Segall Bryant & Hamill leverages its proprietary investment research, deep industry experience and long‐tenured team to provide intelligently constructed portfolio solutions.

If Inflation is Normalizing, Why do Yields Continue to Rise?

Fixed Income Chart of the Month: October 2023

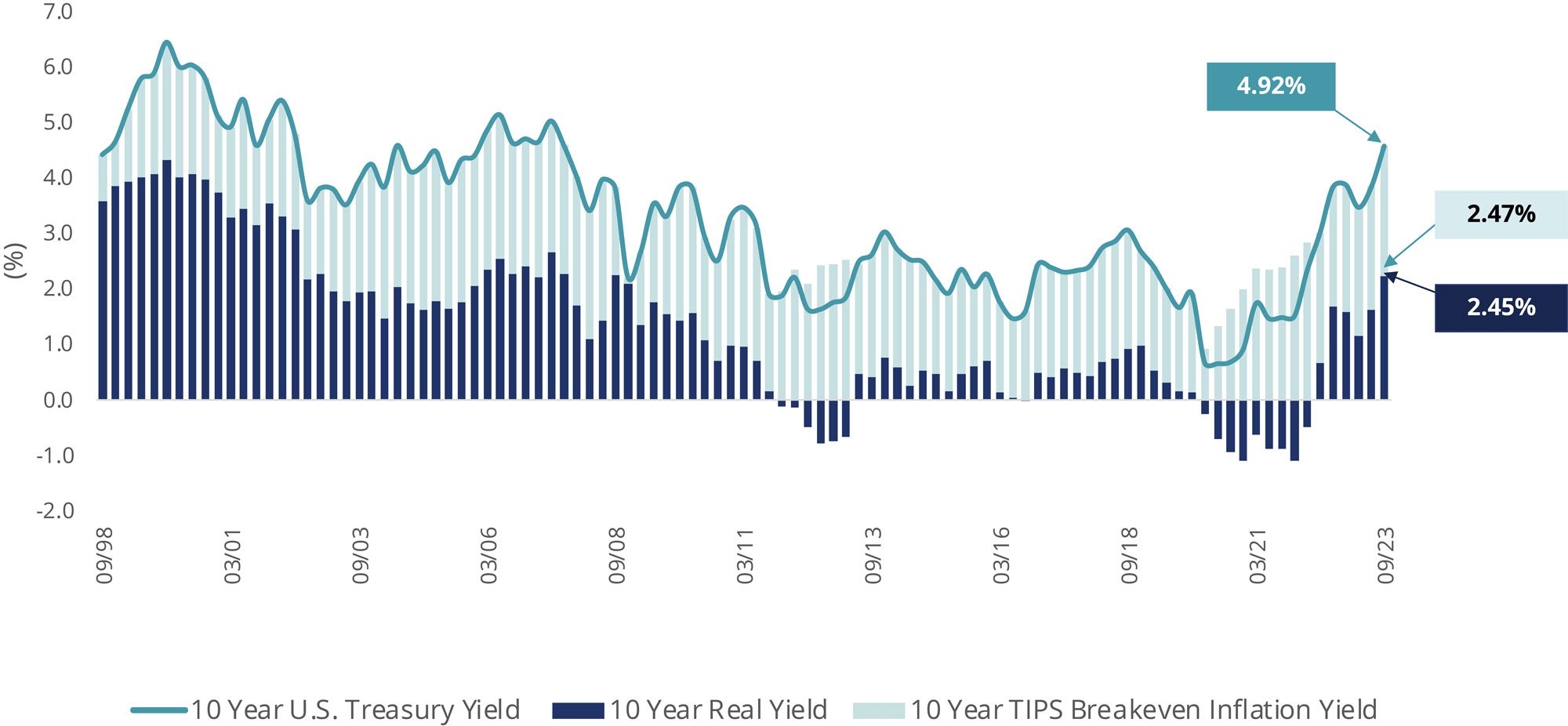

Real yields have spiked to 2.45% over the last 18 months. During this same period, inflation expectations have stabilized which has left us wondering why interest rates have continued to rise.

Source: Bloomberg as of 10/20/23. The real yield is calculated by subtracting the expected inflation rate (10 year TIPs breakeven inflation yield) from a bond’s nominal yield (10 year U.S. Treasury yield).

- Since April 2022, inflation expectations have remained relatively stable (demonstrated by the 10 year TIPS breakeven inflation yield).

- The real yield on the 10 year Treasury, which was negative as recently as April 30, 2022, is currently 2.45%.

- There is much speculation about why real yields are moving higher. Although there are several reasons for the move, an important one is the changing supply and demand dynamics of the U.S. Treasury market. The Federal Reserve (Fed), commercial banks, and foreign buyers have been reducing their holdings while Treasury issuance has increased. 8/23 Chart of the Month: Who’s Going to Step in for the Largest Buyers of U.S. Treasuries?

Positive real yields weren’t unusual prior to the Global Financial Crisis and the subsequent quantitative easing efforts by the Fed. As inflation expectations have held steady, an upward shift in real rates has driven 10 year Treasury yields higher.

Learn more about SBH’s Fixed Income Strategies .

Archive

9/23: Is Now a Good Time to Lock in Short Duration Yields?

8/23: Who’s Going to Step in for the Largest Buyers of U.S. Treasuries?

7/23: Corporate Spreads and Default Rates are Telling Different Stories

6/23: Bank Failures Put Additional Pressure on Mortgage-Backed Securities

4/23: What Does Interest Rate Volatility Mean for Bond Investors?

3/23: “Dude, Where’s My Yield?”

2/23: The Rise of Passive Bond Investments

1/23: End of a (Negative) Era: Negative Yields Reach Positive Territory Globally

12/22: Will the Upcoming Fed Interest Rates Projections Match the Current Market Expectations?

11/22: The “Sweet Spot” for Liability-Driven Investing (LDI)

10/22: The Credit Risk You May Not Realize You’re Taking

9/22: How Higher Yields Can Protect Fixed Income Investments