Worm Capital, LLC (Worm Capital) is an investment management firm with a focus on equity-oriented strategies. We analyze industries that are experiencing a wave of disruptive forces.

Inside the “Three Revolutions” That Will Transform Our Global Transportation System

Despite their ubiquity in our car-obsessed culture—or perhaps because of it—it’s easy to forget the dangers of driving in a vehicle.

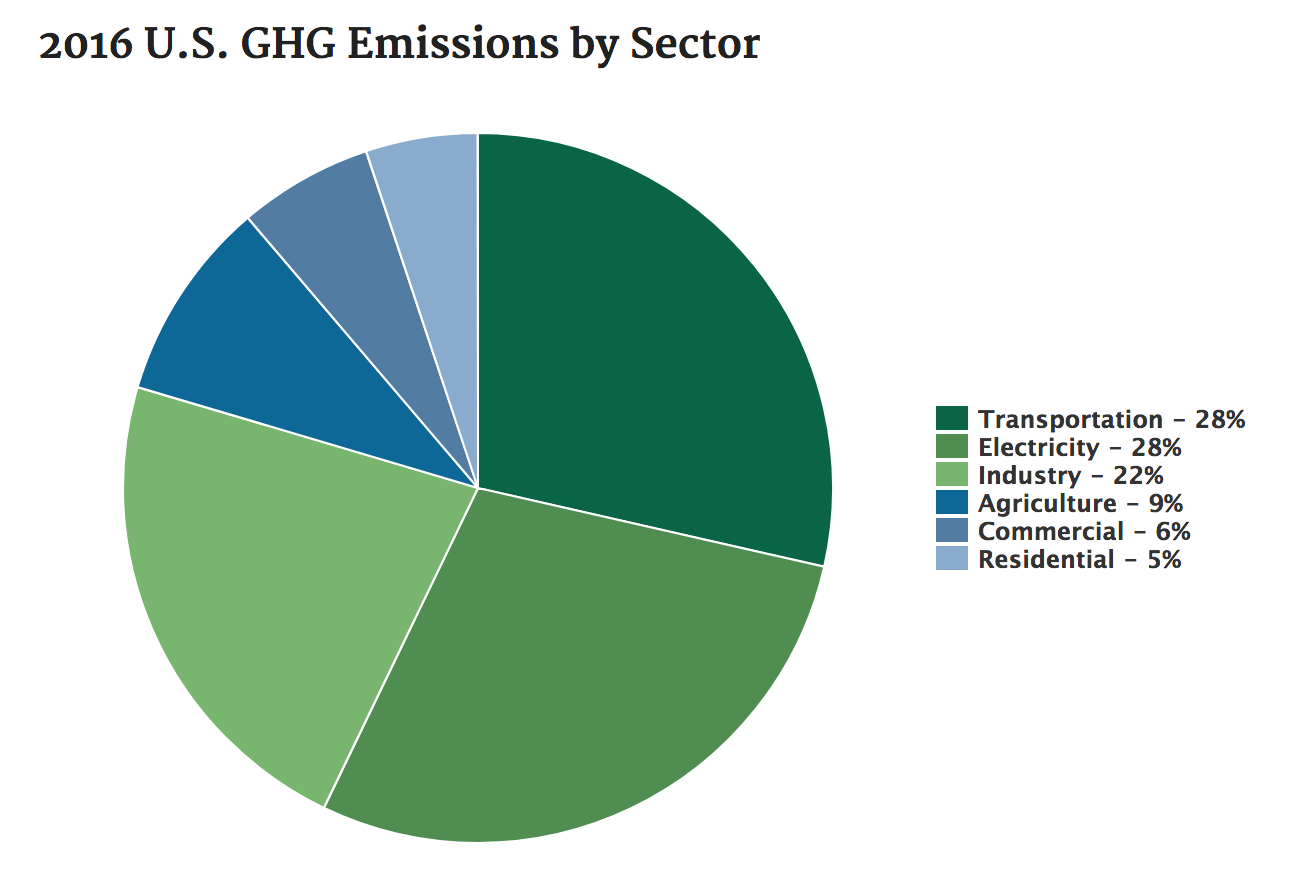

Automotive transportation is dangerous both in the immediate sense—over 40,000 people were killed in traffic accidents last year, according to the National Safety Council—but cars are perhaps even more dangerous in the cosmic sense: Automotive pollution is one of the leading causes of global warming. The EPA, for instance, has concluded that the transportation industry accounted for the largest portion (28%) of total U.S. GHG emissions in 2016. Internal engine combustion (ICE) vehicles are dirty and unsafe: A 2013 MIT study found that air pollution from road transportation causes some 53,000 premature deaths per year.

• • • • • • • • • • • • • • • • • • •

This must change.

Without implementing radical changes to our transportation networks—starting by immediately reducing our dependence on fossil fuels and pivoting away from fossil fuels—scientists say we are quickly reaching the point of no return. As Wired magazine put it recently: “Even More Evidence That Electric Cars Could Save the Planet.”

Thankfully, we believe these radical changes are within grasp. Electric vehicle (EV) battery prices are plunging. Self-driving automation is within reach. Essentially, we believe that the transportation industry is getting a tech-driven “reboot.” Future systems will be connected and data-driven. Fully automated. We must—and hopefully will—pivot away from ICE vehicles and towards self-driving safer vehicles. Our research indicates an optimistic future, and our portfolios are designed to capture these economic and industrial transformations. Above all, we believe these changes could radically disrupt the current transportation system—and could lead us to a cleaner and more efficient future.

Daniel Sperling envisions a similar future—and I spoke with him recently about his research.

Sperling is a professor at UC Davis and the founding director of the Institute of Transportation Studies, as well as the founding chair of the Policy Institute for Energy, Environment, and Economy. He also happens to be a winner of the 2013 Blue Planet Prize—some describe as “the Nobel prize for the environmental sciences.”

Sperling’s most recent book, which came out earlier in 2018, is titled Three Revolutions: Steering Automated, Shared, and Electric Vehicles to a Better Future. In my opinon, it’s an absolutely fascinating book for anyone interested in (or concerned about) the future of transportation, the environment, or how society will function decades from now. I particularly recommend the book if you represent an institutional investor or a family office. With change comes opportunity—but also tremendous risk. And so it is imperative to understand how these disruptions could possibly play out—and could affect your portfolios.

I called Sperling at his office in early November. Despite studying and writing about transportation and environmental issues for the last 30 years or so, he says the industry has mostly been stagnant. That is—until now. “The last 40, 50 years, since the interstate highways, we haven’t seen any big innovations,” he says. “Cars are a bit cleaner, a bit safer, but functionally—they’re the same. We’ve seen no transforming innovations at all.”

But we’re on the cusp of enormous change, he says. The three revolutions in transportation— automation (or self-driving), shared (or “pooling”), and electric vehicles—will fundamentally alter society and our economy.

“Change is afoot, finally,” Sperling writes in an early chapter. He continues:

“For the first time since the advent of the Model T one hundred years ago, we have new options. The information technology revolution, which transformed how we communicate, do research, buy books, listen to music, and find a date, has finally come to transportation. We now have the potential to transform how we get around—to create a dream transportation system of shared, electric, automated vehicles that provides access for everyone and eliminates traffic congestion at far less cost than our current system.”

Later, he writes: “What we know for sure is that the technological arms race has begun. Companies are already competing to control the technology and market—with regulators and governments struggling to keep up.”

It’s worth pointing out here that all of these technologies have, in some form or another, existed for quite a while. The first electric cars were actually invented well over a hundred years ago, and “shared” or “pooling” systems have existed by another name for decades: Carpooling. Similarly, many cars today also offer “automated” systems—in the form of adaptive cruise control and lane change sensors. The change, of course, is superior, improved technology and downward-driving costs—as well as a recognition from policymakers that change must happen soon—for the sake of the planet.

It’s also worth noting that Sperling does not imagine one definite, idyllic future of shared, electric transportation. In fact, he envisions two potential outcomes for the “three revolutions.” The first is a “dream” scenario, in which he imagines that by 2040, average citizens enjoy clean—and more fair—transportation options. “They breathe cleaner air, worry less about greenhouse gas emissions, and trust that transportation is safer,” he writes.

On the flipside, there is also the “nightmare” scenario, in which winner-take-all systems lead to more inequality and unfairness in transportation. “Instead of adopting policies and incentives to encourage pooling of rides,” Sperling writes, “the city allows the private desires of individuals and the competitive instincts of automotive companies to prevail. Traffic congestion gets worse as people who can afford AVs indulge themselves and send their cars out empty on errands. Most AVs are not electrified, and greenhouse gas emissions increase as people travel more. Time to spend with children and engage in community service becomes scarce. Transit services diminish as rich commuters abandon buses and rail and withdraw their support for transit. Those without driver’s licenses and cars continue to be marginalized as the divide between mobility haves and have-nots becomes a chasm. Meanwhile, suburbs sprawl as people seek affordable homes farther and farther out, opting for long commutes and cheap mortgages over proximity and more expensive real estate.”

When I spoke with Sperling by phone, I asked him about the reaction to the book. “I think it’s been eye-opening for people to think about how we have to integrate all those revolutions together. People don't normally think that way. It’s all brand new. Government people are probably the target audience in some ways—they’re trying to get up to speed quickly. It motivated lots of people to get more engaged at a leadership level.”

Above all, however, Sperling tells me that he’s most interested in convincing policymakers and leaders about the importance of pooling—i.e. ride sharing (think Uber and Lyft). While automation and electrification are exceedingly important, they are also the two most likely developments: “EVs will eventually sweep gasoline and diesel cars from the market; it’s a question of when,” he writes.

It’s pooling, however, that will need to be pushed and supported by policymakers—and will also lead to more sustainable transportation societies. If he is right—and I believe he is—that will have enormous, disruptive results for current automakers, auto parts suppliers, and the car rental business. (If you are an investor, it’s imperative to start thinking about those impacts today.)

In the end, Sperling concludes: “... momentum in the direction of pooling is gathering, and at some point, it will become irreversible. There is too much at stake for business as usual to go on indefinitely. As electric and AV technology comes along, the push toward pooling becomes even more compelling and consequential. It is a future that we must steer toward if we want a better world.”

If you want to learn more about how Worm Capital views disruption in the transportation industry, please contact us . To buy a copy of Sperling’s book, click here: Sperling, Daniel. Three Revolutions: Steering Automated, Shared, and Electric Vehicles to a Better Future

Disclosures :

Worm Capital, LLC does not accept responsibility or liability arising from the use of this document. No document or warranty, express or implied, is being given or made that the information presented herein is accurate, current or complete, and such information is always subject to change without notice. Shareholders and other potential investors should conduct their own independent investigation of the relevant issues and companies involved in this article. This document may not be copied, reproduced or distributed without prior consent of Worm Capital.

The opinions expressed herein are those of Worm Capital, LLC and are subject to change without notice. This information should not be considered a recommendation to purchase or sell any particular security or constitute as investment advice. It should not be assumed that any of the investments or strategies referenced were or will be profitable, or that investment recommendations or decisions we make in the future will be profitable. Past performance is no guarantee of future results. Worm Capital reserves the right to modify its current investment views, strategies, techniques, and market views based on changing market dynamics. This article contains links to 3rd party websites and is used for informational purposes only. This does not constitute as an endorsement of any kind. Worm Capital, LLC is an independent investment adviser registered in the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about Worm Capital including our investment strategies, fees, and objectives can be found in our ADV Part 2, which is available upon request. WRC-18-17