A retired former ML Investment Banker & Regional Stock Broker Dealer/Invesmet Banking firm President with 47 years Market Experience

Kandi Technologies, China’s EV First Mover Completes Upgrades, Reveals New EVs, Strong H2 17 Sales Laying Groundwork For ...

ABSTRACT : While more than double from its low in 2017, NASDAQ listed, China Based Kandi Technologies (KNDI), China’s “first mover” in the Electric Vehicle (EV) space, is still trading 70% below its 2014 high of $22.49. With Tesla's acquisition of Solar City, KNDI is now the only listed pure-play Electric Vehicle maker available for stock market purchase by US investors. As probably the hottest legitimate technology sector, particularly in China, a logical question by a new investor would be why is KNDI trading so poorly in the hottest Tech Market in history? The likely answer to that has much to do with a comment in my first line as KNDI being a “first-mover” of EVs in China. In this article while it is my intention to help clarify the likely cause of the lethargic trading, but more importantly spell out why KNDI has now crossed the chasm and is set up for a three year run to reach and continue beyond the 200,000 annual EV sales target in 2020 alluded to by Management in last quarters conference call. Very rare is the opening for an investor to have the opportunity to participate in the infancy of a trillion dollar market segment with a proven surviror company with a ten year track record. One thing for sure. As you will see later in this writing, three years from now KNDI will not be a $10-20 stock, nor will it be out of business. It will either still be struggling along at the $5-7 level, or it will be $50 to $100+. The Chairman of this Company is the founder and largest shareholder with around 15 million shares who has never taken a salery over $32,000 a year, never sold a share and bought some $2 million in open market stock over the past year. With most stocks trading at rediculouse and lofty prices, KNDI has to be an interesting speculation even if only for a few hundred shares.

KNDI in its 10th year on NASDAQ came public in the United States in 2007 as a reverse takeover in the Off Road Recreational Vehicle field (ATV, UTV, Go Carts, etc.) . Shortly thereafter KNDI developed some low speed electric vehicles (LSEV) mainly for export to the United States. (LSEVs are allowed to be driven in most states in the US but with speed limited usually to 25 to 35 miles an hour). At that time KNDI was a maker of off-road recreational vehicles also mostly exported to the United States. that chose to add LSEV's to their inventory of export products. Among other off road vehicles, KNDI was most noted as China's top exporter of go karts to the US. Looking at KNDI’s Chairman CEO, Xiaoming Hu’s history of being a very early scientist and developer of electric vehicles in China for the Government, it was not surprising to see him test the waters for eventually developing EV’s in China. In 2009, KNDI did export almost 3,000 LSEVs. At that time, China’s auto saturation was less than 100 ICE “cars” per thousand or around where the US was pre-WWII, let alone any EVs on the market.

In mid-2009 KNDI notified shareholders that it was entering into building electric vehicles for use within China,. On the first day of trading January 4th 2010 KNDI put out a stunning press release that it had signed a four part joint venture agreement with China's largest mobility battery maker, Tianning Power, Government computer high-tech Think Tank China Portivio and CNOOC (NYSE-CEO), China's largest and national oil company, to develop a program of electric vehicles with quick Battery Exchange features in Jinhua China. On that announcement the stock went ballistic trading a record 3 million shares and running from just under $4 to over $7 that day before closing in the mid 5 level.

10 months later on October 5th shareholders were again surprised by further announcement of a modification to that original Alliance where giant CNOOC was replaced by even larger (and likely more logical) State Grid (SG), China's national electric utility. SG is so large that it alone services is over 85% of the country land mass at over 1.1 billion consumers.

At the high Cost of power at that time SG’s main interest was a vehicle to Grid or V2G program using Battery Exchange. Simply the batteries that were charging overnight when utilities need to keep power flowing cost almost nothing to charge and then those batteries can be used throughout the course of the day exchanging it into EVs.

Approximately 6 weeks later the first joint venture partnership opened a quick battery exchange charging facility with much fanfare in Jinhua, China. I chose this time to make my first of two visits to the company in China. As Chairman Hu’s guest, I was personally at attendance at the ceremony for this first opening where Chairman Hu introduced me to several top level State Grid Executives and Government dignitaries. .

For those familiar with KNDI, the express change battery station concept is well known as being a KNDI invented product to which it has several patents. Subsequently this service became better known as “Quick Battery Exchange”, or QBEX. The key patent showed the batteries under each of the rocker panels on both the passenger and the driver side where through a mechanical door, both could be slid in and out and changed in a matter of seconds by robotic arm or two minutes manually with a hand lift.

Early in this decade there was a battle in China between what was known as the “For Power” group led by Kandi, State Grid China Portivo and a few other companies that we're heavily trying to push quick Battery Exchange as “The Model” for supplying power to all of China electric vehicles. In mid-2012 a white paper came out by a major Government think-tank in China recommending the KNDI QBEX model should be pushed for all of China." Electric vehicle business model innovation and policy should be adopted" release” Up until this point most of the automakers were not taking EVs seriously in China. Meaning many of those that were attempting to make EVs we're just converting gas powered cars to EVs meaning they were just stuffing batteries into whatever space they could find in the vehicle. This obviously would not be very conducive for any type of quick Battery Exchange so the major automakers fired up their lobbying efforts against quick Battery Exchange in favor of conventional “plug-in”. So while it made sense for all the reasons in the above linked article, the automakers were too powerful even for SG, so Mr. Hu and KNDI ended up having to mothball the brilliant QBEX concept, (More on this later). But not before the PRC government included the car share concept and it's early subsidy allocation programs.

As a true entrepreneurial conceptualizer and visionary Mr. Hu was not going to just walk away from his vision of KNDI being a major player in future of EVs. So he next came up with “swapping the whole car” instead of the just the battery and his Car Share model was born. Along with this, due to space and parking concerns, he added the concept of the vertical fully automated parking garage to be used in conjunction with a car share program. But before we get on with this subject let me add some points as to how and why the QBEX created some well-publicized but little understood problems with KNDI regarding subsidies.

The original subsidy programs tailored for quick Battery Exchange allowed the manufacturer to actually sell the car without any battery since the batteries were going to owned by State Grid who would either lease them or charge by the “swap”. Doing it this way would significantly reduce the cost to the consumer’s car purchase. Since logic would tell you that for every installed battery, there should be an equal number of batteries “charging on the rack” at the QBEX station, the Government subsidy program allowed the EV manufacturer to get subsidies (in KNDIs case with two battery packs installed) on all four of the battery packs of which two would be located in central quick Battery Exchange stations where they would be randomly rotated with no specific battery assigned to a specific car.

This first subsidy program remained in place until Early 2016. Since all of KNDI’s Fleet at that time had the quick Battery Exchange feature built into each car, KNDI took advantage since inception of the written subsidy program in place and claimed credit for the car and the 4 batteries but in this case assign all batteries to a specific car. This is where the confusion came in later with the PRC Government's new Minister of the Treasury who did not understand how the subsidy program worked and initially accused KNDI of doubling up battery subsidy submissions. This SNAFU with the Government caused a couple of years of pain and confusion between KNDI and the Ministry of the treasury regarding KNDI’s subsidy claim for 2014 through 2015. Subsequently last year, the government and KNDI came to a settlement where KNDI JV would give voluntary reduce its subsidy request down one level causing a gross reduction of around $7 million or 5% ($3500 to KNDI). From that point forward new subsidy rules would take effect which no longer allows the use of 4 batteries. And in 2016 the rule for lease cars was changed whereby the Manufacturer would have to wait until the EV had 30,000 km before submission for the subsidies. All total, KNDI JV still has some $150 million in subsidy payments owed by the PRC.

Stepping back to early 2013, Chairman. Hu, as the hard-driving realest that he is new it would be an uphill battle against the other major auto companies without some contemporary assistance. Therefore in 2013 KNDI partnered up with Geely Automotive, China’s largest independent passenger car maker at that time that was run and controlled by 43% ownership by his close friend Li Shufu, now China’s 10th wealthiest on Fortunes list. In early 2013 a 50/50 joint venture was announced between the two companies and the joint venture became effective in December of 2013 with each company contributing approximately $160 million in cash and property .

While totally capable, KNDI independently was licensed as a battery maker in China but not licensed to make autos. From 2006 until early last year the PRC government had a moratorium on new automaker licenses. The ban was lifted and now a small number of EV only licenses are being awarded. According to Chairman Hu on the last investor Conference Call, KNDI was told by the Government that it was “next in line” to receive a license once the program is reopened in early 2018. More on this later. However during the moratorium and prior to the closing of the joint venture with Geely, KNDI had an agreement with Zotye Auto (who recently announced a JV with Ford) whereby KNDI could make the cars in their own plant and market them under Zotye’s license, This all for a small fee to Zotye. After the closing of the KNDI JV further sales of KNDI EVs would be piggybacked in perpetuity under the Geely license.

Big Bucks Directly Behind KNDI JV. In 2016 when the PRC government announced it would be opening up a few EV specific licenses, one of the requirements was the potential licensee could not have an owner/shareholder owning more than 20% in order to apply for its own independent license. This created a problem for the JV. Its announced intention was to “go public” with a China based IPO. To get max value, though not required, the JV did want its own license. So, while all of the confusion over the subsidies were being ironed out, it was decided that Geely Auto would sell its 50% interest to Geely Holdings, a private holding Company 100% owned by Li Shufu and son. The deal was consummated October 2016 for approximately $200 million in cash and assumption of liabilities.

With Geely Holdings now owning the 50% interest, it makes KNDI, though its 50% ownership a “stepsister” to some well-known international Auto Companies also owned by Geely holdings such as: 43% of Geely Auto, 100% of Volvo Auto, 100% of London Black Cab, 100% of Lotus, 50% of Proton, 45% of Zhidou, and several smaller positions such as Volvo Commercial Vehicles and even Mercedes Benz. Calculating only Li Shufu’s Geely and Volvo ownership makes him the 10th wealthiest man in China . (reminder: Li recently spent $200 million personally to acquire half of KNDI JV). This would be like Larry Ellison buying half of the KNDI JV. Of course if that happened, KNDI stock would triple overnight. Instead, since very few US investors know Li, or realize the large extent of ownership this somewhat obscured China billionaire has in the JV, no speculative premium is being given at all.

But just to set the record straight about KNDI’s actual business interests. KNDI not only owns 50% of the joint venture but actually manages the whole joint venture with Geely Holdings a passive investor at this time. But just as important and KNDI’s primary current revenue source, KNDI through two of its subsidiaries is a major supplier of Auto Parts to include Electric motors air conditioners, batteries controllers battery Management Systems Etc. generating almost a half billion in revenues in just the last four years. . Since KNDI only owns 50% interest in the joint venture it cannot book any of the joint ventures revenues; only 50% of its profits and loss therefore all of KNDI’s revenues are created by its parts business exclusively making parts for electric vehicles.

Why All This Background?

I've given you all this background to bring home the point that KNDI truly was the first mover in EVs in China. As you may know or at least suspect, very few first movers ever really make it; particularly in technology. For example most people seem to think that the first true personal computer developer was a small unknown Company called Apple. Not Quite true. In 1974 another small company called Micro Instrumentation and Telemetry Systems or MIT, introduced a small computer called Altair, first. It made some noise and had a lot of lights flashing but really couldn't do very much since it had no screen or keyboard. That is not until Bill Gates and Paul Allen joined this small company as programmers which put them on track to starting Microsoft. Shortly thereafter a few young programmers from Homebrew Computer Club Steve Wozniak and Steve Jobs created the short-lived Apple 1 to be followed by that very successful Apple II E and the rest is history re. AAPL. During this time such well-known major corporations such as Xerox, Tandy, Atari, Commodore even IBM tried entering the PC market but where are they today?

But okay let's give the benefit of the doubt and say that Apple was truly the first PC maker. For those that know anything about Apple realize that while the Company and its stock was booming in the late 20th century as the uncontested leader under Steve Jobs, it almost went out of business with its market cap dropping to much less than KNDI’s today in early 2000s. After a few years of problems and some circumspection Jobs was brought back into the company and the rest is history.

So am I trying to compare KNDI to Apple? To a smaller extent possibly. Certainly the size of the potential markets are both immense. But only time will really tell. But after 10 years KNDI’s founder CEO Mr Hu has proven without a doubt the both he and KNDI are survivors and will be around a long time. A fact that has not been missed by the EV Powers that be in China by Awarding Mr. Hu the 2014 China Entrepreneur of the Year award for EV technology.

Now let's look at a few points which clearly show that KNDI has “made the turn” and is in a very fast recovery mode.

Is all of this upgrading of speed and distance now behind KNDI ? I believe so. In just the past two months, KNDI has announced four new gen EVs, the K22 , K27 , K23 and K26 . The first two are vast upgrades to the 2017 model K12 and K17. The K26 is a totally new EV design as KNDI’s first SUV of the small variety and the K23 is the high tech EV mentioned above that Hainan Province and the City of Haikou, provided a $40 million grant to KNDI to develop a new special EV for the Province of Hainan. All of these whole new stable of EVs have faster speeds and range well in excess of the newest requirements fixed until at least 2020 according to the Government.

Valuation

What happened to KNDI to Cause the 18 month downturn? This partially addressed above, with the rest here. KNDI's business model which is, and always has been, primarily made up of selling EVs to China's largest car share programs and to lesser extent individual sales, is oriented 100% towards and urban driving market. For this reason it was always Chairman Hu’s logical conclusion to keep the price and weight as low as possible yet still fully service the Urban Market. The top speed limits in the urban markets are typically 60-80 kmph with 95% below 50 km per hour. Particularly with EVs and the weight of their batteries, efficiency is rapidly lost when an urban car is forced to use larger and heavier batteries and larger and heavier longer range electric motors. From formally unknown, in 2015, KNDI jumped to the top of pure EV sales in China Even topping such well-known names is Warren Buffett's Investment BYD and State Owned Enterprises like BAIC and SAIC.. This rapid move by an unknown like KNDI likely set off a firestorm amongst the major automakers and their lobbyists to push for higher minimum range and speed for all vehicles, including urban to force KNDI out of the EV Market. KNDI who had four different models selling in the market found itself needing to quickly retool and upgrade in both speed and range all of their models to comply with new rules. Not only were the published requirements raised in 2016, but announced in Dec. 2015 then the same happened again for 2017 with notice given Dec. 2016. These two raises in minimum requirements caused KNDI to suffer significant declines in manufacturing and sales for both 2016 and 17, not due to demand, but due to long retooling suspensions.

2017 H2 Turnaround . In first half of 2017, KNDI sold no cars. Not until August, as reported by the company did sales begin, KNDI typically does not announce monthly sales numbers so we have no way of knowing exactly what the company is going to report for all of Q 4. However based on China media who claimed their information comes from the government it appears they KNDI JV did in fact sell approximately 15,000 EVs for the 5 months beginning in August through December.

Company Values Shares at $12? In the Q2 2017 earnings report the very conservative CEO gave a surprise to shareholders with the following quote :

Mr. Hu Xiaoming, Chairman and Chief Executive Officer of Kandi, commented, “2017 has been a challenging year for Kandi. The confusion surrounding the subsidy heavily impacted the Company’s business last year and we have been trying to regain the momentum this year. The management team is working hard to explore better growth opportunities. Despite second-quarter losses, Kandi Vehicles’ estimated value has exceeded RMB four billion .the management team will actively seek strategic investors based upon the estimated value to increase its competitive advantages. The efforts the Company has made will lay a solid foundation to achieve strong business results.”

Kandi Vehicles is KNDI the public company alone. 4 billion RMB is approximately $600 million US dollars US or around $12 a share. Now remember this was reported after 6 months of no sales in 2017 and no revenues by the JV. In other words, this was based on asset value only, with little of any “going concern value factored in”. Obviously with some $200 million worth of EVs sold in just the last 5 months the value should now have increased to that of an operating company, rather than as an asset play alone. As a former Investment Banker, I can assure you this shift would make a significant increase in appraised value. But let's take a second and look at just the manufacturing facility assets of just the JV alone: Note that three of the facilities were designed and built by KNDI in just the last five years totaling some $700 million at cost but likely worth a Billion in today’s market. So simply showing its 50% current or soon to be assumed ownership of these plants at cost is worth more than the current $360 million market cap.

For the record: Kandi New Energy, the holder of the battery license and Yongkang Scrou the parts maker subsidiary who in addition to a myriad of smaller parts, supplies the new, KNDI developed high efficiency EV motor and AC units. To date these two subs were exclusively selling parts to the JV, but as of KANDI's last Conference Call, could soon be selling to third parties..

KNDI Soon To Get its own License Likely Doubling The Speculative Value of the Company.

As mentioned above only recently have new licenses been issued to automakers in China and even those exclusively to EV makers who can pass very rigorous requirements. Currently some 15 companies were issued conditional licenses of which six have now graduated to full licenses. Each company given a conditional license was given approximately 2 years to be up and operational and ready to meet heavy testing. Most of the initial applicants were start up companies with very Deep Pockets, or they were formerly divisions of major China automakers who spun off significant enough ownership to allow eligibility to get their own license. Last October the government cut off issuing new licenses until further notice to evaluate the first 15. Just prior to that time on a conference call KNDI's Chairman Hu inform shareholders that KNDI had in fact applied for its own license in April of last year and the inspection team reported back “very favorably” as to their findings. On the last conference call Chairman Hu inform shareholders that once licensing begins again KNDI anticipates being one of the very first to receive a license.

Government Confirmation for a KNDI License? On December 2nd 2017 an article was published and syndicated throughout China Stating that the government has resumed giving out licenses and naming KNDI as one of three companies to receive a new license. The source of this information as it turns out was a government website that freshly uploaded this list naming the next three companies. However it appears it was done prematurely in that the government was not quite ready yet to issue conditional licenses to anyone to include KNDI and the other two. However the fact that KNDI was in fact named as on the list and the information is still showing on the government website is a strong sign backing up with Mr. Hu told shareholders of the near-term expectation of KNDI receiving its own license.

Some may wonder why KNDI who already has over 400,000 annual capacities waited so late in getting ub a license application. The only response from the company was “Due to logistical reasons, KNDI was not ready to submit their application as early as some other companies had, but fully expects when it gets its license it will be transferred to a full license very quickly as KNDI does meet all the requirements of a full license”.

The value of a full license is not measurable any more than trying to measure the difference between a computer company making computers solely under someone else's license, effectively private labeling, or making it under their own name. Getting its own license in the JV as mentioned earlier, was a key reason the sale was made from Geely Auto to Li Shufu’s private holding company Geeley Holdings. Additional value should be added along with acceleration towards an IPO, soon after the announcement theKNDI has been given its own license.

Two New High Profile Directors Voted In, in December.

On April 28, 2017, KNDI filed an 8k announcing the replacement appointment of a recently deceased Director, the new Director, Mr. Lin Yi who among other accolades is a true EV Pioneer in China. Mr. Yi was the Founding Chairman of BAIC New Energy Vehicle (Beijing Automotive New Energy Vehicle- BAIC or Beiqi). Li Yin and KNDI founder Chairman Hu are close friends going back to China’s 863 Project in 2002 (where Mr. Hu was Chief Scientist for China Development of New Energy Vehicles). Here is an article on new KNDI Director Li worth reading: Lin Yi: “The future of new energy vehicles is dry ou t”

“...project undertaken by Ministry of Science and Technology "863" bus. During the "Eleventh Five-year Plan" period, Lin Yi acted as expert consultant expert for major projects of energy-saving and new energy vehicles in the Ministry of Science and Technology, often checking all over the country and refereeing the new energy vehicles. In April 2007, Lin Yi served as executive vice president of Beiqi Research Institute, Beiqi Deputy Chief Engineer. In 2009, Lin Yi was responsible for the preparation of Beiqi New Energy Vehicle Company (Beiqi New Energy), and served as chairman of the company, and began to enter New energy car coaches stage. .”.

The major significance of this new Director does tie back to his being the founding Chairman of the Board of BAIC New Energy Vehicle company. BAIC is China second largest automobile company and the subsidiary which was subsequently spun off BAIC new energy of which KNDI’s new director was the founder of was number one in total China EV sales In 2017. Needless to say with these type of credentials any one of the 200 young companies vying for position in electric vehicles in China would love to have a man of Lin’s credentials come on their board of directors. With his credentials he's not going to join just any company's board for the 5,000 shares a year KNDI gives its directors. Obviously he's done his homework on KNDI and he see something very big ahead..

On November 15, 1017 KNDI published its annual meeting proxy statement and noticeably was a new Director increasing the size of the board to seven, by the name of Zhu Feng, Now he is the youngest member of the board of directors. Mister Zhu also has a high-profile background in autos and EVs as an early executive with Geely Auto and the right hand man to Geely Auto and Geely Holdings chairman since the early 2000s. As mentioned in the proxy statement, in early 2017 he was promoted from Executive Vice President to President of the joint venture under Mr. Hu as Chairman. To date various short Sellers and KNDI detractors have tried to make an issue of the sale of The JVs 50% interest to Li as being nothing more than a divestiture for Geely Auto of this “problematic company” that he would just a soon forget about. They totally ignore the significance of the need for ownership change transaction allowing KNDI to get its own license as mentioned above.

In my last article on KNDI a few months back I went in depth to the size and scope of Li Shufu’s interest in the Auto industry and more importantly the EV sector of the Auto industry. As Mentioned, just his 43% ownership and Geely Auto puts him in the top 10 wealthiest in China. In fact Geely’s stock is up 10 fold since 2014 and more than a triple over the past year. The recent Triple was likely caused by the massive 67% increase in sales for Geely over the past year to almost 1.2 million units which really incredible growth number. Because of this massive increase Li right now it's probably one of the highest-profile Executives in all of China. To have him personally as a 50% owner of KNDI and now seeing him put his own man on KNDI's own separate board of directors should also be a signal similar to Lin Yi above that these individuals who are much more knowledgeable than you or I about EVs in China see a very bright future for KNDI.

To Reiterate My Point . Any number of EV companies in China would be Ecstatic getting even one of these two extremely well qualified industry experts on their board of directors. I can hardly think of a better endorsement for the future of the company and its stock.

Second Acquisition in 10 years- “Kandi Vehicles To Acquire Jinhua An Kao Power Technology Co., Ltd.”

In the ten years that KNDI has been public there's only been one other acquisition made by Hu and that was the company called Yongkang Scrou referenced above in Feb. 2012. At the Time of that acquisition KNDI had approximately 27 million shares outstanding and issued 2.4 million shares valued at approximately $8 million with no earn-out requirement. The stock price was damaged at the time of this acquisition as it also has this time due to ignorant investors or those with a negative agenda against KNDI saturating the social media with concerns of dilution and possible self-dealing. As it turned out that Youngkang Scrou acquisition was an exceptional “get” for KNDI In that it has been the driving force behind most of the $488 million dollars in Parts revenues KNDI has generated these past 4 years from its Auto Parts Sales.

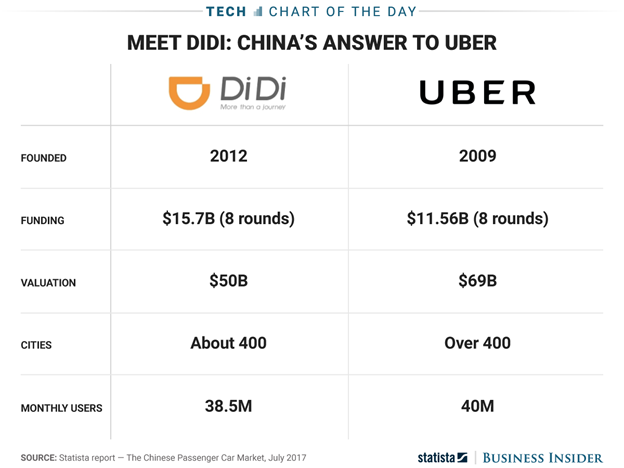

Now A Direct $30 Million KNDI Connection to DiDi, China’s UBER . An Kou Power just inked a $30 million deal with DiDi internet EV ride - hauling for its battery packs. For those not familiar with Didi it is in the same business as UBER but in China alone for now. In fact a few years ago it bought out China Uber from Uber for $1 B. Though three years younger, it has already grown to close the size of Uber world-wide.

Kandi has already been doing some business with Didi due to its prior relationship with UBER preceding the Didi’s purchase. But the earlier deal had to do with KNDI JV providing EVs for lease to Didi Drivers. A very competitive space. This deal has to do with Didi acquiring Battery Exchange Technology and packs, now from a KNDI subsidiary. This, an area that KNDI not only is truly a first mover, but a market that could easily expand to the tens if not hundreds of billions of dollars in the not to distant future.

How is this for a “Tea Leaf”? KNDI Chairman is a pioneer in Battery Exchange. KNDI’s recent acquisition specializes in Battery Exchange. Their first recent Director comed from BEIC NEV who was #1 in EV sales in China 2017. BAIC is now spearheading a Battery Exchange Network in China. “China’s BAIC Group Launches EV Battery-Swap Station Network In Beijing” . This the first example of a “Major” manufacturer going the battery swap route. Is this just a coincidence between these three, or the beginning of a $100 billion sea change into the only way an EV can pull into a service station and leave fully charged in five minutes?

Envision this for the future. Assuming KNDI JV reaches the target sales of 200,000 units discussed by Chairman Hu on the last Investors Conference Call, then the JV would have revenues approaching $3 Billion. JV net should be around $300 million. While KNDI would get none of the revenues to report, it would get its share of the $300 million bottom line. Since the JV will be public by that time, let’s say KNDI ownership is reduced to 40%. That would give KNDI very conservatively around $2.50 a share in after tax earnings. Now add to this KNDI’s own revenues and earnings for selling parts to the JV alone of at least $1 Billion. And net off this of an additional $100 million all belonging to KNDI or an additional $2 per share. Considering that 2020 is now less than 24 months from now, this EPS of $4.50+ makes for an exciting speculation.

In my prior article, I gave a sales growth target for 2018 of 50,000-60,0000 in EV sales. With the pick-up in China Growth, that number is looking better each day.

Considering the low end of 50,000 units, JV revenues should exceed $700,000,000 with a net of $66 million. Half would go to KNDI, or about $.70 a share. KNDI’s own parts business under this scenario should generate around $400,000,000 in revenues and bring another $60 million or $.78 to the bottom line. This for a total Net of $1.48 a share which should become apparent as realistic quickly in 2018.

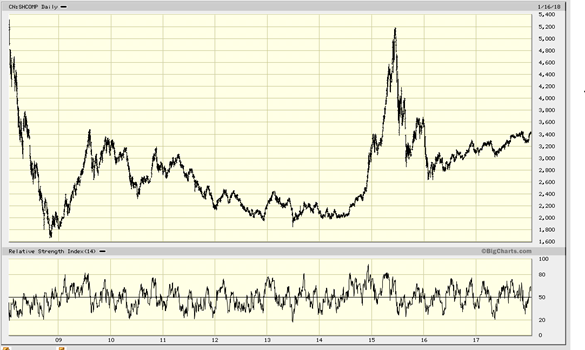

A few of points having to do with trading. KNDI has historically been carrying a large short position over 5 million with Days to Cover sometimes over 20 and consistently 15-20% of the float. Once KNDI starts moving, it can move large in a very short period of time and in most cases on no news. In August it started a run at 3.55 and ran almost non-stop to 9.80 a month later. With most world markets making new highs, as you can see from the chart below, the Shanghai Stock Exchange is still some 40% away. But now it appears that the SSE could break out to the upside at any time here. If that happens, daily moves of 3-5% can happen. If that does happen, though KNDI has no real attachment to the SSE, I would expect KNDI will make a significant move up as well. Similar to what it did late Summer when the SSE ran. For the significant majority of trading days the past few months, KNDI’s best upside action is in the first hour or so. My research tells me most of this early buying is coming out of Asia. Since KNDI only trades on NASDAQ, it is not really accessible to significant mainland investors unless they have an offshore account so not a lot of trading comes out of China. Because of the large short, very late in the trading session is usually the best time to buy.

As alluded to in the article, when the formal news hits that KNDI JV has its license. I would think the stock will make a major move up since this is likely a marker that sets the stage for the JV IPO and likely trigger some pre-ipo VC private equity financing at Billion dollar plus levels.

Authors Disclosure: Long KNDI stock and Stock Options.