ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 50 instruments including FX majors, Gold, Silver, Copper, Oil, Natural Gas, Soybeans, Sugar ,Corn TNX and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup videos, Educational Resources, and 24 Hour chat room where they are provided live updates and given answers to their questions. The guidance of ElliottWave-Forecast gives subscribers the wherewithal to position themselves for proper entry and exit in the Forex marketplace. We believe our disciplined methodology is pivotal for long-term success in trading.

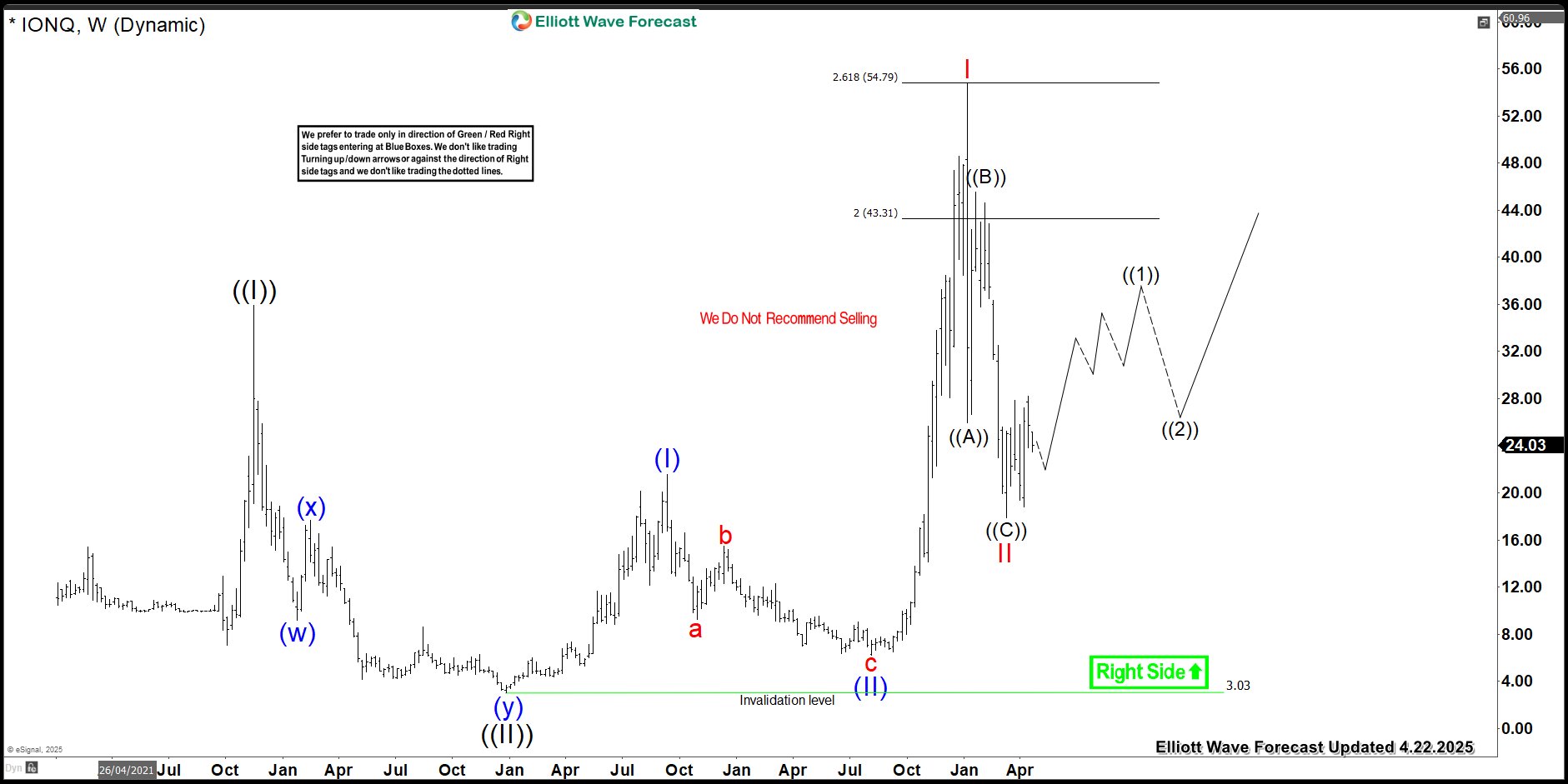

IONQ Analysis: 3-Wave Pullback Complete, Next Stop Higher?

IONQ inc. is a pioneer in the development and manufacturing of quantum computers, focusing on quantum computing and quantum information processing. Founded in 2015 by Christopher Monroe and Jung Sang Kim, the company is headquartered in College Park, MD.

This blog post provides an in-depth technical analysis of IONQ's stock performance, specifically its weekly chart. Key findings include:

-

Two upward channels emerging from all-time lows

-

A potential nest structure forming, indicating further upside potential for the IONQ ticker symbol.

In which the rally to $35.90 high ended wave ((I)) and down from there made a pullback lower. The internals of that pullback unfolded as a double three structure where wave (w) ended at $9.16 low. Then a bounce to $17.66 high ended wave (x) bounce. And wave (y) ended at $3.03 low, thus completed wave ((II)) pullback. Up from there, the stock is nesting higher in an impulse sequence where wave (I) ended at $21.60 high. Wave (II) pullback ended at $6.22 low and made a very nice rally higher. Since then the stock rallied in wave I at $54.74 high and made a 3 wave pullback in wave II. The internals of that pullback unfolded as zigzag correction where wave ((A)) ended at $25.92 low. Wave ((B)) bounce ended at $45.56 high and wave ((C)) ended at $17.88 low. Near-term, as far as dips remain above $17.88 low expect stock to resume the upside.

IONQ Elliott Wave Weekly Analysis From 4.22.2025

Source: https://elliottwave-forecast.com/stock-market/ionq-pullback-complete-next-stop-higher/