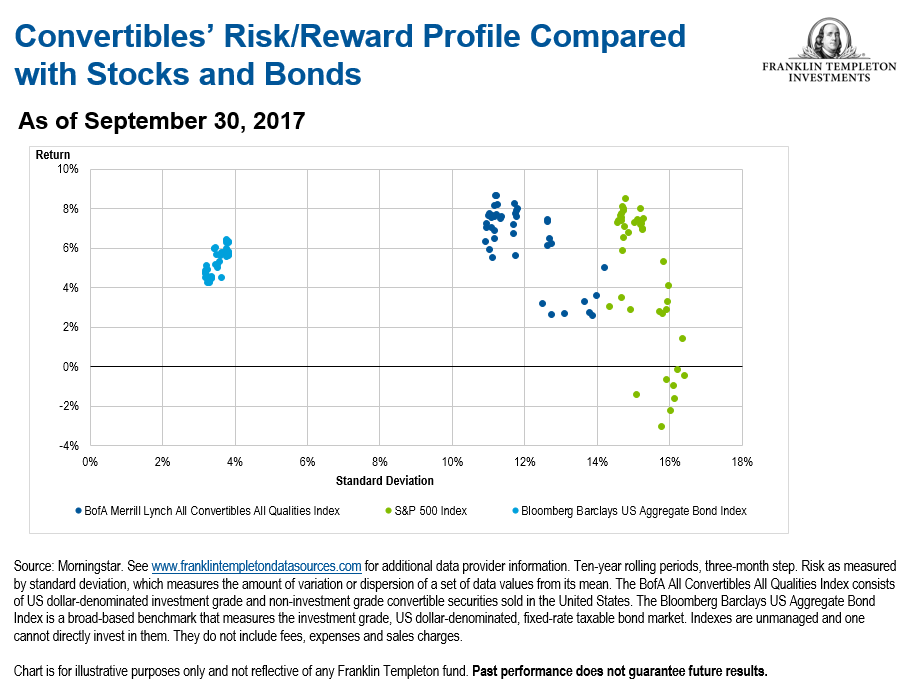

2. Potential for Additional Diversification. Historically, convertibles typically have exhibited a low correlation to fixed income and demonstrated imperfect correlation with stocks (see chart below). 1 This creates the potential for an investor to help enhance portfolio diversification, dampen volatility and improve a portfolio’s overall risk profile. Note, diversification does not guarantee profit nor protect against risk of loss.

3. Attractive Potential for Long-Term Risk-Adjusted Returns. Critics point out that convertibles do not increase as rapidly in value as stocks during rising markets; nor does their downside protection equal that of bonds during market declines. Nevertheless, historically they have been able to deliver attractive long-term risk-adjusted returns compared with both stocks and bonds. (see chart below)

4. Robust and Diverse Opportunity Set. The flexible nature of convertibles makes them appealing to a broad range of investors. As a group, convertibles have historically presented an attractive risk/reward profile, but within the group there is considerable variation in the level of risk, sensitivity to movements in the underlying stock, and upside participation potential. Convertible securities are diversified across credit ratings, sectors, market capitalization and investment characteristics.

Overview of the Convertibles Market

With a value of more than $218 billion as of December 30, 2017, the convertible securities market is a sizeable player in US capital markets. 2 Convertibles tend to have higher representation of small-cap companies relative to the broad equity market indexes, such as the S&P 500 Index.

Convertibles issued by small companies represented over 28% of the investable universe by market value, mid-cap companies comprised about 17% and large-cap companies comprised 50%. 3 In terms of credit ratings, the universe is tilted toward non-rated issues (almost half of total market value), with approximately 20% of securities carrying investment-grade ratings, and the rest rated below investment grade. 4 The universe is also well diversified by sector, similar to the equity market.

Increasing New Issuance

Following a peak in 2007, convertibles issuance in the United States declined as companies took advantage of low yields, a high equity risk premium relative to credit spreads, and strong flows into the credit markets to issue traditional debt rather than convertibles. The perception was that raising capital through traditional debt was relatively cheap, even when convertible securities were issued at slightly lower rates due to the added concern of share dilution. Companies were also hesitant to issue convertible securities as equity valuations were inexpensive relative to historical levels. A sluggish primary market tends to improve as convertibles regain their attractiveness for issuers, and new issuance improved significantly in 2013, followed by an equally strong 2014, and comparable 2015 and 2016. In 2017 we saw slightly stronger issuance figures than in the prior year, driven by better equity market performance, a rise in interest rates and higher spreads.

Reducing Risk through Portfolio Construction

Some investors may have concerns about the credit profile of a convertible issuer. Active portfolio management, fundamental research, and a bottom-up approach to security selection can be used to address these concerns by targeting companies with rising credit profiles. While default risk is an important factor when evaluating securities, many other elements must be considered before making an investment, such as business fundamentals, asset and cash flow coverage of debt and fixed costs, and the likelihood of improvement in the underlying credit profile.

Convertibles: Broadening the Opportunity Set

Although past historical performance cannot guarantee future results, global convertibles, based on historical characteristics, offer the potential for low correlation to other asset classes, a broad universe of opportunities, which may help to reduce risk through portfolio diversification.

Convertible securities can present opportunities for investors to “hedge their bets” by providing characteristics of both the fixed income and equity markets. For those seeking income and risk-managed equity exposure, these investments offer numerous potential benefits, including:

- Low-beta equity exposure: historically, convertible securities have tended to provide equity-like returns with lower levels of beta than common stocks.

- Current income that is usually higher than a common stock’s dividend, albeit typically lower than yields on non-convertible debt.

- Additional diversification potential and a means that seeks to improve the risk/reward profile in a portfolio due to imperfect or low correlations.

- A claim on the issuer’s assets senior to holders of common shares.

- Robust asset class: the convertibles market can be considered a separate asset class due to its size, distinct composition of the issuer base and a unique risk/return profile.

Worldwide, convertible securities are garnering increasing attention from both issuers and investors. The asset class has ample room for expansion as companies look for financing and endeavor to attract investors to their common shares at the lowest possible cost.

We believe convertibles offer attractive opportunities for participating in corporate growth, even in uncertain markets—possibly the strongest argument for including a component of convertible securities in a diversified portfolio of investments.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

This information is intended for US residents only.

To get insights from Franklin Templeton Investments delivered to your inbox, subscribe to the Beyond Bulls & Bears blog.

For timely investing tidbits, follow us on Twitter @FTI_US and on LinkedIn .

What Are the Risks?

All investments involve risks, including possible loss of principal. Generally, those offering potential for higher returns are accompanied by a higher degree of risk. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as the prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of a portfolio may decline. High yields reflect the higher credit risk associated with these lower-rated securities and, in some cases, the lower market prices for these instruments. Convertible securities are subject to the risks of stocks when the underlying stock price is high relative to the conversion price (because more of the security’s value resides in the conversion feature) and debt securities when the underlying stock price is low relative to the conversion price (because the conversion feature is less valuable). A convertible security is not as sensitive to interest rate changes as a similar non-convertible debt security, and generally has less potential for gain or loss than the underlying stock.

______________________________________

1. Source, Morningstar. Correlation measures the degree to which two investments move in tandem. Correlation will range between 1 (perfect positive correlation where two items have historically moved in the same direction) and -1 (perfect negative correlation, where two items have historically moved in opposite directions).

2. Source: Barclays Live, as of December 31, 2017.

4. Ibid.

The post Keeping One’s Options Open: The Case for Convertible Securities appeared first on Beyond Bulls and Bears .

RSS Import: Original Source