It’s Now or Never for Energy Stocks

As the year progresses, commodities look as if they could become the best performing asset class in 2018 (see Q2 2018 Investment Outlook: Commodities Seizing Their Moment ). We believe that major opportunities continue to exist – especially in energy stocks.

Back in March, our view was that with global growth kicking in and fueling demand, commodities were well positioned for a strong year and significant opportunities were emerging.

For several years now, one of our main themes has been that, beyond the macro trends, commodity companies have been undergoing a rationalization process. Since the end of 2015, supply has been constrained. Precious metals companies were the first to restructure and focus on shareholder returns and shareholder equity, followed by the base metals sector. We have, subsequently, seen good rallies in both.

We believe the time has now come for energy companies. For the last year, we have been examining how such a reform process, when applied to the U.S. energy market, has the potential to transform that industry too. Our fund managers note how energy companies, especially those in unconventional oil and gas exploration and production, are now transitioning from “investment” to “harvest” mode, with mature, cash-flow heavy business enabling dividends and share repurchases (see Natural Resource Companies Focus on Returns in 2018 ).

Energy Stocks: The Opportunity Is Now

Since the beginning of 2018, oil prices have continued to march towards $80 a barrel, but energy stocks have lagged behind. 1 Our recent research in the space shows that the returns of unconventional oil & gas equities, or exploration and production (E&P) companies, can mostly be explained by the performance of three independent variables: oil, natural gas, and the U.S. stock market. Meanwhile, similar research has shown that oil service equity returns are predominately driven by oil prices and the U.S. stock market.

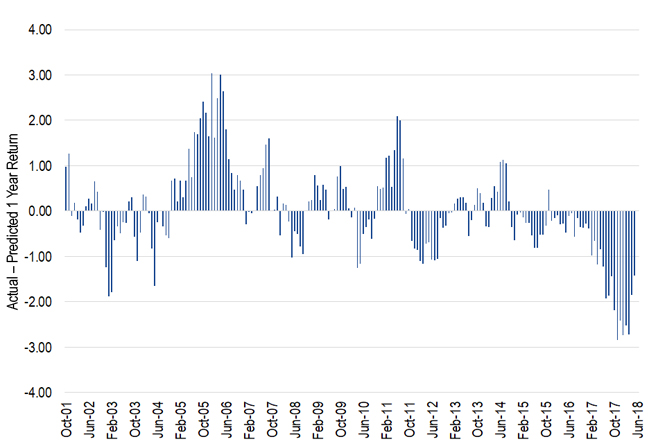

The performance variance between E&P companies and the three key independent variables has recently narrowed significantly from widths not seen for nearly a decade. However, oil servicers still appear to be trading at a discount when we compare actual performance of oil servicers with their predicted performance based on oil and U.S. stock market returns. These levels are close to some of the lowest historical values since 2001, and we believe that this trade in energy stocks constitutes one of the most exciting currently available.

Performance Variance of Oil Servicers and Key Independent Variables

Source: VanEck; FactSet; Bloomberg. Data as of May 31, 2018. “Oil Servicers”, ”Oil”, and “U.S. Stock Market” represented by MVIS US Listed Oil Services 25 Index, West Texas Intermediary (WTI) oil price, and S&P 500 Index, respectively. See index definitions below. Past performance is not indicative of future results. This information is being provided for informational purposes only. It is not intended as investment advice, or an offer or solicitation for the purchase or sale of any financial instrument. No market data or other information is warranted or guaranteed by VanEck.

IMPORTANT DISCLOSURE

1 Source: Bloomberg

MVIS ® U.S. Listed Oil Services 25 Index is intended to track the overall performance of U.S.-listed companies involved in oil services to the upstream oil sector, which include oil equipment, oil services, or oil drilling.

S&P 500 ® Index consists of 500 widely held common stocks, covering four broad sectors (industrials, utilities, financial, and transportation).

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed in this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

You can obtain more specific information on VanEck strategies by visiting Investment Strategies . The views and opinions expressed are those of the speaker(s) and are current as of the posting date. Commentaries are general in nature and should not be construed as investment advice. Opinions are subject to change with market conditions. All performance information is historical and is not a guarantee of future results.

Please note that Van Eck Securities Corporation offers investment portfolios that invest in the asset class(es) mentioned in this post and video. Hard assets investments are subject to risks associated with natural resources and commodities and events related to these industries. Commodity investments may be subject to the risks associated with its investments in commodity-linked derivatives, risks of investing in a wholly owned subsidiary, risk of tracking error, risks of aggressive investment techniques, leverage risk, derivatives risks, counterparty risks, non-diversification risk, credit risk, concentration risk and market risk.

International investing involves additional risks, which include greater market volatility, the availability of less reliable financial information, higher transactional and custody costs, taxation by foreign governments, decreased market liquidity, and political instability. Changes in currency exchange rates may negatively impact an investment's return. Investments in emerging markets securities are subject to elevated risks, which include, among others, expropriation, confiscatory taxation, issues with repatriation of investment income, limitations of foreign ownership, political instability, armed conflict, and social instability.

Debt securities carry interest rate and credit risk. Bonds and bond funds will decrease in value as interest rates rise. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. Credit risk is the risk of loss on an investment due to the deterioration of an issuer's financial health. Securities may be subject to call risk, which may result in having to reinvest the proceeds at lower interest rates, resulting in a decline in income.

Diversification does not assure a profit nor protect against loss.

Investing involves risk, including possible loss of principal. An investor should consider investment objectives, risks, charges and expenses of any investment strategy carefully before investing. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of Van Eck Securities Corporation.

RSS Import: Original Source