A leading global investment company with specialized expertise in equities, fixed income, and alternatives.

Infrastructure and the Business Cycle End

NOV 13 2018

Is listed infrastructure insulated from the end of a market cycle, and if so, to what degree? RARE’s co-chief investment officer, Nick Langley, explains the market drivers for these stocks.

The performance of listed infrastructure stocks in October reflected that pattern. The FTSE Global Core Index returned -2.12%, the DJ Brookfield Global Infrastructure Index -2.60% compared to a much larger decline of -7.32% for the MSCI World Index.

However, if one applies an even stricter application of what constitutes an infrastructure stock than the above indices, then it is possible these losses might be lower. To achieve this, one would focus on companies:

- with assets subject to regulatory frameworks that ensure predictable, inflation protected cash flows.

- which derive the vast majority of their income from infrastructure assets.

- whose shares have either medium or high market liquidity.

- whose profitability is not directly linked to the volatility of the price of oil, gas and coal (e.g. power stations).

A different business model

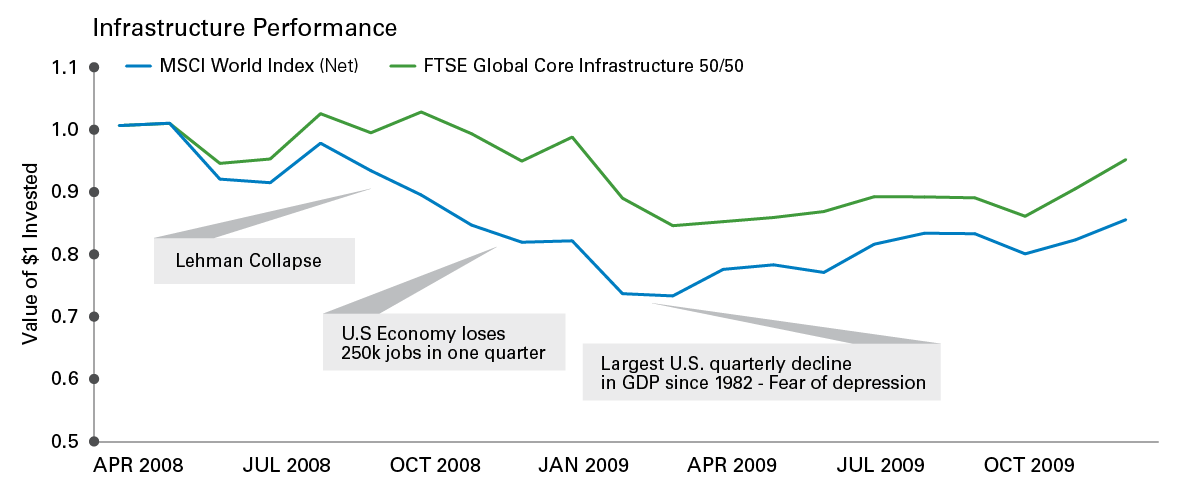

The trading characteristics of pure infrastructure stocks are quite different than general equities because their earnings, cash flows and dividends are primarily linked to the expansion of their asset base rather than to the broad economy. That expansion tends to come from government policy rather than market forces. This means infrastructure stocks can continue to grow their earnings while the broader market's earnings decline; indeed, this happened even through the Global Financial Crisis, as shown below:

Source: RARE. Past performance is no guarantee of future results . Indexes are unmanaged, and not available for direct investment. Index returns do not include fees or sales charges. This information is provided for illustrative purposes only and does not reflect the performance of an actual investment.

One example of how infrastructure companies are expanding their asset base can be seen in the push for decarbonisation in California, which we believe will result in a much higher number of electric vehicles over the next five or 10 years. The impact for electric companies of adding two electric cars to their service territory is equivalent to adding one extra house. So, there would need to be a massive spend required to build out the networks -- which increases the asset base, builds their earnings and leads to higher valuations.

Market outlook

We believe that the volatile market we have had this year, with big falls in February and again in October, makes it clear we are now in a late cycle stage of the global economy. In the US we can see the constraints of very low unemployment, wage growth, inflation coming through and rising interest rates. Plus, we have had a big bump in earnings growth over the last couple of years.

Our analysis of global markets identifies two factors that could determine how long the late market cycle will last.

- If the U.S. and China comes to a compromise on trade , then the current cycle may extend for another couple of years as this will boost earnings projections. However, if there is no resolution then there will be real pressure on corporates in China and in the U.S.A. to start adjusting their supply chain. The cycle could end a lot more quickly under that scenario.

- A second factor is the rise of the more populist style of politics across the world . We believe that would result in more government spending and less room for corporates to grow their earnings over time which probably leads to an earlier and potentially even deeper downturn.

¹ This is taken from a comparison of the performance of the S&P Global Infrastructure Index to the MSCI AC World Index (Local) on a monthly basis from 31 August 2006 to 30 September 2018.

Author:

Nick Langley

Co-Chief Executive Officer, Co-Chief Investment Officer, and Portfolio Manager